Pandemic-proof: COVID-19 increases demand for insurance agents, hiring doubles

As banks turned to focus on pure transactional banking business amidst COVID-19, insurance agents have become a useful resource.

Image: Shutterstock

Image: Shutterstock

Mumbai's 42-year-old Mithilesh Gupta who had quit the insurance agency profession in January 2019 is back in the system after he was approached by a bank-led private life insurer he was working with earlier. Gupta was not only promised higher incentives but also a company laptop which he could own after serving for two years.

“I have experience selling online through tablets and handheld devices. Since I was anyway working in my family garment business where Coronavirus has impacted sales, it made sense to have an additional source of income,” said Gupta.

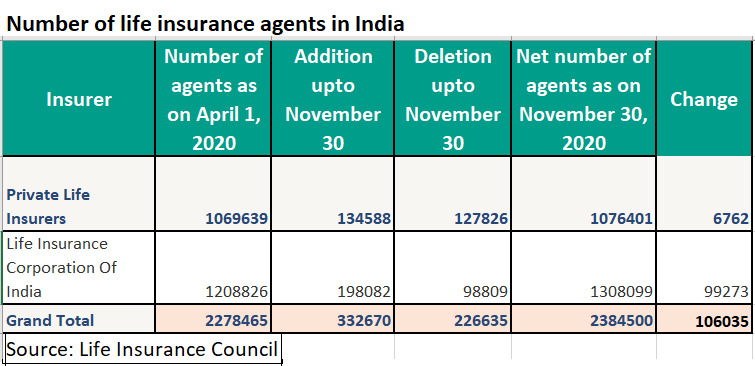

Data from the Life Insurance Council showed that between April 1 and November 30 (FY21) there were 106,035 agents hired by life insurance companies. This is more than double of the 46,203 agents hired during the same period last year.

Industry sources said that the rise is predominantly due to the fact that customers were not fully equipped to completely buy online (without intermediary) on one hand and banks started to refocus on core business amidst the COVID-19 lockdown.

“Though we have three bank partners, they made it clear that the branches will used purely for banking transactions and third-party product sales will be suspended for a few months. This is true for all other banks too. Hence, life insurers hired agents to make up for the loss,” said the head of distribution at a private life insurer.

Banks contribute close to 55 percent of the annual new business premium while agents contribute about 35-40 percent. The rest comes from pure online sales through web aggregators and insurance company websites.

Why are agents in demand?

As soon the COVID-19 lockdown was announced on March 25, insurance business was the worst hit. Bank branches started only doing transactional banking business and insurance sales took a backseat.

In this juncture, insurance agents were responsible for helping insurers meet the new business premium targets. Products were sold online and insurance agents acted as an intermediary for customers to buy digitally.

"Insurance agents could be quickly trained so the life insurance industry saw a revival from July onwards. Also for HNI clients it was easier to have agents meet them physically since most agents have their own bikes," said the chief sales officer of a bank-promoted insurance company.

Showing the first signs of growth in FY21, the new business premium of life insurers saw a 6.9 percent year-on-year (YoY) growth to Rs 22,986.10 crore in July. This growth was led by insurance agents, said industry insiders.

Ever since the coronavirus outbreak in India and the subsequent lockdown from March 25, this was the first month that life insurers have seen a growth in first year premium collection. Post that, insurers have seen 8-10 percent growth every month.

Data from Insurance Regulatory and Development Authority of India (IRDAI) showed that life insurers had a 31.9 percent year-on-year (YoY) growth in new premiums at Rs 22,776 crore in October 2020.

How do the numbers look like?

As of November 30, there were 2.38 million agents in the life insurance industry. Of this, 1.3 million belong to LIC while the rest are private life insurers' agents.

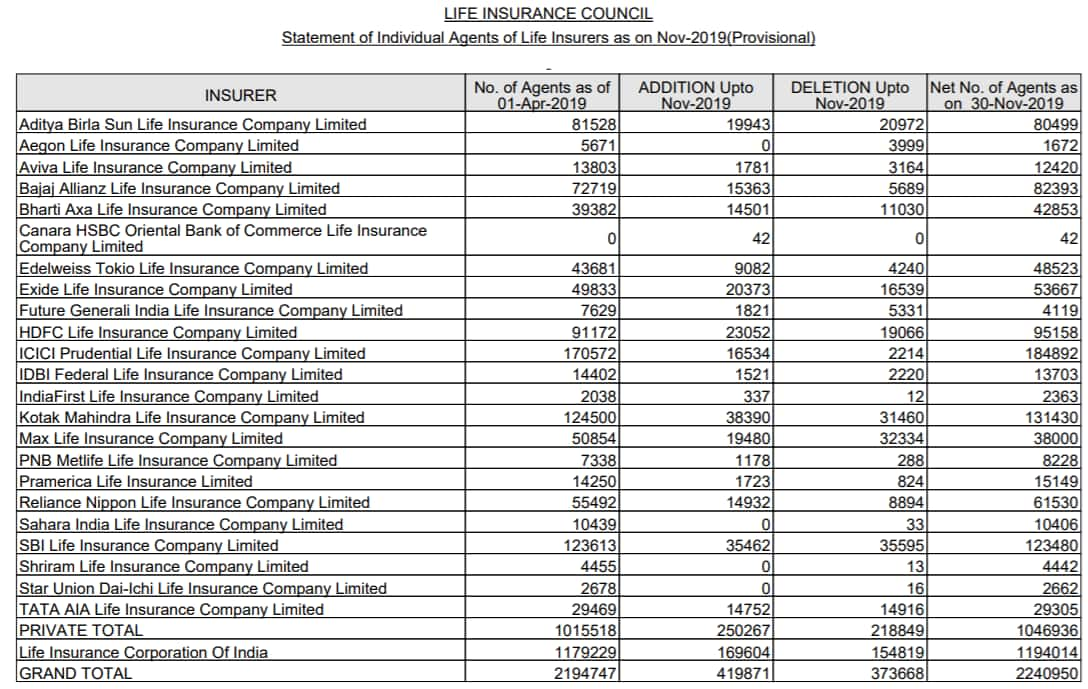

In the private life insurance space, ICICI Prudential Life Insurance had the highest number of agents at 179,245. This was followed by SBI Life Insurance with 164,084 agents and HDFC Life with 109,175 agents.

Canara HSBC OBC Life Insurance which primarily sells through bank branches hired 99 new agents this year. This insurer had 152 agents as of November 30 compared to 54 in the beginning of FY21.

In terms of absolute additions of new agents, SBI Life Insurance took the top spot among private insurers by adding 34,482 agents between April and November. LIC was the number one as the previous years adding 198,082 agents between April and November.

Original Source: https://www.moneycontrol.com/news/business/economy/pandemic-proof-covid-19-increases-demand-for-insurance-agents-hiring-doubles-6285061.html