Budget 2017: Focus on Digital economy for speed, accountability and transparency

For the benefit of those who do not have debit cards, mobile wallets or mobile phone, a merchant version of the Aadhar Enabled Payment System called Aadhar Pay will be launched.

“Promotion of a digital economy is an integral part of Government’s strategy to clean the system and weed out corruption and black money.” - Finance Minister in his Budget Speech

Various tax and non-tax measures have been proposed in the Budget 2017 to hasten the shift to digitisation.

For the benefit of those who do not have debit cards, mobile wallets or mobile phone, a merchant version of the Aadhar Enabled Payment System called Aadhar Pay will be launched. Banks have targeted to introduce additional 10 lakh new Point of Sale (PoS) terminals by March 2017. They will be encouraged to introduce 20 lakh Aadhar based PoS by September 2017.

The BHIM App is expected to unleash the power of mobile phones for digital payments. To promote the enhanced usage of this App, there is a proposal to launch a Referral bonus scheme for individuals and Cash back scheme for merchant bankers.

Budget also proposes to provide exemptions from duty for import of miniaturised POS card readers for m-POS, micro ATM Standards version 1.5.1, Finger Print Readers/Scanner and Iris Scanner. Indirect tax benefits to encourage domestic manufacturing of these are also proposed.

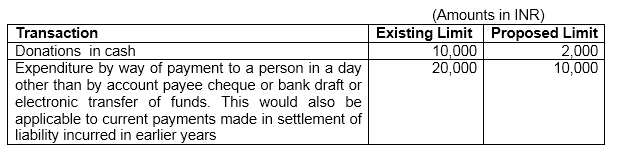

The Finance Minister has also proposed certain measures in the form of inadmissibility of deductions for tax purposes, applicable from FY 2017-18. This includes reduction of existing limits to dis-incentivise cash transactions

It is proposed to also include inadmissibility of depreciation on any asset purchased by cash exceeding Rs. 10,000.

The presumptive income for small and medium tax payers with turnover upto Rs. 2 crores is 8%. i.e. 8% of their turnover is counted as presumptive income. To encourage such businesses to move to digital transactions, the presumptive income is proposed to be reduced to 6% on non-cash turnover. This benefit will be applicable for transactions undertaken in FY 2016-17 as well.

With a view to discourage high value transactions in cash and curb black money, it is proposed that no person shall receive an amount of Rs 300,000 or more in cash from a person in a day in respect of a single transaction or in respect of transactions relating to one event or occasion from a person.

With an intent to cleanse the political funding system, a limit of Rs. 2,000 has been imposed on cash donations that a political party can receive from a person. In order to address the concern of anonymity of donors, there is a proposal to issue electoral bonds in accordance with a scheme to be framed by the Government in this regard.

In order to ensure acceleration of digital transactions and provide a conducive environment, the other reforms being considered are:

- Strengthening of the digital payment infrastructure and grievance handling mechanisms

- Proposal to mandate all Government receipts through digital means, beyond a prescribed limit

- Amendment to the Negotiable Instruments Act to ensure that the payees of dishonoured cheques are able to realise the payments

The Finance Minister believes that the Digital economy would be the best bet to Transform, Energise and Clean India.

By Saraswathi Kasturirangan – Partner at Deloitte Haskins & Sells LLP, and Rajeswari Balasubramanian – Manager at Deloitte Haskins & Sells LLP

The thoughts and opinions shared here are of the author.

Check out our end of season subscription discounts with a Moneycontrol pro subscription absolutely free. Use code EOSO2021. Click here for details.