RIL remains India's largest listed firm with $127 bn market-cap

The current market capitalisation of the company stands at Rs 8,74,739.75 crore, which is equal to $127 billion (rupee-dollar rate was 69.07), higher than that of TCS (Rs 7.6 lakh crore) and HDFC Bank (Rs 6.2 lakh crore).

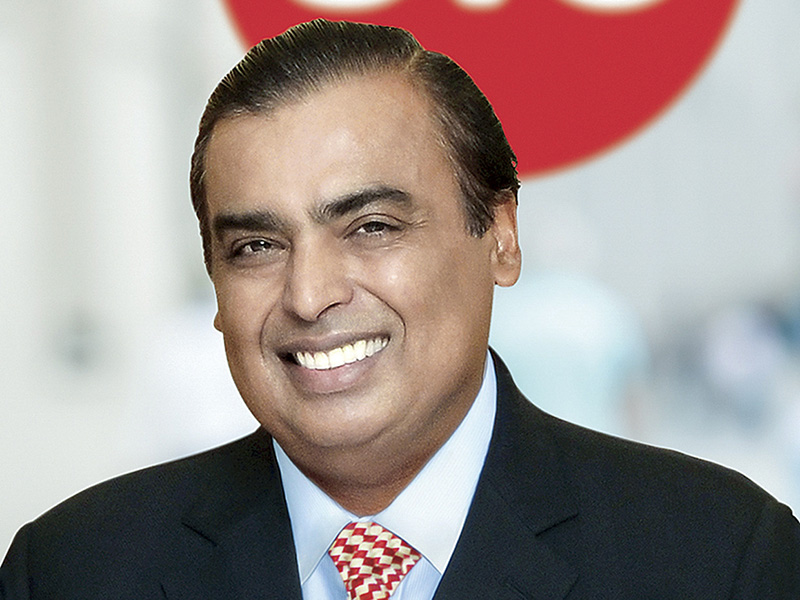

Oil-to-telecom major Reliance Industries retained its tag of 'largest listed firm' in India as the company hit $127 billion in market cap on March 20 intraday trade amid strong market condition.

The stock closed at Rs 1,375.60, up 0.03 percent on the BSE after hitting an intraday record high of Rs 1,386.60.

The stock in current calendar year (January-February-March) performed far better than last whole year. It has surged 24 percent, so far, in 2019 against 22 in 2018.

The current market capitalisation of the company stands at Rs 8,74,739.75 crore, which is equal to $127 billion (rupee-dollar rate was 69.07), higher than that of TCS (Rs 7.6 lakh crore) and HDFC Bank (Rs 6.2 lakh crore).

Consistent growth in new initiatives — retail and telecom — and steady growth in oil segments, petrochemical as well as refinery, helped the stock give strong returns to shareholders.

The Mukesh Ambani-owned company had reported a record consolidated net profit of Rs 10,251 crore and record EBITDA (earnings before interest, tax, depreciation and amortisation) of Rs 22,628 crore for the quarter ended December 2019, a growth of 7.7 percent and 7 percent QoQ, respectively.

Now its consumer businesses (including majorly retail and digital) account for over 25 percent of consolidated segment EBITDA.

Reliance Jio, the most important part of earnings for last one year, reported gross revenue at Rs 12,252 crore and operating revenue at Rs 10,383 crore in Q3FY19, with sustained customer traction. Its profit grew by 22 percent sequentially to Rs 831 crore.

Recently Reliance Industries announced that it is going to sell its loss-making East West Pipeline for Rs 13,000 crore.

"Brookfield has filed the preliminary placement memorandum, in terms of which India Infrastructure Trust, an InvIT set up by Brookfield as Sponsor and 90 percent investor, will invest Rs 13,000 crore to acquire the East West Pipeline," the billionaire Mukesh Ambani-owned company said.

As a part of the transaction, the InvIT will acquire 100 percent equity interest in Pipeline Infrastructure Private Limited (PIPL) which currently owns and operates the Pipeline, it added.

Disclaimer: Reliance Industries Ltd. is the sole beneficiary of Independent Media Trust which controls Network18 Media & Investments Ltd.

Original Source: https://www.moneycontrol.com/news/business/markets/ril-remains-indias-largest-listed-firm-with-127-bn-market-cap-3671251.html