The price of Trump's presidency

Donald Trump's White House tenure—and his polarising politics—has actually dented his net worth. But it's not for a lack of trying to cash in

US President Donald Trump on the South Lawn of the White House

US President Donald Trump on the South Lawn of the White House

Image: Drew Angerer/Getty Images

When Donald Trump opened Trump Tower in 1983, it marked a seminal moment in American retail, as six storeys of glitzy shops like Harry Winston and Cartier beckoned luxury buyers who strode past a live pianist and a 60-foot indoor waterfall. “We got the highest rents ever, anywhere,” says former Trump Organization executive Barbara Res, standing in the pink atrium four decades after she helped build it.

Times have changed. Gazing around, almost all the tenants are now gone. The hollowing-out began years ago, but it has only gotten worse since Trump entered politics. Nike abandoned its attached flagship store earlier this year, and Ivanka Trump’s accessories business shut shop as well.

What’s left is basically nothing but Gucci, Starbucks and The Donald, wall-to-wall. Trump Bar sits atop Trump Grille, next to Trump Café, the Trump Store and Trump’s Ice Cream. It is unlikely Trump pays himself rent for any of them. “Things are all different now,” Res says.

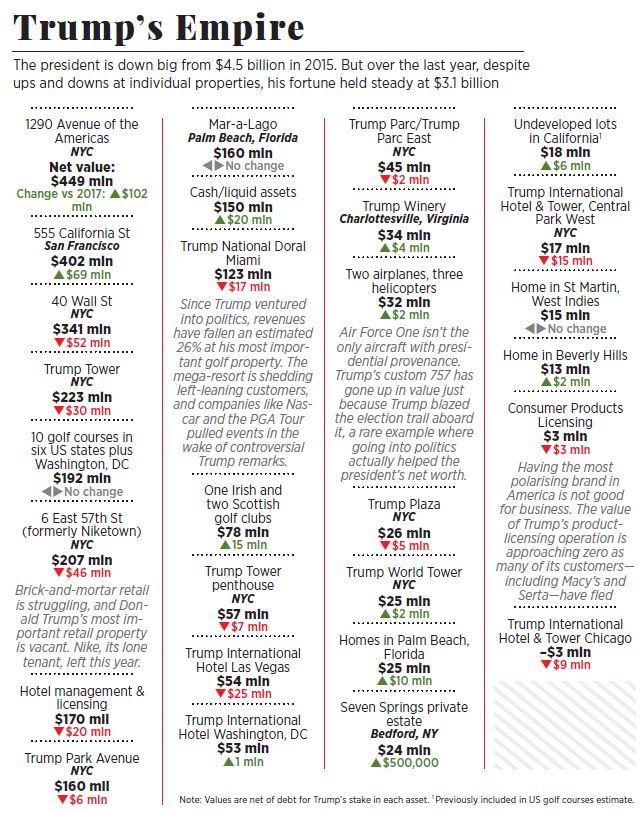

That difference includes profits. Net operating income dropped 27 percent between 2014, the year before Trump announced his run for president, and 2017, his first year in the White House. When the real estate mogul descended the escalator to launch his campaign, in this very building, no one could have predicted the chain of events that would lead to this point. Even among those who gave his moon-shot presidential bid a chance of success, the assumption was that Trump would dump his assets before taking office.

But the third factor comes from how Trump the president affects Trump the brand. Those familiar with him saw his 2016 run as a surreal marketing strategy, and Trump has said as much, telling Fortune way back in 2000, “It’s very possible that I could be the first presidential candidate to run and make money on it.” Since his unexpected ascent to the White House, Trump has tried to leverage the trappings of the presidency to benefit his commercial projects, from visits to his golf courses to hosting summits at Mar-a-Lago to launching a new hotel-licensing business aimed at his voters. “My father made a tremendous sacrifice when he left a company that he spent his entire life building to go into politics,” counters Eric Trump, who now co-manages the Trump Organization on behalf of the president, in a statement to Forbes. “Everything he does is for the good of the American people—he has zero involvement in the Trump Organization and quite frankly to suggest otherwise is outrageous.” (Eric Trump himself, however, told Forbes shortly after the inauguration that he would provide the president bottom-line updates “probably quarterly”.)

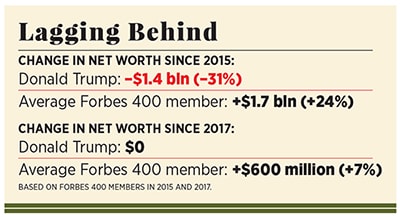

Either way, Trump’s mixture of politics and business has proved to be a net loser for him so far. In further polarising the country, he has also further polarised his business—to the tune of an estimated $200 million hit against his net worth. Understanding how that has happened offers a fresh window into the state of Trump Inc—and Trump’s America.

