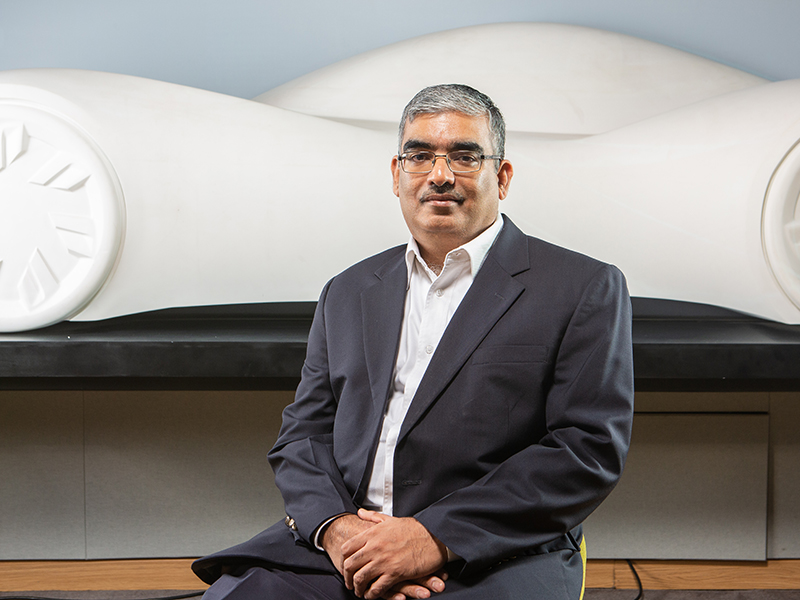

"We can engage our customers very deeply in the product-design process-before we bring the products to them"

Forbes India in conversation with Ashish Goel, Co-founder and CEO of Urban Ladder, on how it has harnessed the internet since 2012 to build a brand for 450,000 customers of furniture and decor—a segment where touch-and-feel product experience is vital. And why he recently did a short course in machine learning

Q. Is there a fundamental problem for e-commerce companies that focus on one segment because multi-segment e-commerce apps like Flipkart or Amazon are more popular than single-segment apps like Urban Ladder?

Every e-commerce player has to think about its customer journey. For sure, customers frequent horizontal e-commerce websites more than a category e-commerce destination like Urban Ladder because they have other needs like smartphones, books, and so on.

For us, the question really is: when a customer needs a product like furniture—wherein they need category expertise, design, believability and trust—do they think of us first? Or do they think of somebody else? The question for us is not whether customers are frequenting somewhere else. Customers visit amusement parks too, which is good but they are not competition for us. The same goes for multi-segment platforms.

The question we constantly ask ourselves, and answer in the affirmative is: when a customer thinks of buying furniture, are we top of mind? Are we the brand of choice? And are we differentiated enough for the customer to believe this is the brand I have to go to?

Q. In 2012, what was the hypothesis: why should a customer even go online to buy furniture? How has that problem-statement evolved after seven years?

Fundamentally, the real problem we identified when we started the business was a distinct lack of customer focus in the furniture industry. Customers were not able to find a brand they could go to for furniture products, a brand that will take care of them beyond simply retailing furniture. In other words, there was an opportunity for a furniture brand that will be there with the customer not just during the purchase, but also be a part of the experience of using the product over a period of time. That was our initial hypothesis: deliver great designs, and build trust over time.

Seven years into the journey, our belief is that we have just scratched the surface of fulfilling that customer need. The amount of work in front of us is unbelievable. That's where the question of online-vs-offline becomes pertinent.

We are technologists at heart. When we started the business, it made sense to start online because we could see that there was a growing number of customers who were browsing online. Search volumes in the furniture category were going up, and people were engaging heavily with the category online. It was quite obvious that there was an opportunity to build an online-first business.

This also allowed us to have a shared platform to communicate with the customer in a sharp and singular voice. People often underestimate the importance of having a sharp customer interface in the process of brand-building. Especially in online retail. We focused a lot of our effort on the online user experience. And that has in fact allowed us to scale much faster than any of our competitors.

In the past two years, we have made our business channel-agnostic: online and offline. But fundamentally, the Urban Ladder brand is still focussed on the two key customer needs – design and trust. In this respect, we have done reasonably well. Over the next 20 or 25 years, we see a journey of constantly improving the quality of our customer experience.

