How mid-caps helped DSP BlackRock script a comeback

How DSP BlackRock scripted a return to form through fresh blood, team work and a belief in the small- and mid-cap space

Every Wednesday, the investment team of DSP BlackRock Investment Managers locks itself in the boardroom of its Mafatlal Towers office at Nariman Point. They call it a No Noise meeting. All 15 members of the team are expected to attend, discuss their portfolios and, importantly, new ideas.

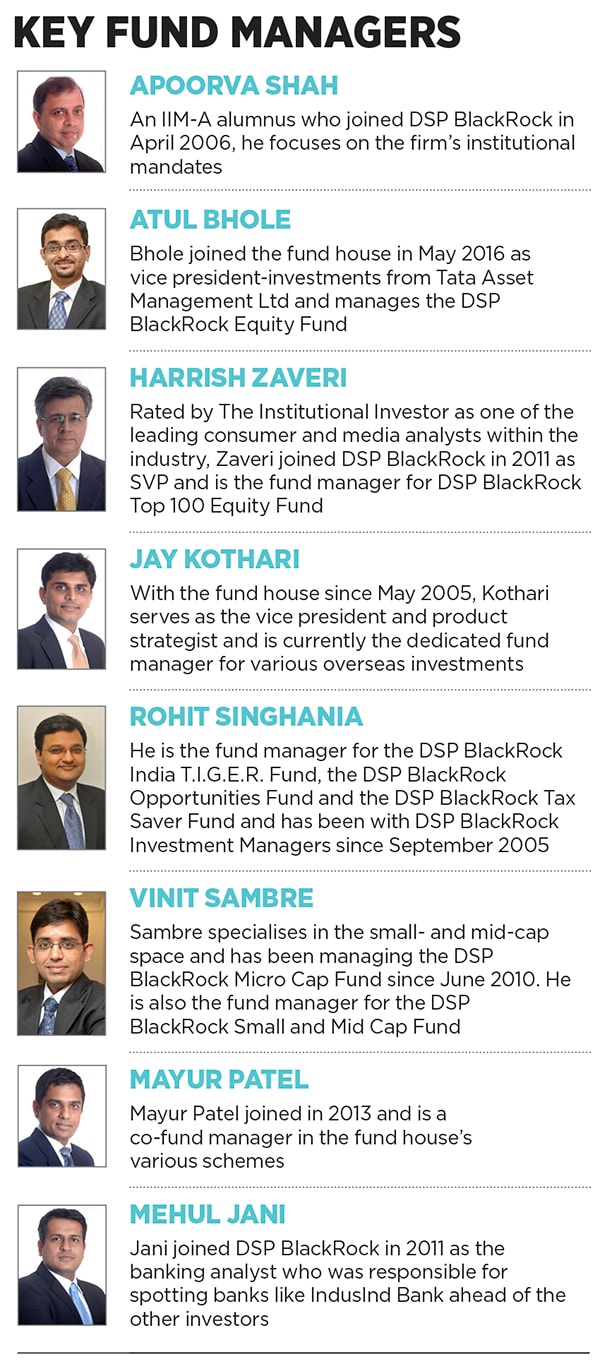

The fund managers have learnt to take this practice seriously. It has, after all, been the source of game-changing ideas for their firm. For instance, it was during one of these meetings in October 2013 that Vinit Sambre, who looks after the DSP BlackRock Micro Cap Fund, presented the financials of SRF, a mid-cap company out of favour with the stock market. As a fund house, DSP BlackRock had already invested in SRF earlier but the positions taken were small. “The speciality chemicals business in the company was getting diluted by the other businesses which are considered cyclical in nature and investors don’t like that,” Sambre told his colleagues. “So the entire company is undervalued. The speciality chemicals business is growing at a fast rate. This company can be a good opportunity.”

At the time, SRF’s stock was being traded at Rs 180 and at a price/earnings multiple of 4. The other fund managers too shared their intelligence about the company, which supported Sambre’s perspective. Anup Maheshwari, executive vice president and equity strategist who heads the investment team, was acquainted with the company too. They all agreed that investors were shunning SRF because of its packaging and technical textiles businesses.

