US Presidential Elections 2020: How to hedge your risks

The 2020 US Presidential election has a lot more uncertainty due to the effect of COVID-1, its influence on the ability or inability of voters to vote in a timely manner, and the increase in demand for Vote-by-Mail (VBM)

The US Presidential election is a major political event that has macro-economic ramifications not only in the US but across the global markets. The effect on policy (monetary & fiscal) in various sectors of the economy within the country propagate its effects through the trade relations that other countries maintain with the US.

The 2020 US Presidential election has a lot more uncertainty due to the effect of COVID-19 and its influence on the ability or inability of voters to vote in a timely manner. The increase in popularity of Vote-by-Mail (VBM) and the politics surrounding it are the major cause for uncertainty.

It is possible to measure this uncertainty in the market which has historically led to increased volatility by tracking leading indicators. Tracking them will allow us to secure appropriate hedges, if required, in the forthcoming months.

Why is the 2020 Presidential Race unique? This year, due to the fear of COVID-19, VBM is the preferred mode of voting amongst voters. This could lead to a delay in counting of votes as ballots need to be mailed from the states to the counting stations, where they will be manually counted and tallied. This delay is expected to push the election outcome from the usual November 3 to further in the week or month.

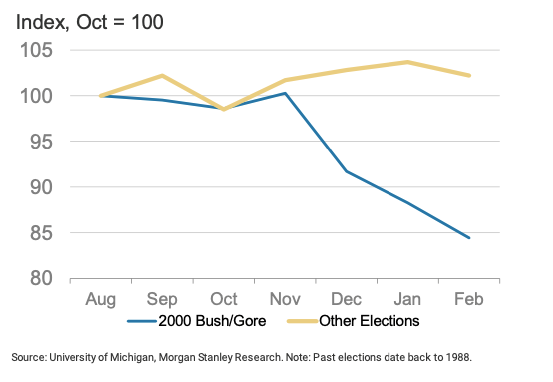

Two decades ago, a presidential race came down to fewer than 600 votes in one state. Incorrect television projections and a month-long battle led the outcome of the race to remain hanging. In the end, George W Bush became president but the uncertainty led to the US markets correcting by 9 percent between November-December 2000. The correlation between Indian markets and US markets has increased over the last 20 years and a drawdown in the US markets is likely to affect the Indian markets in a similar way.

The operational challenges of VBM

» Unlike machines that tally votes automatically, local officials must manually open and tally each received VBM, making it a slower process.

» Processing these ballots can begin before Election Day but the manual counting can only be done on Election Day, and in some states only after the polls close.

» The VBM must be posted and will be received on Election Day, during or after voting closes. Most election offices (locations where votes will be counted) have imposed a deadline for receiving VBM ballots by Election Day (November 3).

Due to the fragile US Post Office System, delays of up to two weeks are expected depending on the quantity of VBM voters.

Evidence of potential delays and confusion can be seen in primaries held earlier this spring, coinciding with the worst of the coronavirus outbreak. In many instances, a significant number of ballots were rejected for arriving too late, even though they were sent within the acceptable window. A recent NPR analysis found that "an extraordinarily high number of ballots—more than 550,000—have been rejected in this year's presidential primaries...that's far more than the 318,728 ballots rejected in the 2016 general election."

This year, there are 50 million more requests for VBM ballots compared to 2016, with the requests from Democrats exceeding that of Republicans by 1.3 million. Hence, early signs may indicate a Republican majority, but a late Democratic comeback will definitely be on the cards as delayed VBM votes are tallied.

Leading indicators to track

1. Consumer Sentiment

The relative consumer sentiment can be tracked between 2000 and other elections.

Consumer Sentiment declined by 8 percent MoM from November to December 2000 as the uncertainty around the election outcome lingered. In contrast, sentiment tends to rise post-election results.

We can track this metric to gauge consumer confidence in the market.

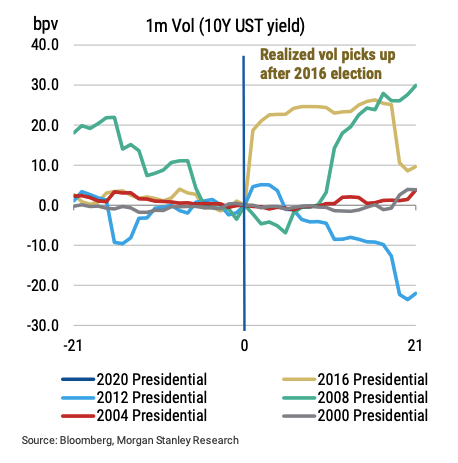

2. Treasury YieldsDuring periods of uncertainty, the appetite for risk among investors is low and hence people will bid for US Treasuries.

The more delayed the result, the closer the race will be. This, in turn, points towards a divided government outcome.

The Treasury Yield declined from 5.72 percent in October to 5.12 percent in December 2000 during the election period as the result was unconfirmed.

By tracking Treasury yields, a decline in yields will be indicative of uncertainty.

Conclusion

The extent to which economic activity may be affected around the 2020 presidential election will depend greatly on how quickly the uncertainty over the election outcome is resolved. A relatively quick resolution that leaves a shallower mark on public sentiment would likely result in little economic impact, on net, all else equal. The longer uncertainty lingers, however, the greater the impact may be felt on measures of economic activity. This means that the US presidential election has the ability to present downside risks to the near-term economic outlook–something that monetary policymakers may decide to take into account when setting the appropriate stance of policy.

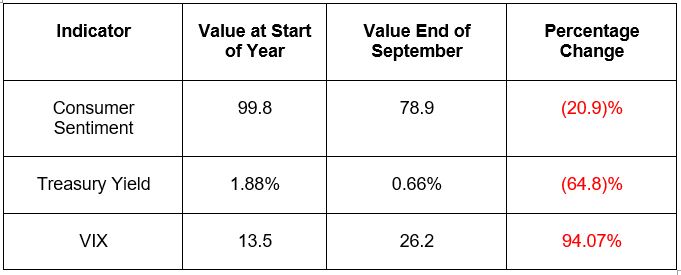

At a portfolio level, tracking indicators like Consumer Sentiment, Volatility (VIX) and Treasury Yields for the US Markets should help us gauge the uncertainty in the market.

As of today, the effective values for the three indicators are:

Appropriate degree of hedges can be secured based on the delay in declaration of the new President.

Appropriate degree of hedges can be secured based on the delay in declaration of the new President.

The writer is co-founder and CIO of investment firm True Beacon and online stock trading platform Zerodha

The thoughts and opinions shared here are of the author.

Check out our end of season subscription discounts with a Moneycontrol pro subscription absolutely free. Use code EOSO2021. Click here for details.