The other Muthoot: True blue heirs

How the Muthoot Pappachan Group is transforming the family-owned business of gold loans into a full stack financial services provider

From left: Thomas Muthoot, director, Muthoot Pappachan Group, MD, Muthoot Microfin, and executive director, Muthoot Fincorp Thomas George Muthoot, director, Muthoot Pappachan Group, and MD, Muthoot Capital Services Suzannah Muthoot, zonal strategic consultant (West), Muthoot Fincorp Tina Suzanne George, associate vice president-finance, Muthoot Capital Services Thomas John Muthoot, chairman and MD, Muthoot Pappachan Group and Muthoot Fincorp Thomas Muthoot John, chief manager-marketing, Group Marketing

From left: Thomas Muthoot, director, Muthoot Pappachan Group, MD, Muthoot Microfin, and executive director, Muthoot Fincorp Thomas George Muthoot, director, Muthoot Pappachan Group, and MD, Muthoot Capital Services Suzannah Muthoot, zonal strategic consultant (West), Muthoot Fincorp Tina Suzanne George, associate vice president-finance, Muthoot Capital Services Thomas John Muthoot, chairman and MD, Muthoot Pappachan Group and Muthoot Fincorp Thomas Muthoot John, chief manager-marketing, Group Marketing

Image: Arjun Suresh for Forbes India

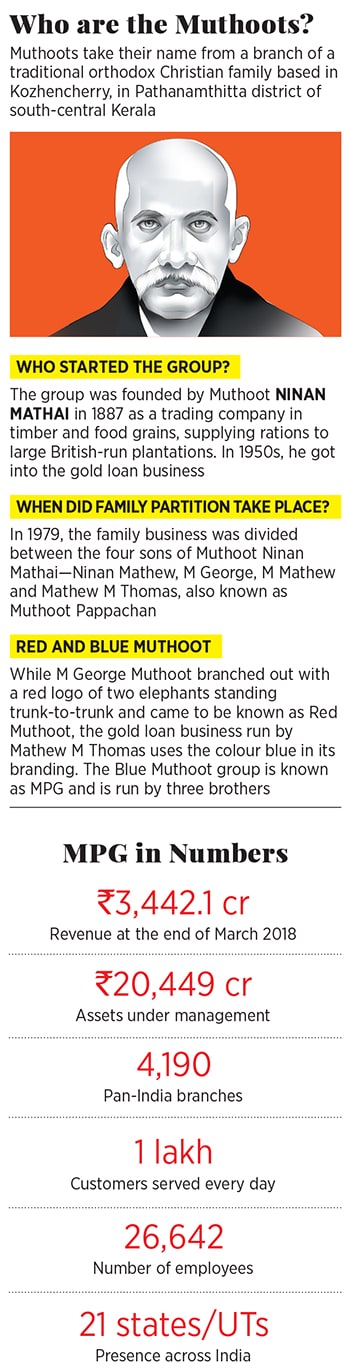

The split of the family business of gold loans, started by patriarch Ninan Mathai Muthoot in 1887 as a trading firm in Kerala, was without any fuss. Thomas John Muthoot, 56, vividly remembers how swiftly the umbilical cord was cut in 1979. “Everything ended within 10 minutes.”

The three sons of Ninan Mathai sat around a table in their ancestral village building in Kozhencherry and amicably settled the matter. “We were just spectators,” recounts the chairman and managing director of Muthoot Pappachan Group (MPG), started by John’s father Mathew M Thomas, the youngest of the three brothers fondly known as Muthoot Pappachan.

“Everything was divided into three,” recalls John from the third generation. M George Muthoot, the eldest brother of Pappachan, branched out to Kochi with a red logo of two elephants standing trunk-to-trunk and came to be known as Red Muthoot. The gold loan business run by Pappachan started operations from Thiruvananthapuram and later identified itself as Blue Muthoot because of its blue branding. “It’s like Coke and Pepsi,” John smiles, “but there’s no sibling rivalry.”The partition had another unprecedented element to it: Common ownership of the building in Kozhencherry. On Monday and Tuesday, all transactions through walk-ins accrue to the eldest brother (Red Muthoot). The business of the next two days goes to the second brother (Muthoottu). And Friday and Saturday are for the youngest one—Blue Muthoot. “The arrangement is unique,” says John.

