The 10 big questions for 2019 - Part 2

Here's a look at the most important issues plaguing different sectors in the country, and the possible scenarios that may play out in the coming year

Image: Joshua Navalkar

Image: Joshua Navalkar

6. Will residential real estate see better days?

Indian residential real estate developers, grappling with the worst slowdown in a decade, will take any lifeline they can get. Unfortunately there aren’t too many of those coming their way. They’ve been struck with the triple blow of demonetisation, the implementation of GST on under-construction projects, and the recent tightening of liquidity. At rock bottom, things can only get better.  “In the second half of 2019, we could see stability come back into the market, subject to a majority government coming into place. The consolidation process among developers would be largely completed, and we expect some initiatives from the government, such as the reduction of GST rates, to help catalyse the sales momentum,” says Anuj Puri, chairman, Anarock Property Consultants.

“In the second half of 2019, we could see stability come back into the market, subject to a majority government coming into place. The consolidation process among developers would be largely completed, and we expect some initiatives from the government, such as the reduction of GST rates, to help catalyse the sales momentum,” says Anuj Puri, chairman, Anarock Property Consultants.

Expect a lot of consolidation to take place. Well capitalised developers will have their pick of projects that have stalled due to lack of funds. Traditional developers who have built a brand name with customers, with timely deliveries and financial discipline, will continue to do well. “It will be the weaker developers who will start consolidating,” he adds.

This year will witness a slew of corporates, like the Aditya Birla Group and the Hero Group, launch their real estate business, and more corporates with larger balance sheets and execution ability enter the space. Expect a lot more financial discipline in the industry.

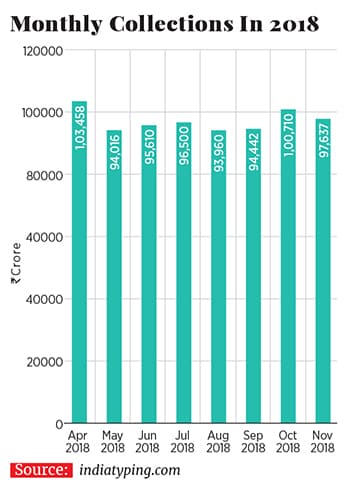

Fewer players and lesser supply, along with stable prices, mean that end users may have no choice but to return to the market. According to data by PropEquity, in Q3 of 2018 new launches across key cities decreased by 22 percent, compared to the previous quarter. Unsold stock fell marginally—by 3 percent—compared to the previous quarter owing to fewer launches and higher sales.

“A lot of projects are expected to be delivered in 2019, although there would be some delays in project completion due to the liquidity crunch,” says Samir Jasuja, founder and managing director at PropEquity, pointing out that this could finally lead to a demand-supply equilibrium in the market.

—Pooja Sarkar

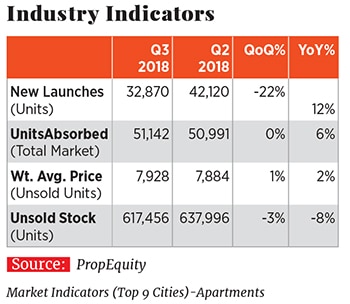

7. Will GST revenue touch ₹1 lakh crore a month run rate?Add and then subtract seems to be the mantra of the administrators of India’s Goods and Services Tax (GST). A five-slab tax regime was never going to be efficient, but the frequent rate cuts have made it that much harder to get to the figure of ₹1 lakh crore a month in tax collections.

Since the GST was introduced in 2017, there have been at least six instances of rate cuts on items as varied as washing machines, cinema tickets and soaps. Lower slabs have meant that even as consumption has increased, tax revenues have declined. The GST Council estimates that the rate cuts have resulted in a revenue loss of ₹80,000 crore. As a result, in 2018 there were only three months with collections above ₹1 lakh crore, and with a slowing consumer economy it’s unlikely to happen again in 2019.

The frequent rate adjustments have also created huge uncertainties for both the government and businesses, according to Arun Singh, lead economist at Dun & Bradstreet. The sooner the government settles GST slab rates the better.

For now the government plans to converge most goods under the 12-percent and 18-percent slabs with luxury goods remaining at 28 percent. (A small number of everyday use items, mainly packaged food, is at 5 percent.) Other reforms such as the implementation of the interstate expressway bill and the matching of invoices are also likely to plug revenue leakages but would still not be enough to consistently make tax collections cross ₹1 lakh crore a month.

One easy, yet politically fraught, way to get there: Include alcohol, crude oil and aviation fuel within the GST’s ambit.

—Samar Srivastava

8. Will there be a grand alliance against the BJP? It remains to be seen if Rahul Gandhi can form an anti-BJP front Image: Rajendra Jadhav/ Reuters Recent setbacks in key states like Madhya Pradesh, Chhattisgarh and Rajasthan may have sounded the alarm bell for the BJP with regard to the 2019 general elections, but will the opposition be able to cobble together a ‘grand alliance’ against the ruling party to secure political mileage at the Centre?

It remains to be seen if Rahul Gandhi can form an anti-BJP front Image: Rajendra Jadhav/ Reuters Recent setbacks in key states like Madhya Pradesh, Chhattisgarh and Rajasthan may have sounded the alarm bell for the BJP with regard to the 2019 general elections, but will the opposition be able to cobble together a ‘grand alliance’ against the ruling party to secure political mileage at the Centre?

