A funding tool that makes great civic sense

Value Capture Financing can boost municipal revenues, but implementation is key

The buzz around land-based fiscal tools for Urban Local Bodies (ULBs) has grown louder with the Ministry of Urban Development coming up with a policy on value capture finance (VCF) recently.

It is estimated that the Smart Cities would have to raise three times their revenues – including mission grants and convergence – of last year to meet the funding requirement for the development projects planned under the scheme. While some could argue this is an overestimate, there can be no denying that Indian cities require enormous resources to provide adequate, equitable and reliable infrastructure services. CRISIL believes VCF can help urban local bodies tap the appreciation in land value resulting from infrastructure improvements. However, a number of facilitating changes are required before it can emerge as an effective tool.

What is value capture finance?

VCF works on the conviction that public policy and infrastructure projects typically lead to improvement in the quality of housing, jobs access and transportation, yield other social benefits, and lead to the emergence of important commercial, cultural, institutional or residential developments in the influence area. This, in turn, leads to an appreciation in land value in the neighbourhood.

Given this, VCF seeks a share of the enhancement in value for the municipal body, since the appreciation has resulted from positive externalities other than the land/property owner’s investments. It comprises a range of funding instruments or tools that ‘capture’, ‘recover’ or ‘share’ a portion of the extra value of land and buildings resulting from public investments and policy initiatives in the influence area.

The VCF process comprises four key steps:

1) Value creation – Public regulations, policies and investments lead to creation of value

2) Value realisation by private owners – For instance, the investment made by a developer fetches a higher monetary value when he sells housing units along a metro corridor planned by government than he would have without the project

3) Value capture – It involves the government and private owners agreeing to a sharing mechanism for the value captured

4) Value recycle – The resources collected are ploughed back in other parts of the city to create fresh value

Thus, VCF can serve as an infrastructure financing tool, directly or indirectly.

VCF in India

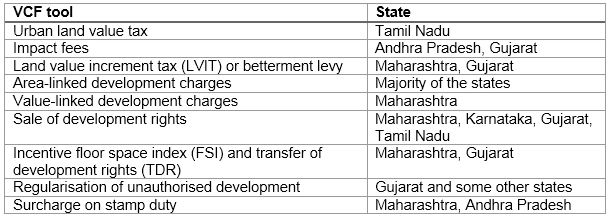

Several states, including Maharashtra, Gujarat, Tamil Nadu and Andhra Pradesh, are using various VCF tools, which have been documented by Professor Vidyadhar Phatak, dean, Faculty of Planning, in his paper titled “Land Based Fiscal Tools and Practices for Generating Additional Financial Resources”.

These tools take the form of:

Yet, in many cases, the basis on which these levies are charged is not buoyant. For instance, development charges are often levied on a per square metre basis with fixed rate. The increment in land value, therefore, is not optimally captured through such a levy.

Yet, in many cases, the basis on which these levies are charged is not buoyant. For instance, development charges are often levied on a per square metre basis with fixed rate. The increment in land value, therefore, is not optimally captured through such a levy.

For the VCF tools to provide meaningful additional revenues to the ULBs, it is critical to ensure that these tools are rooted in a buoyant base. Typically, the VCF tools are enabled through various legislations. For example, in case of Tamil Nadu, the urban land tax is collected through a unique legislation called the Urban Land Tax Act.

Legislative framework for VCF

In the current context, the VCF tools are enabled through various legislations. In a single state, there are multiple legislations that enable VCF tools and also identify the beneficiary authority for each of these tools.

In general terms, some of the key legislations that enable VCF tools are:

Municipal Corporation Acts – Typically cover property tax, betterment charges, and building permission fees (if this is under the purview of the ULB)

Municipality Acts – Typically cover property tax, betterment charges and building permission fees (if this is under the purview of the ULB)

Development Authority Acts – Formation of development authorities is typically covered in Town Planning Acts, though in some cases, there are separate Acts for formation and functioning of development authorities. Such Acts provide for VCF tools similar to Town Planning Acts.

Town Planning Acts – Typically cover betterment charges, external betterment charges, and building permission fees (if within the purview of development authorities), sub-division charges, and layout charges

Stamp duty and registration Acts – Typically cover stamp duty (and surcharges) levied on sale/purchase of land and built-up property

Basis for a productive VCF tool

While there is a whole body of research related to the constituents of land-based fiscal tools, this article limits its focus to the Indian context and the typical legislative issues around the same.

For any tax/ fees/ levies/ charges, the fundamental base is the legislative enablement. To review any kind of tax/ fees/ levies/ charges, the following aspects are critical:

1. Policy aspects

a. Base

b. Rate

2. Operational aspects

a. Collection

b. Administration

The prime focus for decision makers should be on the policy aspects to ensure that the tool is efficient, equitable, adequate and manageable. The realisation of resources from the tools is a testimony to the efficiency of the operational aspects of collection and administration.