Fast forward to 2018. MPG is in the midst of a transformation from a family-run gold loan business to a full stack financial service provider catering to the bottom of the pyramid.

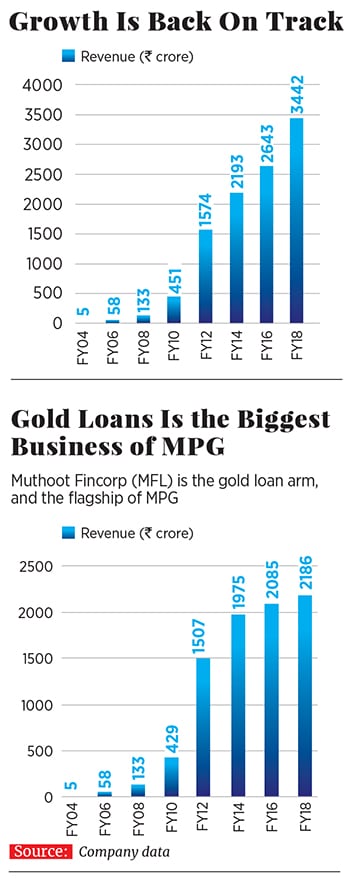

The group has a turnover of a little under ₹3,500 crore, of which Muthoot Fincorp, the gold loan vertical, accounted for ₹2,186 crore in fiscal 2018. In contrast, Muthoot Finance, the flagship gold loan vertical of the red faction, had an income of ₹6,185 crore. Playing catch-up is not a priority for John. “We will not be very aggressive. That’s not in our DNA,” he asserts. “We do things that are correct.”

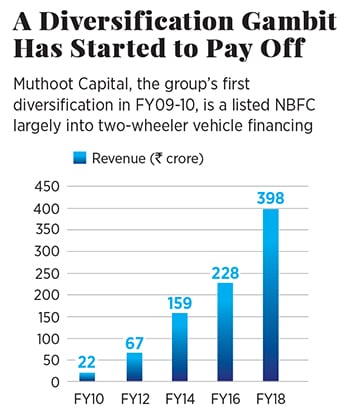

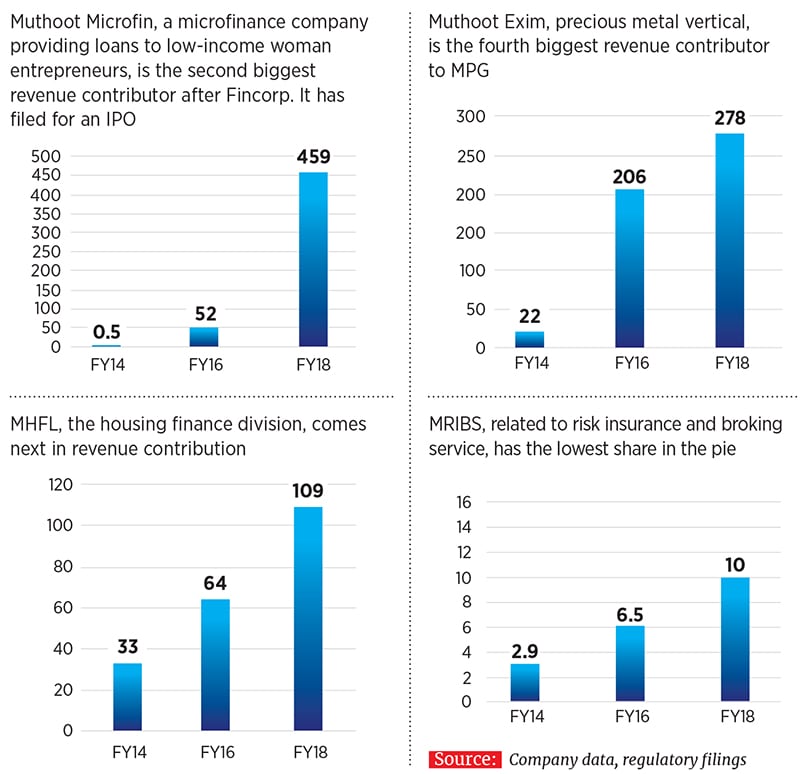

One of those ‘correct’ things John may be hoping is Muthoot Microfin. A microfinance company providing loans to low-income woman entrepreneurs, Microfin has emerged as the second biggest revenue contributor to the group in a short span of time: From ₹50 lakh in FY14 to ₹459 crore in FY18.

