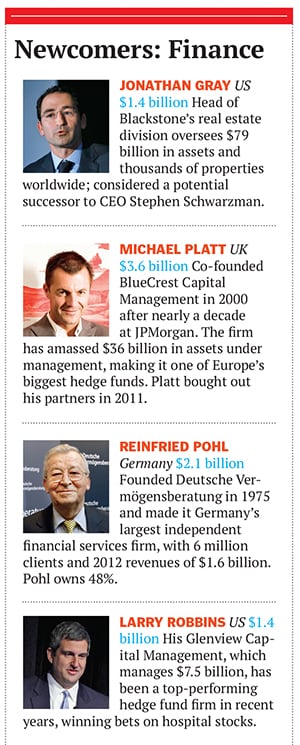

The most interesting man in the world isn’t a beer pitchman. He’s a guy who once heli-skied into a British Columbia avalanche and survived despite being buried while two companions died. He tamed an 11,000-acre wilderness, where pumas roamed, into a winery that sells pricey Bordeaux-style blends. He and his wife personally selected each chair and commode for their ultraluxury art hotel in Uruguay.

A Norwegian who was raised in Sweden and schooled in the Canary Islands, Vik attended Harvard, where he won the Ivy League golf championship—twice. He brought up his children in an eight-bedroom Greenwich, Connecticut, mansion that once belonged to a Rockefeller heir, but he claims residence in Monaco. And while he does not drink often, when he does, he prefers Christiania Vodka, made from a 400-year-old recipe that originated in the court of Norway’s King Christian IV. He owns it.

We could go on and on. (His Manhattan art gallery sells 20th-century Italian furniture! His pre-retirement hobby has been playing ice hockey! He comes from a family of fur merchants!) But for most readers the most interesting thing about Alexander Vik, 59, is how he built a personal fortune that Forbes estimates to be at least $1 billion, dabbling in virtually every modern financial bubble—from closed-end country funds to dotcom 1.0 to derivatives—while leaving a small army of investors and business partners fuming in his wake.

It’s a story that’s never fully been told. The secretive Vik hasn’t granted an interview about his business dealings in more than seven years and rebuffed several attempts to contact him for this story. But his 35-year track record reveals a lucky streak that borders on the miraculous. “Alex was a super risk taker, and sometimes these guys can worm out of things,” says Stephen Greenberg, a former general counsel at one of Vik’s insurance companies, who later clashed with his boss in court. “Everything he did was so complicated with so many companies. Trying to get to the bottom of anything would get people very frustrated.”

With a tendency to operate through offshore companies, Vik has bought and sold everything from insurance companies to penny stocks and even once tried to break up French media giant Vivendi. His biggest ventures and bets ultimately failed, yet Vik almost always seemed to come out on top, emerging unscathed and often richer, even as those who invested alongside him were burned.

Harvard itself may be something of a club, but current and former athletes there have cleaved off their own, the Harvard Varsity Club. Among them is Alexander Vik, who came to America for the first time as a member of the Class of 1978. There is a page devoted to him on the club’s website, featuring a photo of Vik. “In business, ‘brand’ is very much in vogue,” Vik notes below it, “and Harvard has the greatest global educational brand and we have to continue to nurture it.”

Vik’s business brand started on Wall Street, where he worked as a broker at firms like Kidder, Peabody during the day and converted Manhattan rentals into condos at night. His big break, though, came courtesy of his wealthy dad, who bought a controlling interest in the Scandinavia Fund and put Vik in charge, with younger brother Gustav riding along as treasurer.

On paper it was a value play. The Scandinavia Fund traded at a discount during the late 1980s, when some closed-end country funds were selling at unjustifiable premiums to their underlying holdings. But in reality, investors claimed Vik tried to turn it into a piggy bank. Under Vik Scandinavia Fund went into cash just before equities in countries like Norway soared.

The fund tried to buy real estate loans from a financial firm that had loaned the Viks money to buy shares of France Fund, another closed-end country vehicle. As the closed-end-fund bubble deflated, minority shareholders sued in 1989 for not fully disclosing the connection between Vik and other financial firms and breaching fiduciary duties. Vik denied wrongdoing, and Scandinavia Fund ended up settling the lawsuits, reportedly for less than $700,000.

