The High Fives: Best of Forbes India Stories

At Forbes India, we believe in telling the stories behind the newsbreaks—stories that lie at the intersection of business, policy, economy and entertainment. Here's a selection of our best

Year 1 (2009-2010)

Year 1 (2009-2010)

Mr Steel’s Moment of Truth

The iconic success story of Lakshmi Mittal has entered a nightmarish chapter. The slowdown has shaved $26 billion off Mittal’s fortune—more than half of his previous year’s wealth of $45 billion. ArcelorMittal’s market cap has fallen by over 75 percent since July 2008. The most urgent threat is a potential breach of the company’s debt covenants: Mittal must make one dollar of Ebitda for every $3.5 of debt he carries. With $27 billion in debt, he should be making an Ebitda of $7.6 billion a year. He isn’t making it. But Mittal’s bigger, long-drawn challenges are emerging from the crippling slump in the global economy and pushing through the changes needed to make ArcelorMittal fighting fit again. The moot point: Can Mittal the accumulator become an equally successful stabiliser?

First published in the June 5, 2009 edition.

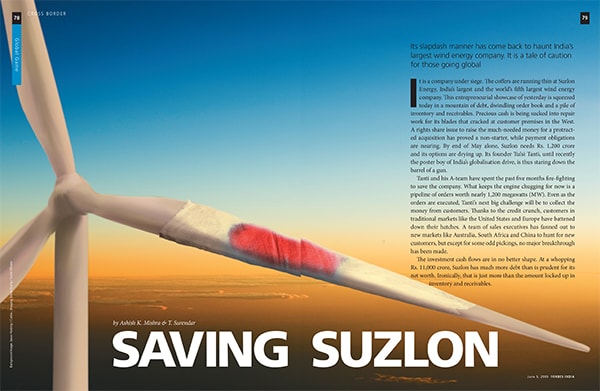

Saving Suzlon

Saving Suzlon

In less than one year, the suzlon story has unravelled. Through 2006 and 2007, Tulsi Tanti was known as the man who had catapulted his relatively unknown company into a global player in a little over a decade. Till he made it to the Forbes List of 40 Richest Indians in 2005, not many had even heard of Tanti. With an overwhelming 50 percent share of the Indian market, Tanti set his sights on the global stage, gobbling up two majors: Hansen and REpower. But this entrepreneurial showcase of yesterday is squeezed today in a mountain of debt, dwindling order book and a pile of inventory and receivables. Precious cash is being sucked into repair work for its blades that cracked at customer premises in the West. Suzlon is a cautionary tale of an entrepreneur who allowed his ambitions to get ahead of himself.

First published in the June 5, 2009 edition.

The Blackstone Hypothesis the world’s largest

The Blackstone Hypothesis the world’s largest

Private equity firm took two contrarian bets in India: Textile firm Gokaldas Exports and BPO firm Intelenet. Together, both account for half the total money that Blackstone has invested. Blackstone owns the companies, letting their previous owners run them. The hypothesis: It can unlock hidden value that will disprove the conventional wisdom about these companies. And make 200 percent profit in five years. After 20 months and with the onset of global recession, many have started asking whether the hypothesis is working. Akhil Gupta, MD of Blackstone India, believes he and his team can make both companies more profitable by getting the companies Blackstone has invested in globally to outsource their needs to Gokaldas and Intelenet, keeping the business with the family as it were. When stock market conditions improve, Blackstone will get its chance to exit.

First published in the June 19, 2009 edition.

The Broken Paddle

The Broken Paddle

Neville Tuli became the best-known spokesman of the country’s art and launched the world’s largest art fund, Osian’s art fund. And then he fell from glory with the plunge in the art market, struggling to pay his investors. Used to fancy NAVs, investors expected to be paid at least what was due when the fund matured in July 2009. But for five months, even that didn’t happen. In the euphoria of the previous years, they had been blind to one small detail: Tuli practically decided the value of the stock, as he had hand-picked every piece of art. The valuations were based on an art index managed by Osian’s in association with The Economic Times. Tuli also bid aggressively, paying top dollar for the art. Investors didn’t get early warning. Even as the market fell, optimistic valuations by Osian’s of the art it owned kept the fund’s NAV higher than its actual market value.

First published in the February 5, 2010 edition.

