Birla Sun Life's BFE Fund chases performance by grabbing hidden opportunities

A Balasubramanian and Mahesh Patil have built Birla Sun Life's BFE Fund into India's biggest large-cap fund by spotting hidden opportunities

While Birla Sun Life CEO A Balasubramanian (left) says he tries to keep his employees calm, co-CIO Patil says his aim is to build a consistent fund rather than the biggest fund

Image: Joshua Navalkar

In June 2013, Mahesh Patil, co-chief investment officer (CIO) at Birla Sun Life Mutual Fund, and his team were scouting for new ideas in the equity space. It was important for Patil to set himself up for the good times around the bend. They were looking for changes—in management style and strategies of companies, or structural shifts in an industry—across various sectors.

Patil noticed that non-banking financial companies (NBFCs) were poised for growth, and Bajaj Finance was acquiring customers at the lowest possible cost. Patil and his team made a trip to the company’s headquarters in Pune and spent a day with Sanjiv Bajaj, vice chairman of Bajaj Finance, and also met the senior management.

They liked what they saw: Bajaj Finance, which dealt with consumer finance and multiple verticals, was using a lot of data mining to understand customers their risk management systems were solid. Patil started buying the stock—which was priced Rs 1,200—immediately for their Birla Sun Life Frontline Equity Fund (BFE), a large-cap fund that also allocates 15 percent of its portfolio to mid-caps his team thereafter continued to increase the stock’s position in their portfolio.

Their faith has been validated. Bajaj Finance has shown income growth of more than 30 percent annually, with a consistent return on equity (RoE) of 20 percent it has given a return of 88 percent annually over three years, and is trading at Rs 1,000 levels (if not adjusted for bonus shares, the price would be around Rs 11,000). The stock currently adds 1 percentage point to BFE’s annualised returns.

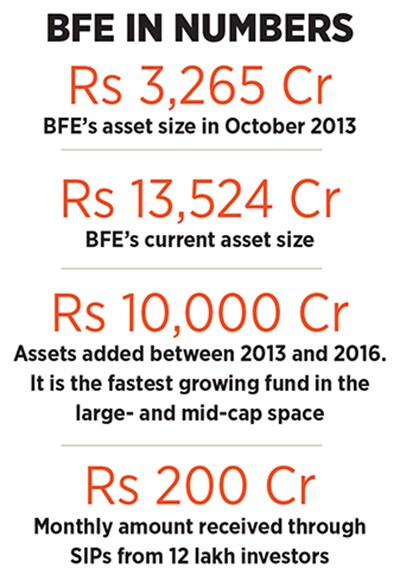

Birla Sun Life MF has total assets of Rs 1.80 lakh crore, making it the fourth largest fund house in India in terms of assets. Of this, 28 percent (Rs 50,000 crore) account for equities in 2009, equities accounted for 15 percent (Rs 8,000 crore). Balasubramanian largely associates this increase to the growth of BFE, which is the largest mutual fund in the large-cap equities category according to Value Research, a fund analytics company. (See chart BFE in Numbers.)

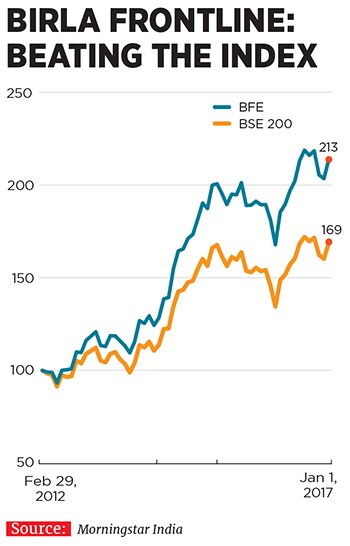

In 2013, following the announcement of Narendra Modi as a prime ministerial candidate, the stock markets were on a roll, where mid-caps benefited more than the large-caps the Nifty Full Midcap 100 Index rose by 30 percent annually over the last three years, while the S&P BSE 200, the benchmark index for large-cap funds, went up by 16 percent annually. BFE has managed to clock returns of 21 percent in this period. “We always had a process-driven approach towards investing, and had to handle funds that came to us from legendary fund managers. So it was really important for us to take our fund house to another level. Patil came in and built the team in 2006, and their equity calls have worked well for us,” says Balasubramanian.

