How a Triad scripted the turnaround for DSP BlackRock

After a slump, DSP BlackRock Mutual Fund has climbed back to the top. Credit this to its three investment managers who have worked together for 15 years

In July 2013, S Naganath, president and chief investment officer of asset management company (AMC) DSP BlackRock Investment Managers Pvt Ltd, was holding a meeting with his investment team in the 10th floor office at Mafatlal Centre in the Nariman Point business area of South Mumbai. The tenor of the meeting had an unusual intensity. Reason: Equity funds managed by DSP BlackRock had been underperforming the markets (which were, in any case, in a state of flux) over the past year.

This was a far cry from Naganath’s triumphant performance in the past: He was part of the team that had won the ‘Best Fund House’ award in India from the globally renowned mutual fund rating company, Lipper, for four consecutive years from 2006 to 2010. First, when he was managing the erstwhile DSP Merrill Lynch and, later, when it became DSP BlackRock Fund in 2009.

After 2010, however, its various equity schemes began lagging behind competitors. By 2013, analysts sounded its death knell and gave up on it when one of its flagship schemes, DSP BlackRock Equity Fund, went in the red and underperformed the markets.

This is why, at the July meeting, 49-year-old Naganath, known to typically give his team a free hand on money management, had some tough questions. For instance, why was textile manufacturer Arvind Limited, headquartered in Ahmedabad, Gujarat, still a part of the portfolio, he asked his vice president and fund manager, Apoorva Shah.

The price of the textile stock, which was trading at Rs 70, had not moved over the last year and though there was a slight uptick to Rs 110 in-between, it fell back to settle at Rs 70 again. Even so, despite its poor performance, it still accounted for two percent of the equity fund’s portfolio.

Shah, 51, wasn’t rattled by the question. He had researched Arvind Limited thoroughly, and had met the textile company’s management in Ahmedabad with Anup Maheshwari, 43, executive vice president and head of equities and corporate strategy. They presented a two-fold rationale for holding on to the stock: Falling raw material (cotton) prices as well as potential international tie-ups would bolster Arvind soon, they said. Naganath backed their call even though it was a risky one consider that mid-caps as a segment had crashed by 10 percent over the last year (2012-13) and there were no indicators of a revival on the horizon.

But it was a risk that paid off. By October 2014, the stock’s value had increased four times and has since become among the biggest contributors to the returns of DSP BlackRock Equity Fund, one of the older equity schemes in the Indian market. At the same time, DSP BlackRock’s overall assets under management now stand at over Rs 37,500 crore.

IN FOR THE LONG HAUL

The DSP BlackRock Equity Fund, launched in 1997 (then called DSP Merrill Lynch Equity Fund), currently has assets close to Rs 2,300 crore and has given consistent returns to investors who have stayed with it through thick and thin. This can be attributed to its fund managers’ long-term approach to wealth creation.