Says senior journalist Arathi Jerath, “Grand alliance is a bit of a misnomer, as it would mean all parties against the BJP, but I don’t think all the parties would be on one side.”

It remains to be seen whether the Congress, buoyed by its recent victories, would take a lead in patching together an anti-BJP front. The party has refrained from proposing Rahul Gandhi as its PM candidate, even though the DMK’s MK Stalin has voiced his support for Gandhi, as a pre-poll announcement may distance the Congress from many of its allies.

Meanwhile, the TRS’s K Chandrashekhar Rao is trying to rally support for a non-BJP, non-Congress front. But powerful regional satraps like the Trinamool Congress in Bengal may prefer to go it alone because of their stronghold in home states.

Most vexing remains UP, which will send 80 MPs. The BSP’s Mayawati and the SP’s Akhilesh Yadav are likely to hold their cards close to their chest, even though Akhilesh recently hinted at his opposition to a Congress coalition by taking a jibe at the party for leaving out the SP’s lone MLA out of the MP cabinet. With multiple permutations and combinations at play, it may be a while before a clearer picture emerges on the grand alliance.

—Pranit Sarda

9. Will telecom tariffs go up?

Operators in the indian telecommunications sector are grappling with financial stress, except for Reliance Jio. With consolidation being the key word in 2018, it is only fair to watch out for what 2019 holds for the incumbents in terms of turning around their businesses through asset sales and increased tariffs.

Before the launch of Reliance Jio in September 2016, the industry grew at 12 to 13 percent year-on-year from fiscals 2014 to 2016, and has since seen a steady decline. “At least initially in 2019, we expect subdued pricing to continue, but during the fag end of the year we can expect prices to inch up,” says Abhimanyu Sofat, head of research at IIFL Securities.

Sofat adds that the market is divided between three players, and the amount of debt Bharti Airtel and Vodafone-Idea have is unsustainable, which will lead to asset sales and attempts to increase prices. Reliance Jio, with investments of more than ₹2.5 lakh crore, has debt of ₹80,000 crore, whereas Vodafone Idea has debt of ₹1.20 lakh crore and Bharti Airtel has over ₹1.13 lakh crore.

According to ratings agency Crisil, the corrosive effect of competition will see the average gross revenue of the top three players (Bharti Airtel, Idea Cellular, and Vodafone India) decline by 18 to 20 percent year-on-year during the fiscal. The onslaught of cheaper voice and data tariffs will lead to this decline, as the companies will focus on retaining market share by matching the cuts in pricing of the new entrant.

Sofat adds that Reliance Jio will continue to put pressure on the market, which could lead to consolidation. “We clearly believe that Reliance Jio can grow a market share of nearly 50 percent and the entire telecom business could become a duopoly, going forward,” says Sofat.

Telecom operators have not raised tariffs for the last two years. According to June 2018 data from the Telecom Regulatory Authority of India, there has been a drop in wireless connections and a substantial increase in internet users. Hence, telecom operators are in a limbo when it comes to price rise, and are betting on increasing data prices.

“Prices will probably be subdued until Reliance Jio reaches a market share beyond 40 percent, but after that we expect prices to go up,” says Sofat.

—Pooja Sarkar

10. Will the government abandon fiscal prudence?

The last few months of an election cycle are typically fraught with fiscal uncertainty, but the present government has so far been hesitant to loosen its purse strings. Barring a cut in excise duty on account of rising oil prices, and periodic rate cuts in the Goods and Services Tax (GST), there has been no knee-jerk pushing of money into the economy. (A string of election defeats could lead to farmer incentives being announced.)  Instead, the government has preferred to stick to its signature schemes like the Pradhan Mantri Ujjwala Yojana (for domestic LPG) or the Mahatma Gandhi National Rural Employment Guarantee Act, which it inherited from the previous government, to fulfil its social sector obligations. In addition, it has ramped up spends on infrastructure. It maintains that it plans to stick to the 3.5 percent fiscal deficit target. Oil prices that averaged $44 a barrel during its term gave it the opportunity to consistently reduce the deficit.

Instead, the government has preferred to stick to its signature schemes like the Pradhan Mantri Ujjwala Yojana (for domestic LPG) or the Mahatma Gandhi National Rural Employment Guarantee Act, which it inherited from the previous government, to fulfil its social sector obligations. In addition, it has ramped up spends on infrastructure. It maintains that it plans to stick to the 3.5 percent fiscal deficit target. Oil prices that averaged $44 a barrel during its term gave it the opportunity to consistently reduce the deficit.

Part of the reason for the government’s reticence could be an expected windfall from the Reserve Bank of India’s reserves. A committee under former Governor Bimal Jalan will recommend on the optimum level of reserves that could be freed up.

Expect this tightness in money supply to last only till the general elections. A coalition government with its pushes and pulls from various parties would have to spend more to keep its constituents happy. The fiscal consolidation of the last four years will give them the leeway to spend more. Lower oil prices and benign food inflation may just give the new government the fiscal space it needs.

—Samar Srivastava

(Illustrations: Chaitanya Dinesh Surpur)

First Published: Dec 30, 2018, 14:39

Subscribe Now