Q. So does the furniture category continue to be about touch-and-feel product experience?

Yes, one of the insights we got since we opened stores is that customers have a deeper understanding of the value proposition of a product once they are able to touch and feel it. This creates trust in the brand and product quality. While the online channel is great to drive awareness amongst tech savvy consumers, there’s still a large segment of the population that prefers walking into a store and touching the products for themselves. It is very important to establish that kind of trust in quality with new customers. Brick and mortar cultivates that value.

Q. How was the customer demand before you opened offline stores? What did you learn from those customers?

The browse volume for customers who search for furniture on the internet is quite high, which is very good for us. However, a large number of those customers are not comfortable making transactions for furniture based just on the online experience. That was the insight for us.

As we went deeper into understanding our customers, we found a lot of interesting reasons for this hesitation. One, our category is not an impulse purchase. It often involves second thoughts because it is a high-ticket purchase. Two, it is a category where the purchase has many decision-makers – and very often in age groups that span more than one generation. So, it is a multiple decision-maker and multi-generation category. And the last reason, which I think is very important, is the tradition of ‘inheriting’ furniture in India.

We are still developing as an economy, and outright purchase of furniture is still low. In India, there is a tradition of furniture that is often custom built by carpenters, which is then passed down from generation to generation. Our customers—the sweet spot is in the 27 years to 45 years age group—have not experienced much furniture being bought before they come to us.

When we saw all these factors together, we felt a lot of customers need an additional source of understanding, knowledge and reassurance. This is the role our offline stores end up playing.

Q. How do Urban Ladder stores help in capturing data points about your customer? Can you share insights of the data granularity?

In the online world, the opportunities to gather data are immense – specifically on how our customers perceive our products. One of our dream projects has been the Product Performance Dashboard (PPD), which is essentially to track the customer behaviour at the level of every product. For each product, we can measure the number of impressions on the listing page, against the number of marketing assets used per product, landing page, product page, and so on. We track the funnel for each product.

You can see that the PPD allows us to make very informed decisions about a product. For example, we can track that a customer is at a listing page, but is not clicking through and coming to the product page. This could mean many things – something may be wrong with that image, or the product is not appealing enough. We then have a chance to make changes and see how that affects their future behaviour. So, we get a sense at a very granular level to make decisions.

Being a technology-first company, we are data-oriented. We are now taking the PPD and implementing as much of it is possible in our offline stores as well. The need to capture equally granular data about the customer behaviour in the offline stores is just as, or perhaps even more, important. Take a chair at the store, for example. I want to know how many customers came to the area where the chair is kept every day. How many of them looked at it? Of those, how many sat down on it, and for how much time did they sit on it? After a customer sat down on the chair, did somebody from the same family or purchase group sit down on it? What was their reaction or sentiment they expressed? After that, did they make a purchase?

We want to track this whole cycle, and use that data to make our choices. If 40 percent of people who sat on this chair didn't find it comfortable, it is an instant data point for our product teams to work on.

This is our big project, which involves video technologies. We have done a bunch of video-tech pilots to see heat maps of the store and so on. In a month or 45 days, we will roll it out in a few of our stores, a process, whereby we can know how many customers sat on a product to experience it, and how many engaged with it for how much time, and so on. When we link all of this together, we actually get a complete data view of an Urban Ladder store.

It is amazing that the moment we put on that hat, we have richer data that can be available about a store. I cannot generate 'furniture usage data' online. That comes only when a customer experiences the furniture physically. So when it is done right, the store has the ability of giving us richer data, over and above the data that the online world gives us because of our website and app.

Q. How does this reflect in Urban Ladder's technology talent as a percentage of its overall headcount? In the future, will you have more specialists in AI, and data scientists?

One thing is very clear: it is not workable for any company today to not be technology- or data-oriented. I don't do coding. But a few months ago, I did a short course in machine learning just to start thinking about how to solve different problems.

As we keep moving forward, the single-largest area of investment we will make for years and years to come is technology. The interesting part is that the cost of doing tech the right way has come down dramatically over the last many years. But the question before a CEO is: Are you smart enough to use the changing dynamics of the technology world?

