Snapdeal set to sell Freecharge to Axis Bank for $60 million

Deal will give the cash-starved Snapdeal a reprieve until it finalises a sale of its online marketplace to larger rival Flipkart

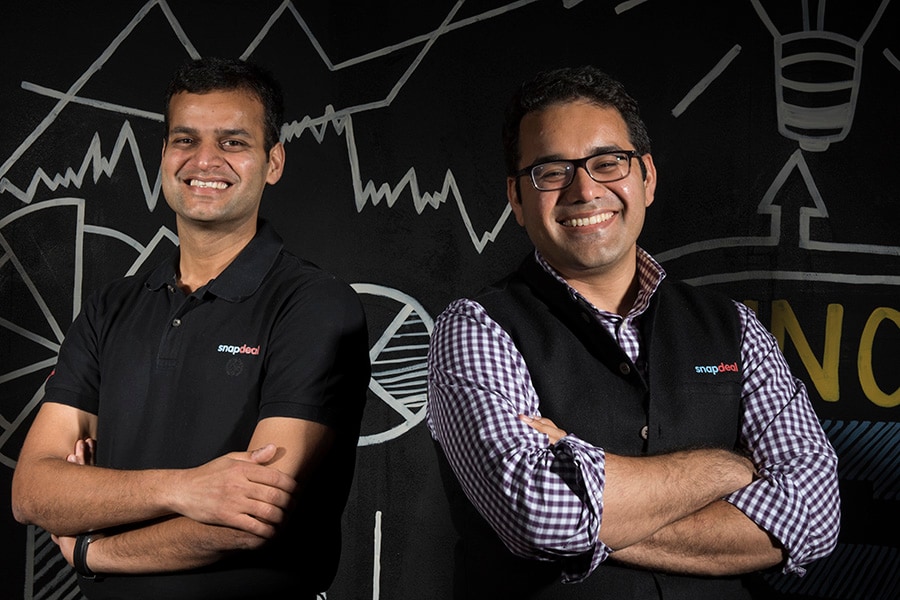

Snapdeal co-founders Rohit Bansal and Kunal Bahl

Snapdeal co-founders Rohit Bansal and Kunal Bahl

Image: Amit Verma Snapdeal is likely to sell its payment subsidiary Freecharge to private sector lender Axis Bank for about $60 million in an all cash deal, said sources aware of the development. The deal will give the cash starved company a much needed financial reprieve until it finalises a sale of its online marketplace to larger rival Flipkart.

Freecharge has been trying to raise funds since late last year and been in talks with the likes of Foxconn, financial technology companies Paypal and Paytm at different points in time for a strategic investment or sale at a valuation of about $1 billion. None of the conversations, however, translated into a deal because of Freecharge’s steep valuation and the rise of Paytm, which was bankrolled by Chinese e-commerce company Alibaba and its subsidiaries.

Incidentally, the Freecharge acquisition by Snapdeal two years ago was the most expensive buyout in the domestic consumer Internet segment. But, that deal was scripted at a time when investor interest in Indian consumer Internet start-ups was at its peak.

Snapdeal, which stoked enough interest among investors at that point in time, was a close competitor to Flipkart. The scenario changed soon with Amazon stepping on the gas and pumping in billions of dollars to grow its India business. Snapdeal was eventually dethroned as the second largest online retailer after Flipkart and investor interest in the company gradually eroded.

Consequently, Snapdeal was constrained to cut jobs, reduce discounts and offers, which saw its customers drifting to Amazon and Flipkart. The cash crunch at Snapdeal also restricted Freecharge’s access to fresh capital, hence spending prowess, while rival Paytm continued to expand its market share.

Valued at $6.5 billion in February last year, Snapdeal has so far raised close to $1.6 billion.

“The sale of Freecharge will give Snapdeal some breathing time before the deal with Flipkart closes. Freecharge mainly went to Axis Bank as it is an all cash offer. The deal will give Axis Bank access to new edge technology that traditional businesses struggle to build in-house,” said a person privy to the development.

Snapdeal and Axis Bank spokespersons did not immediately respond to emails seeking comments.

Simultaneously, Snapdeal is also in advanced stages to sale its marketplace business to Flipkart for about $850-900 million. SoftBank, which owns about a third of Snapdeal and has two board seats, is pushing for a sale to Flipkart, which, despite the recent markdown in its valuation by about 26 percent, is still the most valuable Indian startup at roughly $11 billion. The immediate plan is to buy out a part of Tiger Global Management’s stake in Flipkart and infuse fresh capital into the company.

While Ahmedabad-headquartered e-tailer Infibeam had also thrown its hat in the ring and made an offer of about $700 million to buy Snapdeal, the deal is likely to swing in Flipkart’s favour at the insistence of SoftBank, the sources said.

First Published: Jul 26, 2017, 21:26

Subscribe Now