*****

In May 2016, a dozen or so golf course appraisers settled in at Trump National Doral, the president’s 643-room Miami mega-resort, for a few days of seminars and golf. At the time, Trump was steamrolling through the Republican primaries while bashing Mexicans, Muslims and even the pope. So it was no surprise when, inside his resort, the conversation turned to how the tumult was affecting Trump’s golf businesses.A top Doral executive, of all people, was willing to provide an answer. According to three witnesses, he told the room of appraisers that business at the resort—whose revenues were as big as Trump’s 10 other US golf courses combined—was suffering because of the campaign. Historically, Doral had drawn much of its clientele from the Northeast, where Trump was and is especially unpopular. “At the time there was a lot of talk about comments that Trump had made,” says Jeff Dugas, who attended the event. “Nobody was extremely surprised.”

Big names like Nascar and the PGA Tour also pulled business from the club. After Trump won the election, Doral lost 100,000 booked room nights, according to someone who knows the resort’s business. While revenues for the Miami luxury hotel market jumped 4 percent overall in 2017 according to the data analytics firm STR, Doral’s revenues fell by an estimated 16 percent. And that was before a deranged gunman wandered into the lobby earlier this year, draped an American flag over the front desk and began shooting at the chandeliers before he was apprehended by police.

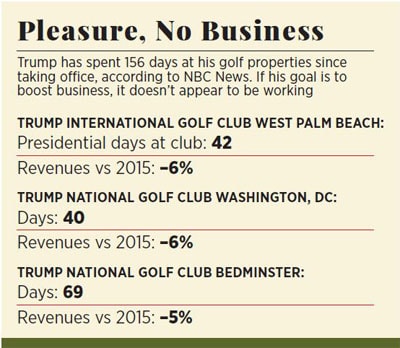

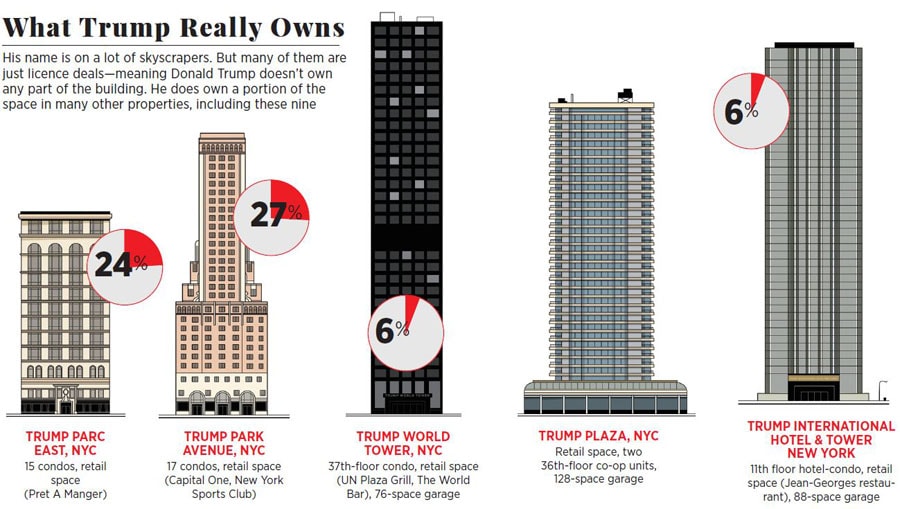

Overall, revenue at the president’s US golf properties fell by an estimated 9 percent in 2017. It goes beyond politics—guests now endure metal detectors and bomb-sniffing dogs. “It’s not a country club experience,” a source familiar with Trump’s golf business says. “It was captivating at first, but it has become tiresome.” Not even the chance to rub shoulders with a sitting president can overcome this problem: Revenues appear to be down at the three courses Trump visits most often.A similar scenario has played out in Trump’s traditional wheelhouse: Luxury residential real estate. The president still holds roughly 500 condos, co-ops and mansions, all with their own complications, in terms of both hassles and branding.

