Rajat Gupta's Last Card

Rajat Gupta's defence lawyer Gary Naftalis has poked holes in the prosecution's case and steered the jury to possibly doubting the credibility of some witnesses

Rajat K Gupta is remarkably poised for a man who, if convicted of criminal conspiracy and securities fraud, could spend up to 20 years in jail.

The 63-year-old ex-McKinsey head and former director on the boards of Goldman Sachs and Proctor & Gamble must have walked into meetings in a similar dark blue suit, silk tie and crisp white shirt.

But today, May 29, at the US District Court in the southern district of New York in Manhattan, he and his defence team from Kramer, Levin, Naftalis & Frankel LLP are fighting the fight of his life. Gary P Naftalis, the law firm’s co-chair, is one of America’s top white-collar defence lawyers.

“Gupta is lucky to have Naftalis,” says Stephen Gillers, professor of law at New York University, who has known both Naftalis and the presiding judge, Jed S Rakoff, for years. Gupta needs all the luck he can get.

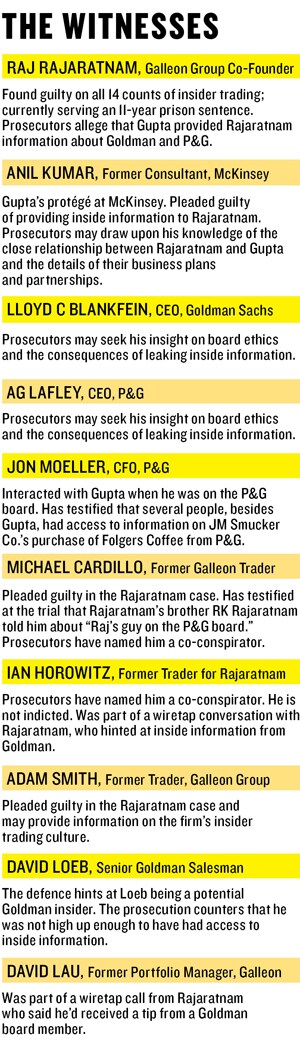

In a six-count indictment, the US Department of Justice charged that Gupta “joined in an agreement or understanding” with Galleon Group’s Raj Rajaratnan, who is serving an 11-year prison sentence and was fined $156 million, “to disclose inside information about Goldman Sachs, P&G, and the JM Smucker Company.”Prosecutors named Michael Cardillo and Ian Horowitz co-conspirators. Cardillo, a former Galleon trader, pleaded guilty of criminal charges last year. Horowitz is not indicted. The names of four others have been withheld.

But unlike Rajaratnam’s trial, where prosecutors presented direct evidence through wiretapped conversations, Gupta’s case so far is built on circumstantial, suggestive evidence consisting of hearsay conversations, indirect witness testimony, emails, Galleon trade records and Gupta’s and Rajaratnam’s phone logs.

The case smacks a bit of Sherlock Holmes. For example, the indictment states that on September 23, 2008, Gupta took part via telephone in a special meeting of the Goldman board, which approved a $5 billion investment from Berkshire Hathaway. Approximately 16 seconds after that call, Gupta’s assistant called Rajaratnam and connected Gupta to the call. Four minutes later at 3:58 pm, two minutes before close of market, Galleon Tech Funds bought approximately 2,17,200 shares of Goldman common stock for approximately $27 million.

Legal experts say although such evidence is not direct, it’s powerful and compelling. “The evidence against him is unusually strong—direct phone contact almost immediately after a crucial board meeting, followed by an immediate trade,” says Lynn A Stout, professor at Cornell Law School.

“It is possible to prove a criminal case by circumstantial evidence. Success is dependent on the prosecutor’s ability to present a series of facts that have only one reasonable interpretation—namely, that the defendant, in fact, gave inside information so that someone else could trade on it,” says Thomas Lee Hazen, professor at the University of North Carolina (Chapel Hill) School of Law.

And that’s exactly what assistant US attorneys Reed Brodsky and Richard Craig Tarlowe, appearing for US attorney Preet Bharara, are trying to construct. Their task is to prove beyond a reasonable doubt to the 12-member federal jury of New Yorkers, who will determine Gupta’s fate, that it was he who tipped off Rajaratnam.

Naftalis is doing everything he can to convince the jury that the government has put the wrong man on trial. The defence strategy thus far is four-fold.

One: Plant doubt in the minds of the jury that Rajaratnam could have had any number of inside sources. Two: Thoroughly discredit certain witnesses as liars. Three: Weaken the prosecution’s evidence as hearsay. Four: Given Gupta’s personal net worth of $84 million, argue that he would not have risked his reputation for financial gains.

