Groceries Online, Will it Click?

Groceries have finally entered the realm of e-commerce, courtesy a few startups

K Ganesh, 50, the Energizer Bunny of Indian entrepreneurship, is either angry, annoyed or sarcastic. I can’t tell.

“VCs [venture capitalists] have a herd mentality. They don’t mind funding the sixth baby products site or the eighth [discount] deals site. But one of the reasons we got into this business is because it isn’t ‘VC-able’. It means two pony-tailed youngsters out of college can’t enter it. It’s our competitive barrier to entry!” he says.

Ganesh, a 25-year veteran of funding, building, scaling and selling technology businesses, has a near-uncanny ability to spot and ride a trend before it becomes mainstream. His past ventures offer a concise view of how the Indian technology story evolved: Hardware maintenance in the 1990s, BPO in 2000, analytics in 2004 and online tutoring from 2005.

“But this is the toughest and yet most exciting of all my ventures,” he says, with his characteristic half-smirk, half-smile that can be maddeningly hard to read.

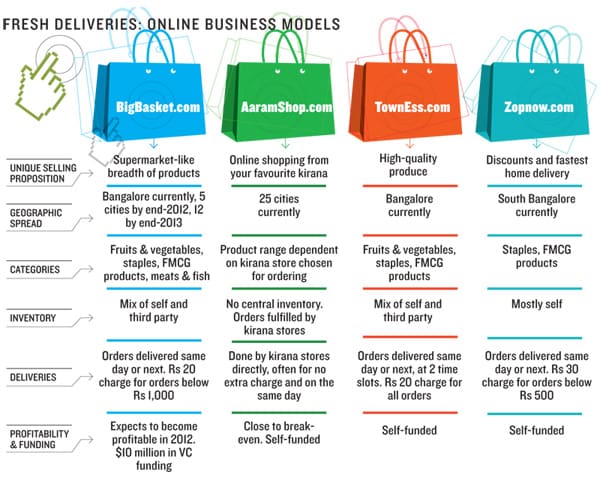

The business Ganesh is referring to is BigBasket.com, an online grocer he funded and incubated just a few months back in December 2011. Just three months later he roped in $10 million in funding from private equity firm Ascent Capital.

“No VC can write a ‘Series A’ cheque of that size. And we were clear this isn’t a $2 million or $3 million investment business,” he says.

He is right, VCs don’t like this business.

There’s a reason for their scepticism: Selling groceries online is a bruising, penny-pinching business that has bled entrepreneurs and investors for over a decade and a half.

“My own personal belief is that this is a very complex business where margins will always be under pressure. Hence the amount of investment required to reach scale will be significant,” says Kanwal Singh, co-founder of Helion Venture Partners, generally one of the most gung-ho investors in Indian e-commerce but a marked sceptic on groceries.

But that isn’t preventing a bunch of Indian startups from trying.

www.kirana.com?

Connaught Place, bang in the heart of Delhi, isn’t normally the kind of place where you’d expect an online grocer to set up shop. Real estate is prohibitively expensive, traffic and parking can be maddening and it’s far away from Gurgaon’s dense and rich urban jungle.

Yet, that is where Aaramshop, one of the fastest growing online grocers currently is headquartered.

It can afford to do so because, unlike most of its peers, it has no need for large warehouses, call centres to take orders, engineers or logistics staff. It has just 12 employees.

Yet, it home delivers grocery orders in over 25 cities.

In comparison, BigBasket, that serves just Bangalore city, has over 120 employees, three distribution hubs and 25 delivery vans.

Aaramshop’s secret: It does not source, stock or deliver any or the products ordered by customers. Instead, it acts as the internet face for any neighbourhood grocery store (kiranas) that signs up with it.

“We believe e-commerce in its traditional form will not work with FMCGs [fast moving consumer goods] and groceries. Because unlike other categories, the margins available to retailers here range from 6-8 percent, which makes stocking and logistics of groceries and perishable products a near impossible task,” says Vijay Singh, 42, Aaramshop’s founder and CEO.

Customers who log in to Aaramshop must select the kirana store nearest to them before ordering any products. Within seconds, Aaramshop relays the order via SMS and email to the kirana. And within hours the kirana delivers the order, with the customer paying in cash. The average order size a kirana gets through Aaramshop is around Rs 570, says Singh, compared to Rs 100 when customers were directly calling them up.