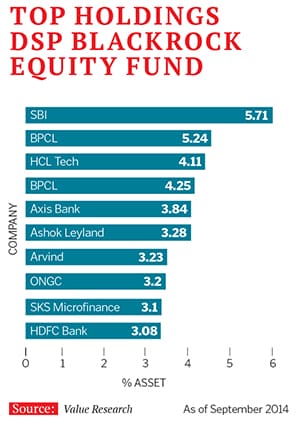

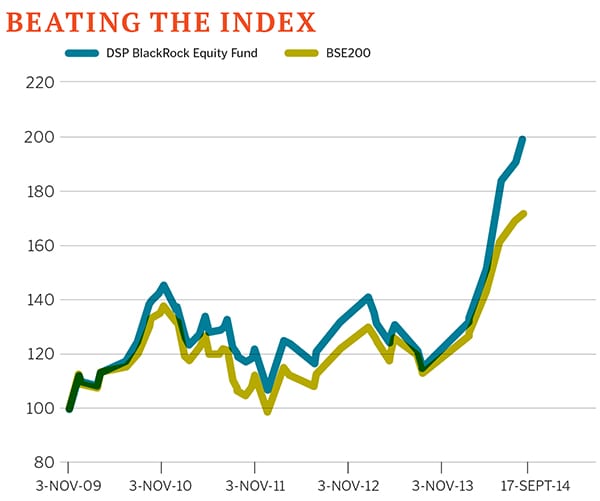

The numbers do the talking: According to Value Research, a company that rates mutual funds, DSP BlackRock Equity Fund is ranked second in the multi-cap category (investing in both large and small capital companies) and has returned 22.76 percent annually against the category average of 19 percent.

Similarly, its Top 100 Equity Fund, which—as the name suggests—invests in the top 100 companies (on the BSE), has returned 20 percent against the category average of 17 percent over the last 10 years. Value Research ranks it number two against its competitors. It has also placed DSP BlackRock’s Microcap Fund, launched in 2007, in the second position. This fund has given returns of 24 percent over the last five years against the small-cap index, which had a category average of seven percent.

Shah, who manages the DSP BlackRock Equity and the Top 100 Funds, admits to being spooked by the markets in mid-2013. He says he had expected an early recovery, having overlooked macro trends such as high inflation and a high fiscal deficit. “It was a difficult time, but we decided to hold on to our convictions when the going was really tough. We knew that, eventually, earnings will follow and we just needed to stick to the fundamentals,” says the investment manager.

And that, right there, is the cornerstone of its success.

Unlike many triumphs that are often based on flash (and thereafter, frequently fizzle), this is a story of how three fund managers—S Naganath, Anup Maheshwari and Apoorva Shah—made the right noise in a measured way.

“The team prefers investing in stocks with high or rising returns on equity (RoE),” says Niranjan Risbood, director of Morningstar India, an independent mutual fund research firm. A small portion of the portfolio, he points out, is invested in stocks that are trading at a substantial discount to its price to book value (P/BV), which makes the portfolio more balanced than what may be found in competing funds. Such an approach can have more of a growth or value tilt. The focus on risk management is evident with the investment in a single stock normally maintained below five percent, he adds.Naganath and his colleagues credit their success to the risk management and investment processes from BlackRock, DSP’s foreign partner that had purchased the 40 percent stake held by Merrill Lynch in DSP Merrill Lynch AMC in 2008 to create DSP BlackRock AMC. (DSP Merrill Lynch AMC was one of the earlier mutual fund companies launched in India in 1995 after the Indian markets opened up to international players.) Globally, BlackRock oversees around $4.59 trillion, making it the biggest money manager in the world. Against this, the entire BSE market capitalisation of all companies works out to $1.54 trillion.

THE BEDROCK OF SUCCESS

The DSP Group has been involved in the business of stock broking for more than a century, and was one of the founding members of the BSE, which was established in 1875 as the Native Share and Stock Brokers’ Association. Through the 1980s, the company emerged as a leader in stock broking and investment banking. To further cement its position, Hemendra Kothari—a third generation promoter of the DSP Group—tied up with investment bank Merrill Lynch in 1995 by offering them 29.41 percent stake to start DSP Merrill Lynch.

When Kothari wanted to get into the business of mutual funds, it was logical for him to tie up with Merrill Lynch for this new venture. At the time, Naganath was based in Hong Kong and was working with Merrill Lynch Asset Management as portfolio manager. He was sent to India to lay the foundation for what would become DSP Merrill Lynch AMC, or DSPML.

Naganath—who joined DSPML as chief investment officer (CIO) in 1996—immediately began hunting for the right fund manager. He already had a man in mind: Anup Maheshwari, who at the time was working in Mumbai as fund manager at Chescor Capital, one of the early FIIs registered in India. The two had met in Hong Kong the previous year, and Naganath was aware of his passion for equity research. He wanted Maheshwari to be part of DSPML.

