Apollo Tyres hits IL&FS brakes

Profit drops two-thirds after firm once again writes off ₹100 crore in bankrupt lender

The write-offs by corporate India are in contrast to those of banks and non-banking finance companies that have marked the loans as NPAs but not provided fully for them. The RBI has so far not asked them to provide fully for these NPAs.

“Companies are generally more prudent and would only invest in the highest rated paper. So it is hardly surprising that they have written off the entire amount. Going forward, I see them only investing in bond funds and liquid funds where yields are lower but the risks also lower,” says Abhimanyu Sofat, head of research at IIFL, a brokerage.

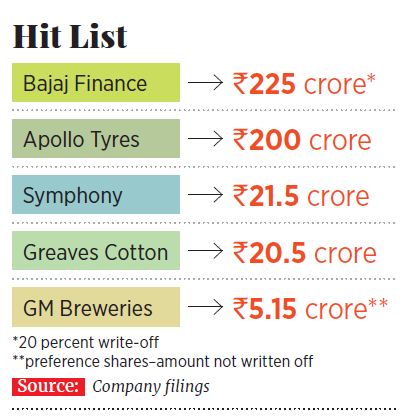

While there is no compilation of the total amount that corporate India (excluding banks and finance companies) had invested in IL&FS, estimates range from ₹2,000 crore to ₹4,000 crore. (IL&FS’s total default is ₹94,000 crore).

For now the stock markets have ignored the one-time loss in earnings as shares have reacted only to operational earnings. It now remains to be seen how the markets react if banks and finance companies are also forced to mark their IL&FS holdings to zero.

(This story appears in the 21 June, 2019 issue of Forbes India. To visit our Archives, click here.)

Post Your Comment