How to deal with a rise in home loan interest rates?

A long-term financial commitment like a home loan as a part of your financial portfolio can be tricky, especially when interest rates keep fluctuating

As incomes rise, the repayment capacity of the younger generation especially those in their 20s and their 30s is, on the whole, better than that of the previous generation. It’s no surprise that buying a home is no more an aspiration restricted to the 40’s and 50’s or for those with capital.

But there’s no denying that having a long-term financial commitment like a home loan as a part of your financial portfolio can be tricky, especially when interest rates keep fluctuating. The latest repo rate hike of 25 bps by the Reserve Bank of India came just days after prominent banks had hiked their marginal cost of funds based lending rates (MCLR).

In simple terms it means loans will now get costlier and deposits will earn better returns. However, every individual’s financial portfolio will have a different impact depending on their outstanding debt, non-fixed assets, liquid assets and spending patterns. To ward-off an unprecedented debt burden from your home loan in the coming years, find out how you can reorganise your portfolio.

Assess outstanding debt

Your home loan may be the biggest debt in your portfolio. However, you might hold other debts for which you may be paying a higher rate of interest. Make a list of all your debts, and ideally try to prioritise those that have very high rate rates of interest like unpaid credit card dues or unsecured personal loans. Now focus on your home loan as the total interest outgo will increase post the rate hike.

Assess investments and savings

To avert effects a rate hike, you need to rake up your savings and investments to be able to create a surplus and pay off your debt earlier. This surplus could be taken out of your existing investments or you could plan for new ones.

Since its debt, you may opt for more secure and stable investment options like liquid mutual funds and short-term debt mutual funds, fixed deposits or recurring deposits. Once you have decided on your instrument of choice, assess your monthly expenditures and see how much you can invest in these aimed purely at debt settlement.

Remember to not compromise on your basic and essentials to just pay off debt earlier. You may need money for necessities later for which you will have to resort to debt if you are not prepared.

How to handle home loan

Carving a new strategy for your home loan depends on what stage you are at of the total tenure. Making a pre-payment for part of the loan is one of the best options as it will lower your overall interest outgo. This is particularly a good move for those at the beginning of their loan tenure. You may also, with your lender’s help, try to switch to a longer reset period of up to two years assuming the MCLR for that tenure is the same.

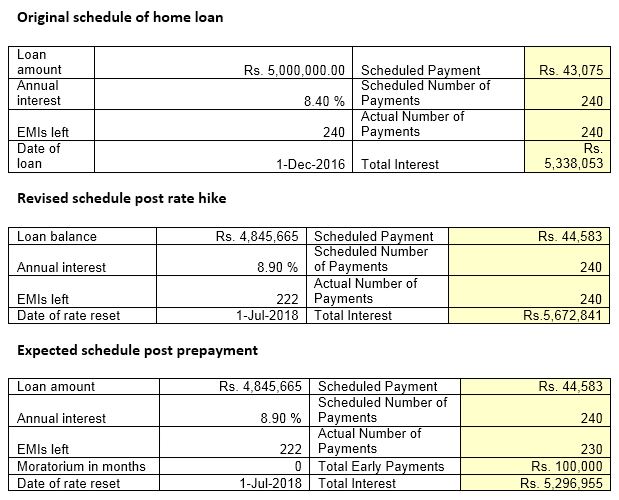

Let’s assess a test case to see how this will impact you in actual numbers. As shown in the table below, let’s say you took a loan of Rs 50,000,00 from a bank in December 2016 with an 8.4 percent interest rate and a tenure of 20 years. All this while you were paying an EMI of Rs 43,075 every month and the total interest to be paid by you for the loan stood at Rs 53,38,054.

Let’s say that after 18 EMIs, the interest rate was revised to 8.90 percent in June 2018, which is after 18 EMI payments. Till this point, you had paid Rs 775,354 in EMIs, but Rs. 621,019 was towards interest, and only Rs. 154,335 was towards the principal. That meant that after 18 months, your loan balance was still Rs 48,45,665. With the rate reset in July, and with 222 EMIs left, your EMI increased marginally to Rs 44,583. But your long-term interest also rose to Rs 50,51,823 having gone down to Rs 47,17,035 just before the hike. So your interest has increased by Rs 3,34,788. It could go up further if there are more rate hikes in the future. How do you deal with this situation?

You need to follow a strategy where your EMI doesn’t shoot up much or remain the same and you do not have to pay extra much interest. Let’s say you make a pre-payment of Rs 1,00,000 in December 2018. Your total interest outgo would again come down to near the original mark at Rs 5,296,955. In addition to this your total number of payments will also reduce to 230 months, ten months lesser than the original schedule.

But if you are nearing the end of your loan and have just a couple of years to go, it may be useful to not to take any steps and just maintain the schedule till the end of its tenure to collect any available tax deductions. If you are in a high tax bracket like 30 percent, a higher interest would also get you higher deductions.

If, despite your calculations and prepayment plans, the impact is substantially high, you can explore transferring the loan to other banks after a comparison of the rates.

Remember, whatever strategy you adopt, make sure to factor in every aspect of your financial portfolio instead of taking a sudden decision. You do not want additional debts just to benefit on your home loan.

The author is CEO at Bankbazaar.com.

The thoughts and opinions shared here are of the author.

Check out our end of season subscription discounts with a Moneycontrol pro subscription absolutely free. Use code EOSO2021. Click here for details.