Construction sector: Strong order book, lower lending cost to ensure strong footing

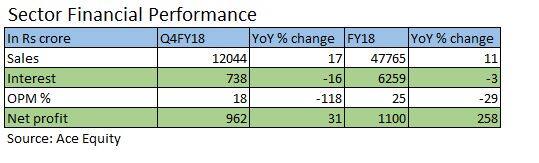

In Q4FY18 itself, these companies have delivered strong 31 percent growth in earnings on a sales growth of close to 17 percent

Image: Shutterstock

Image: Shutterstock

Jitendra Kumar Gupta

Moneycontrol Research

Fiscal 2018 was remarkable for the entire road construction sector. On an aggregate basis, the 9 companies that we covered in this space reported a strong 257 percent year-on-year growth in net profits and 11.4 percent growth in sales. The biggest contributor was reduction in interest cost resulting in some of them turning into profits or cutting their losses significantly.

Importantly, the trajectory remains strong as most of these companies are sitting on order book of close to 3 times their sales. Besides, easing financial hiccups and execution constraints should mean good growth. In Q4FY18 itself, these companies have delivered strong 31 percent growth in earnings on a sales growth of close to 17 percent (see table).

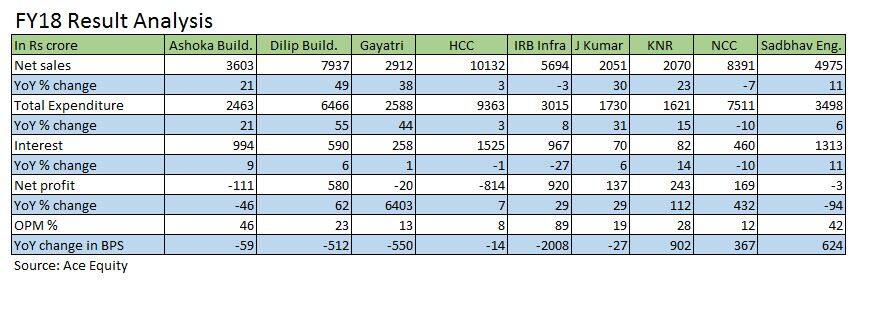

Amongst the companies, KNR Constructions reported strong 111 percent growth in profits to Rs 243.5 crore on a sales of Rs 2,069 crore, that was up by 23.2 percent during fiscal 2018. The company benefited because of strong order book and execution. It is sitting on an order book of close to Rs 6,300 crore, which is about 3 times its sales. Moreover, the company has guided to order inflows of about Rs 2,500 crore in FY19. It is expected to clock 20 percent growth in sales over the next two years.

"We believe it is set on a steady growth path with strong growth visibility, minimal leverage, lean working capital cycle, a prudent bidding strategy and a good corporate governance track record," said analyst Parikshit Kandpal, who is tracking the company at HDFC Securities

While prospects are bright, part of this is already reflected in price as stock is currently trading at 20 times it FY20 estimated earnings thus offering very little upside in the medium term.

Spurt in inflows

Companies have seen strong order inflows. During the fiscal gone by, road projects worth 17,000 kms were awarded as against 15,800 km in fiscal 2017. Companies like NCC saw close to Rs 23,266 crore of orders against its own expectations of mere Rs 12,000 crore orders. It has got robust revenue visibility with the order book of close to 4 times its sales. It is also a good investment candidate in this space trading at 14 times FY20 estimated earnings and 1.4 times its FY20 book value which is appealing in the light of strong order book and growth in earnings.

If the execution stay at current levels there is very little reason why these companies should not deliver strong growth in earnings. Sadbhav Engineering, which reported 72% spurt in order book to Rs 13249 crore or close to 5 times its sales, is expected to deliver close to 25-30% growth in earnings over the next two years. The stock is trading at 10 times its FY20 standalone estimated earnings which is reasonable considering the growth in earnings and can be considered for investment.

Companies like Ashoka Buildcon, which is sitting on order book of close to Rs 5,800 crore or about 3 times revenues, guided for close to 40 percent annual growth in EPC sales over the next two years.

Improved execution key to growth

Not just bulging order book, companies are able to execute at higher pace as most of the projects now come with the stringent execution timeline and there are minimal policy hurdles or obstacles on ground in terms of land acquisition, environment, funding etc.

This is precisely the reason that during fiscal 2018, close to 10,000 km of roads were constructed as against 8,200 km in FY17. To put in perspective, companies like J Kumar, which is executing Mumbai Metro, saw strong 30 percent growth in revenues during FY18 purely because of strong execution. It is sitting on order book of about Rs 8,500 crore, which is more than 4 times its sales and remains one of the key pick in this space. The stock is trading at 10 times estimated FY20 earnings.

One of the reasons why these companies are able to grow earnings at higher pace is reduction in interest cost. At aggregate level, we have seen close to 3 percent reduction in interest cost in FY18 and 16.4 percent reduction in Q4FY18. For any construction company this is a big lever for earnings growth because of their dependency on borrowed funds. Companies like IRB Infra, which despite 2.6 percent decline in sales saw 28 percent growth in earnings led by close to 27 percent reduction in interest cost.

Original Source: https://www.moneycontrol.com/news/business/moneycontrol-research/construction-sector-strong-order-book-lower-lending-cost-to-ensure-strong-footing-2583207.html