Issues in the legislative framework for VCF tools

A quick review of various legislations across states reveals that the urban local bodies have very limited powers to influence the revenue realisation from VCF tools. The tax base and rates are defined either in the legislation or by the state (through a government order), with ULBs having limited to no recourse to changing either the base or the rate.

ULBs, in a majority of the cases, have control over only the operational aspects, i.e. collection and administration, of any VCF tool. The third tier of governance is limitedly empowered to influence local taxation. This is, arguably, the biggest stumbling block in the legislative framework.

The state government typically sets out rates for most taxes/ fees/ charges as part of the legislative framework and the ULBs tend to follow these set charges. Very often, these rates are not revised for several years, for a variety of reasons. This presents a challenge for ULBs because there is no upside in the potential revenue from the VCF tools, while the infrastructure provisioning costs keep getting revised upwards.

In some cases, there are multiple levies that ULBs charge. For instance, a betterment charge and external betterment charge can effectively be one and the same in the absence of ring-fencing the utilisation of revenues so realised. Indeed, it is a major issue with the various legislations that provide for VCF tools – that the realisation of resources from the VCF tools is not ring-fenced, i.e. they are subsumed into the overall resources of the ULB.

In many states, the ULBs are not fully empowered to charge taxes/ fees/ charges, especially the town planning related charges such as betterment charge, building permission fees, regularisation fees, etc. Wherever there are development authorities (also known as urban development authorities, in some cases), these retain the powers to levy most of the Town Planning related charges. In such a scenario, while the ULBs provide infrastructure services and also maintain them, they are unable to recover costs except in the form of property tax or water tax (or charges).

Good practices

There are a few good practices, however, that demonstrate legislative frameworks responsive to changing land market dynamics and values.

Mumbai levied area-based development charges until fiscal 2010. The area-based charge of Rs 350 per sq mt yielded revenues of Rs 132 crore in fiscal 2010. Later in 2010, the rate was changed to 2.5 percent of the land value as recorded in the Ready Reckoner. This resulted in a revenue of Rs 306.9 crore in fiscal 2012. Even in this case, the rate was linked to land value only. Had the rate been linked land plus construction, the revenues would have sky-rocketed and would keep on increasing every year.

Ahmedabad has been using the premium Floor Space Index (FSI) tool for quite some time now. The provisions for the same were made under the Development Plan, 2021 through the General Development Control Regulations. The Ahmedabad Urban Development Authority has proposed chargeable FSI. In the residential zones (I & II), the chargeable FSI ranges from 0.45 to 0.9 (over and above the base FSI of 1.2 and 1.8). In the Central Business District (CBD) area, the chargeable FSI available is 3.6, which is over and above the base FSI of 1.8.

Recently, with the implementation of the Bus Rapid Transport System (BRTS) projects across Ahmedabad, the authority, with the objective of developing transit-oriented development (TOD), and to recover part of the investments, has proposed the premium FSI concept along the BRTS corridor.

Up to 4 FSI permitted till 200 mt along BRTS corridors and proposed metro corridors. The proceeds generated from sale of premium FSI go to the Urban Transportation Fund which is proposed to be utilised for improving public transport in the city. This is a great example of use of statutory tools for infrastructure development in a city.

Changes that will enable VCF

As discussed earlier, there are multiple legislations that influence the buoyancy of land-based fiscal tools. The number and variety of legislations differ from state to state. In short, we are dealing with a complex web of multiple legislations and therefore changes to those need to be calibrated carefully keeping in the state context.

Some examples of the legislations requiring changes are:

1. Betterment/ Development Charges – The town planning legislation (or the Municipal Corporation/ Municipalities Act, depending on where these charges are enshrined) will need amendment in sections that deal with betterment/ development charges in case these are levied on area basis as opposed to land value basis.

2. Property Tax – The Municipal Corporation Act/ Municipalities Act will need amendments in sections that deal with property tax in case the property taxation method is proposed to be changed from the current annual rental value method to capital value method.

3. Stamp Duty Surcharge – The Stamp and Registration Act will require amendment to sections that allow the levy of a surcharge on the stamp duty rate. A large proportion of the surcharge revenues collected typically accrues to the urban local bodies.

Summing up

Local governments are caught in a vicious cycle of poor infrastructure service delivery, lower taxation/ user charges and poor resource mobilisation. To put this in perspective, municipal corporations in the country have a per capita income of Rs 2,758, but a per capita expenditure of Rs 4,360.

If the vicious cycle is to break, VCF will have to become the backbone of change.

The Ministry of Housing and Urban Affairs has commissioned VCF studies for several cities in the country. These studies will identify changes that will bolster the possibility of generating additional revenues for the cities.

Yet, while theoretically very attractive, an optimal VCF will require changes backed by strong political and administrative will.

Brijgopal Ladda, Director - Urban Practice, CRISIL Infrastructure Advisory

The thoughts and opinions shared here are of the author.

Check out our end of season subscription discounts with a Moneycontrol pro subscription absolutely free. Use code EOSO2021. Click here for details.