They bought into Sambre’s argument and gave him the green signal to purchase more of the stock for his Micro Cap Fund. SRF is now his top holding and is currently trading at Rs 1,800.

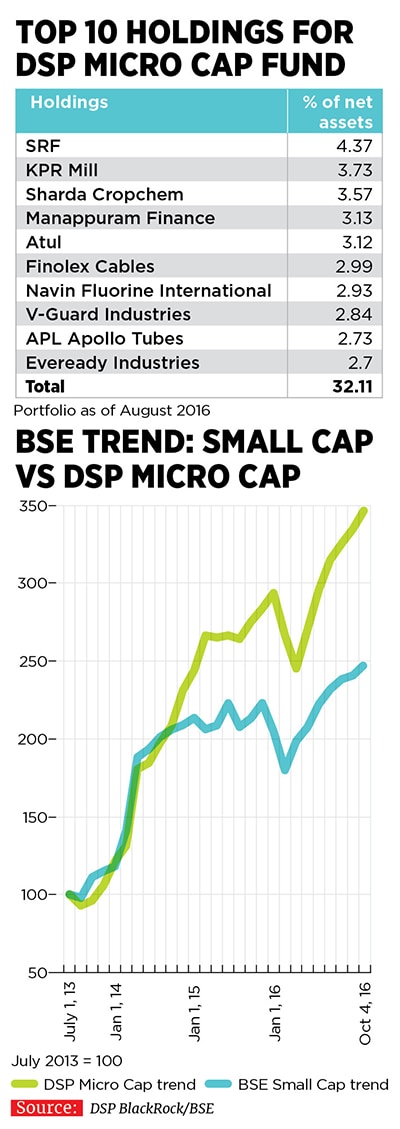

Over the last three years, the DSP BlackRock Micro Cap Fund has managed to buy several companies with strong fundamentals at lower valuations and, as a result, has emerged as one of the best performing funds in the equities space. According to Morningstar India, a fund analytics company, the fund has managed to give a return of 52 percent annually as against a category average of 42 percent since 2013. The overall growth in mid-cap stocks over the last three years has been 30 percent as compared to 13 percent for large-caps.

It is not just the Micro Cap Fund that has performed well. All the funds of DSP BlackRock are now attracting record flows from investors. The AUM (assets under management) of the fund house has gone up by 33 percent over the past year to touch Rs 49,851 crore in September 2016 (almost 40 percent of these assets are attributed to equity funds) it is ranked 10th in terms of assets. If you add DSP BlackRock’s alternative investment management business and offshore assets, the number stands at Rs 67,645 crore.

Over the last year, DSP BlackRock’s growth is only next to that of SBI Mutual Fund whose assets have moved faster because of the government-led ETF business that it manages.

This success is the result of three years of hard work. Till about 2010, the fund house had been a consistent performer. But after 2010, some of its equity schemes became laggards. And, by 2013, many analysts tracking the sector gave up on the flagship DSP BlackRock Equity Fund after it underperformed the market over the previous year.

At that juncture, Maheshwari was looking for investment ideas that would prop up his funds. Enter managers like Sambre, who indicated that mid-caps were the next big thing as many companies in that space were trading at a discount to their fair value. Only a few months prior to Sambre’s SRF presentation, Apoorva Shah, who headed the DSP BlackRock Equity Fund, had defended his position on Arvind Ltd, a textile manufacturer who he felt would do well over the years. (He was proved right. More on that later.)

In fact, all the good ideas from Maheshwari’s portfolio managers belonged to the mid-cap space which had fallen by 10 percent in 2013 and, worryingly, there was no sign of a revival: The rupee was weak, there were concerns about the current account deficit and inflation was high.

In that context, recalls Sambre, 41, “it was important to meet companies and then do a check with distributors and vendors, especially for companies operating in the export-oriented space. Promoters tend to be over-optimistic.” After this screening, their best picks at that time included Indoco Remedies, SRF, KPR Mill and APL Apollo Tubes, he says.