No matter. Insurance soon piqued Vik’s interest. Hurricane Andrew, which leveled South Florida, had pummeled underwriters, and the Viks bought up insurance assets. They set up shop in Lawrenceville, New Jersey, and Vik Brothers Insurance was soon writing $300 million of property and casualty insurance premiums, when Vik sold it in 1997 to Highlands Insurance for $100 million. His timing was good: By 2002 Highlands filed for bankruptcy, though Vik Brothers Insurance was not the cause. In another insurance move Vik teamed up with two big insurers from Sweden and Finland and bought Home Insurance Co for $800 million. The insurance companies bought out Vik’s minority stake soon after. Again, good timing. In 1998 Home Insurance failed.

It’s unclear how much money Vik and his family made from their adventures, but Vik emerged unscathed. And he still controlled Scandinavia Fund—his family owned 73 percent—which he had converted into an operating company. Since it still traded on the American Stock Exchange, he now had a public vehicle for dealmaking. And because he based it in the Cayman Islands, his company could operate with more opacity, delaying financial filings with the Securities & Exchange Commission. At first Vik used the firm to run a resort in the Canary Islands. But then came the internet bubble, and he turned his attention there.

With Vik as CEO, Scandinavia Co became Xcelera.com and in 1999 purchased a majority stake in Mirror Image Internet, an internet-caching company in Woburn, Massachusetts. Scandinavia also began scooping up minority stakes in a grab bag of companies—Active ISP, deo.com and e-game—that had good stories, even if they had neither revenues nor paying customers. Press releases and press appearances floated the stock. Vik would personally craft the wording late into the night, sweating the details of each promotional outburst. “Relatively speaking, there’s very little competition. This is a brand-new field that didn’t exist a year-and-a-half ago. People are projecting it to be $14 billion by the year 2003,” Vik said in one interview. On CNN’s now defunct financial channel he answered a question about Xcelera’s “voodoo” by likening it, in theory, to Akamai Technologies, a comparison that drove Akamai executives crazy. “What’s frustrating is that there are all these press releases they put out,” Akamai’s late founder, Danny Lewin, told Forbes at the time. “But there’s no revenue, no customers, no service.”

![mg_74787_alexander_vik_280x210.jpg mg_74787_alexander_vik_280x210.jpg]()

While Xcelera is largely forgotten, it may have been the biggest dotcom bubble stock of the era: In April 1999 it was trading at 21 cents a share, in March 2000 at $112.50. The 54,000% rise, valuing Xcelera at $11.7 billion, made the likes of Pets.com, Webvan, and theglobe.com look like blue chips. The stock collapsed soon, but not before Vik and his family sold $250 million of Xcelera stock, according to a class action filed by shareholders. He denied the allegations.

For more than a decade Vik faced Xcelera-related lawsuits, and for more than a decade he won. “We spent years on the case, and you don’t do that unless you think you have something,” says Peter Pease, the frustrated plaintiff lawyer who spearheaded a major class action. (A federal judge disagreed: She tossed the case on the first day of trial, citing lack of evidence.) Minority shareholders of Mirror Image sued Vik in Delaware state court and also lost. Vik was unchastened. After Xcelera’s stock was delisted, Vik launched a successful tender offer to buy the remaining shares for 25 cents each without disclosing any financial information about the company, according to a shareholder class action that accused Vik of insider trading and market manipulation. He denied the allegations. And again, Vik prevailed and held on to the remaining assets of Xcelera.

Still, even people who felt cheated by Vik found his charm tough to resist. Visiting Vik’s Greenwich mansion was like entering a Scandinavian version of the Louvre, packed with works by the region’s top artists. Vik also keeps prized art possessions in New York in a two-bedroom apartment on the 67th floor of the Time Warner Center that he bought for $4 million in 2004 and later transferred to wife, Carrie. He travels constantly to visit his vineyard in Chile, homes in France and Monaco and hotels in Uruguay. “Up on the Estancia it’s like Marlboro country,” Vik told ForbesLife in 2011 about his Uruguayan properties. “Romantic and rustic, with gauchos. But on the beach it’s like Saint- Tropez in the summer, with parties and dancing and beautiful people.”

Vik works all the time, say former colleagues, but maintains a Scandina- vian reserve, always contemplating his next move. “I would be ready to work with him again, but you need to make sure you don’t have things in writing—you need to have it in your bank account,” says Martin Alsen, a Swede who was Mirror Image’s first employee. “The positive side of him is he is always on target with a positive attitude. But you just can’t trust him.”

