Who Pays For Free Wi-Fi At Airports

Travellers are demanding free airport Wi-Fi. But who is going to foot the bill?

With banks of blinking slot machines situated just past the security check, McCarran International Airport in Las Vegas will never be a “normal” airport. But the tourism and convention money that comes from serving as the gateway to the Strip means that McCarran can also afford to be an early adopter of traveller-friendly technology.

Ten years ago, McCarran was one of the first big US airports to give away Wi-Fi. Today, the airport is in the process of deploying one of the first systems to beam Wi-Fi outside the terminal to fliers stuck on board arriving and departing aircraft. “The experience where a customer feels forced to pay at a location is not a happy experience,” says Samuel Ingalls, McCarran’s longtime IT chief. “I can’t overstate what kind of positive reaction we’ve gotten over the years.”

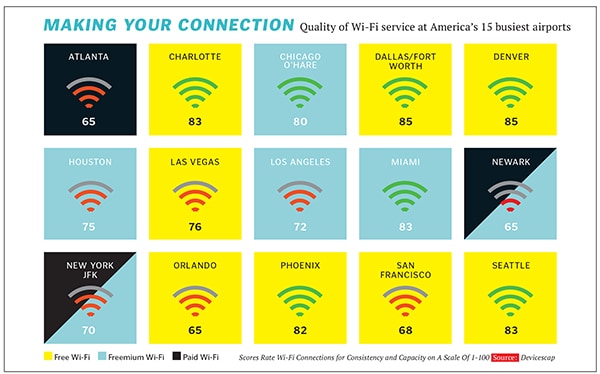

The rest of the country is finally catching up, with more than 90 percent of the biggest 150 US airports offering a free or “freemium” internet connection last year, according to research by wireless software company Devicescape. Last year, three of the biggest holdouts—the New York-area airports John F Kennedy, LaGuardia and Newark—offered free Wi-Fi almost half of the time.

Airports aren’t offering Wi-Fi because it’s suddenly cheap—it’s expensive and often a headache to deploy. “We’ve got almost 3 million square feet to cover. It’s not like running to Best Buy,” says Scott Wintner of Detroit Metro Airport.

But customers want free Wi-Fi and the failure to offer it has become a competitive disadvantage. The number of major hubs that charge for Wi-Fi is now 10. America’s busiest airport, Atlanta’s Hartsfield-Jackson, is the one most often singled out.It lowered its fees to $4.95 in 2012 and delayed a planned switch to free in the fall. Minneapolis-St Paul International shifted to freemium, charging only for intensive use such as video streaming or connections that last for more than 45 minutes.

The shift to free has led to changes in who pays for airport Wi-Fi. Four years ago, Google popularised the concept of underwriting an entire airport’s Wi-Fi during a holiday promotion. Startups such as JiWire and Cloud Nine Media began offering ad deals directly to airports to defray some costs with 30-second video spots, rich media and banner ads.

Even as ad-supported Wi-Fi took off, the biggest partner to airports has remained Boingo Wireless, which has traditionally paid for the equipment and installation and split its monthly and daily access fee revenue with the airports. Buying up its rivals, Boingo, in 2011, claimed to reach 42 percent of all North American passengers in 271 airports.

But the emerging appetite for free Wi-Fi has forced Boingo to look for more varied revenue sources. It bought into the ad-supported trend by acquiring Cloud Nine in August 2012 and a fast-growing competitor, Advanced Wireless Group, which had contracts with LAX and Miami, in October. That brought back airports such as Minneapolis-St Paul, which AWG snatched from Boingo in an adsupported deal that made the airport twice as much money.

But, even with acquisitions, Boingo’s revenue grew just 3 percent last year, and its shares are of 50 percent from their highs in 2012. Analysts are more bullish about its move into military bases through its February 2013 acquisition of Endeka. “There is always competition to keep us on our feet,” says Boingo President Nick Hulse. “I think we are caught up to this new market trend.”

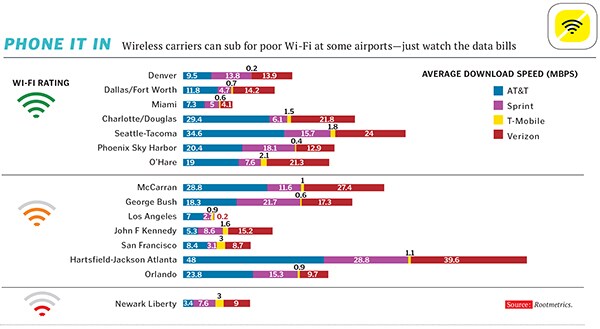

As long as advertisers are footing the bill, airports no longer care which vendor gets the deal. Throwing open a contract to new players brings the extra benefit of higher-speed networking gear. By switching to AT&T, Dallas/Fort Worth is getting one of the best high-speed free Wi-Fi systems in the US (see table, page 96). Houston’s two airports will forgo the $300,000 they make per year in a 35 percent revenue share with Boingo and choose a new ad partner to help cover the cost of new gear.

Boingo still has tricks up its sleeve. At Chicago’s bustling O’Hare International Airport, Boingo is testing a new Hotspot 2.0 that lets authenticated smartphone users hop onto Wi-Fi securely for free. Who would likely foot the bill? AT&T and Verizon.

First Published: Mar 03, 2014, 07:48

Subscribe Now