Equity AUM of MFs hit all-time high of Rs 9 lakh cr in 2019; largecaps remain the top pick

Mutual funds during the year poured in little more than Rs 49,000 crore in equities.

Image: Shutterstock

Image: Shutterstock

Calendar 2019 was a great year for Indian equities as the Nifty50 climbed 12 percent and the BSE Sensex climbed 14 percent. However, the broader markets continued to underperform frontliners for the second year in a row.

The rally was only limited to a select 10-15 stocks and was further augmented by several measures taken by the government to spur growth including the corporate tax cut.

Favourable global cues, stable oil prices, easing US-China trade deal and Brexit concerns propelled the upside. FII and DIIs flow also lent major support to equities in 2019.

During the year, mutual fund houses poured in more than Rs 49,000 crore in equities.

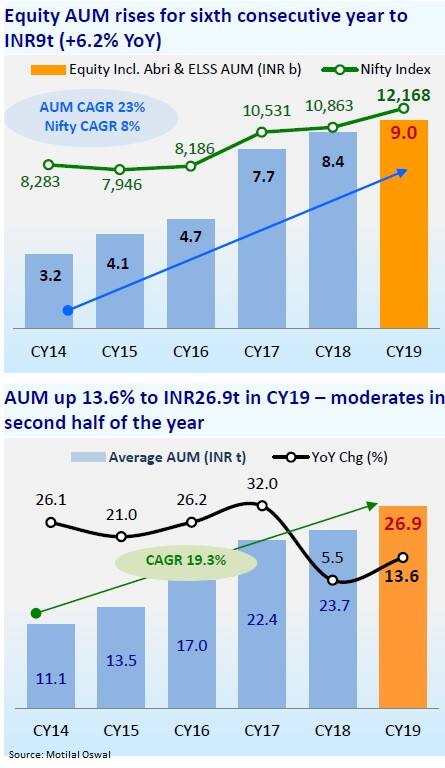

"Domestic mutual funds (MFs) witnessed steady flows during the year, propelling an uptrend in the AUM of equity funds for the sixth consecutive year," Motilal Oswal said.

The brokerage said equity asset under management (AUM) of domestic MFs touched a new high of Rs 9 lakh crore, up 6 percent YoY, in CY19, led by a rise in market indices.

Redemptions decreased 12 percent YoY to Rs 2,02,400 crore during the year, but a decrease in sales of equity schemes (down 14 percent YoY to Rs 3,07,900 crore) led to a decline in net inflows to Rs 1,05,400 crore in CY19 from Rs 1,28,800 crore in CY18, it added.

The brokerage said mutual fund industry's average AUM increased 13.6 percent YoY to Rs 26.9 lakh crore in CY19, primarily led by inflows in equities, other ETFs, income and liquid categories.

The year saw a notable change in the sector and stock allocation of funds.

Domestic cyclicals' weight increased marginally by 30bp to 62 percent while defensives' weight decreased from 27.6 percent in CY18 to 27.4 percent in CY19 and global cyclicals' weight, too, decreased 10bp to 10.6 percent during the year, Motilal Oswal said.

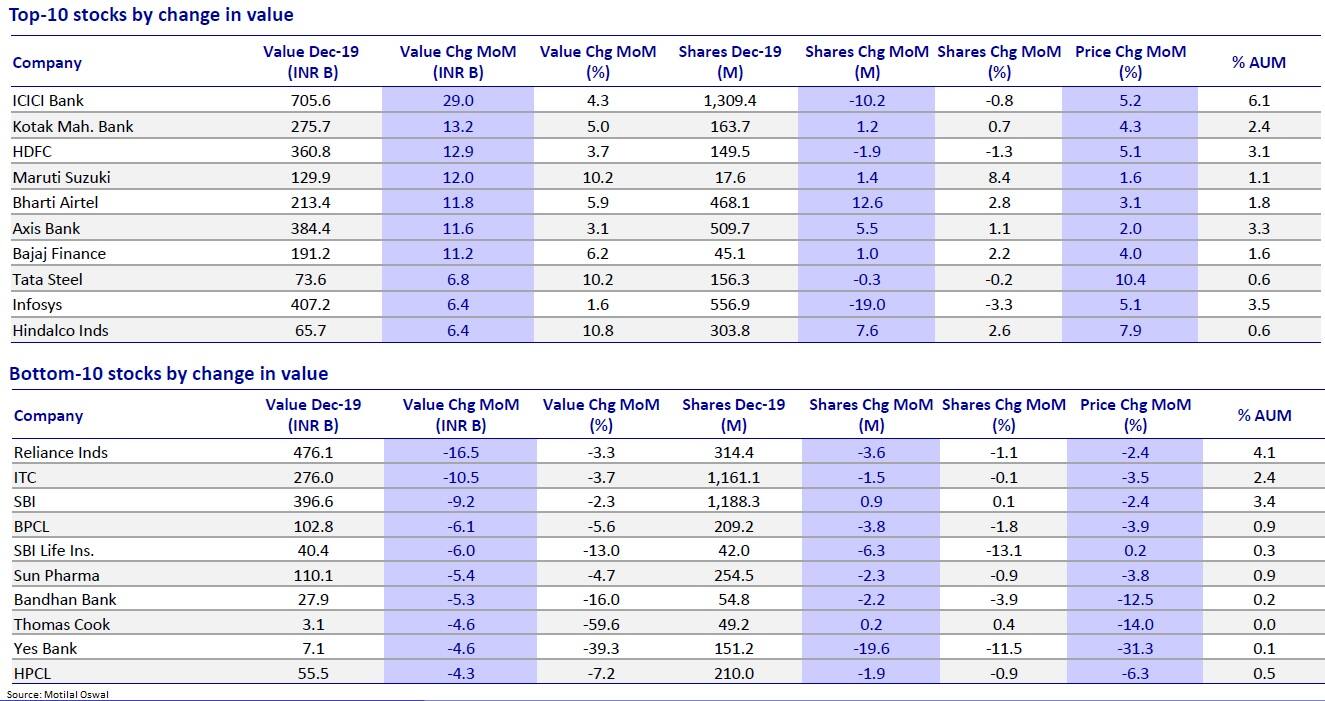

Mutual funds remained net buyers in 46 percent of stocks during December with highest net buying in Maruti Suzuki, UltraTech Cement, Nestle India, Titan Company and Coal India.

Maruti Suzuki's value increased by Rs 1,200 crore and notably, the stock witnessed net buying by 17 of the top 20 funds, the brokerage said.

During the month, in terms of value increase month-on-month, 5 of the top-10 stocks were from financials which were ICICI Bank, Kotak Mahindra Bank, HDFC, Axis Bank and Bajaj Finance, it added.

Stocks exhibiting a maximum decline in value MoM were Reliance Industries, ITC, SBI, BPCL and SBI Life Insurance.

Disclaimer: The views and investment tips expressed by investment expert on moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Original Source: https://www.moneycontrol.com/news/business/markets/equity-aum-of-mfs-hit-all-time-high-of-rs-9-lakh-cr-in-2019-largecaps-remain-the-top-pick-4818601.html