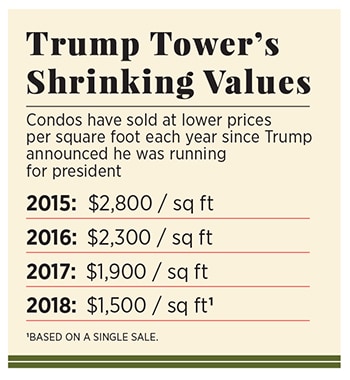

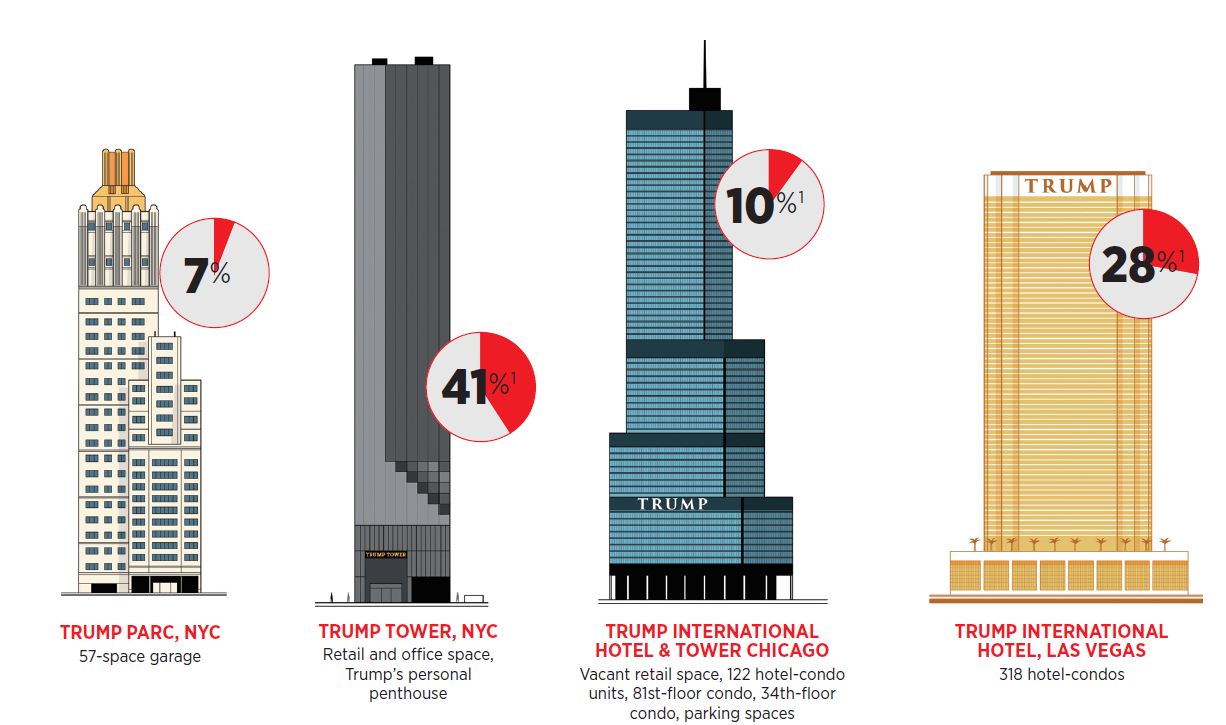

He has 37 units worth an estimated $215 million in midtown Manhattan. Prices for condos in Trump Tower have fallen every year since 2015, when Trump declared his candidacy, and are an estimated 33 percent below their highs. Similar trends are playing out a few blocks away at Trump Parc East, where prices are down 23 percent, and at Trump Park Avenue, where they have dropped 19 percent.

In Chicago, values of Trump condos have crept downward, the opposite direction of the overall market. “People bought into the building based on the brand being synonymous with luxury,” says Cyndy Salgado, a real estate broker who once worked for the Trump Organization, selling condos in the Chicago tower. “Now many people feel that the brand represents divisiveness, embarrassment and questionable morals.” All told, the shift in perception has erased an estimated $50 million from the value of his residential units in Chicago and New York.

On the Caribbean island of St Martin, Mario Molinari, a real estate agent, recalls trying to show a Chinese billionaire a villa a few months ago. The seller, he says, was Donald Trump, who was offering 11 bedrooms, an outdoor bar and a private tennis court for $16.9 million. But when they got to the gate, the president’s property manager told them they needed background checks to go inside, which typically take a couple of days to process. “It’s too small for me,” the billionaire responded, miffed. More than a year after the place went on the market, Trump still hasn’t sold it.

Such weakness seems to have infected the Trump brand across the board. After multiple bankruptcies, Trump adroitly turned his business toward real estate management and licensing, slapping his name on other people’s buildings, ties, steaks and even a urine test—allowing him to make money while others take all the financial risk.

undefinedIf Trump had liquidated, paid capital gains tax on his entire fortune and created a trust to invest it all in the stock market, he would be $500 million richer than he is[/bq]

But partners at three Trump-branded hotels (Toronto, Panama, New York City’s SoHo) have taken the president’s name off their projects, which helps explain why politics has dragged that segment of the Trump hotel empire down about $30 million, by Forbes’ estimates. Meanwhile, many of his licensing customers, including Macy’s and the mattress-maker Serta, fled in the early days of his abrasive campaign—and the president’s company doesn’t seem to have landed a single new deal since.