The DSP Merrill Lynch Equity Fund was launched in 1997 with an initial corpus of Rs 20 crore. That same year, Naganath also started a bond fund, which had a corpus of about Rs 80 crore. “We thought it was a good start. In those days, collecting Rs 100 crore was a big deal, or so we thought, but our management felt that we could have done better,” says Maheshwari.

The equity fund concentrated on identifying companies that were high-growth and had a high RoE. The philosophy was simple: Identify growth at reasonable price.

The late 1990s was an interesting period for the funds business, especially as software companies in India were coming into their own and beginning to get noticed by the rest of the world. But then, in October 1999, Naganath moved out of DSPML to join Credit Suisse Asset Management as portfolio manager for international equities in New York. It was a blow for the fund as Naganath had helped lay the foundation for DSPML.

MASTERING THE BOOM AND BUST

At the time Naganath quit, the markets in India were flourishing, buoyed by the growing IT and dotcom industry, which was gaining international interest. It was the beginning of the dotcom boom, a period when the entire business was driven by star fund managers. Companies were traded at high valuations. But DSPML had strict guidelines for managing portfolios. Funds were not allowed to go beyond 15 percent of their holdings in a particular industry or company, irrespective of the movement of the benchmark. When the technology sector crossed more than 30 percent of the total market capitalisation of the BSE during the dotcom boom, DSPML fund managers took a relatively conservative position. The portfolio construction did not allow them to indulge in the technology sector. This, in turn, led to an underperformance of the funds during the entire dotcom boom. But when the bubble burst in February 2000, the equity funds from DSPML, though affected, were able to rise faster than that of the competition.

When the technology sector crossed more than 30 percent of the total market capitalisation of the BSE during the dotcom boom, DSPML fund managers took a relatively conservative position. The portfolio construction did not allow them to indulge in the technology sector. This, in turn, led to an underperformance of the funds during the entire dotcom boom. But when the bubble burst in February 2000, the equity funds from DSPML, though affected, were able to rise faster than that of the competition.

Most of the country’s stellar fund managers were left licking their wounds, and some even moved out of the profession, but not DSPML’s team. The technology sector was a no man’s land, but that did not stop the AMC from launching three funds—a tech fund (called Technology.com) and an Opportunities Fund in 2000 followed by a Savings Fund in 2002.

The year 2002 saw another noteworthy event: Naganath rejoined DSPML as its CIO, and charted a road map which clearly predicted a 50 percent upside for the markets for the following year. He was right. It helped that when the technology sector began reviving in 2003, DSPML’s funds were already well established.

Naganath also launched the Top 100 Fund (2003), which at present has a size of Rs 3,306 crore. By then, DSPML was managing around Rs 250 crore in assets. Over the next five years, however, the conservative style of fund management attracted new investors. And by 2007, it was among the top 10 asset managers in the country with assets at Rs 12,000 crore.

“I think investors and distributors acknowledge the importance of consistency of investment processes, and being on the top is just a by-product. We like to be in the top quartile but not by comprising our investment philosophy. That is very important to our team. You won’t see our funds taking excessive risks in any kind of market,” says Maheshwari, who had left the fund house to join HSBC Asset Management as CIO in 2005. He, however, returned within 10 months, and this time, as head of equity and corporate strategy.

What’s interesting is that DSPML did not launch any new funds in 2007, when the market had reached an all-time high. Naganath, who has always been interested in the psychological aspect of business, sees the market as an emotional basket, one that attracts all kinds of investors who buy and sell depending on what they feel is right. He recalls that in 2007, the markets were so heated up that all the ratios indicated a huge bubble. “You can call it a gut feeling or you can look at some basic valuation ratios. All this made me uncomfortable. The market was completely run up and we decided not to participate in the rally,” says Naganath.

This move, or the lack of it, paid off during the global financial crisis in 2008. Markets all over the word were debilitated by massive falls, and investors who had entered the arena at the peak of 2007 were hurt the most.

