What's Mitt Romney Worth?

The presumptive GOP nominee has diversified far past Bain Capital. From hedge funds to his kids $100 million trust, Forbes reveals the most definitive valuation of the man who would be the richest Pre

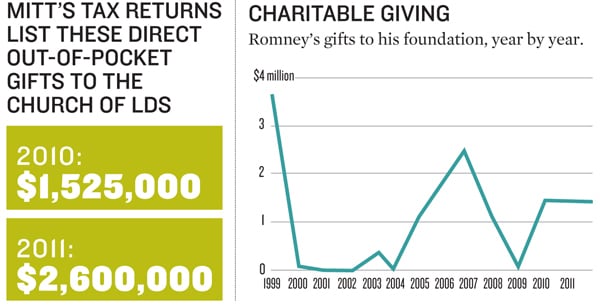

Mitt Romney isn't the richest person to ever run for President—Ross Perot had him beat by a factor of ten. And if he’s elected, inflation adjustments might favour sprawling plantation owners like Washington and Jefferson, or Kennedy if family assets counted. But there’s no denying that in terms of total dollars a President Romney would be the wealthiest White House occupant ever. So just how rich is he?

Forbes spent the past month trying to answer that question definitively. The core basis for our valuation comes from Romney himself—specifically, the US Office of Government Ethics disclosure forms, which he filed in August 2007 and August 2011, plus discussions with high-level Romney officials familiar with specific changes to his holdings since that last report. Of course, those disclosures, taken at face value, are about as concrete as a campaign promise, with vague asset ranges (“$1 million to $5 million”) and definitions.

Seeking to remove as much guesswork as possible, we assigned a value to every single asset Romney owns—184 in all. Our core method: Noting the shift in ranges between the 2007 filing, the 2011 filing and now (much of his wealth has been consistently held over the whole period). Comparing which assets changed brackets—or didn’t—with their underlying price fluctuation (or in some cases, a good comparable) over that period, we were able to get better estimates of where each fell in the range. Supplemented by a dozen interviews—from local real estate experts to private equity partners—we get a detailed look at the current state of Mitt’s money.

Methodology Forbes analysed 184 assets belonging to Romney to come up with a net worth. Assets that jumped to a higher bracket were valued at the 25th percentile of the current range, while those that fell were valued in the 75th percentile of the current range. Assets that stayed within their bracket were appreciated at the market rate from their initial median value through May 14 benchmark indexes were used as proxies for non-marketable assets. Real estate was valued based on current property values.

Into Ballista went a total $2.5 million of reinvested profits, $1 million from angel investors—and the brainpower of engineers recruited from the likes of Raytheon, Northrop Grumman and General Atomics.

Now in beta, Ballista is being tested by military labs paying $1.5 million to do so. DreamHammer plans to release the product in 2013. Paez is seeking $20 million in funding for the next phase: Commercial applications. Congress ordered the Federal Aviation Administration to allow for private drones in the national airspace by 2015. That puts companies like FedEx and UPS on DreamHammer’s radar.

Real Estate

The Romneys have rejiggered their property portfolio in recent years. The family, who lived in a 7-bedroom colonial in a Boston suburb for 20 years, sold their home, which had a swimming pool and tennis court, for $3.5 million in 2009. Mitt and Ann bought a more modest condo in the same town the following year. They swapped their Park City, Utah ski chalet, sold for a reported $5.2 million also in 2009, for a $12 million beach house in La Jolla, California, bought a year earlier. (That home was reassessed last year at $8.7 million, dropping the Romneys’ tax bill. A local agent thinks that even that figure is “pie in the sky” today.) The family also has a summer compound in Wolfeboro, New Hampshire, consisting of a main home, a converted stable and other land that have been combined.

Bain Alternative Investments

Romney cut a deal with Bain when he departed, giving him a share of profits from all Bain funds between February 1999 and February 2009. He also received the right to invest his own capital alongside current Bain partners. He now has stakes in dozens of his old firm’s funds.

