Thank God for Bailouts

Noted economic commentator and Financial Times journalist Martin Wolf has supported financial stimulus packages, but is concerned about national deficits.Forbes India asks him about this apparent paradox

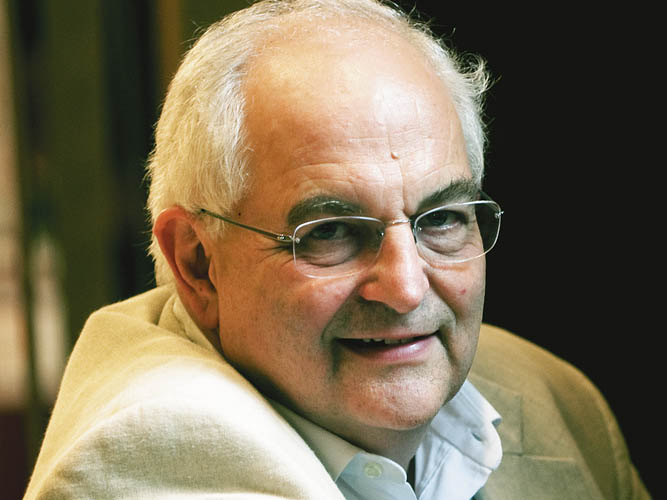

Name: Martin Wolf

Title: Associate editor and chief economics commentator at the Financial Times Age: 63

Career: In 1971, he joined the World Bank’s young professionals programme and became a senior economist in 1974. He joined the Financial Times in 1987; he has been associate editor since 1990 and chief economics commentator since 1996

Education: He has a master of philosophy degree in economics from Oxford University

Interests: Literature

In economics we never know anything. It is more like medicine but worse. But doctors have many patients to deal with unlike economists which have only one. The world economy has had a disease like this only twice in the last 100 years.

If central banks had not pursued the monetary policies that they did and had governments not supported the financial system the way they did, we would have been in the biggest depression ever. I think the stimuli have been a success. But I can’t prove this because I don’t know what the world would have been like if we had not done all these things.

Were all the measures taken necessary? We don’t know but if you do too much, you can withdraw it. If you do too little, you are stuck in a depression.

Then why are you castigating the British government and Indian economists blaming the Indian Government for running a massive deficit?

India is growing at around 7-9 percent. That makes it much easier to grow out of debt because the growth rate is high. The British growth rate is 2 percent and therefore, the deficit is much more difficult to manage. In the case of the UK, we have a very large structural deficit. When the economy recovers we will have to eliminate it.

Our position is worse than the US because we are not producing the world’s key currency anymore. Over a period of time, we have to hope that we don’t run out of fiscal credibility before we make a recovery from the crisis. Because if we do, then we will have a second crisis. This will be a crisis of government insolvency.

Are we destined then to live in cycles of boom and bust?

We can’t get out of this sensibly. I think you have to restructure some of the debt of the private sector. Some of it has to be socialised. And the high deficit countries will have to export their way out of it. They have to generate demand on the basis of foreign demand. Domestic demand is not going to be strong enough.

You want spenders to save and savers to spend?

If the US would have allowed itself to go into a slump and had it not made the adjustment through fiscal policy then the other countries would have been forced to make these adjustments because external demand would have disappeared.

Other countries just assumed that the US would find some way to generate domestic demand so that they don’t need to. My hope is that the pain of this correction is sufficient that most of them, at least the Chinese, think of generating domestic demand.

(This story appears in the 17 July, 2009 issue of Forbes India. To visit our Archives, click here.)

Post Your Comment