Why single-speciality hospitals are Prospering

Low capital and investment-friendly business models have created a surge in single speciality hospitals

The last few weeks have seen a lot of activity around single speciality clinics being set up by the two largest hospital chains—Fortis Healthcare and Apollo Hospitals. Fortis Healthcare has invested around Rs 30 crore in setting up Renkare, a dialysis centre, while Apollo has set up a joint venture with GSK Velu, founder and MD, Trivitron, to launch dental and renal care centres.

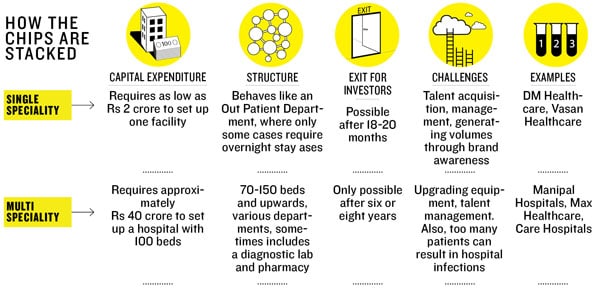

The entrance of the large players only underlines what investors have found in healthcare—an investment-friendly business model. “Single speciality hospitals are PE-friendly business models which do not require high capex like that of hospitals and you can exit in a much shorter time,” says Amit Mookim, executive director, transactions & restructuring, KPMG. Previously, investors kept away from large hospitals as it not only required a large amount of capital, but also a long time to recover the investment as well as exit the business.The exit period is one of the key differentiators for single speciality chains like Cloudnine, Nephrolife, NephroPlus, LifeSpring Hospitals and White Dental clinics which specialise in gynaecology, nephrology and dental care. A large hospital typically requires an investment of Rs 40 lakh and upward per bed, and breaks even in six to eight years. Single speciality chains, however, may not even require patients to stay as is the case with a patient on dialysis. This brings down the investment significantly from Rs 40 lakh per bed to as low as Rs 2.5 lakh per bed like at LifeSpring Hospitals, a low-cost healthcare provider for mother and child.

With clarity on an exit period and a significantly lower capital expenditure, the one thing that holds single specialties back from rapidly expanding is the lack of talent. “We should have had more than 20 centres by now,” says Velu, a seasoned businessman in healthcare. “But the biggest challenge is finding good doctors. There are only 900 nephrologists in this country,” he says. Today, Alliance Medicorp India, which runs dialysis centres, has five centres and will use telemedicine in future to allow one doctor to manage three to five centres. With this, they hope to scale up to 25 centres by 2013.

As single speciality clinics increase, they also decrease the burden of patient care in large hospitals as it allows the latter to focus on their top three specialties—cardiology, neurology and oncology.

The biggest issue now is to increase the talent pool in the country to meet the number of players entering the market. While investors and doctors mull over how to expand with this challenge, their ultimate goal is to be the neighbourhood service provider for diseases.

Healthcare is also going the ‘glocal’ route like retail.

First Published: Apr 06, 2012, 06:09

Subscribe Now