7 out of 10 big IPOs in FY19 gave positive returns; 5 issues to watch for in FY20

Experts feel that investors should avoid getting stuck in companies that lack growth prospects

Image: Shutterstock

Image: Shutterstock

"You don't have to really worry about what's going on in IPOs. People win lotteries every day..."

Warren Buffett (2016)

Buffett is right about many things in stock markets, he was proven right again in IPO market as five out of 10 companies that raised more than Rs 500 crore each underperformed Nifty50 in the last 12 months.

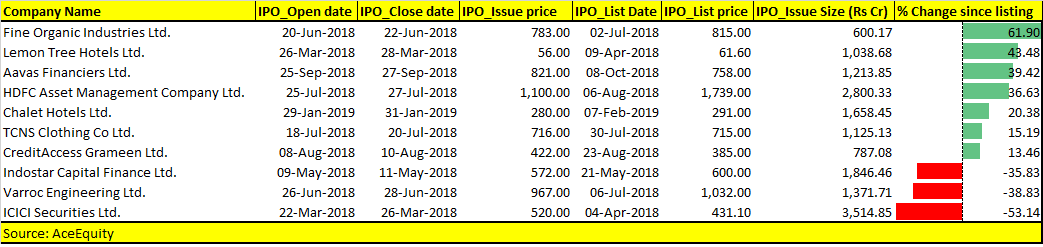

Seven out of these 10 companies gave positive returns though. This includes Fine Organic that rallied over 60 percent, followed by Lemon Tree that gained 43 percent, and Aavas Financiers that jumped 39 percent in FY19.

However, not every stock that debuted in FY19 gave such stellar returns. TCNS Clothing and CreditAccess Grameen rose 13-15 percent as compared to 15 percent rally seen in Nifty50.

ICICI Securities was the top loser among them, down by over 50 percent, followed by Varroc Engineering and Indostar Capital Finance that tanked about 40 percent each.

So, given the underperformance, should investors look at the companies that have gone below their issue price?

Experts feel that investors should avoid getting stuck in companies that lack growth prospects.

“Some businesses are stagnating ventures, which do not create wealth like ICICI Securities, BSE India, etc. If you are looking for a multibagger, then ICICI Securities is not the correct choice as inherently this company generates low growth and doesn't have the capability to produce exceptional returns,” Umesh Mehta, Head of Research at Samco Securities told Moneycontrol.

“In general, all IPOs have to be evaluated on merit of valuations otherwise even a good business at a bad price (i.e., high valuations) cannot create wealth for its shareholders,” he said.

IPO activity in FY19

The activity in the primary market in H2FY19 remained largely muted. Globally, however, India ranked second in terms of number of IPOs, which includes both mainboard and SME issues.

According to Pranav Haldea, Managing Director, PRIME Database Group, 2018-19 saw fundraising through IPOs drop by a huge 81 percent from Rs 83,767 crore in the previous financial year to just Rs 16,294 crore in 2018-19.

As many as 14 mainboard IPOs came to the market collectively raising Rs 14,674 crore compared to 45 IPOs that together raised about Rs 81,553 crore in the previous year. And 106 SME IPOs raising a total of Rs 1,620 crore versus previous year's 154 IPOs raising Rs 2,213 crore in total.

IPOs to watch out in FY20:

Massive corrections in the broader markets fuelled negative sentiment for the primary market and kept companies at bay. The new financial year, however, has started with a bang as Sensex has hit a fresh record high and ventured into unchartered territory that should fuel positive sentiment. But, investing in IPOs should be dealt with caution, suggest experts.

It is also prudent to avoid investing without accessing risk factors or likelihood of risk expected in the future from such entities, and refrain from taking a bet on a short-term basis, they say.

“Making an investment in IPOs also requires an in-depth study about the entities ranging from its business model and financial strength to the competency of management, which should be able to sustain on a long-term basis,” Dinesh Rohira, Founder, CEO - 5nance.com told Moneycontrol.

“A decent number of IPOs is expected in the primary market including from SME segments in FY20, and also big ticket-size issues that withdrew on account of a volatile secondary market in 2018. A tentative issue to look forward in FY20 includes mainboard IPOs like Lodha Developers, PNB Metlife India Insurance, Flamingo Travel Retails, GR Infraprojects, Bharat Hotels, and so on,” he said.

Disclaimer: The views and investment tips expressed by investment experts on Moneycontrol.com are their own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Original Source: https://www.moneycontrol.com/news/business/markets/7-out-of-10-big-ipos-in-fy19-gave-positive-returns-5-issues-to-watch-for-in-fy20-3739431.html