There are a lot of products to pick and drop. Cloud has become a lot more important. When we started the business seven years back, the systems were far heavier. Today, you have enterprise-level systems that are far lighter than consumer-level systems a decade ago. That shift allows a lot more agility. And it also poses another unique challenge: if a company is operating with systems that were developed seven or eight years ago, which is actually not a long time, we have to accept that those systems need a complete overhaul because the world has changed. That also necessitates another look at the technology skillsets we want for our employees. So, yes, we will definitely have more specialists in A.I, and machine learning.

Q. So how is Urban Ladder harnessing its technology systems for a strategy to replenish furniture at its showrooms? Has this begun to play out?

Absolutely! When we launched our showrooms, we implemented an algorithm that we call ProductRank. To put it simply, it is the equivalent of a page rank algorithm, but one that takes into consideration all the customer signals we receive from our physical stores, which gives a ranking of all the products that are there in any of our stores. Based on that ranking, at any time, we know what products are playing what role in the Urban Ladder store. We get a sense of which products are garnering interest, and which products are probably candidates for an eventual phase-out.

Given the physical nature of the business, we run the algorithm on a 15-day basis, though it is possible to do it on a daily basis. We have daily results, but the results are more meaningful when we use them on a 15-day basis. Accordingly, we replenish products in every store.

Q. And how does data help in creating a feedback loop back to your furniture producers?

For any technologist, one of the more complex and inspirational challenges to work on is: how do you link the absolute frontend—the voice of the customer—back through everything that happens in the product journey? This means through our manufacturing and design processes. This is a really exciting problem to work on, but not an easy one to solve.

We have built a state-of-the-art Quality Management System, so that every time something goes wrong in a product—the reasons a customer does not like a product—that loop gets closed straight back to the manufacturer and to Urban Ladder's design team. So, it helps define what specifically needs to change: aesthetic, usability problem, or a material that is not alright. Essentially, every feedback loop gets addressed and closed.

Second, our entire inventory management and supply chain runs on a replenishment model. So, we have to ensure this model transmits information up and down the chain continuously. We have built this in an exhaustive way.

You will see us invest a lot more effort in the next 12 months, so that we can engage our customers very deeply in the product-design process—even before we bring the products to them. This is the real challenge for a direct-to-customer brand in this day and age. Twenty or 30 years ago, a furniture manufacturer or brand that distributed through a trade channel did not have direct access to customers. Today, we can engage with customers. We have a unique opportunity to learn from them. So, I want to know exactly what the customer wants, and have the capability to give them exactly that.

Q. But then, how will Urban Ladder get the economies of scale in a highly-customised model of design and development?

Through technology, we are bringing the economies of scale up to the design stage, and not just in production. I could show thousands of customers 50 images of potential products we are dreaming about, and ask them to tell us which ones they like. That gives us a sense of what to do next, and where to leverage production economies of scale.

Q. And how long is it before you get the product out to market?

That will be a three or three-and-half-month loop after the customers love a product. Also, today we have mechanisms to do short-run productions to test the market. To the point where we make only one piece and show it to customers in different settings to see if it works for them. And all of this has to be done online only. That's taking the voice of the customer straight to manufacturing through design and product concept.

Q. What's the Urban Ladder split between online and offline customers?

Online continues to be the largest part of our business. And, offline (stores) started only in the past two years. A little over 400,000 buyers would be online customers, and more than 40,000 customers are offline. But even these 'offline' customers started their journey online with Urban Ladder. This is important because we are not a physical retail store. When a customer has walked into our store, they have already engaged with us online. They know about our products, and walk into our stores knowing our catalogue, sometimes better than we know it ourselves. They come to the store to complete their purchase journey.

In terms of numbers, about 60 percent come from online channels and about 40 percent of our sales come in from retail/offline channels. We are constructing for the customer journey to start online. Our belief is that all our target customers are spending some amount of time online. They are strapped for time. The online process gives customers incredible flexibility to engage with the category from the comfort of their homes, offices, or cars. We have to use that time to get the engagement going. When they have to make the purchase decision, we don't want to waste the customer's time.

Q. So what is Urban Ladder doing to make customers comfortable to complete the purchase journey online?

We make sure to provide as much information as we can. Be it dimensions, materials, or the way our product images are taken, we ensure the customer has the complete picture to make an informed decision about the product. Additionally, we also focus on our flexible return policy. We believe this really instils confidence in our customers. If the customer is unsatisfied for any reason, we provide on-the-spot returns and after sales services as well.

.jpg)

.jpg)