Personal finance: How to structure your portfolio during Covid-19

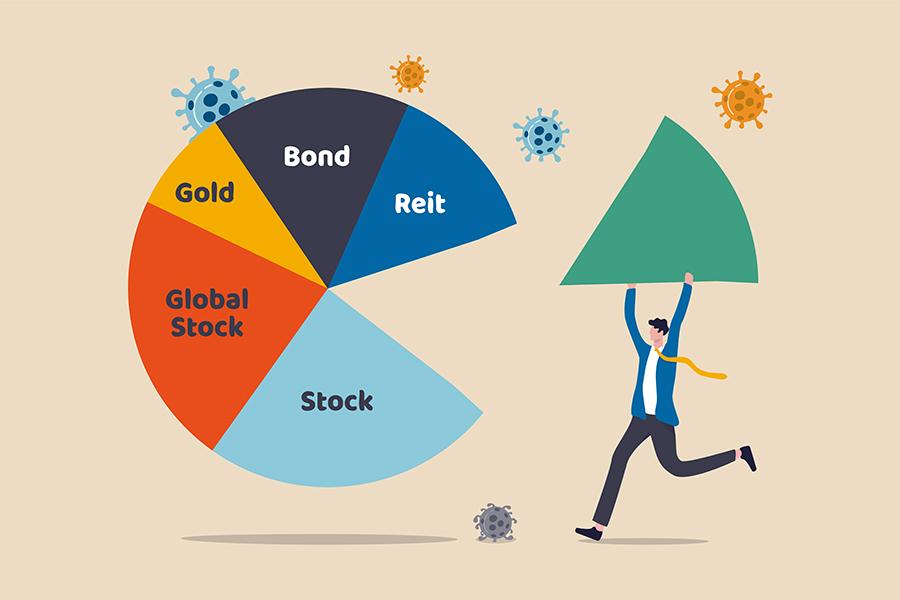

A well-balanced, profitable portfolio given the times would involve an approximate diversification of 20 percent in gold, 35 percent in equity, another 30 percent in real estate and 15 percent in fixed income. Here's why

We live in times when the promise of profits sounds as bleak as the promise of a COVID-cure-ready-tomorrow. You can't believe it till you see it. And given the world today seems to be divided into naysayers and a lot of hot air, it is difficult to understand which way to turn to make your investments grow.

In investing, the two paramount factors are one’s risk profile and targeted returns. The key, therefore, is to adhere to this profile while developing a balanced portfolio. But let’s move on from theory to practice.

One of the most significant issues plaguing the Indian investment market is that too large a chunk of our asset base is allocated to real estate, an over-inflated, illiquid asset which, were one to monetise for rent, would seldom provide a rate of return higher than 1.5 to 2 percent. This challenge can be attributed to a multitude of factors, foremost being that 10 percent of India’s populace controls ~75 percent of the wealth. A major chunk of this demographic is in the 45-60 age group.

Here is how this impacts the market: 40 to 60-year-olds have seen only a unidirectional bull market in the real estate asset category. Coupled with the socio-cultural mindset of Indians where renting is considered taboo among the affluent, most Indians have a portfolio where real estate as an asset plays a prominent part.

However, I see a correction in the real estate markets, which means that in order to maintain liquidity in such VUCA (volatility, uncertainty, complexity and ambiguity) times, it may be prudent to rebalance portfolios drastically, putting aside socio-cultural stigma and traditional mindsets.

Therefore, a targeted return rate of 12 percent would allow most Indian investors with earnings of Rs 2 crore per annum, and savings for the same tenure of Rs 4 crore, to double their asset base every six years. Using the power of compounding, which could be achieved using the above mantra of financial rationale and diversification, a moderate risk profile could be created for a majority of India’s HNI base.

A well-balanced, profitable portfolio given the times would therefore involve an approximate diversification of 20 percent in gold, 35 percent in equity, another 30 percent in real estate and 15 percent in fixed income.

Why do I say this?

Because gold as an asset class is gold-class (pardon the pun) in times of uncertainty. Any investment in gold acts as a natural hedge against the equity and real estate components.

The allocation to equity is subject to several conditions, among those being the choice of fund managers who have a stellar track record of returns. The benefits that investors receive of having a 10 percent long-term capital gain tax rate justifies the significant allocation to this piece. However, investors need to be wary of distributors, high running costs and management fees. A 2 percent annual fee with something paid out at setup and exit can exponentially impact performance over two decades. A quick recommendation here would be to keep it simple and go for one or two funds focused on large caps.

As far as allocation in real estate goes, in order to diversify risk, it might be a good idea to split this 30 percent into two properties in different geographies, against having one substantial investment.

Coming to the fixed income piece—one’s portfolio should be so mapped that in a downward interest rate cycle such as the one we are amidst, outside of the yield earned on bond, mark to market gains could be garnered over the short run. A couple of quick tips here would be to stay away from corporate debt, and instead buy government tax-free bonds, as they provide a yield of 4.8 percent net of taxes and come with a sovereign guarantee. Tax-exempt bonds also add an element of stability, when the world at large is in choppy waters.

There is no one-size-fits-all mantra that can beat these times. Similarly, there is no single asset class that guarantees returns. The portfolio therefore should provide ample liquidity and risk mitigation to help deal with the uncertainties in a Covid-driven market. Balance and diversification therefore are key, if one intends to make profits in the eye of the storm.

The writer is co-founder and CIO of investment firm True Beacon and online stock trading platform Zerodha

The thoughts and opinions shared here are of the author.

Check out our end of season subscription discounts with a Moneycontrol pro subscription absolutely free. Use code EOSO2021. Click here for details.