In October 2004, Birla Sun Life MF, which had assets of Rs 8,982 crore, took over Alliance Mutual Fund, with assets of Rs 1,951 crore. BFE—then called Alliance Frontline Equity—was part of the Alliance stable.

When Patil joined Birla Sun Life in October 2005, he was given charge of BFE, along with Alliance 95 (renamed Birla Sun Life ’95 Fund) and Alliance New Millennium Fund (renamed Birla Sun Life New Millennium Fund).

In the late 1990s, these funds were managed by Samir Arora, who made a name for himself during the dotcom bubble by investing in software stocks. For the year 1999, Alliance 95 had generated a return of 180 percent. During the same period, Birla Sun Life Advantage Fund became popular because of its CIO, Bharat Shah, who, like Arora, took concentrated bets in software stocks the fund gave more than 300 percent returns in one year.

After the dotcom bust, Shah joined ASK Group in 2002, and Arora moved out of Alliance Mutual Fund in 2003.

In 2006, Balasubramanian—who had worked with Birla Sun Life since 1994, and is one of the few veterans in the mutual fund industry to have stayed with a single fund for his entire career—became CIO. In April 2006, the fund was ranked sixth in terms of assets under management, with Rs 17,389 crore. It was important for it to perform and improve its overall ranking. To do that, Balasubramanian told Patil to build a bottom-up approach towards investing.

In 2006, the markets were on a bull run and the capital goods sector was witnessing a lot of action. Patil had tracked capital goods and telecom for almost 10 years while at Motilal Oswal Financial Services and Parag Parikh Financial Advisory Services. When these sectors became the flavour of the market, he was able to bring the equity schemes of Birla Sun Life back into the limelight.

Patil started looking for long-term investments, which included scalable businesses, good management quality and growth. It was important to identify stocks and include them in the portfolio as quickly as possible, before they ran up in valuation. The team reduced the time taken to do this from months to weeks, with four fund managers and seven research analysts working through weekends. The Birla Sun Life Infrastructure Fund was up 92 percent in one year in November 2007, compared to the benchmark BSE 200 index’s 70 percent most of the other funds performed in line with their respective benchmarks, but BFE underperformed. This did not rattle Patil and the team. “BFE underperformed because there was euphoria in the market, and BFE was not getting carried away, which helped in later years,” Patil explains.

And then the global financial crisis hit the markets. Most equity funds suffered, while BFE managed to stay afloat while the BSE 200 was down by 68 percent for the year till October 2009, BFE was down by 58 percent. BFE increased its liquidity to 30 percent in cash from a pre-crisis 5-7 percent.

Balasubramanian relied heavily on market intelligence at the time. In 2009, he hired an analyst from Merrill Lynch to track international trends, and created a composite risk index to track commodity data across the globe. Patil, on the other hand, was telling his team to cut risky positions in metals and refineries, and in stocks affected by global events. “Patil is like Gautam Buddha. You can never shock or surprise him. So even when we were in the middle of a financial crisis he was not losing his cool. He was ready to experiment, and was happy to catch falling knives,” says Vineet Maloo, a senior analyst and fund manager who works closely with Patil. (‘Falling knives’ is a phrase in equity markets that describes stocks that are losing value and could either collapse completely or bounce back.)

During the financial crisis, Patil bought Rural Electrification Corporation (REC) at Rs 60 and saw its stock price touch Rs 300 in a year. He also bought IndusInd Bank and Cummins India, both the stocks giving good returns.