“The fundamental advantage of the kirana is their proximity and huge amount of trust with consumers. Besides, the view most of us have of the kirana store manned by an old gentleman wearing a banian is no longer true. Having seen the Subhiksha model, there is huge interest in them to change. Counters have changed, aisles have come in and most owners use high-end smartphones and Facebook,” says Singh.

Subhiksha was, of course, the discount supermarket chain that rose dramatically to 1,600 outlets across India in just over a decade, before spectacularly flaming out in early 2009. Its twin value propositions of deep discounts on groceries and FMCG products together with local neighbourhood availability were fairly successful with Indian consumers.

The other impossible task is for any startup to match the extensive, deep and low-cost distribution network put in place over the decades by large and small FMCG companies in India: 7.8 million outlets retail groceries across India, of which grocers alone account for nearly 60 percent.

“The FMCG industry has a distribution system that can service the nearest kirana store [meaning, they can get their products to even the smallest kiranas]. Till that exists, any new startup’s ability to compete from, say 20 kilometres away, will remain in question,” says Damodar Mall, the head of Future Group’s food business.

Before joining Future Group, Mall headed Sangam Direct for Hindustan Unilever, which aimed to deliver FMCG’s directly to customer doorsteps.

Launched in 2001, Sangam was sold off in 2007 to Mumbai-based Wadhavan Retail which ran a chain of stores under the Spinach brand. Sangam turned out to be the kiss of death for Wadhavan too, because in 2010 it shuttered all its Spinach stores.

Margins aren’t the only aspect that makes grocery e-commerce so tough to pull off: Customers expect 24-hour delivery. That entails maintaining your own warehouses, significant inventory, and delivery vehicles and staff. A centralised Amazon or Flipkart-style warehouse using third-party couriers is out of the question. Add perishables like fruits, vegetables or meats into the equation and the supply chain costs and risks increase exponentially. Finally, the scale of FMCG distribution and the high service levels of the neighbourhood kirana (who will often home-deliver even one or two items at no extra charge) set impossibly high benchmarks to beat.

These factors forced Singh to give conventional wisdom a go-by when it comes to revenue. Instead of charging a commission from either its customers or the kirana stores, he charges FMCG brands for running promotions and marketing campaigns on its website. Singh believes FMCG companies don’t have the last mile connect with their customers in spite of being the largest ad spenders in the country. Aaramshop is the platform that he sells to them as the solution.

“Which is why in just our eighth month of business we’re close to breakeven,” he says.

BEEN THERE, HEARD THAT

BigBasket’s is a more conventional approach in the sense that it relies on its own warehouses. Yet, its strategy is disruptive: It includes multiple warehouses and inventory a wide range of over 6,000 stock-keeping units (SKUs) including fruits, vegetables and meats and plans to expand to five cities in the first year and 12 in the second.

“We’ve been hearing the kirana argument back since we were starting our chain of supermarkets,” says VS Sudhakar, 52, co-founder of BigBasket.

Sudhakar was one of the co-founders of Fabmart.com, arguably India’s first e-commerce website (it currently operates as Indiaplaza.com), back in 1999. When Fabmart fell victim to the dotcom crash, he started a chain of supermarkets in Bangalore under the Fabmall brand in 2002. Those got sold in 2004 to Hyderabad-based Trinethra Super Retail in 2004, which subsequently got acquired by the Aditya Birla group in 2007 and became part of its More chain.

Having tilted at India’s dysfunctional retail realities for well over a decade, Sudhakar certainly isn’t a greenhorn.

“Tell me, if most Indians love to buy from kirana stores, why would modern retail take off?” he asks.

He has a point. According to the latest data from global information and measurement company Nielsen, in just over a decade modern retail chains have captured from kiranas nearly a third of the market share in home, personal care and food products in 17 of the biggest urban markets.

“Besides,” says Sudhakar, “I’m not replacing the kirana, but the need to go to a supermarket!”

“Head to head with modern retailers, I figure we can save 10 percent in costs because things like rent, utilities, staff and shrinkage simply don’t exist at the last mile for us. And compared to their 3 percent net [profit] margins, I think we can get to 6-7 percent,” he says.