A key metric considered was the company’s cash flow statement. Those with negative cash flows were kept out of the portfolio, irrespective of growth. Corporate governance practices also had to be evaluated, particularly since these were smaller and, by and large, family-run companies. Having realised that market capitalisation had become a significant currency and that good governance was integral to that, the management teams were happy to communicate.

A reassuring sign of promoter maturity was the jump in return on capital employed for companies like Ratnamani Metals & Tubes, Finolex Industries, Kajaria Ceramics and Astral Poly Technik: This was the result of promoters appreciating the value of efficient capital. Another positive sign was that for slightly older companies, the next generation was taking charge—for example, Ceat and Eveready. They were more cognisant of the importance of minority shareholders.

These were all good boxes to tick, but the overarching theme for DSP BlackRock, however, was to stick to quality.

By the end of 2014, the approach started to deliver. In October 2014, the call on Arvind Ltd bore fruit: The stock value increased by 4 times and got the flagship equity fund back into its earlier form. The mid-cap space also gathered steam, and the DSP BlackRock Micro Cap Fund saw its returns go up by 115 percent between September 2013 and September 2014.

“I think the [credit for the] entire success goes to the team. We hired the right people and put them on the right jobs,” says S Naganath, 52, president and chief investment officer of DSP BlackRock Investment Managers.

Since 2013, Naganath and Maheshwari had noticed that many of the fund managers were managing more than one fund this was over-stretching them and leading to problems in the day-to-day running of the schemes. They felt it was time to expand the size of Maheshwari’s eight-member team.

Further, even though he had been using sell-side analysts at research houses, he found their work too specific. “As we were expanding, we wanted our research analyst to think more from a portfolio perspective,” Maheshwari, 45, points out. These research analysts, Maheshwari felt, could eventually take on the role of fund managers.

Naganath and Maheshwari had also got a carte blanche to hire from their boss, Hemendra Kothari, the non-executive chairman of DSP BlackRock. Kothari, who owns 60 percent of DSP BlackRock, is a veteran in the Indian financial system his great-grandfather Purbhoodas Jeevandas Kothari was one of the founders of the Bombay Stock Exchange. Hemendra Kothari had started DSP Financial Consultants, an investment banking and securities firm, in 1975. The firm later partnered with Merrill Lynch in 1996 with a 57 percent ownership of the resultant DSP Merrill Lynch. Merrill Lynch sold its stake in the joint venture to BlackRock in 2009.

Maheshwari and Naganath hired seven people in the past three years. Of these, five are research analysts who work closely with the fund managers. One of the hires in 2013 was Mayur Patel, 35, whose expertise was in the oil and gas and capital goods sectors. While there was scepticism about the implementation of independent pricing of fuel, Patel was convinced that it would materialise and, when it did, it would benefit oil marketing companies. He put his case forward to Maheshwari. At that time, both HPCL and BPCL were available at very low valuations, he pointed out. Analysts had pegged their earnings at Rs 60 per share but Patel felt that the number could be Rs 100.DSP BlackRock’s fund managers bought into Patel’s view and stacked on HPCL and BPCL far ahead of the rest of the market. Over the next three years, the prices of these stocks more than doubled. Such individual brainwaves need to applauded, says Maheshwari.

Team DSP BlackRock appears rock-solid, a fact acknowledged by Kothari. “We hired good people because we wanted to further strengthen our investment team. Selling products is a good thing but what is important is the interest of the investors. The basic idea is to beat indexes and give alpha returns. We have been able to do that in the recent past very successfully. We want to continue doing that,” says Kothari, 70. Daughter Aditi Kothari Desai heads the sales and marketing division and is the fifth generation from her family at DSP, a business that now exists for more than 150 years since it originally started as stockbroking firm DS Purbhoodas in the 1860s.

Temperament has been a non-negotiable requirement. “When I hired Anup, I looked at his focus on fund management, his analytical skills and the fact that he is temperamentally a very sound person,” says Naganath, who started the mutual fund business for DSP Merrill Lynch in 1996 and hired Maheshwari in 1997 to look after the equity fund that he had launched.

