As a minority shareholder, I have been left in the lurch: C Sivasankaran

Serial entrepreneur C Sivasankaran blames a trust deficit post-Ratan Tata's exit as chairman in 2012 for his predicament involving his investment in Tata Teleservices

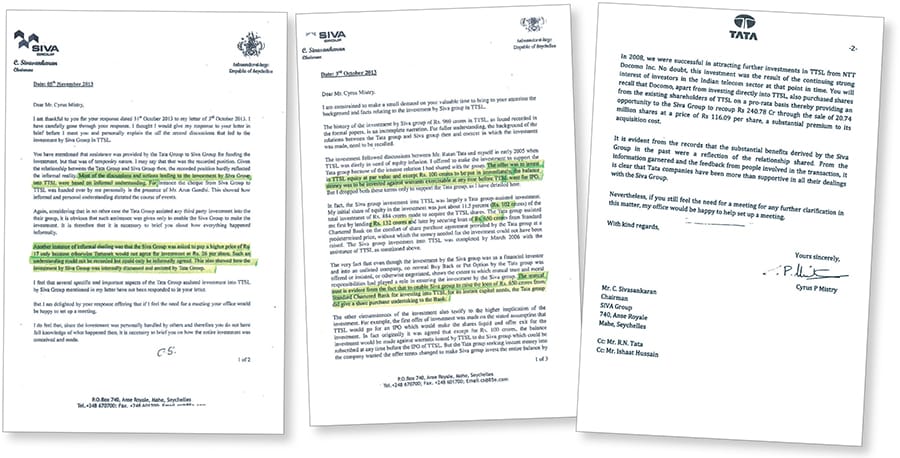

Sivasankaran’s letters (left and centre) to Cyrus Mistry about Siva Group’s investments in TTSL and the Tata group’s role in helping it borrow money from a bank for the same. Mistry reiterates Tata companies’ support (right) to the Chennai-based group

Sivasankaran’s letters (left and centre) to Cyrus Mistry about Siva Group’s investments in TTSL and the Tata group’s role in helping it borrow money from a bank for the same. Mistry reiterates Tata companies’ support (right) to the Chennai-based group

C Sivasankaran, chairman of the Chennai-based Siva Group and founder of Aircel (which was sold to Maxis in December 2005), is an unhappy man. His name, he says, has been unnecessarily dragged into the boardroom battle that is currently on at Bombay House. “Tata Capital had a book that required significant clean-up on account of bad loans to the infrastructure sector. The loan given to Siva was under the strong advice of executive trustee [R] Venkataramanan which has turned into a non-performing asset,” Cyrus Mistry, former chairman of Tata Sons, said in a letter dated October 25, to the directors of the Tata group holding company, after his sudden ouster.

Sivasankaran, 60, says he invested in Tata Teleservices Ltd (TTSL) in 2006 after discussions with Ratan Tata (the then chairman of the Tata group) when the company was in dire need of funds, based entirely on trust. He did not seek any exit option or a seat on the board for the Rs 969 crore investment. The Tata group, he claims in his correspondence with Cyrus Mistry in 2013 (copies of which are in possession of Forbes India), even gave him a loan and a comfort letter to help him borrow to fund the investment.

Today, he rues the investment as the company failed to deliver the expected results. He, in fact, claims to be a victim and not a beneficiary of the Tata group, pegging his loss from the TTSL investment at Rs 3,000 crore.

Forbes India caught up with Sivasankaran during one of his recent visits to Mumbai. Edited excerpts:

Q. Cyrus Mistry has said you have derived “substantial benefits” from the Tata group on your investments in TTSL. Is it true?

I have not benefited from the Tata group. Actually I am a victim who has lost Rs 3,000 crore due to my investment in TTSL which was badly managed. Cyrus Mistry was aware of this investment since 2013. He could have settled it then. His bringing up of this issue now is opportunistic.

Q. What is the background of the investment you made in 2006 in TTSL? You have said it was based entirely on trust.

I had invested my family money in TTSL against the wishes of my family in 2006, based on the request of the Tata group. They also supported [me] in terms of guarantee to the banks, on the strength of which I borrowed partly to invest in TTSL. The original offer was to invest in TTSL at par [Rs 10 per share] and apart from Rs 100 crore to be put in immediately, the balance money was to be invested against warrants exercisable at any time before the IPO. Also, the Siva Group was asked to pay a higher price of Rs 17 only because Temasek [which invested in TTSL 10 days after Siva Group’s investment] would not have otherwise agreed to invest at Rs 26 per share.

Q. You claim this investment has resulted in a loss of Rs 3,000 crore.

I had invested close to Rs 1,000 crore in 2006, and most of it was borrowed from banks. Adding all the interest and other costs, it amounts to more than Rs 3,000 crore now.

Q. Whom do you blame for this loss?

I blame both NTT DoCoMo and the Tata group. TTSL was mismanaged.

Q. Why did you not take a board position when you invested Rs 969 crore in the company?

As the investment was based on trust, the Tata group requested me to not ask for a board seat, which I agreed to. I did not realise that post-Ratan Tata, the level of trust [between Siva Group and Tata group] would not be the same. Q. In your notice to Tata Sons, TTSL and NTT DoCoMo, you have called their behaviour “despicable”. Why?

Q. In your notice to Tata Sons, TTSL and NTT DoCoMo, you have called their behaviour “despicable”. Why?

Tata Sons, TTSL and DoCoMo had full management control of TTSL, and they ran the company into losses to the dismay of minority shareholders like me who did not even have a board seat in spite of making a significant investment. Now DoCoMo is suing Tata Sons to get their investment back, while a minority shareholder like me has no say in the management of the company.

Q. You have also accused them of ignoring the “moral and legal rights of a minority shareholder” when NTT DoCoMo’s exit was secured from TTSL. How were you wronged?

I am a minority shareholder who has stayed invested in TTSL, hoping that stalwarts in the industry like DoCoMo and the Tata group will manage the company profitably and ensure that my investment in TTSL gives commensurate returns. Instead they failed and one majority shareholder will compensate the other, while the minority shareholder is left in the lurch. What kind of equity is this?

Q. Is this the reason you did not pay up your share (Rs 694 crore) of DoCoMo’s claim?

Yes. Assume you have given a commitment to buy 1 kg of apples at a price. You are committed to buy them if the seller offers good quality apples. Will you buy if the apples are rotten? Shares of TTSL that DoCoMo wants me to buy have no value. If they [the Tata group and DoCoMo] destroy the value and give [the shares], why should I buy?

Q. Some reports have suggested that one of the main reasons for Mistry’s ouster is the legal action he was contemplating on you to recover Rs 694 crore.

I do not know the reason for Mistry’s ouster, but I had started my legal case against Tata Sons and DoCoMo back in August 2016 itself, when my communications to Mistry to solve my issue [outstanding] from 2013 were not answered.

Q. What kind of resolution are you expecting?

I am expecting mediation with the Tata group directors and my advisors to solve this amicably and fairly with the Tata group and DoCoMo, so that my losses due to the TTSL investment are compensated.

First Published: Dec 15, 2016, 06:10

Subscribe Now