Then there is Muthoot Capital. A listed NBFC into two-wheeler vehicle financing and the first diversification gambit by the Muthoots, Capital has also pulled up its socks: From ₹159 crore in revenue in FY14 to ₹398 crore in FY18. Muthoot Exim, the precious metal vertical and the fourth biggest revenue contributor to the group, is also making its presence felt with revenue climbing from ₹22 crore in FY14 to ₹278 crore four years later. MHFL, the housing finance division, makes a modest contribution, although its grown three times in four years, from ₹33 crore to ₹109 crore.

The diversifications are scaling at a time when the group warhorse, Fincorp, is growing in single digits: From a de-growth of 5 percent in FY14 to a 2 percent revenue growth in FY16 and 4 percent two years later.

John’s twin brother, younger by a few minutes, Thomas George Muthoot, explains how the group has evolved to cater to the financial needs of the entire spectrum of the low-income segment. “First it was gold loans, then loans for two-wheelers, next was microfinance for small businesses and then housing and so on,” says George, explaining the need to reinforce the ‘blue’ identity of the group with its latest campaign with actor and brand ambassador Vidya Balan.

Though the company painted itself blue in 2010, the confusion with ‘Red’ persisted as both the groups use ‘Muthoot’ in their business. “Any family business with multiple groups will have an identity crisis,” reckons George. “For a small customer, the best identity is colour.”

FOUR PILLARS OF TRANSFORMATION

The transformation has not been confined to diversifying the group and reinforcing its blue branding in the minds of users. Business processes have got restructured as well.

The most radical change has been deep collaboration among the various verticals, which were working in silos. “The One Muthoot experience for the customer is crucial,” George contends. Cross-selling or leveraging the power of over 4,100 pan-India branches which serve over 1 lakh customers every day became an integral part of the strategy.

“The branch has become the main supermarket for financial services by turning into a primary distribution centre,” says Vasudevan Ramaswam, chief operating officer of Muthoot Fincorp. That Muthoot Blue has a huge customer base means an opportunity to sell to them other products. “We do not want to be just a gold loan company,” asserts Ramaswam. While gold loans would stay as the primary core product, the group sees a floodgate of opportunity in tapping into the customer-lifecycle needs of its users. Suddenly, a gold loan taker became a potential consumer for a two-wheeler loan, a housing loan or an MSME loan. She could also be a potential consumer of gold jewellery from Muthoot Exim.The second pillar of business transformation is people development. While a sharper focus on developing the talent of over 26,000 employees was assigned to a people development officer, all the group verticals got a new head over the last two years. Rationalisation of manpower at the branch level and a structure to empower the grassroots worker was also put in place.

Digitalisation is the third pillar. A technology team is working towards a seamless integration of the various group verticals, an analytics team is digging deep into the data of over a lakh users to make new products, and efforts are being made to optimise the efficiency of each branch.

A delicate balance between the old and new is being maintained to avoid disruption. “We have not disturbed the legacy way of doing business, but are using technology and creating a parallel system,” says Thomas Muthoot, the youngest of the three Muthoot brothers running MPG. An app has been developed that tracks every transaction across the country. “I get brand updates, product information, profitability targets or anything about the business in real time,” he says. Hunting for investment opportunities in new-age businesses was also explored, resulting in equity stakes in peer-to-peer lending platform Faircent and RemitGuru, which offer online money transfer service to Indians abroad.

Profitability is the fourth pillar of transformation. Previously, the branches were more bothered about assets under management. “Apart from fixing accountability, every branch has to work towards turning profitable,” says Thomas, adding that non-performing branches have been either closed or merged.

HARVARD, AND FAST FORWARD

Although the transformation started some 18 months ago, the seeds were sowed in 2014 when John completed his three-year Owner/President Management programme from Harvard Business School.

