August auto sales hit by delayed festive season and Kerala floods

The commercial vehicle segment continues to remain strong on the back of factors like normal monsoon, improved rural sentiments and investment in infrastructure

Image: Shutterstock

Image: Shutterstock

Nitin Agrawal

Moneycontrol Research

Automobile players posted a mixed set of sales for August on the back of delayed festive season and floods in Kerala. The commercial vehicle (CV) segment continues to remain strong on the back of a normal monsoon, improved rural sentiment and investment in infrastructure. Tractors and two-wheeler (2W) sales were hit by a delayed festive season. The outlook for the same continues to remain positive on the back of a revival in the rural economy and normal monsoon.

Three-wheeler (3W) sales continue to zoom given the government's decision to end Permit Raj. There has also been a strong pick-up in exports on the back of an improving global climate.

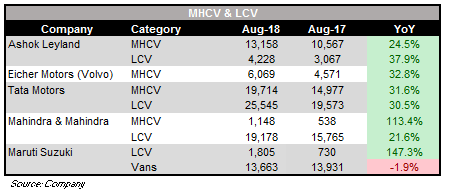

Strong showing by CVs

Despite uncertainty around the new axle load norms, CVs continue to remain buoyant given the government's increasing focus on infrastructure, construction demand and increase in mining activities.

The light commercial vehicle (LCV) segment, in particular, continues to show a strong uptrend in monthly numbers primarily because of increased thrust on agriculture, FMCG and e-commerce sectors and increasing demand accruing from container and refrigerated trucks.

Tata Motors registered a significant growth on the back of reasons stated above. The medium and heavy commercial vehicle (M&HCV) segment continued its robust performance in the backdrop of strong GDP growth (8.2 percent) in the April-June quarter. Replacement buying and various infrastructure projects continue to lead to strong demand for higher tonnage trucks and tippers.

Mahindra & Mahindra (M&M) posted healthy growth thanks to its rural penetration. The management expects growth momentum to continue on the back of some recent refresh launches as well as the better performance by its product portfolio.

Eicher Volvo also witnessed significant year-on-year (YoY) growth of 32.8 percent in August. Ashok Leyland continued to deliver strong YoY growth at 28 percent.

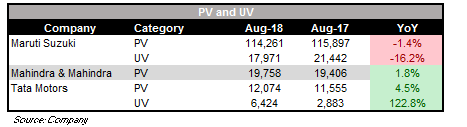

Cars segment: Leader hit by floods

Segment leader, Maruti Suzuki, saw domestic volumes decline 2.8 percent due of its large exposure (around 11 percent) to Kerala. The new Ciaz is gaining traction and witnessed a growth of 8.4 percent.

For Tata Motors, its passenger (PV) and utility vehicle (UV) segments grew 28 percent and 122.8 percent, respectively, thanks to strong demand for Tiago, Tigor, Hexa and Nexon.

M&M posted flat volume growth. The management hopes to see buoyancy in PV sales with the launch of the Marazzo.

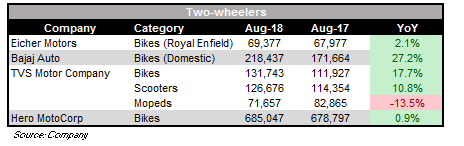

Bajaj Auto: Gaining momentum in the 2W space

In the 2W space, Bajaj Auto is the market leader in August, clocking a growth of 27.2 percent.

Eicher posted a meagre 2.1 percent YoY growth in volumes due to the Kerala floods. TVS Motor Company and Hero MotoCorp were impacted by a delayed festive season.

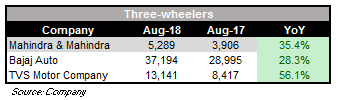

Steller showing by three-wheeler manufacturers

The overall three-wheeler (3W) market continues to gain strength after the end of the Permit Raj. Bajaj Auto, the leader in this space, posted a growth of 28.3 percent. The same for TVS and M&M stood at 56.1 percent and 35.4 percent, respectively.

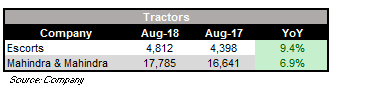

Tractors gaining on positive rural sentiment

Delayed festive season has impacted sales of tractors. However, revival of the rural economy and expectations of a normal monsoon would continue to augur well for companies in this space. Recent initiatives from the government to usher strength into rural India should continue to support demand for farm equipment like tractors.

Escorts and M&M posted a YoY growth of 9.4 percent and 6.9 percent, respectively.

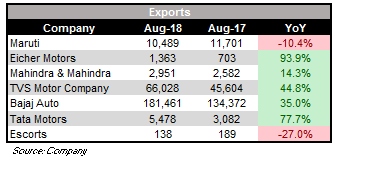

Exports revive

Auto companies have been struggling in the export market for long. Overall revival in the global economy is finally reflecting in the numbers of some of the leading automobile exporters. All auto majors, barring Maruti and Escorts, posted strong YoY growth in the overseas market.

Follow @NitinAgrawal65

For more research articles, visit our Moneycontrol Research page

Original Source: https://www.moneycontrol.com/news/business/moneycontrol-research/august-auto-sales-hit-by-delayed-festive-season-and-kerala-floods-2909891.html