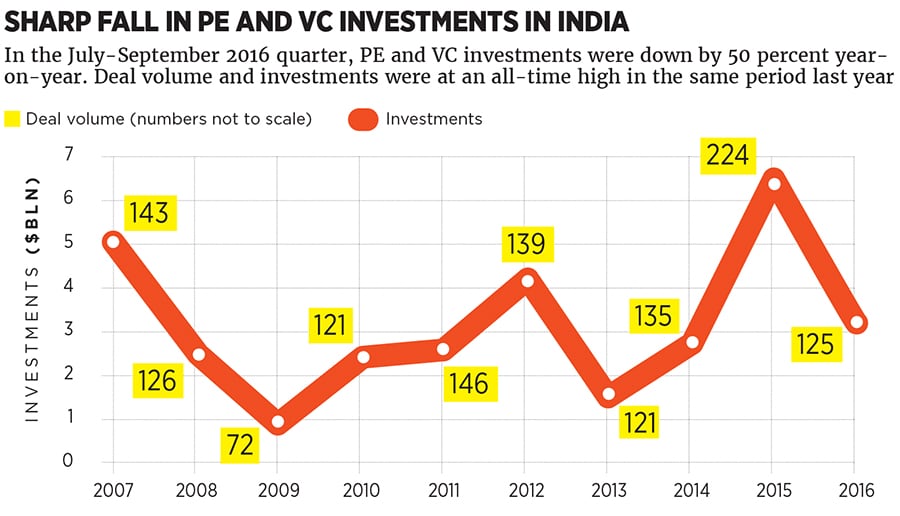

Caution on deal street as PE and VC investments dip in the September quarter

Last Updated: Nov 07, 2016, 07:41 IST1 min

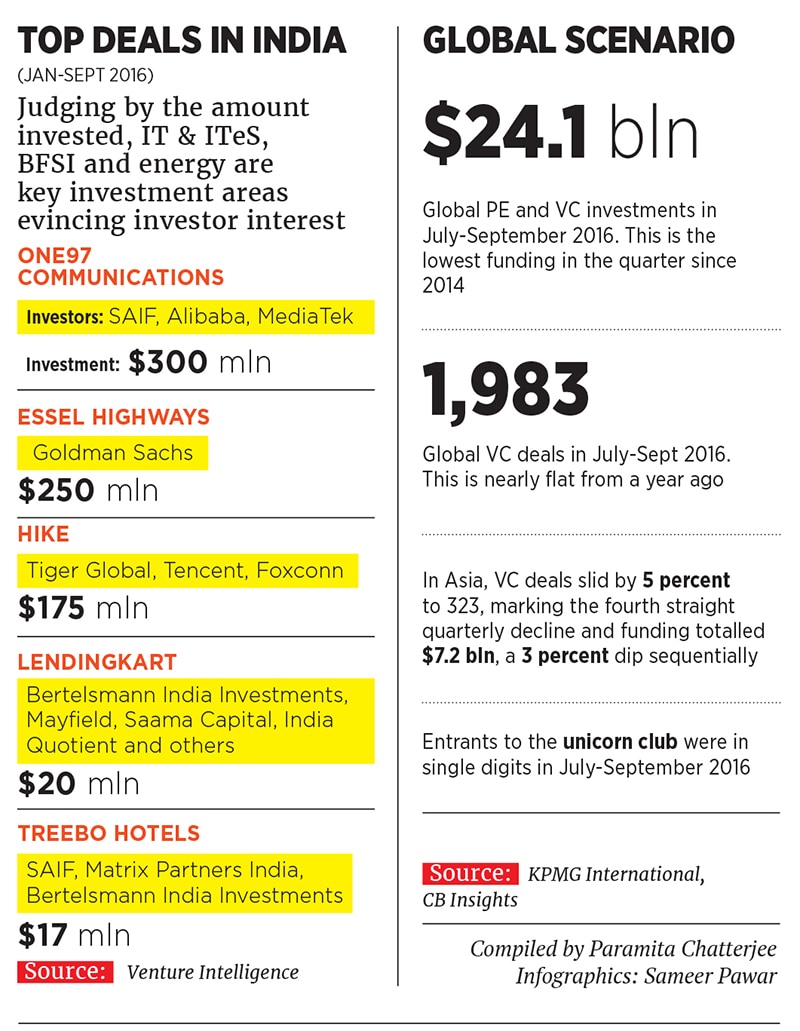

After doling out cheques generously through 2015, private equity investors and venture capitalists are tightening their purse strings in India as major global economies stare at financial uncertainties.

First Published: Nov 07, 2016, 07:41

Subscribe Now