By virtue of the location and experience of its founders, and given the city’s comfort with modern retail, BigBasket currently operates only in Bangalore.

Isn’t that too small a potential market?

Apparently not. Because BigBasket maintains that the monthly grocery spends in the city range from Rs 400-500 crore, of which modern retail accounts for nearly Rs 150 crore. Even assuming BigBasket’s target is only the latter, that’s an annual market of nearly Rs 1,800 crore.

Armed with oodles of venture funding, experience and derring-do, BigBasket is leaving no stones unturned in its race to capitalise on what it sees as the last great frontier in the Indian e-commerce story.

Customers can order either via the web or phone. Orders are then automatically fulfilled either from its own inventory or via partners.

Currently BigBasket stocks most provisions (which it cleans and packages under its own brand) while most fruits and vegetables are sourced twice daily from wholesale mandis or Safal, and FMCGs from Metro Cash & Carry. It claims to be shipping nearly 400 orders a day with an average order ranging between Rs 1,000-1,100.

“It’s a model that will evolve as volumes grow. Over time we will increase the number of vendors for both fruits and vegetables and FMCG products such that any time an ordered item should be available from vendor A, B or C and our technology will automatically route it appropriately,” says Sudhakar.

Orders are delivered either the same day or at worst, the day after. The person delivering the order is equipped with a tablet PC on which he enters a unique code that is SMS-ed to customers, in order to track delivery times. The tablet also lets him map routes or take instant feedback.

Even with all of this, Sudhakar says BigBasket is aiming to break even in Bangalore within 12 months when his daily order volume hits 1,000.

HOLY GRAIL TO HOLY SMOKE

In many ways grocery is the Holy Grail of online commerce—a category where significant amounts of money are spent in every household, week after week, buying the same set of products. Most consumers have no desire to waste their time driving to a store, walking through aisles and standing in crowded checkout counters.

In theory it’s a category ripe for digital disruption.

Yet multiple failed experiments in country after country over the last decade have proved that theory is near impossible to implement.

To begin with, profitability must be built into the DNA of an online grocer right from day 1. For, while a website can sell books or mobile phones at a slight loss in the hope of winning a customer over the long run, in groceries the razor-thin margins rule that option out.

Over a period of time, profitability must cover three milestones: At the unit (order) level, at the customer level and the business level.

There aren’t too many synergies a firm will get by spreading to multiple cities, unlike say, a Flipkart that can service literally the entire country from a few centrally located warehouses. In fact, early and aggressive expansion is exactly what destroyed firms like Webvan. Business models need to be proven and profits need to be generated at a city, or even a locality level.

Another sure-fire way to crash and burn is spending too much on acquiring new customers—usually the biggest cost element for an online grocer.

The way to avoid this is to resist the urge to splurge on generic TV or web advertising and instead run targeted local advertising on, say, radio and below-the-line promotions within specific areas.

Judiciously choosing which products to stock themselves and which ones to purchase after consumer orders, is another critical area. Unsold inventory is a slow and sure poison that can kill even mature businesses.

Being technology-driven businesses, there is also the tendency to overestimate its abilities and hence, overspend. One of Webvan’s most vivid acts before going belly up was to place a $1 billion order to build a warehouse!The final tripping point is the cost of delivering orders. Thanks to the low benchmarks set by kirana stores and other e-commerce websites for home delivery, online grocers have to deliver large and heavy orders for free or at best, Rs 20-30.

“Where the cookie crumbles is the cost of logistics which makes sense only when scaled up over, say, a five year period. The margins in this category are so low that you literally run out of money the moment you’ve travelled 5 kilometres to deliver an order,” says Future Group’s Mall.

Fingers burnt and lessons learned, Mall now believes the only model that will work in India is a network of physical stores integrated through a centralised online order booking system. He says Future Group will have such an operation shortly.

Then there are risks beyond anyone’s control: If one madman gets funded by a mad VC and plays the discounting game, that might derail the entire sector for two-three years.

Thankfully there don’t seem to be any such madmen around.

As for Ascent, the company it has chosen to fund is run by a bunch of battle-hardened retail veterans and a canny entrepreneur with a Midas touch.

“In two years we want to be Rs 100 crore in revenue. How many e-commerce companies have done that in India?” asks Sudhakar.

First Published: Jun 16, 2012, 06:48

Subscribe Now