Deciphering a healthy stock market rally

As intelligent investors, we must analyse tangible factors to conclude whether the given stock market rally is healthy, or if a bubble is being formed

The Indian stock market has witnessed seven recorded bull market rallies since 1984. The first rally, which mirrored the decade-long rallies that we have become accustomed to was post the tech-bubble burst in 2003. While each rally comes to an end due to different factors, the salient features of the rally itself are generally the same.

In the most basic terms, the stock market’s performance should ideally be a function of its underlying elements i.e the companies that make up the stock market. Post India’s liberalisation in 1992, the stock market has seen a strong correlation with global markets. These two factors, fundamentals of the Indian economy and developments in the global markets, form the basis for the direction of the stock market. Another key factor, often overlooked, is human sentiment.

“The market is a pendulum that forever swings between unsustainable optimism (which makes stocks too expensive) and unjustified pessimism (which makes them too cheap)," American writer Jason Zweig, author of The Intelligent Investor, said.

As intelligent investors, we must focus on tangible factors that we can analyse to conclude whether the given stock market rally is healthy, or a bubble is being formed.

Benchmark indices: A barometer for the economy

In a perfect world, the stock market should rally when the economy does well and vice versa. A common barometer to judge the state of the economy is ‘benchmark indices’. For example, in India, Nifty50 and Sensex are the two benchmark indices. These two indices are made up of the 50 and 30 largest companies in the country respectively and it is understood that their relative performance as a whole is a fair representation of the state of the economy.

Therefore, to identify a healthy rally, one can focus on analysing:

1. The fundamentals of the companies that make up the benchmark

2. The general state of the economy

If these two factors are in alignment, one can be relatively sure that the stock market will move in the direction indicated.

Analysing an economy to gauge the rally

The most efficient way to analyse the state of an economy is to breakdown the factors that contribute to the economy’s GDP.

Corporate investment and performance

The first component of calculating GDP is corporate investment. In this context, two factors are measured: Fixed investment and change in inventory levels. Fixed investment refers to money spent on building infrastructure, equipment and other capex that have the potential to increase the output potential of the company.

Change in inventory levels is the second metric tracked. New orders, which lead to an increase in inventory levels, is indicative of a rise in demand and is therefore added into the GDP calculation.

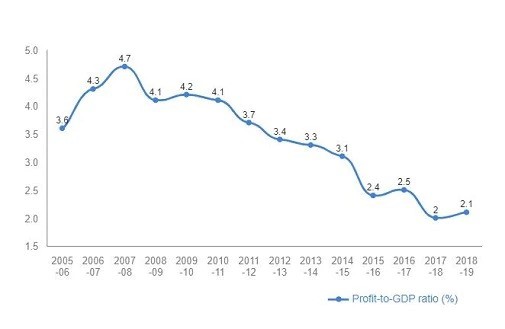

The third point, which is not a contributor to GDP calculation but is relevant in this context is corporate performance or the growth in net profits. Ideally, if a benchmark index/stock is rallying, its underlying companies must also show a growth in net profits but this is not always the case.

For example, in the recent Nifty50 rally up to its peak on January 20, 2020, the index was forming a new high almost every other week but the performance of the underlying companies was dismal. The contribution of the bottom line of most company’s income statement to the GDP was diminishing every quarter.

Government expenditure

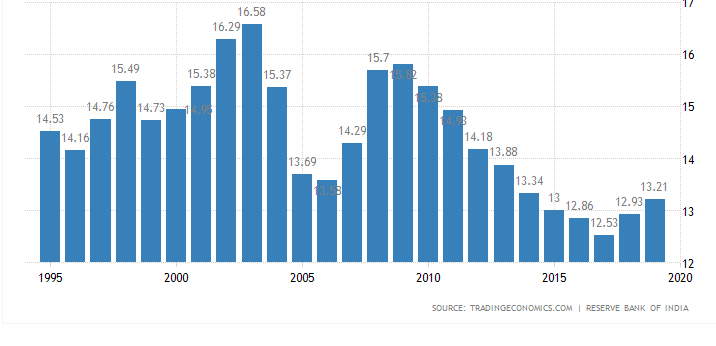

This component tracks the government’s spending on goods and services. It includes all expenditure on infrastructure, purchase of intermediate goods and wages paid by the government. An increase in the government’s expenditure is added to the GDP calculation.

