Serena Williams' formula for successful business

The most successful woman athlete ever has figured out a formula that will make it hard for her to lose

Image: Levon Biss for Forbes at The Rome Cavalieri, A Waldorf Astoria Resort[br]

On Serena Williams’s calendar—which is to calendars what Jackson Pollock paintings are to art—Saturdays are designated family time. The Saturday I’m with her in Rome (she was in New York earlier in the week and will be in Paris the following one) carries extra significance. Exactly four years ago, in exactly that Eternal City, she met her husband, Alexis Ohanian, co-founder of online community Reddit.The two celebrate, in part, with the kind of outing anyone who’s not the most famous woman athlete in the world takes for granted: A stroll in a hotel garden with their joint venture, 22-month-old Olympia, in tow. It’s more romantic than it sounds: The Rome Cavalieri goes so far as to call its 15-acre garden a “private park”, littered with marble and bronze, lions and unicorns.

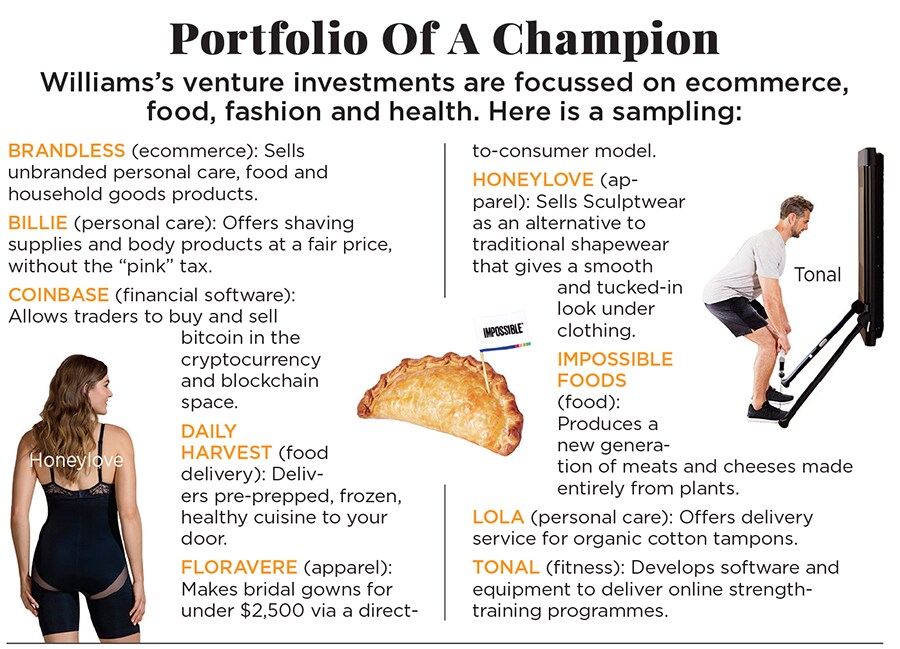

The regal surroundings befit a historic figure of American sport, who has 23 Grand Slam titles and has blown away any number of barriers and stereotypes. And the unicorns? Between Reddit and his $500 million fund, Initialized Capital, Ohanian does his part. But it turns out that Williams has quietly been playing that game, too. She’s now the first athlete ever to hit Forbes’s annual list of the World’s Richest Self-Made Women, with an estimated fortune of $225 million, the vast majority of it having come via her brain and brand rather than her backhand. And over the past five years, she’s been quietly dropping money into 34 startups. In April, Williams formally announced that Serena Ventures is open for business, to fund others and launch companies herself.