The programme, meant for owners of business of a particular size for over 10 years, not only expanded the mental horizon of the third generation entrepreneur, but also bridged the gap between legacy and the future. “I knew I was doing many things right, but I needed to know what I didn’t know,” John says.

Thanks to interactions with leadership professor Rob Kaplan, John learnt to ask ‘the right kind of questions’. Kaplan, John recalls, used to point out that answers are plenty but questions few. “One must ask the right questions all the time,” he says.In 2012, while at Harvard, John asked the ‘first right question’: Why do we exist? All the top executives were taken to an offsite for a one-day discussion and asked to brainstorm this question. A year later, a similar exercise was undertaken, but the question this time was different: Would our consumers miss us if we are not there tomorrow?

The question that set the transformation ball rolling came only in 2014, when John had completed the course. “Where are we going to get our next set of consumers, Eugene,” John asked the chief purpose officer of MPG. The question left Eugene Koshy stunned. “That was a funny thing to ask because we had over 75,000 people walking into our branches every day at that time,” he recalls. “John could sense the tectonic shift in the business and consumer landscape,” he reckons, adding that there was another query that John posed.

“How do we ensure that we stay relevant tomorrow?” This question, Koshy recalls, hastened the transformation process. It brought to fore the unpleasant memories of what happened to companies like Kodak and BlackBerry, which failed to hit the refresh button at the right time.

What Harvard also did was to help John rediscover the Founder’s Mentality. In a book titled The Founder’s Mentality, authors Chris Zook and James Allen contended that when companies fail to achieve their targets, 90 percent of the time the root causes are internal, not external. The solution lies in developing the “founder’s mentality”—behaviour with three traits: An insurgent’s clear mission and purpose, an unambiguous owner mindset and relentless obsession with the front line.

With the induction of the fourth generation into the family business, says John, the balance between experience and youth has also been found. Tina Suzanne George, the eldest daughter of Thomas George Muthoot, is associate vice president with Muthoot Capital. A chartered accountant who has had stints with Deloitte and EY in the US, Tina has been championing financial strategy for the group. “A lot has been revamped over the last two years. New functions, verticals have been added,” she says. Ask her how she differs from her father, and pat comes the reply: “I am more organised. I have a structure in everything that I do.”

Thomas Muthoot John, son of Thomas John Muthoot, has been involved with the operations at Muthoot Fincorp. The group’s decision to invest in fintech startups was largely driven by him. “We do not want to become the number one brand in the country,” he says, mirroring the ideology that he inherits from his father. “In terms of emotional connect with consumers, we want to be the best.”  FACING THE BLUES

FACING THE BLUES

Alhough the group, unlike other NBFCs, has been prudent enough to diversify itself into businesses that complement the core, it still stares at huge potential challenges. The biggest is the overreliance on Fincorp. If global gold prices crash, as they did in 2014, the group might come under tremendous pressure.

Being heavily concentrated in South India—Kerala, Tamil Nadu, Karnataka, Andhra Pradesh and Telangana are its top five states in terms of branches—is another potential risk. Take, for instance, the recent floods that devastated Kerala, where MPG has 872 out of 4,190 branches. With the repayment capacity of most of the unbanked segment of population linked to daily labour, the natural calamity will take a toll of MPG.

Though cross-selling mitigates the risk of diversifying, working with the bottom of pyramid has its own share of blues, points out Anil Joshi, founder and managing partner, Unicorn India Ventures. “They need to ensure that repayment logistics don’t burn a hole in their pocket.” he says.

Meanwhile in Kochi, a month before the floods, the three brothers had got together at their home for a sumptuous meal. Amid gusts of a monsoon wind and a backdrop of a ferry cruising along , the trio was firm on staying the course. The pace of growth isn’t top priority. Neither are numbers. As George sees it, “Value is more important than valuation.” That’s not something you’ll hear a lot in the country’s financial capital or its tech and startup hubs, but in God’s country doing business is a bit like a ride along the backwaters: Reaching in a hurry is not the end game. Enjoying the ride, and its sights and sounds, are.

First Published: Sep 11, 2018, 12:25

Subscribe Now