Wabco India: Brake point

The company was quick to adopt the newer technologies required by global commercial vehicle OEMs and has now cemented its position as a market leader

P Kaniappan, MD, led a transformation at Wabco India that entailed a change in mindset of the workforce

Image: P Ravikumar for Forbes India

P Kaniappan hadn’t seen it coming. It was 2012 and Wabco India, where Kaniappan is managing director, was supplying air brake systems to domestic commercial heavy vehicle manufacturers. So, when a global original equipment manufacturer (OEM) snubbed Wabco in the run-up to its India foray, his team was shaken.

Indeed, the ‘times they were a-changin’, but the same could not be said about Wabco India’s shop floors. Comfortable as a leader in its category—Wabco makes safety and control systems for trucks and buses—the company had been caught napping, while potential customers yearned for components that matched its Belgian parent’s state-of-the-art offerings.

Click here for the full list

Wabco India traces its roots to Sundaram Clayton, a JV between the TVS Group and UK-based Clayton Dewandre in 1962. In the ’70s, Wabco became a stakeholder in the JV through its acquisition of Clayton Dewandre. The brakes business of Sundaram Clayton was spun out in 2007 and two years later, Wabco bought TVS’s stake in the entity.

“Till 2009, we sold products— like conventional dual line braking systems—developed in India. Our portfolio served the domestic market, which was, however, technologically behind Europe. The market was mostly about value-for-money products and being cost-competitive” says Kaniappan.

Sales remained steadfast—revenue approximately doubled to ₹1,135 crore between FY09 and FY12, while profits quadrupled to ₹153 crore—and nobody complained. The growth was largely driven by a revival in the macro economy, which led to a surge in demand from OEMs.

But Wabco India completely failed to foresee the demand for newer technologies from global OEMs—Daimler, Volvo, Isuzu, Scania and MAN Truck and Bus—that were rolling into India in the aftermath of the global financial crisis. (India presented itself as a cheap manufacturing hub for the foreign players.) Indian OEMs, too, embraced the latest technologies to stave off competition from global peers. But, Wabco India was found wanting.

What ensued between 2012 and 2014 is what Kaniappan calls ‘Wabco India 2.0’, a transformation that entailed a change in mindset of the workforce, accompanied by a recruitment drive for fresh talent, and reducing operational redundancies. “We needed to change and recognise that we are now part of a global group and that there is a new standard. We had to induct new talent across functions to support this transformation,” says Kaniappan. As part of the transformation, Wabco India changed its quality management standard from the ISO/ TS16949 framework to the more rigorous VDA 6.3, which Wabco used globally.  At the Wabco India shop floor in Chennai. The company has five manu-facturing units in India

At the Wabco India shop floor in Chennai. The company has five manu-facturing units in India

Image: P Ravikumar for Forbes IndiaThe efforts are paying off. So much so that the OEM that once shunned Wabco India (Kaniappan declines to name it) is now one of its key clients, which includes Tata Motors, Daimler, Ashok Leyland, Scania and Volvo, according to analysts.

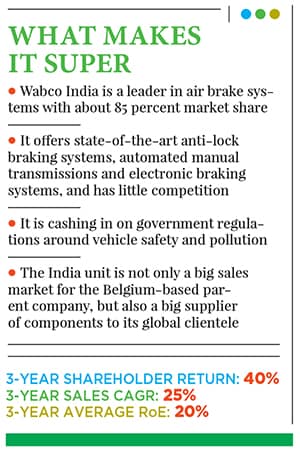

With five manufacturing units— in Jamshedpur, Lucknow and Pantnagar and two in Chennai—Wabco India has metamorphosed into a manufacturing hub for the parent’s global clientele. Its repertoire of products—anti-lock braking systems (ABS), automated manual transmissions (AMT), electronic braking systems (EBS), clutch boosters, suspension control systems, and high capacity compressors— are expected to set sales soaring.

“Wabco looks at India in a big way for manufacturing. In 2017-18, Wabco India exported ₹773 crore worth of products and services to Wabco locations globally. About 80 percent of the products are manufactured in India. We are still importing some advanced products like EBS, key parts of AMT and air disc brakes (ADB). We will localise these as the market evolves,” says Kaniappan.

“India is also becoming a key pillar of Wabco’s engineering, with most of the software being written here now these are advanced codes for AMT, dynamic vehicle control, EBS etc. Compressors, actuators and valves are developed here as part of the global network,” he adds.

Analysts believe that Wabco India’s repertoire of advanced technologies and a stranglehold over the market—it is estimated to have an 85 percent market share in air brake systems—makes it a much sought-after vendor. A lack of competition also helps: German firm Knorr-Bremse, which entered India in early 2000 is the only notable rival. Players like Bosch mostly produce hydraulic brakes meant for light commercial vehicles and do not pose a threat.

“There are two aspects to their [Wabco India’s] growth. One, the commercial vehicle industry is growing and two, there are specific things that they are doing. They have global products, and are the only ones who can introduce them to India,” says Abhimanyu Sofat, head of research at IIFL Securities. “If you see their last quarter results [Q1, FY19], the profit [₹75 crore] was very similar to the previous quarter, which is typically the best quarter for any commercial vehicle-oriented company.”

undefinedFOR Belgium-based Wabco, India is now a manufacturing hub for its global clientele[/bq]

Wabco, says Kaniappan, has a clear roadmap to roll out products to support electric vehicles, connected vehicles and autonomous driving. “We have fleet management solutions and digital customer services which are part of our connectivity roadmap. We have EBS for electric vehicles. In the area of autonomous driving, we have already launched advanced emergency braking systems,” he says.

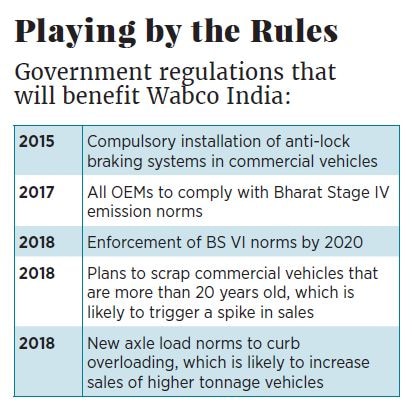

While some of these offerings will rake in cash in the long run, much of the euphoria around Wabco India at this stage is driven by a string of government regulations since 2015. (See table Playing by the rules.)

“We believe Wabco India is one of the major beneficiaries of an improvement in [sales] volumes in the medium and heavy vehicles (MHCV) segment. Further, it is increasing the overall [braking-related] content per vehicle in India, which is at $500, whereas in Europe and the US it is at $3,200 and $1,500. The new axle norms, that are already in place, will demand higher weight lifting category of braking-related products and will increase the braking content per vehicle,” analysts at ICICI Securities noted in a report in July.

A robust aftermarket presence—Wabco India operates about 280 service centres to retrofit components to vehicles, a segment which accounted for about 15 percent of its revenues in FY18, according to ICICI Securities—will further aid in increasing content per vehicle.

The company is now eyeing trailers, and construction and agricultural sectors to boost revenue and wade through challenges like a spike in raw material costs. Once again, the times are changing, but for Wabco India, this time it’s different.

First Published: Aug 24, 2018, 14:52

Subscribe Now