Section 80 C - Why not take it to Rs 10 lakh?

The archaic standard deduction section of 80 C allows salaried individuals to save up to Rs 1.5 lakh every year and make that amount of income, tax-free

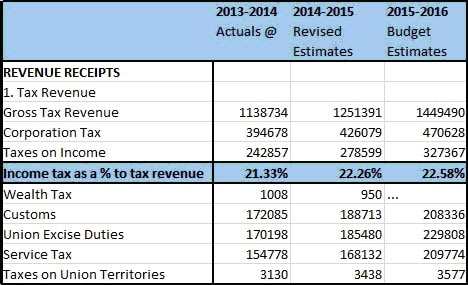

Income tax receipts form 22.58 percent of the government’s overall tax revenue (2015-2016 estimates). This is after you and me, and the whole community of salaried taxpayers, grudgingly part with our income every year. I am not even discussing the other taxes that we pay (look at the lumpsum corporation taxes, service taxes, etc), sometimes to just live in hygiene. I am not because it can be so infuriating that I fear I may digress and stop writing.

Look at this data carefully: Source:http://indiabudget.nic.in/glance.asp

Source:http://indiabudget.nic.in/glance.asp

We run with a fiscal deficit debate every year if the government should divest its holdings in PSUs or sell its stake in listed companies or immovable assets. After all the pre-budget polls, endless debate and talk shows, the government comes up with a tiny increase – in taxes. Some new way of pinching us again. Either in the form of a cess, or some other extra.

The archaic standard deduction section of 80 C allows salaried individuals to save up to Rs 1.5 lakh every year and make that amount of income, tax-free. So, the cumulative total of investments in EPF/PPF/long-term FDs/ELSS/ and expenditures like principal repayment of home loans/tuition fees, etc is deductible from taxable income to the tune of Rs 1.5 lakh only. Why not take it to Rs 10 lakh?

What could be the benefits? Apart from being a source of raising funds (albeit at an interest cost), the government can actually drive investment behaviour, encourage citizens to self-fund their social security measures and increase deposits with banks that may again in turn be used to offer credit.

Now let us examine this in detail.

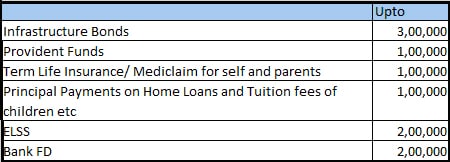

While going through the new investment pattern for non-government provident funds, I started wondering, what stops the government from modelling section 80 C around this format and increasing this Rs 1.5 lakh limit to let us say, Rs 10 lakh.

For example, can it look like this?

How many people do you think will save up to this amount and what maybe the consequences?

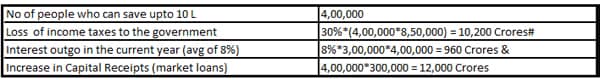

According to this Ministry of Finance report in 2011-12, 4 lakh people earned above Rs 20 lakh per annum. Because we do not have a more recent (authentic) data, let us work with this number. So, about 4 lakh people in India are in a position to invest Rs 10 lakh per annum, should the government roll out such a plan.

Now, let us assume all of them make use of this. The government will proportionately collect lesser taxes on this increment (Rs 8.5 lakh per person), its market loans will go up by Rs 3 lakh per person, which will need to be serviced at let us say 8 percent ( too high, but just as an assumption)So, we are saying that the government can raise up to Rs 12,000 crore by just increasing the infrastructure bonds limit to Rs 3 lakh.

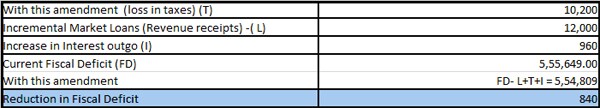

What then, will happen to the fiscal deficit numbers?

Let us superimpose these numbers on the budget estimates for 2015-16 (In crores):Considering that this year, the government has received huge benefits in the form of a large dividend from the RBI and savings on oil subsidies, surely one can afford to do some out-of-the box thinking?

What may be the intangible benefits of such a measure?

The government will have created a self funding social security measure – one will be encouraged to take up term insurance, a family floater, mediclaim – with their own income. The government does not have to take the burden of promising welfare measures that it later finds difficult to sustain (like in some developed economies). The overall condition of living may improve and the ever daunting medical expenditure fears may reduce.

Retail participation in equities will grow. There is so much talk on how Indian households barely invest in equities. Well, if the combined amount across EPF/PPF/Insurance/FD and ELSS is just Rs 1.5 lakh, what can one expect?

Banks will have larger deposit bases. If 4 lakh people have 2 lakh FDs, that is Rs 8,000 crore of funds available in the banking system to extend as credit.

Paradox of thrift, admittedly no longer plays out. Remember?

Abaneeta is an experienced Private Banker. She is also Guest Faculty at Praxis School of Management where she teaches a Course on 'Marketing of Financial Services'. These views expressed are her own.

First Published: Feb 26, 2016, 13:21

Subscribe Now