Maheshwari believes that the fund management team should complement each other. “If there is no cooperation within the team, you tend to miss out on a lot of ideas,” he says. This is also important because Maheshwari likes to meet companies in groups since he wants more minds on the job. Maheshwari himself tries to connect with as many companies as possible. “This job is about understanding businesses and how they are growing. The excitement is in meeting entrepreneurs and understanding how they plan to grow,” he says.

This process and vigour have allowed DSP BlackRock’s funds to rise to the top. While the funds go through market cycles, Maheshwari chooses to stay with long-term quality businesses. And that is the philosophy Sambre has followed while looking at the micro-cap space, a subset of the mid- and small-cap categories that saw a huge correction till September 2013. The decade since 2003 had not yielded any returns but the worm turned in 2013, and the Nifty Free Float Midcap 100 Index doubled by September 2016.

Investors started coming into the DSP BlackRock Micro Cap Fund from September 2014 onwards because they saw it had doubled its returns in a year. While there has been an extreme swing in returns over the last three years, the composition of return on equity for most of the companies in this segment has remained the same. The price-to-book value for the Micro Cap Fund portfolio has moved from 3 to 8.

“It is one of the best funds that I have been recommending to investors. When the cost of borrowing comes down, the mid- and micro-cap segments of the market always benefit. It [the fund] may not give similar returns when compared to its past performance, but long-term investors will do well because this segment has higher sensitivity to macro factors which are improving,” says Abhimanyu Sofat, vice president at brokerage house IIFL, who looks after retail research.Maheshwari, on his part, understands that this kind of valuation is not sustainable for the Micro Cap Fund. The size of the fund itself has increased from Rs 300 crore to Rs 3,600 crore and is attracting greater investor interest. In fact, to discourage them from investing at such high levels, the fund has stopped accepting bulk investments of over Rs 1 lakh a day it only allows SIP (systematic investment plan) investments. “What people don’t understand is that this fund has existed since 2007. If you look at the returns of the Micro Cap Fund for the last nine years, you will see that they are in line with the market at around 19.53 percent annually compared to the mid-cap index which returned 11 percent. Investors need to come to this fund with a long-term perspective and not look at the returns of the last three years,” Maheshwari says.Sambre and he have started to expect the “derating” of the fund—in essence, a fall in returns. Maheshwari draws from the experience of the DSP BlackRock T.I.G.E.R. Fund which invested in infrastructure companies. It was launched in 2004 and gave strong returns in 2006. Its popularity was such that it led to $1 billion in AUM. However, after the market crashed in 2008 due to the global financial crisis, the fund did not perform as per investor expectations. And those who got in at the peak of 2007 felt they got a bad deal.

Bulk investors tend to get more affected, he points out SIP investors, on the other hand, generally perform well over the long term because they can accumulate huge numbers of units when the markets fall. However, investors tend to start their SIPs when the markets are high and stop when they fall.

It has been a similar case with the Micro Cap Fund. SIPs account for 30 percent of the investments which came in 2014 when the fund gave its highest return over the previous year. The biggest concern for Maheshwari is that these investors will move out when the market starts to tank. “In fact, it makes sense to continue with the SIPs when the markets start to fall but our experience is that investors will move out when that happens,” Maheshwari says. “The fund will perform over the long term. But we don’t want to give this feeling to investors that the past three years will get repeated and that is what the investors think.”

That said, he is pleased that the Micro Cap Fund has proved to be a retail product without too many high net worth investors who bring in big sums of money and also exit in a similar fashion this can hurt the fund as maintaining liquidity becomes a huge challenge.

Also, as the size of the fund increases, Sambre has to look for newer companies to invest in. (Today, it invests in 60 companies.) He is, not surprisingly, wary of the expectations from him.

At the same time, his experience has made him confident of delivering. “There are still opportunities in this space that will work out in the next three years.” In a sense, the folks at DSP BlackRock are getting bogged down by their own performance. And this is a happy problem to have.

First Published: Oct 27, 2016, 09:34

Subscribe Now