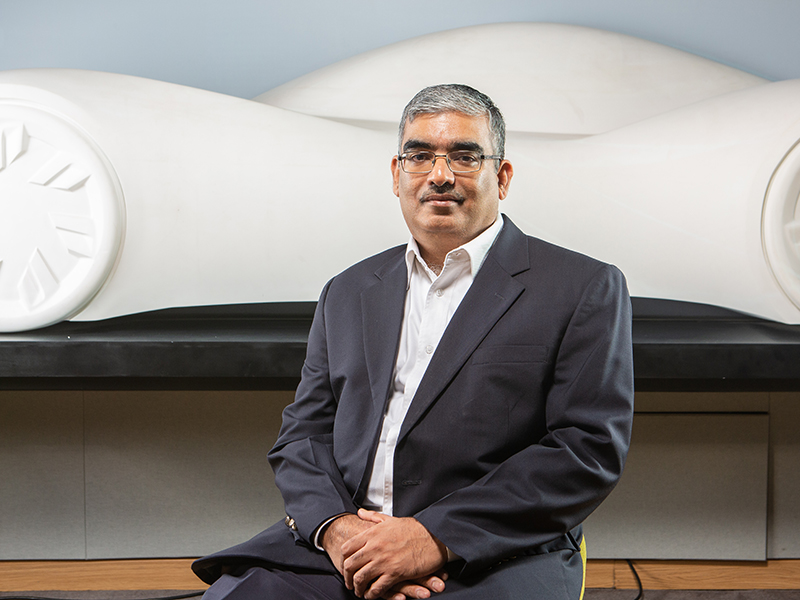

How AI is helping IndiaMart fulfil its vision of buyer-supplier matchmaking

IndiaMART is a remarkable story in Indian ecommerce. The company clocked Rs 533 crore in profitable revenue in fiscal year 2019—and listed publicly on the stock-markets in June 2019. This is rare for internet companies in India. Throughout the IndiaMART journey, CEO and managing director Dinesh Agarwal has ensured the focus remains on B2B ecommerce. He wanted to make the internet simple for the growing community of MSMEs (micro, small and medium-sized enterprises). Today, more than 5.5 million MSMEs are registered on the IndiaMART platform, which lists 63 million products. To find out how it innovates for the B2B economy, Forbes India met Dinesh Agarwal. Edited excerpts:

As an internet platform, who does IndiaMart serve? Can you tell me about your user base?

We serve all kinds of businesses—small, medium or large businesses; Indian as well as international businesses. Today we have about 5.7 million suppliers and about 93 million buyers registered on IndiaMart. We do more than 40 million business matchmakings every month.

Can you explain the concept of matchmaking on IndiaMart?

It is where a buyer discovers a supplier, and a supplier discovers a buyer for a particular product or a service.

You started out in 1995, tell me about the different technology eras that IndiaMart has been part of.

We started in 1996—it was the early days when there were hardly any computers or internet in India. However, I had come from the US where both were already popular. Understanding that exports were very important for the Indian economy, we realised that there for a price opacity and limited information about Indian products for the American importer. We started with that opportunity. Back then, we got online enquiries from the US and every night, we printed them, faxed them overnight and then sent them by post the next day. This went on for five years.

The internet really only took off when the dot com boom happened in 1999-2000. The focus shifted to computers, e-mail, content-building, more suppliers, and more exporters online. From 2001-2006, that was the second era.

Around 2007-08, Indian exports had started to flatten out. The mobile feature phone became very popular. We had to completely reinvent ourselves from being a computer- and email-based platform to more of a voice-based and SMS-based platform.

Finally, the smartphone regime has now transformed the Internet in a very different way. In 2010, we also thought for the first time that we want to completely pivot from an export-oriented business to a domestic B2B business. That is when, I think, we started growing at a very rapid base—from $10 million revenue business, we are now a $80-$90 million revenue business. Today, there is a greater focus on technology, machine learning and artificial intelligence.

You have always been an advocate for simplifying the internet experience. How and why is this important for the B2B marketplace?

Not only B2B marketplace. It is important for any consumer website service or business website service. You deploy technology for the users to use, not for the users to see the technology. So when you use IndiaMart, you would simply search for something and you will find it. There are many important things going on behind the scenes—the kind of data collection we have done, the behavioural affinity that we have found, the kind of keyword matchmaking, locational affinity, and computational power that goes behind that are very different.