Other Alternative Investments

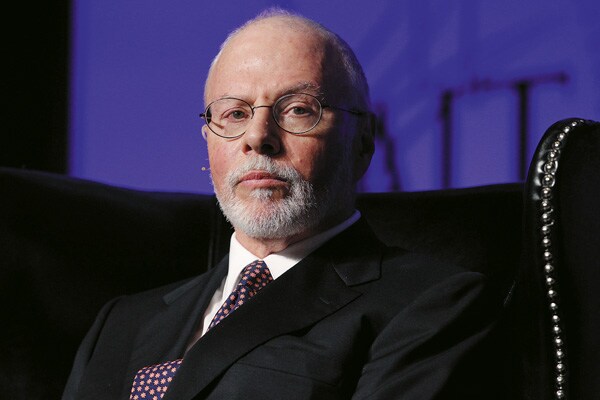

Nearly all of Romney’s non-Bain alternative assets are managed by connections. Billionaire hedge fund manager Paul Singer oversees more than $1 million he has also donated $1 million to the Romney super PAC Restore Our Future. Romney also has money in Golden Gate Capital, whose investment team is largely Bain alums, and son Taggart’s Solamere Capital.

Debt Securities

Romney has an estimated $10 million worth of structured notes from Goldman Sachs and BNP Paribas. He also has $36 million worth of Federal Home Loan Banks consolidated obligations. In recent months, he dumped foreign equities held through Thornburg Investment Management and bought notes from the governments of Canada, Australia and Sweden, giving the former governor some international exposure without the potential political liability of holding foreign companies. Also in this category is a personal loan of approximately $400,000 made to the family’s horse trainer, and a loan secured by a suburban home in Missouri, Texas.

Mutual Funds/ETFs

Among his top holdings are an S&P 500 ETF, an S&P Europe 350 ETF, Goldman-managed mutual funds, and SPDRs.  Individual Equities

Individual Equities

Sources told Forbes that over the past nine months Romney dumped 71 stocks and ADRs worth an estimated $6 million, including McDonald’s, Google, Apple, JPMorgan and Walmex. He holds just three individual stocks: Marriott International, Marriott Vacations Worldwide and Ford Motor. Romney has long ties to Marriott and the company’s founding family, fellow Mormons: He was named after the chain’s founder, J Willard Marriott, a friend of his father’s, and served on the Marriott board for more than a decade. Ties to Ford? The son of an auto exec, he owns a 2005 Ford Mustang.

Image: Getty Images

CASH

Pre-Race Sell-Off: Since August Romney’s cash, held in currencies such as US and Australian dollars, has jumped from $1 million.

Gold

Public Bears? The bulk of their investments are in blind trusts, but the Romneys own a quarter of a million in gold directly.

Image: Newscom

Mitt and Ann wuth son Taggart

The Romney Boys’ $100 Million Windfall

Mitt’s net worth might be pushing $350 million except for some early-stage estate planning. In 1995, Mitt and Ann set up an irrevocable trust, now worth $100 million, benefitting their 5 sons. Not a ne’er-do-well in this bunch: Eldest son, Taggart, is a co-founder of investment firm Solamere Capital, along with Spencer Zwick, the former finance director of Mitt’s first presidential campaign and his former deputy chief of staff when he was governor. Father Mitt, an initial investor in the fund, has at least $1 million invested, according to disclosures. Other sons have various white-collar jobs: Son Matthew, for instance, is a senior vice president at Excel Trust, a publicly traded retail-focussed REIT based in San Diego, and Benjamin is an internal medicine doctor. Transportation

Transportation

Romney owns horses through Rob Rom Enterprises, LLC, a Moorpark, California-based entity that has a one-third stake in Rafalca, a 15-year-old Oldenburg mare that represented the US in the Reem/Acra World Cup Final in the Netherlands in late April. Ann, who was diagnosed with multiple sclerosis in 1998, rides horses as a form of therapy. She and her husband reportedly ride such breeds as Austrian Warmbloods and Missouri Fox Trotters.

Methodology Forbes analysed 184 assets belonging to Romney to come up with a net worth. Assets that jumped to a higher bracket were valued at the 25th percentile of the current range, while those that fell were valued in the 75th percentile of the current range. Assets that stayed within their bracket were appreciated at the market rate from their initial median value through May 14 benchmark indexes were used as proxies for non-marketable assets. Real estate was valued based on current property values.

First Published: Jun 20, 2012, 06:19

Subscribe Now