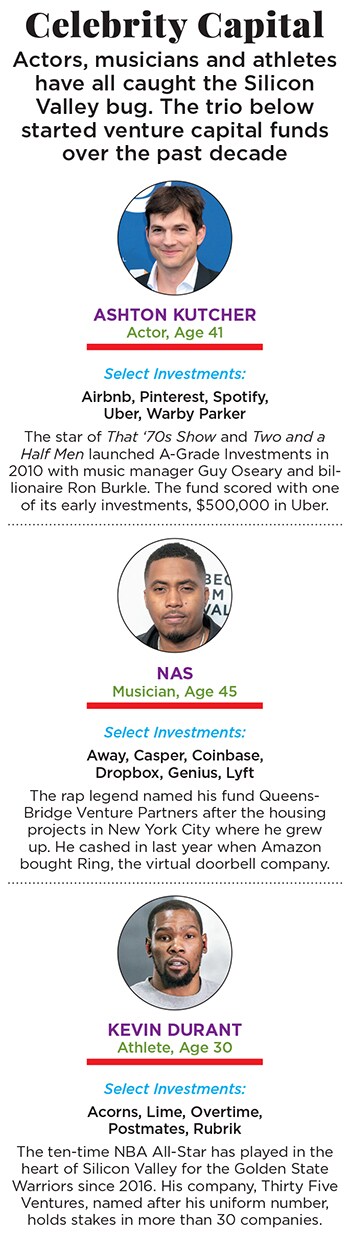

Athletes are richer than ever, thanks to the explosion in TV rights fees for live sporting events, which trickle down to players. The 50 highest-paid athletes in the world made $2.6 billion last year, versus $1 billion 15 years ago. And Williams is hardly the first to put newfound disposable income to active work—in the NBA alone, LeBron James, Stephen Curry and Kevin Durant have all launched media companies, and Durant, Andre Iguodala and Carmelo Anthony are active venture capital (VC) investors. But she is one of the few specifically gearing investments around a single north star: Herself.

“I want to be a part of it,” she says, sitting at the hotel. “I want to be in the infrastructure. I want to be the brand, instead of just being the face.” Given her longtime background in style and design, that means overweighting on fashion lines, jewellery and beauty products. Yes, she’ll keep competing at tennis—her resilient comeback last year after giving birth burnished her as a cultural icon who transcends sports. And sure, she’ll happily continue to rake in easy endorsement money from the likes of Nike and JPMorgan Chase—her $29 million total income over the past 12 months is the highest of her career.

But like a ground stroke with torque, Williams bets she can eventually dwarf those figures by leveraging some of her own cash with her name and fame.

*****

The story of how sisters Serena and Venus Williams reached the top of the tennis world is the stuff of Hollywood legend: A black father with limited tennis experience homeschools his two daughters and teaches them on the streets of Compton, California, to penetrate and then dominate a lily-white sport. “You’d see different people walking down the street with AK-47s and think, ‘Time to get in the house’,” she remembers of those early years. “When you hear gunshots, you get low.”

Their father’s insistence that his precocious daughters avoid the private tennis academy machine and well-oiled junior tournament circuit left a mark on the younger one, especially after she won her first Grand Slam title at the age of 17. “It really shaped me for the rest of my career both on and off the court in terms of taking a chance and how to be different and how to stand out,” Williams says of his strategy. When everyone zigs, she zags.So at Serena Ventures, she focuses on companies founded by women and minorities. Yes, there’s a social purpose to that decision. But as with her tennis upbringing, she’s also finding opportunity by avoiding the herd. Just 2.3 percent of the total venture capital invested last year in the US went to women-led startups—and even when including firms with both a male and female founder, you’re just at 10 percent. The numbers are worse for black and Hispanic founders. Yet some 60 percent of Williams’s investments so far have gone to companies led by women or people of colour. “What better way to preach that message?” asks Williams.

The only way to find enough of those companies right now is to nurture them early, something that Williams got hooked on after investing and losing (eventually) $250,000 in a startup in the years before Serena Ventures. “I learnt you can’t overspend, but I also learnt that I love seed investing,” she says. Of the 34 companies she’s backed through Serena Ventures, more than three quarters are early-stage.

“It’s fun to get in there. I don’t gamble. I don’t jump off buildings,” says Williams. “I’m the most non-taking-a-chance kind of a person, but I felt like seed was where we wanted to be.”