In 2015, Forbes valued Trump’s product-licensing operation at $23 million. It’s now down to a mere $3 million. “He’s so polarising that people are afraid to do business with him,” says Jeff Lotman, who runs the licensing company Global Icons. “He has significantly tarnished the brand.”

Headaches in the luxury market could, in theory, be offset by Trump’s newfound popularity with the larger, less affluent MAGA set. Four months after their father took office, Eric and Donald Trump Jr announced a new business venture to bring lower-priced Trump brands to hotels in Middle America. Filings released months later indicate that the majority owner of this venture is none other than the president himself, with a 77 percent stake, positioning Trump to profit from his political stardom.

But not much has come of it. The Trumps signed deals to brand four hotels in Mississippi, but those agreements generated only $27,000 last year. They told reporters there were as many as 35 other deals in the works—none of them have panned out so far.

*****

Despite what seems a violation of the Constitution’s emoluments clause, designed to keep presidents free from foreign financial interest, the governments of other nations are welcome too.

Everyone from Kuwaiti officials to the prime minister of Malaysia has reportedly spent money there. And lobbyists working for Saudi Arabia disclosed that they ran up a $270,000 tab in just six months.

In terms of condo sales, Trump sold one in New York to a woman named Angela Chen, just a month after he took office. Chen paid $15.9 million, $1.8 million more than her downstairs neighbour shelled out for a similar apartment a year earlier. The deal sparked conflict-of-interest concerns because Chen is apparently the head of a business called Global Alliance Associates, which claims to use its network with the “highest levels of government officials” to help companies expand into China.

Presidential provenance is also proving lucrative. After Trump made Mar-a-Lago world famous, the club is said to have doubled its initiation fee to $200,000. Fallout from the president’s response to the deadly white-supremacist rally in Charlottesville reportedly prompted roughly 20 organisations to yank events from the club, likely costing Trump over $1 million in revenue. Nevertheless, Forbes estimates, Mar-a-Lago is now worth $160 million—$10 million more than it was before it became the winter White House.

The same goes for the president’s penthouse in Trump Tower. Although declining prices in the building have likely hurt its value, the 11,000-square-foot apartment became a historic landmark the moment Trump won the presidency. Forbes figures the election could have added $10 million to any potential deal.

This phenomenon also extends to the value of Trump’s Boeing 757, which became a backdrop for his campaign rallies. Some plane brokers think it could be worth double the roughly $20 million it would fetch if anyone else owned it (Forbes estimates a more conservative $6 million presidential premium). Eric Roth, who customised the interior of the plane for Trump, says, “What’s a baseball worth? About $3. What about if Babe Ruth signed it? It’s not $3 anymore.”

Some of the presidential profiteering appears more direct: On the day he assumed office, Trump took the unusual step of immediately launching his re-election campaign. Donor money kept flowing, and Trump’s companies have kept charging rent to the campaign. The result: America’s first billionaire president has turned more than $900,000 of donations into revenue for himself, without putting up a dime.

As long as he’s president—and refuses to divest his business holdings—Donald Trump will be able to boost his fortune in ways no other businessman can. Three days before Christmas last year, Trump sat in the Oval Office to sign the most significant tax reform legislation in decades. “This is something I’m very proud of,” he said, clutching a black marker. “Great for our country, great for the American people.”

Great as well for Donald Trump. The president famously refused to release his tax returns, but the new bill clearly benefits him. A Forbes analysis shows that Trump could save about 10 percent on business income. Based on Trump’s 2005 tax return, which leaked shortly after the real estate mogul took office, that could mean as much as $11 million annually.

Other policies, which went into effect with far less fanfare, may also bolster his fortune. Take tariffs. Higher steel and aluminum prices make it more expensive for developers to build. For someone like Trump, who owns buildings but hasn’t done much construction recently, that raises the barrier to entry for competitors. His immigration policies, which appear to be raising the cost of construction labour, could have a similar effect. Those two factors are “very favourable to a guy who owns hard assets,” says Dave Rodgers, a real estate analyst at financial firm Baird.

For now, though, Trump’s presidency remains a net loser for him, which seems ironic. In not divesting, he set himself up so that his actions, and those of people who engage with his businesses, present perpetual conflicts of interest—or the appearance of them.

Meanwhile, if he’d liquidated, paid capital gains tax on his entire fortune and created a blind trust to invest it all in the booming stock market, Trump would be $500 million richer than he is today—without the headaches.

First Published: Nov 20, 2018, 10:56

Subscribe Now