Using our previous example, if we track government expenditure. We can see a drop in this metric over the last few years as the government reigned in the fiscal deficit and increased subsidies for essential goods.

Consumer spending

Consumer spending

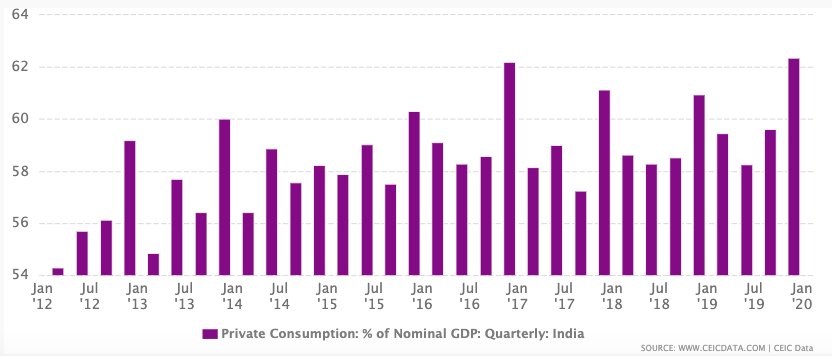

Consumer spending measures the value of goods and services that are purchased by households (individuals) and non-profit institutions. In general, a high consumption component is a good indicator that the economy is driven by the market.

Coming back to our example, consumer spending over the last decade has remained mostly stable but the first signs of weakness were seen in FY18 when consumer spending declined for the first time in 4 decades according to the National Statistics Office (NSO).

Net exports

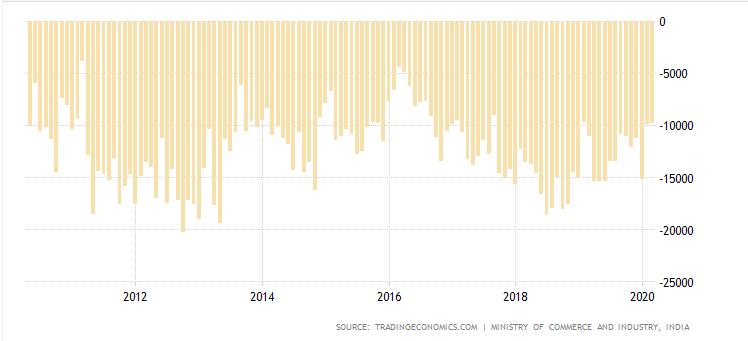

The final component of the GDP equation is net exports. While the subtraction of imports from GDP is generally considered to be a negative sign, it is not necessarily true. They may, for example, allow an economy to better use the natural resources available at its disposal.

In the context of our example, India has been a net importer of goods for many years and this value has increased further driving the GDP calculation down.

Final thoughts

Final thoughts

Deciphering if a stock market rally is healthy is a simple process if analysed systematically. Sometimes, our judgement is clouded when markets tend to rally despite negative cues from our key indicators. Human sentiment, as referred to before, may cause markets to rally due to optimistic expectations in the near future. While these rallies may offer short-term gains, their long-term viability is uncertain and therefore is not a repeatable process.

As American economist Benjamin Graham says, “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

The writer is co-founder and CIO of investment firm True Beacon and online stock trading platform Zerodha

The thoughts and opinions shared here are of the author.

Check out our end of season subscription discounts with a Moneycontrol pro subscription absolutely free. Use code EOSO2021. Click here for details.