Behind Netflix India's audacious plans

From Sacred Games to Little Things, a deep dive into why Netflix is betting big on India, with a bold original content play

Team Netflix India (from left): Abhishek Nag, director for business development and partnerships; Monika Shergill, director (international originals); Srishti Arya, director (films); Aashish Singh, director (films)

Team Netflix India (from left): Abhishek Nag, director for business development and partnerships; Monika Shergill, director (international originals); Srishti Arya, director (films); Aashish Singh, director (films)Image: Mexy Xavier

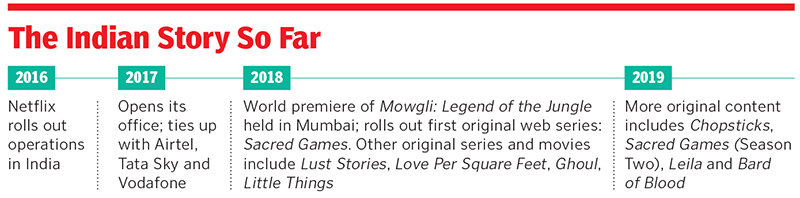

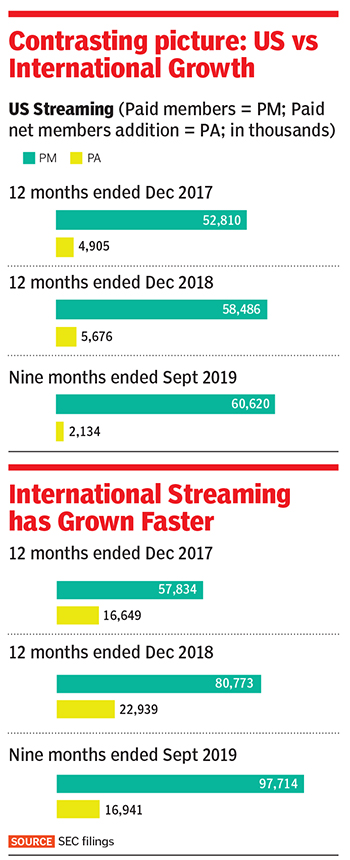

The proclamation was ‘mighty’. “We don’t shy away from taking bold swings if we think the business impact will also be amazing.” Netflix made this daring declaration in its latest quarterly letter to shareholders in October. The world’s biggest online streaming player was alluding to the ever rising cost of generating premium content—it flaunted its content budget of around $15 billion in cash for the year—and how the impending launch of online video platforms by rivals such as Disney and Apple would make the scramble for content even costlier. In the bargain, the American giant would inadvertently go on to offer a glimpse into one of its ‘bold swings’ and ‘amazing’ impact in one of the Asian countries it had debuted three years ago. Cut to Mumbai, India. December 2016

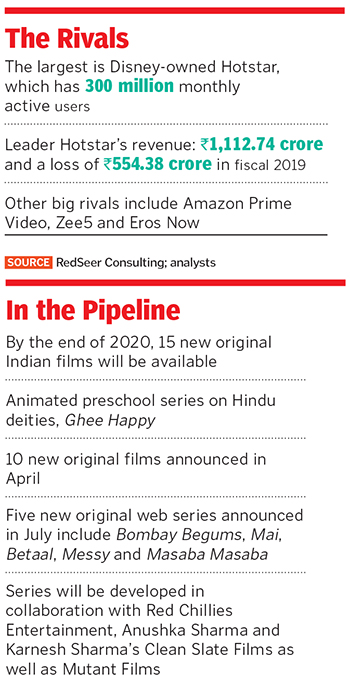

Despite having an 11-month head-start over rival Amazon Prime Video—which entered India in December—and the popularity of American crime drama web series Narcos, Netflix was still a niche concept, confined largely to salaried corporate honchos in Mumbai and Delhi. The reason was not hard to fathom. Netflix was prohibitively expensive. While Amazon offered an ad-free, on-demand service at a monthly rate of ₹41, Netflix was available at ₹500 for a month. Even Hotstar, another big competitor, now owned by Disney, had a tempting tag: ₹199 per month. A year down the line, Netflix CEO Reed Hastings, though “pleased with the progress made in India”, acknowledged the reality. “YouTube gets the most streaming in India, but Hotstar gets the second most,” he said in an investor earnings call in 2017. Undeterred, the CEO went on to wager a mighty bet on India in 2018. “The next 100 million (subscribers) for us are coming from India,” Hastings said at a business summit in India in August 2018. The reality, though, was still playing on Reed’s mind. “We’re way behind YouTube and Hotstar (in India),” he admitted in another earnings call. However, he was quick to look at the brighter side. The advantages, he continued, are tremendous in India for internet viewing. “We just have a lot of work and a lot of opportunity ahead,” he remarked. Back in California. October 2019

