Family Finances: No extra taxes to fund budget sops

Using a Bengaluru-based family as a case study, Forbes India decodes the impact of the Budget 2019 on the middle-class

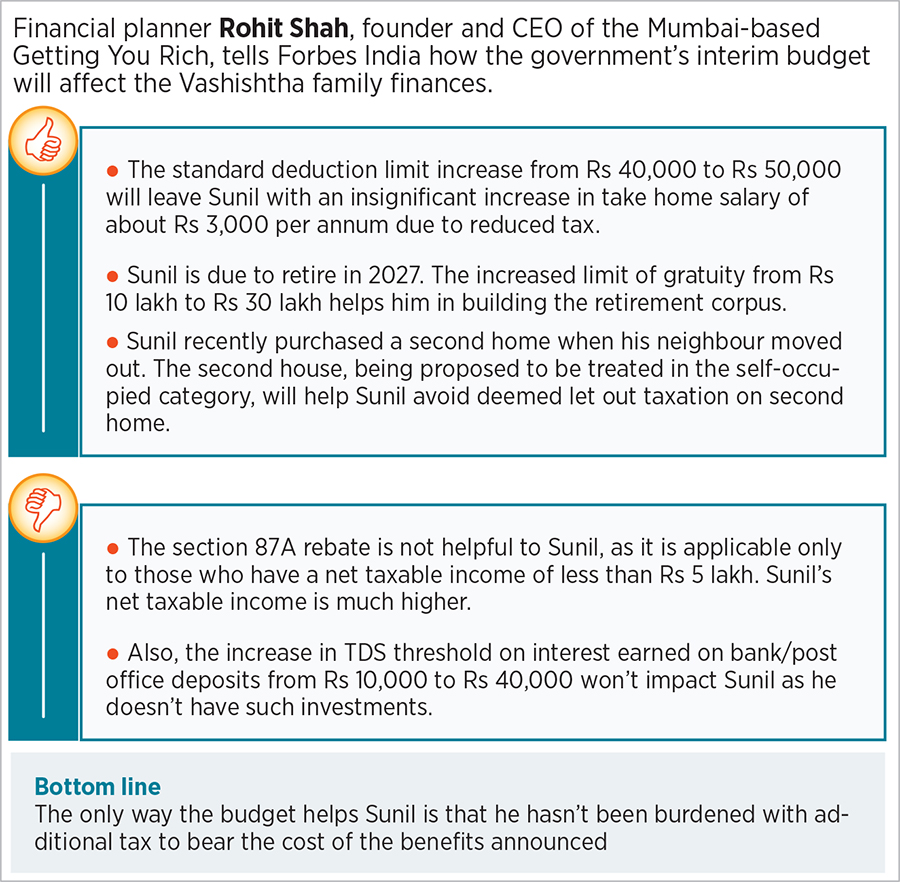

Bengaluru-based Sunil Vashishtha, 50, is currently a manager at chip maker Intel with about 27 years of experience. Prior to Intel, Vashishtha had stints at Cadence Design System, Kota Thermal Power Station and the Rajasthan State Electricity Board. His wife, Shalini, 46, is a professor at the Atria Institute of Technology. She has been working for 24 years. Sunil and Shalini have two children: Son Jai, 19, and daughter Tanisha, 11. The couple, who jointly earns about Rs 30-40 lakh per annum, is looking to save Rs 1 lakh per month for their children’s education and marriage, apart from building a retirement corpus, both totaling a couple of crores. Sunil had started investing small amounts in mutual funds since 2004, but he significantly increased his investments only in 2015. The couple doesn’t don’t have any dependents other than the children.

Post Your Comment