You can search IndiaMart in nine different Indian languages. It converts into English on the backend, takes a voice input—all that has to be seamless for the user. While we are a technology company, users should see us as a functional company—not a technology company. My mantra is—let the user get his job done without being exposed to the jargons of technology or the technology hurdles.

At the backend, what is the complexity that is taking shape for IndiaMart?

There are about 400 people working in the product and technology teams. We have multiple set of databases spread across India, US, Europe and Singapore. Every product and service—all 63 million of them—can be translated into different languages. Those are the kinds of technologies we use. There are APIs (application programming interface) that help us do this.

Our earlier brand promise that “IndiaMart pe kaam, yahin banta hain”, and the one now, “IndiaMart pe kaam bada aasaan hain,” we continue to focus on how to make product-matchmaking easier for businesses. Our overall mission or vision is to make it easy for doing business in India.

But IndiaMart has consciously stayed out of logistics and delivery. What have the challenges been because of that?

We have been mostly a platform—a technology platform or a media-cum-technology platform. We provide you with content, matchmaking, prices and specification. We are across 100,000-plus categories in India. So from steel to truck, iron ore to steel components, everything you see comes under our hood. It is almost impossible for us to add value in logistics across categories. The B2B sector’s orders require a lot of customisation. It’s not about picking up an item from the shelf and delivering it home. So we decided it is best delivery and its terms and conditions are left to the buyer and supplier.

Has the order size on IndiaMart gone up, or has it optimised over the last few years, considering the scale that has come onto the platform?

Order sizes vary. As I said, we have 100,000-plus categories. Order sizes vary across categories. On one side, we could have a simple a button, which with an order size of 1,000 could be worth Rs 1,000. On the other hand, we could have an Earth-moving equipment, with the order size of one, but worth Rs 50 lakh or Rs 5 crore. So it is very, very varied. Over time, I have seen more adoption happening both on the lowest and highest order-size items.

With 20 years of data on the IndiaMart platform, how are you able to harness external changes like AI and machine learning?

Earlier, we used data by way of traditional algorithmic matchmaking. But in the past couple of years, we find there are many use-cases for us to utilise machine learning and deploy artificial intelligence.

I’ll give you some examples. IndiaMart is a curated database of good businesses. A lot of tele-marketers use that to spam or sell their service. How to identify which call is spam, a sales call, or a genuine call? Earlier, listening to calls was almost impossible. Now there is a complete voice-to-text algorithm behind that, which automatically searches the patterns and identifies whether it is spam or not.

Similarly, there are suppliers like furniture-suppliers who say, “I can do all kinds of furniture–chair, sofa, table, and so on”. However, we know by his activity on the platform, he deals mostly in sofa-sets and dining tables. On his website, a hundred products are listed, but technology helps us discern which two products are his bread and butter. And on what products the supplier is more likely to convert, based on the market behaviour. If we use machine learning to gauge each supplier—their locational behaviour, price behaviour, quantity behaviour—we are able to do effective matchmaking on the buyer side.

We are a marketplace where a lot of people try and sell anything and everything. This could include banned substances. There could be banned items, which are not allowed in the marketplace. How do we check every product that goes through when even humans can’t identify them effectively? Every day, we upload 25,000 new product images on the platform. It is only AI and ML, which can sort them out—that a particular image is not right for the platform.

And how are you harnessing large shifts like video, playing out in India?

We have tried to harness video multiple times. In 2010-11, we used to hire special videographers to go to the suppliers’ office and shoot videos. It never took off. But in the last three years, especially after the Reliance Jio data revolution, videos have become quite a popular thing.

What has happened is, today we clock about 65 million visits every month, which is a lot of people coming from rural and remote parts of India. Around 33% of our traffic is from tier-three and –four cities, smaller tehsils, and villages of India. They prefer to watch videos in their language rather than in English or Hindi. In the past year, we have probably added more than 2 lakh videos—product videos and category videos that helps us. And in each of our categories, suppliers who were providing product photos and prices have started providing product videos. Each of those categories is becoming a destination in themselves.

.jpg)

.jpg)