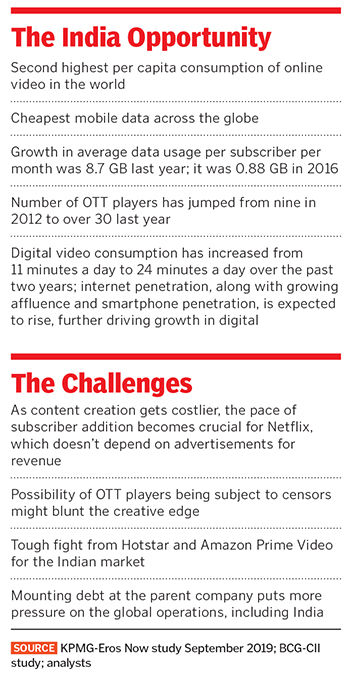

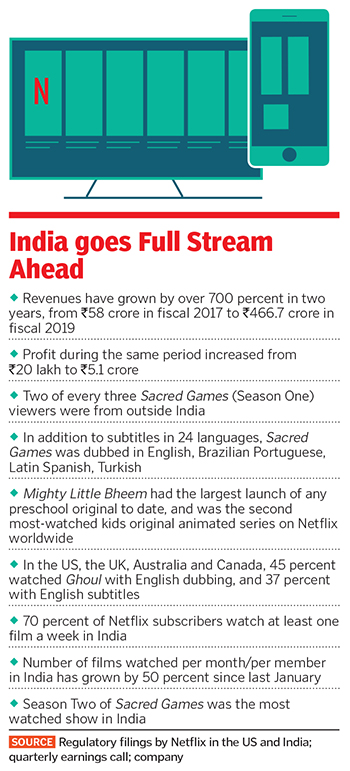

There is a ‘beam’ of optimism. “We’re pleased with the results,” Netflix let on in its letter to shareholders. In July, it had rolled out its lower-priced mobile plan—₹199 per month. The bold swing—India is the first country where Netflix has dropped to such a price point—had an impact. Our approach, the US giant added in the newsletter, with pricing is to grow revenue and so far, uptake and retention on the mobile plan in India has been better than initial testing suggested. “This will allow us to invest more in Indian content to further satisfy our members,” the company said, adding that it is continuing to test mobile-only plans in other markets as well. Gregory K Peters, chief product officer, was elated. “We’ve been very, very happy with the mobile plan.” India, one of the 190 countries where Netflix gets streamed, is fast turning out to be a crucial market for the media-services provider in its global scheme of things. This is at a time when growth in the home country is moderating and competition gets cut-throat as Apple and Disney roll out streaming services of their own. “India is a priority for us,” says Todd Yellin, vice president (product), at Netflix in an exclusive email interview with Forbes India. Since making its India debut in 2016 and launching the first original series last year, Netflix has announced 40 original series and films. Netflix’s optimism is backed by India’s promising performance so far. In 2017, Indian viewers devoured a web series at a faster pace than global counterparts: Three days as against the global average of four. A series viewed more than two hours per day was labelled as ‘devoured’ by Netflix. The financials picked up accordingly. From a paltry ₹58 crore in fiscal 2018, revenue leapfrogged eight times to ₹466.7 crore a year later. Profit jumped 25 times to ₹5.15 crore from ₹20 lakh. Though Netflix doesn’t disclose its global breakup of users, its subscriber base in India is estimated to be between 12 million and 14 million. The success of the ₹199 mobile plan for Netflix also means a massive opportunity to tap into the fastest growing smartphone market in the world. Its subscribers in India—the second biggest base globally after China—watch more on mobile than anywhere else. As a percentage of overall time spent on Netflix, film viewing in India is the highest for any country worldwide. The number of films watched per month per member in India has grown by 50 percent since last January.

Post Your Comment