How will pressure on rupee, rising crude oil prices impact stock markets?

The Indian Rupee has slipped by 2.7 percent, from Rs 64.70 to Rs 66.46 per dollar

Last Updated: Apr 24, 2018, 18:34 IST1 min

Image: Shutterstock

Image: Shutterstock

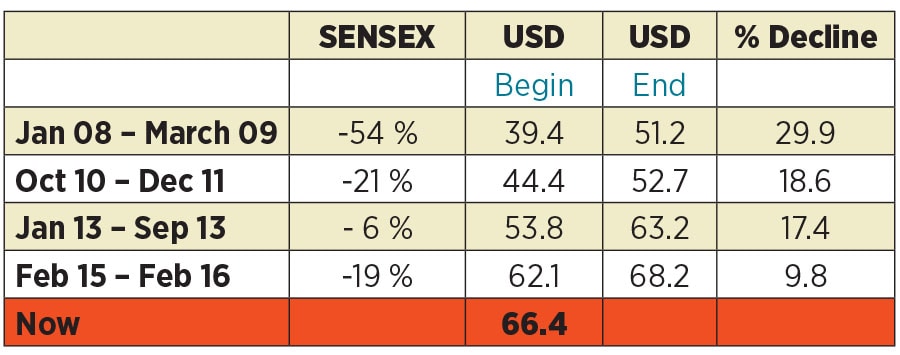

While the current fall has been mild in comparison with the fall during the Lehman crisis or the Taper tantrum of 2013 rising oil prices that show no sign of abating, have prompted rupee watchers to pencil in the probability of a 3-5 percent fall in the rupee. Futures contracts are already trading at 68.5.

While it’s hard to say when and at what level foreign investors would start pressing the panic button, a further 5 percent fall would almost certainly prompt them to take some money off the table. At some point, these falls become self-fulfilling i.e. every decline in the rupee results in a fall in the market. The only thing that’s hard to predict: the quantum of the fall.

First Published: Apr 24, 2018, 18:34

Subscribe Now