Well after the crisis years, Patil took a bet on the real estate company DLF, in 2015. DLF had a large commercial portfolio that was doing well, and the company was restructuring its debt of Rs 21,000 crore. The company was 60 percent below its intrinsic value at Rs 93 in January 2015. Most fund managers had chosen to stay away from the real estate sector. But that is the reason Patil calls DLF his contra bet: He held DLF to the tune of one percent of his portfolio for six months and exited with 60 percent returns.

Similarly, in January 2016, when there was a global commodity crisis, Glencore, an Anglo-Swiss commodity trading and mining company, saw its bond yields rise and its stock price fall by 75 percent from the previous year. There was bad news across all commodities, which also affected Indian commodities companies. As analysts at Birla Sun Life tracked the effects on Indian markets, Patil took a call to buy commodity stocks, such as Vedanta, Hindustan Zinc and Tata Steel. The gamble worked: Over the next few months, these stocks went up.

Inevitably, Patil has had his share of bad calls. After the 2008 financial crisis, when the market rose in 2012, he bet on GMR, believing that infrastructure as a sector will make a comeback. But the sector was debt laden, and in 2013 the markets fell. Having learnt his lesson, Patil started avoiding heavily debt-ridden companies. More recently, his call on the pharma industry did not work out either because of concerns expressed by the United States Food and Drug Administration.

“Patil continues to manage this fund with ease despite the gradual yet consistent inflow that it has witnessed over the years. His capabilities as an efficient stock picker stand out and a growth bias is evident,” says Kavitha Krishnan, a senior analyst with research firm Morningstar India. While Patil looks at valuations closely, he tends to take tactical bets if convinced of a company’s growth prospects, she adds.

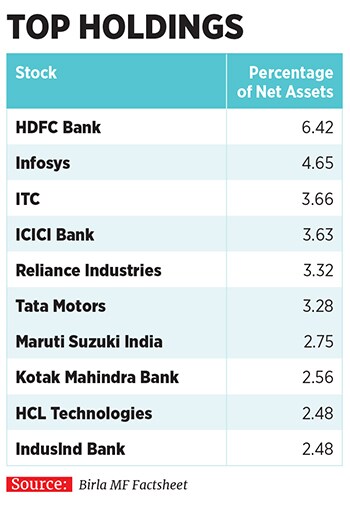

The high growth in assets now puts Birla Sun Life in the classic position where the size might start affecting its performance. As a fund reaches a certain size, say Rs 12,000 crore, it becomes difficult for the fund managers to beat the markets because its investing options shrink they have to invest in only a certain number of stocks else the liquidity of the fund gets compromised. In the past, some large-cap funds have found it very difficult to beat the markets because their size did not allow them to invest in stocks that were not in the Nifty 50. However, with mid-caps facing inflating valuations, several fund managers are touting the resurgence of large-caps and BFE is well-positioned to take advantage of that.Patil points out that some of the large-cap funds failed to beat the market not because of their size but due to concentrated sectoral and company bets. Large-cap funds betting on public sector banks, for instance, suffered because the sector was hit by rising non-performing assets. “We don’t have any concentrated bets. And if you look at the size of our fund, it is hardly 25 basis points of the top 100 stocks in terms of free-float market capitalisation,” he says. BFE’s top holdings are HDFC Bank, at 6.42 percent, and Infosys, at 4.65 percent. (See table Top Holdings)

Patil is betting on the fact that a large section of the unorganised sector will now move towards getting organised. His big bets include consumer discretionary stocks and companies like Crompton Greaves Consumer Electricals, where Birla Sun Life is the largest stockholder.

Patil’s aim is not size but to build a consistent fund. “For that it is important to have a calm mind. And at Birla Sun Life we try to keep our employees calm, rather than work them up for performance or sales,” says Balasubramanian. “I like to chase performance and would also like to be the No 1 fund in the country, but we don’t want to rush.”

First Published: Feb 22, 2017, 06:48

Subscribe Now