Given the exponential riskiness involved in pre- and early-revenue companies, Williams has built a team of Silicon Valley mentors around her, much as Patrick Mouratoglou has guided Williams on the court and WME’s Jill Smoller has handled her endorsements—almost a quarter-billion worth—for nearly two decades. There’s Chris Lyons, from Andreessen Horowitz, who is an informal advisor and friend. “She is more passionate than 99 percent of the people in this space,” says Lyons. “She’s reaching out to me regularly asking what we think of companies.”

There’s Facebook chief operating officer Sheryl Sandberg, a longtime friend, with whom she serves on the board of SurveyMonkey. “I always ask her advice in a lot of different areas,” Williams says. (The tennis star is also on the board of the social shopping platform Poshmark.)

But one mentor stands above the rest—the one she married. “I’ve been really leaning on Alexis,” she says. Williams had never heard of Reddit when the pair met in 2015 and Ohanian knew little about tennis. But they bonded over ambition. “She is determined to be great at everything she does,” says Ohanian, who Forbes estimates is worth $70 million on his own.

His venture firm’s targets are traditionally more tech-focussed—big scores include Instacart and Patreon. But in living through Ohanian’s deals, Williams has learnt. Initialized and Serena Ventures have even co-invested on a few, including Gobble, which does weekly dinner-kit deliveries, and Wave, which offers no-fee transfers on money sent to Africa by phone. “I’d like to call us a more modern business family,” says Williams.

The rate of Williams’ investments has ramped up in lockstep with the onboarding of a portfolio manager. Alison Rapaport, 29, was fresh out of Harvard Business School with an MBA after a five-year stint in JPMorgan’s asset management group, when she got connected with Williams through Andreessen’s Lyons. Williams told Rapaport to come to the interview with three investment ideas, along with the numbers and rationale behind them. Rapaport did her homework on the investment ideas—and diligence on her potential new boss, who earlier in the week posted on Instagram how much she liked Taco Sunday. Rapaport arrived at Williams’s home outside San Francisco for a Sunday meeting at noon armed with investment ideas and two bags of takeout, make-your-own tacos, and she handled Ohanian’s rapid-fire follow-up emails with aplomb. “I knew this was our girl,” Williams says.

*****

Serena Williams slides around the red clay of the Tennis Club Parioli in Rome a few days ahead of the Italian Open, practicing to an eclectic mix of musical genres whose only commonality is that they’re sung by powerful women, from Rihanna to Adele to Pink. As word spreads around the club that the world’s most famous tennis player is hitting balls in their midst, a crowd predictably gathers, the youngest among them squealing “Serena!”, the oldest snapping and sharing pictures.

Williams is by far the most famous female athlete in the US—and only Tom Brady and Tiger Woods finish a tick ahead among all athletes in terms of awareness. And that fame carries almost no brand downside—her appeal rates above average across all demographics, from millennials to blue collar to high income, says Henry Schafer, who tracks Q Scores, which measure the likeability of a celebrity.

After 20 years in the spotlight, Williams knows how to handle the star power. At the end of the two-hour session, she gracefully obliges several with autographs and selfies. But more important: She has figured out at Serena Ventures how to harness it.

The past decade has given rise to the celebrity VC investor, spurred by the success of people like the actor Ashton Kutcher and the musician Nas, who both have their own funds. The recent IPOs for Uber and Lyft included scores of musicians and Hollywood A-listers like Gwyneth Paltrow, Jay-Z and Olivia Munn, who got in early and cashed in big. Overall, Ohanian is sceptical of the trend. “The advice I generally give to founders is don’t take money from celebrities,” he says. “The only exception is when they are really going to add value. Because in most cases, they are not really familiar with this world and if you are doing it to feed your ego, it’s a bad idea.”

So Williams tries to put money in deals where her fame and brand and platform grow the pie. As one of the better product endorsers of this century, it’s something she’s honed in ways that most musicians and actors (who turn up their noses at most product deals) have not. She counts nearly 30 million followers across social media—her posts of herself wearing Nike’s swoosh generated more than $2 million in promotional value for the brand over the past 12 months, according to Hookit, which tracks celebrity influence on social media. “Serena is a once-in-a-generation voice, reaching a global audience that extends well beyond tennis,” says Hookit CEO Scott Tilton.