In the next year, Merrill Lynch sold its stake to BlackRock but by then, Naganath, Maheshwari and Apoorva Shah (who had joined the team in 2006 as fund manager of DSPML’s equity schemes) were well-versed with each other’s ways. Even when DSP Merrill Lynch became DSP BlackRock, the three investment managers remained true to their core philosophy of identifying growth at a reasonable price.

The trio has had an association that goes back at least 15 years. Though Shah entered the mutual fund business much later, he had been a part of the DSP Group in the global private client and institutional equity division, and worked with Naganath and Maheshwari.

With Naganath at the helm, DSP BlackRock concentrated on performance and saw its asset grow even in a flat market from 2008 to 2012. According to the Association of Mutual Funds in India (Amfi), as of March 2014, DSP BlackRock stands at the ninth position among 46 mutual fund companies.

None of the three fund managers have worked at selling side brokerages or, for that matter, been sector specialists. But as the fund grew, it started hiring research analysts and fund managers to build a cohesive team, one that is defined by unity and stability. And this can be credited to Naganath whose calm demeanour has anchored the team during volatile market cycles.

RIDING TROUGHS AND CRESTS

The first crisis they handled together was the 2008 global slump. In the previous year, YV Reddy, the then governor of the Reserve Bank of India (RBI), had started increasing interest rates to limit excess capital in anticipation of problems in international markets.

The investment managers took a call to change the portfolio and move away from infrastructure companies which, at the time, were the flavour of the bull run and were being traded at high multiples. The valuations were based on discounted cash flows, and analysts assumed that projects would be completed on time. Interest rates and demand factors were ignored. And many paid the price for this.

“But we had moved out of infrastructure and property [before the crisis]. We went into stocks that were liquid and were more aligned to the market. We also eliminated stocks that carried interest rate risks and where valuations were based on long-term demand. This helped us manage the portfolios during the 2008 crisis,” says Shah.

Five years later, they faced another exigency: The flagship DSP BlackRock Equity Fund was underperforming the markets. It had returned only six percent over the last one year, while the overall market was up by about 12 percent. The fund had a 50 percent weightage in midcap stocks, a segment that crashed by 10 percent in 2012-13. Investors in the fund were complaining about the underperformance. But the fund managers wanted a clearer picture before making the next move. When the divergence of the midcap and the large-cap funds was affecting the performance of DSP Equity Fund, Maheshwari and Shah travelled across India to meet midcap companies to understand why they were underperforming.

And that’s when they met the management of Ahmedabad-based Arvind Limited. It was only after a series of meetings that Maheshwari and Shah were convinced of the textile company’s plan to get international brands into India. Again, cotton prices, the main raw material for Arvind, were falling. But the market was looking only at the high debt and the fact that it was a midcap company which could face difficulty in demonstrating healthy earnings.

At the July meeting, Shah and Maheshwari convinced Naganath of their decision to stick with the textile company. And the fund managers at DSP BlackRock feel vindicated: As of October 14, the Arvind stock was trading at Rs 325 on the BSE. (In 2014, Arvind announced a tie-up with American apparel brand Gap. The company plans to manage about 40 Gap stores, operated through a franchise model in India.)

FREEDOM TO GROW

Their decision to remain with the textile company despite the poor investor sentiment at the time was taken based on 15 years of working together. Such a long working relationship—the bedrock of which is trust—is rare because the Indian mutual fund industry is still in its adolescent years. It sees a high turnover in terms of personnel, and few teams have had the luxury of working together for such long durations.

“The main reason for all of us coming back to DSP after our brief stints with other funds is the fact that the culture of this place is free spirited. Everyone has a say and is given a lot of independence in their work. The idea is to grow the right way,” says Maheshwari.

And Naganath agrees: “We have been together for a long time because the working style here is collegial, and considerable autonomy is given to everyone. It flows right from the top. We are very focussed on our investment process, and believe that every day brings new learning experiences.”

First Published: Nov 04, 2014, 06:53

Subscribe Now