New Roadmap for PE Fund-raising

There is a preference for deal-by-deal engagement, allowing investors to decide on a case-to-case basis

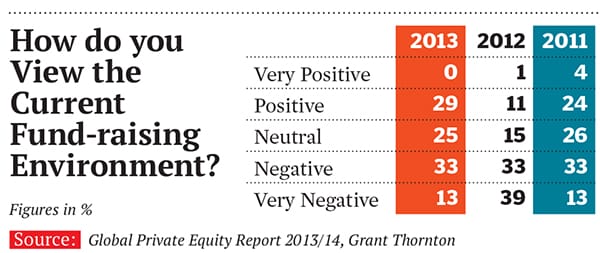

Even as sentiment improves, a new PE roadmap seems to be emerging. The survey shows 56 percent of GPs (General Partners) predicting an increase in alternative fund structures over the next three years as LPs (Limited Partners) prefer options other than the traditional 10-year blind pool fund. The preference now seems to be for deal-by-deal engagement, where investors are presented opportunities on a case-by-case basis.

The survey also shows the lines between fund-raising and investor relations are blurring. Fund-raising is now being seen by PEs as a constant process of engagement. With the power clearly shifting in favour of LPs, they are being wooed by concessions, co-investment rights, advisory board seats and fee discounts.

First Published: Nov 18, 2013, 07:23

Subscribe Now