And that voice is amplified exponentially when dealing with an early-stage brand, rather than one like Nike. She shared a pair of videos in an Instagram story of her entourage eating Daily Harvest meals ahead of her hosting duties for the Met Gala. She collaborated with Neighborhood Goods, which brings a pop-up approach to retailing, for her clothing line. “Using her platform to talk about our mission was the biggest support we’ve had besides her capital,” says Georgina Gooley, co-founder of Billie, which makes razors priced to eliminate the “pink tax” that makes female-targeted products cost more than similar versions for men.

The dating and networking app Bumble added Williams as an endorser for 2019, including a Super Bowl ad. The pair also partnered in a pitch competition in which two winners with female founders were chosen for funding from Serena and Bumble. Three executives of companies in the Serena Ventures portfolio—Daily Harvest, the woman-centric co-working space The Wing, and Lola, a natural tampon brand—networked at the first-ever Bumble Fund Summit in April. “She is facilitating a place for people to connect with one another,” says Jordana Kier, Lola’s founder.

That kind of investor-as-rainmaker power translates into another benefit: Deal flow. For more mature deals, traditional venture firms need to take large ownership stakes to hit return targets. Williams, though, is happy to ride along. “Firms know Serena is a hugely valuable strategic investor,” says Ohanian. “I think it is the best of all opportunities, and she can essentially cherry-pick from the top VC firms on deals that are interesting that come her way and at the same time she still has her own deal flow from folks who want her to invest.”

*****

Another benefit of early-stage investing: Even with 34 cheques written, she has still sunk only an estimated $6 million into these companies. As venture investing goes, given her net worth, it’s still low-risk stuff. And the returns so far seem promising Serena Ventures says they currently value the portfolio at more than $10 million and double the initial investment. Nearly half of the companies have had follow-up rounds of venture investment since Williams invested, and Serena Ventures even seems poised to score its first exit after Unilever announced plans to buy supplement firm Olly Nutrition in April. Five of her investments are up at least fivefold. Top performers include Billie, Daily Harvest, MasterClass and The Wing.But Serena Williams wouldn’t be one of the all-time great competitors without also needing to invest more in herself. While she’s known as a fashion icon, she has cashed in only via others’ platforms, whether endorsements or partnerships. Now that’s changing. Smoller, her longtime endorsement agent, recalls a recent meeting at Nike. “I was talking, and Serena interrupted me and started asking all these questions about their distribution channels, KPIs and growth strategies,” she says. “I looked around and saw their faces... she’s at a level where she wants to understand the process and methods, which I think a lot of people don’t expect.” In May last year, Serena Ventures launched a self-funded, direct-to-consumer clothing line, S by Serena. She kept waiting for someone to fund a company for her to design clothing, she says, but “I was thinking of this the wrong way. I had to invest in myself”.

The line includes dresses, jackets, tops, denim and more mostly priced under $200. She’s excited about an S by Serena show for New York Fashion Week in September. The line got a boost in October when Williams’s close friend Meghan Markle was spotted wearing the collection’s “Boss” blazer, which quickly sold out on the website. Williams returned the favour when she hosted a baby shower for the Duchess of Sussex in February. Williams plans to launch an S by Serena jewellery line this year and one of beauty products in 2020.

With all this commerce, Williams says she’ll continue to abbreviate her on-the-court schedule, prioritising the Grand Slam events that burnish her brand. While a dinosaur in the tennis world at 37, she still figures she has two or maybe even three years left. “I am in no rush to get out of this sport,” she says. But in Serena Ventures, she’s laid the foundation to keep playing the game her entire life. “I want to create a brand that has longevity, kind of like my career,” she says. “It’s not fancy, it’s not here, it’s not out, it’s not trendy, it’s a staple, like my tennis game.”

First Published: Jul 16, 2019, 17:22

Subscribe Now