Walking away from the dotcom refuse, Vik spied the next big fortune-creating trend: Derivatives trading. He set up Sebastian Holdings, which was incorporated in Turks and Caicos but largely operated out of his Connecticut house (his official resi- dence remains Monaco). He employed two Wall Street traders, Klaus Said and Michael Kluger. Together they took big positions in everything from shipping stocks to foreign currencies and futures contracts. Armed with a margin account provided by Deutsche Bank, Vik even bought a sizable stake in Vivendi and drew headlines in 2006 by trying to force the French company to sell assets. The operation was clearly a money machine—in about one year Said made $45 million in profits for the operation, according to a court opinion filed by a judge in London.

During the financial storm of 2008, however, the highly leveraged currency and derivatives bets put on by Vik and Said went against them—big-time. At one low point Vik’s wife took him to Greenwich Hospital, where he was given anxiety medication. DB and Morgan Stanley issued margin calls on Sebastian Holdings. Court documents show that Vik was able to meet $500 million worth from Deutsche Bank, but the cash in Sebastian’s Deutsche Bank accounts were drained with $244 million still owed to DB.

Sebastian, which Vik wholly owns, had other funds available, but Vik had better places for that money to go. In October 2008 Vik transferred about $1 billion out of Sebastian to offshore entities and trusts controlled by him and his family, according to a court document filed by DB and an opinion filed by a judge in London, where DB sued Sebastian to get its money back. “Realising that [Sebastian Holdings] had incurred hundreds of millions of dollars in losses and faced imminent margin calls from its prime broker Deutsche Bank, Vik exercised his control over [Sebastian Holdings] to strip it of its assets,” DB claims in a re- cent legal fling. Vik countersued for $8 billion, claiming inappropriate mar- gin calls pushed the trading vehicle out of positions that later rebounded.

The trial, in spring 2013, did not go well for Vik. Judge Jeremy Cooke of the High Court of Justice in London found in November that Vik had lied in his testimony and fabricated evidence: “I have concluded that in some respects [Vik] was simply dishonest.” For the first time in his life Vik had lost a major case the judge ordered Sebastian Holdings to pay DB about $300 million.

Andrew Jackson, upon hearing of a Supreme Court decision that went against him, famously replied: “John Marshall has made his decision now let him enforce it.” When you’re a Norwegian-Swede who lives in Connecticut, incorporates companies in the Cayman Islands and apparently pays taxes (or not) in Monaco, that might also apply to the decision of a London court. “I’m here. If I have done something wrong, I can pay whatever judgment my Lord decides,” Vik said during his London trial. Yet Vik still refuses to pay and has indicated he plans to appeal the London ruling. In recent weeks DB has filed suit against him in New York and Connecticut, trying to collect on the $300 million in America. The bank has been eyeing several assets Vik owns, including Confirmit, a market-research software company. DB declined to comment.

It’s not the only battle Vik is fighting. One of Vik’s Greenwich neighbours, Sheldon Gordon, a well-known mall developer who built the Forum Shops at Caesars Palace, claims his company was bilked out of more than $30 million in a pump-and-dump scheme cooked up by Vik and his other trader at Sebastian, Michael “Jack” Kugler. Gordon’s Gordon Group Investments claims in a lawsuit that it invested $40 million with Kugler years ago, but that instead of putting the money in bonds, as he was supposed to, Kugler secretly bought shares of a thinly traded German media company in which Kugler and Vik had also built a stake through entities they controlled, helping to boost the stock.

Kugler and Vik sold some shares before the stock collapsed but left Gordon Group with more than $30 million in losses, the complaint says. Both Vik and Kugler denied wrongdoing, and a New York state judge dismissed the case, citing statute-of-limitations deadlines. In January a New York state court heard Gordon Group’s appeal. At the same time Vik’s Sebastian trading operation has sued Kugler, claiming that Kugler also improperly invested Sebastian funds in the German media company.

Even the Xcelera debacle won’t go away. In January a federal appeals court in New York revived the insider-trading claims against Vik over his tender offer for the minority shares of Xcelera, saying the lower court had improperly dismissed them.

Vik, meanwhile, is surely inured to these kinds of assaults by now. The most interesting man in the financial world was recently promoting his high-end hotel retreat in Uruguay—Estancia Vik—and living the life of a prototypical billionaire, albeit one whose fortune seemingly came from exploiting capitalism rather than honouring it. “We decided to do some of the things that we like—nature and art, architecture and design—and combine that in Uruguay,” Vik said in a promotional video. “I am hoping the people of Uruguay will love it and be proud of it and tell the whole world about it.”