John Distilleries: The Good Choice

For entrepreneur Paul P John, maker of Original Choice whisky, selling alcohol wasn't his first choice. But it turned out to be his best

Paul P John, chairman and managing director of John Distilleries, plans to premiumise his entire portfolio of brands

Image: Vikas Khot

When, between 1990 and 1992, the Karnataka government issued 20-30 distillery licences in the state, Paul P John, then in his mid-20s, was among the licence awardees he set up National Distilleries in 1992. Three years later, he renamed it John Distilleries and launched its whisky brand Original Choice.

This wasn’t the first time John was trying his hand at entrepreneurship. His first attempt was a disaster, leaving him running for cover from creditors.

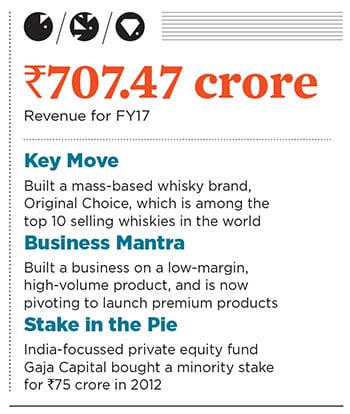

Today, Original Choice, a mass market product that is largely a regional player (selling mostly in Karnataka), has climbed the ranks to become the eighth-largest-selling whisky brand in the world. It also accounts for 95 percent of the company’s revenue, which stood at

707.47 crore for FY17.The factory manufactured a local brand of biscuits, Crisp Biscuit, which was primarily sold in the neighbouring states. It was a business that wasn’t doing well, but John thought it was the perfect platform to give wings to his entrepreneurial dreams. “Biscuit is something that everybody eats, and logically it made sense that it would be easy for me to sell,” recalls John, now 52, chairman and managing director of John Distilleries.

But he was wrong about his abilities to sell biscuits. The business went bust in 24 months and, as John recalls, “I had to shut shop and go underground to resolve issues with creditors.”

Over the next two years, he settled his dues, and thanks to another loan from his father, got a second chance at entrepreneurship. This time, John played it safe and forayed into a sector his father knew well—the alcohol market.

Why it is a Gem

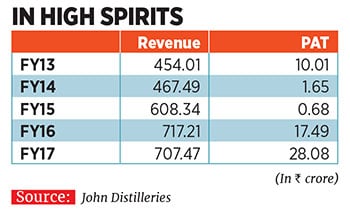

According to data shared by IWSR, a global research firm that supplies data on the alcoholic beverage market, in 2016, Original Choice reported volumes of 10.1 million cases (each case is equivalent to 9 litres of alcohol). Apart from being number eight among the top 10 selling whiskies in the world, it also ranks No 26 in the top 100 brand of spirits, globally. Officer’s Choice and McDowell’s No 1 whisky—both Indian brands—are ranked No 1 (32.2 million cases) and No 2 (25.6 million cases) respectively, among the top 10 selling whiskies in the world. “The most attractive thing about John Distilleries is its strong distribution and manufacturing infrastructure in key liquor consumption markets of South India and Maharashtra, primarily Mumbai and Pune,” says Sanjay Jain, director at Taj Capital, a boutique investment advisory firm based in New Delhi. Between FY13 and FY17, the company reported a 9.28 percent CAGR in revenue, while its profit reported a CAGR of 22.91 percent.

“The most attractive thing about John Distilleries is its strong distribution and manufacturing infrastructure in key liquor consumption markets of South India and Maharashtra, primarily Mumbai and Pune,” says Sanjay Jain, director at Taj Capital, a boutique investment advisory firm based in New Delhi. Between FY13 and FY17, the company reported a 9.28 percent CAGR in revenue, while its profit reported a CAGR of 22.91 percent.

At

50 for an 180-ml Tetra Pak, Original Choice has been a low margin, high volume business that has delivered results.Risks and Challenges

“The key weakness of John Distilleries’ portfolio is its skew to the value segment, which is getting commoditised and is working capital intensive,” says Jain. John, however, now has plans to premiumise his entire portfolio of brands—premium brands have higher margins, which will increase profitability—work on which has already begun.

In 2012, John Distilleries launched a ‘Made in India’ single malt, branded as Paul John Indian Single Malt, which is retailed in five expressions—Brilliance, Edited, Bold and Select Cask Classic and Peated. Priced between $50 and $100 for 750 ml, depending on the expression, the single malt series, which is made at a company distillery in Goa, retails in over 30 countries.

In the last three months, the company sold a limited edition Paul John Indian Single Malt—aged in sherry casks imported from Spain—priced at $250 for a 750 ml bottle. Only 250 bottles of the product were made.

John Distilleries also has a range of wines—white, red, rosé and dessert—under the brand Big Banyan, priced between

650 and 1,000 for a 750 ml bottle. The company has a few vineyards in Karnataka, but sources the bulk of grapes from Maharashtra.“We are working on a high quality brandy,” says John. “I would like to have a range of products at different price points.” One route to premiumisation that John is exploring is getting onboard a strategic foreign investor from the alcohol sector. The entry of such an investor would also give the company’s private equity (PE) investor Gaja Capital an exit.

“It [John Distilleries] is trying to make a transition by entering the super premium segment through its single malt, and one needs to watch its progress,” says Jain. “It is a segment that may require large advertising and promotional investments as competition is from entrenched global players.”

In 2012, India-focussed PE fund Gaja Capital invested close to

John has already begun discussions with multiple potential strategic foreign investors and is exploring options of a public float. But, he says, “It would be fantastic if we could tie up with a foreign distiller who has world-known brands, which he could bring to India.” Also, the technological know-how that the foreign company would have, he adds, “can come in to upgrade the quality of the products that I have”.

As of 2016, the India spirits market reported volumes of 314.26 million cases, registering a CAGR of 9.4 percent between 2007 and 2016, according to IWSR. The whisky segment alone accounts for more than 60 percent of the market. Given the market size and growth, Shah says, “John Distilleries is an attractive investment opportunity for global strategic players as well as investors looking for a strong toehold in a large domestic consumption category.”

First Published: Aug 28, 2017, 07:38

Subscribe Now The person behind it

The person behind it