In court, silver-haired Naftalis, 70, has an understated demeanour. But it would be a mistake to underestimate him. This is a man who managed to persuade the US government not to file criminal charges against Salomon Brothers for US Treasury auction bidding practices, and against securities firm Kidder, Peabody in connection to insider trading.

But the last few years have been rough for individuals facing white-collar charges. Bloomberg reported that since August 2009, 59 people pleaded guilty or were convicted out of a total of 66 who were charged with insider tipping. So far no one was found to be not-guilty and some cases are pending.

Naftalis has a soft but forceful way of poking holes. During a cross-examination of Jon Moeller, chief financial officer at P&G, he made Moeller acknowledge that several people besides Gupta, including employees at P&G and Smucker and their lawyers, were aware, prior to the announcement, about P&G’s impending sale of Folgers to Smucker.

Raj’s brother RK Rajaratnam on June 2, 2008, purchased 75,000 shares in Smucker. Naftalis said in court that there was nothing aberrational about the trade. He was head of Galleon’s consumer products team.

“This is their pattern trade,” Naftalis said. Slowly and surely, he has steered the jury to possibly doubting the credibility of some witnesses. According to media reports, Naftalis is portraying Cardillo and other Galleon employees as merely bragging about having inside sources in high places.

The reports state Cardillo testified that RK Rajaratnam, for whom he made the trade, told him about “Raj’s guy on the P&G board.” Naftalis then brought up the name of George Soros, asking if it was not true that he’d heard Rajaratnam claim that he provided inside information to Soros on Intel. Cardillo admitted that he remembered something in connection with Intel and Soros.

The Wall Street Journal reported that a Soros spokesman said Soros did not receive any such information from Rajaratnam. So far, Naftalis has had some gains and some losses. Gupta won a court order that requires prosecutors to disclose information to the defence attorneys that could enable them to show that he is innocent. But Judge Rakoff did not allow him to prevent prosecutors from showing wiretap evidence.

The tension is palpable among members of Gupta’s family. Waiting in the security line at the courthouse entrance, this Forbes India correspondent struck a conversation with a woman who said she was a member of Gupta’s family.

How is he holding up? “It is stressful, but he is not an ordinary man,” she said, looking both fragile and defiantly strong. It seems that Gupta was holding it together for all of them. At one point Judge Rakoff asked a juror to move to the front row, saying if this was a Broadway play, he won’t be able to afford the ticket. Gupta smiled.

Is the government particularly tough on him?

The persistent reference during the trial to other potential inside sources points to the large picture, and it’s not pretty. As Judge Rakoff said on May 29 in court when the jury was sequestered: “The most disturbing thing about this case is what it says about business ethics. It’s not a case of one bad apple, but a bushel.”

Not everyone agrees.

“I do not think insider trading of this sort should be illegal, especially not enforceable by criminal sanctions,” says Todd Henderson, professor at the University of Chicago Law School. Henderson was formerly a McKinsey employee and worked directly under Anil Kumar. A Gupta protege, Kumar pleaded guilty for tipping off Rajaratnam and is now a key witness for the prosecution.

“That said, I think what Gupta allegedly did is illegal under current law, and I think it is likely he will be convicted,” he adds. Henderson is among a not-so-small group of legal eagles in the US who believe that there’s nothing wrong with this type of insider trading.

Prosecutors allege that on October 24, 2008, Rajaratnam sold Goldman stock after learning, allegedly from Gupta, that Goldman was losing $2 per share, which was worse than prevailing market expectations.

He explains: “Take the case of Raj Rajaratnam’s trades in Goldman. He had information that the price of Goldman trading in the market was not accurate, and he traded to arbitrage this information. His trades provided information to the market about the true value of Goldman’s stock price. This is a public service, since the trades at the higher price were not an accurate reflection of the true value. The price was going to come down eventually, and I’m not sure why a big drop on an announcement is better than a gradual one based on insider trading. Now, it may be that Goldman may want to contract with its board members like Gupta, to prevent them from telling secrets to outsiders, but this should be a matter of private contract. If they aren’t harmed, it is hard for me to see the social harm.”

Federal prosecutors bristle at such a line of thinking. Sanjay Wadhwa, who is heading a parallel Securities and Exchange Commission case against Gupta, says there’s good reason why insider trading is illegal.

“The US markets are the envy of the world because there is transparency, there’s full and fair disclosure, and there’s an even landscape,” he says. “The markets are not supposed to be rigged in anybody’s favour. When you turn to insider trading, you undermine the core values of integrity and fairness that underlie our system. You victimise the marketplace and everyone else who participates in it. It’s hardly a victimless crime.”

The three-week trial began on May 21. The verdict is expected anywhere from a day or two to three weeks and more, depending on how long the jury deliberates before their announcement. In Rajaratnam’s case, the jury deliberated for 12 days.

First Published: Jun 09, 2012, 06:44

Subscribe Now