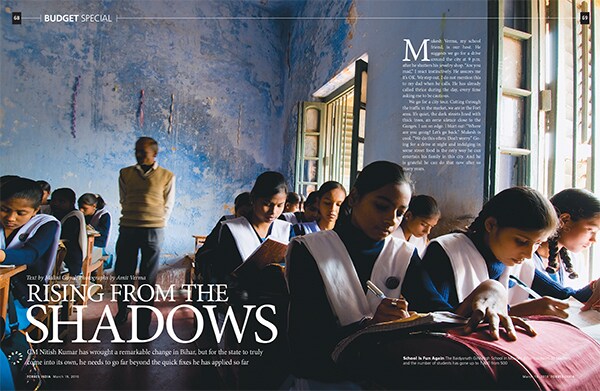

Rising From the Shadows

Rising From the Shadows

Where the Laloo-Rabri government did nothing—or worsened things—for 15 years, even modest work by Nitish Kumar’s government makes him look good. He has picked his battles well. Law and order, roads, health care and education—the four big thrust areas, have a broader relevance for the people, cutting across income and social class. Of course, Kumar has tremendous motivation to deliver. His political career hinges on it. Unlike Laloo Yadav who became complacent, assured of loyal Muslim-Yadav votes, Kumar has no such loyal support base. Only his work will hold the key to his electoral fortunes. And he knows it well. Bihar is vastly better today than it was five years back. But for the state to truly come into its own, he needs to go far beyond the quick fixes he has applied so far.

First published in the March 19, 2010 edition. Year 2 (2010-2011)

Year 2 (2010-2011)

The King’s Eye View in 2010, Viswanathan Anand came back

From virtual annihilation and became the world chess champion by defeating Veslin Topalov in trying circumstances. He had started out as a shy child prodigy, but over time, he matured into a methodical player who could hold his nerve against any opponent. As he ages, his game has only sharpened. In the last three years, he has been virtually unbeatable. Despite all this, Anand remains a simple guy. But then, just how did this nice guy finish first? His life has quite a few lessons on the art of winning.

First published in the July 30, 2010 edition. The Firm

The Firm

Amarchand & Mangaldas, jointly run by Cyril Shroff in Mumbai and his brother Shardul in New Delhi, is the largest, most influential law firm in the country. Yet, life isn’t perfect. The problems of India’s family-run firms that grow large are catching up with Amarchand. The Mumbai and Delhi operations have two distinct operating cultures. Some clients say they feel comfortable being advised only by the senior management because the firm lacks mature talent. Many lawyers at the firm feel their own career growth is stifled because the family wields too much control over the business. This problem is exacerbated because foreign law firms have begun to circle the Indian market. Though they are not allowed to practise in India, they have formed alliances with local firms. Over the last few years, Amarchand has lost very senior people to these firms. The time for solving the internal issues is now. Otherwise, Amarchand could be overtaken by the new firms that are either more entrepreneurial or global.

First published in the July 30, 2010 edition.

And the Lessons Life Teaches

And the Lessons Life Teaches

For more than two decades, Analjit Singh was a part of the messy disintegration of what was once Indian pharma’s first family, Ranbaxy. That is why, for more than two years now, Singh has been putting in place mechanisms that ring-fence his company, Max India Group, from any needless interference from the promoter family. In this endeavour to put in place a new governance model, he is getting help from some of the best minds in the business, including management guru Ram Charan. He has also given his board the freedom to challenge him and his CEOs. And it seems to be paying rich dividends already.

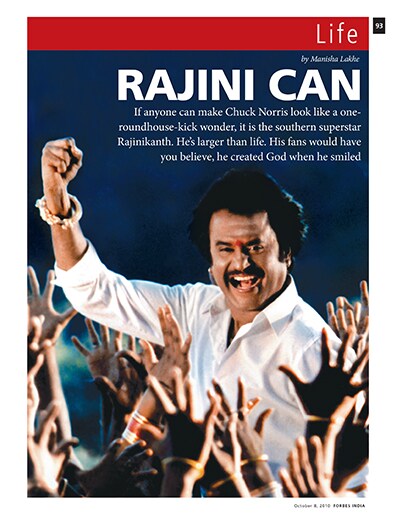

First published in the April 22, 2011 edition. Why Rajinikanth Rocks

Why Rajinikanth Rocks

Rajinikanth has made the formula of punch-line-laden, impossible-action-packed movie persona work for over three decades. How does this 60-year-old grandfather transform miraculously—and credibly—into a limber young chap who whips up bad guys as easily as he polishes his sunglasses? Partly, it is the focus. After his initial experimentation, he did not attempt to stretch his range. Partly, it’s the simplicity of his image, the uncomplicated heroics that give the man on the street something to cheer. Purely and simply, Rajinikanth makes the whole package work. Only he can.

First published in the October 8, 2010 edition.

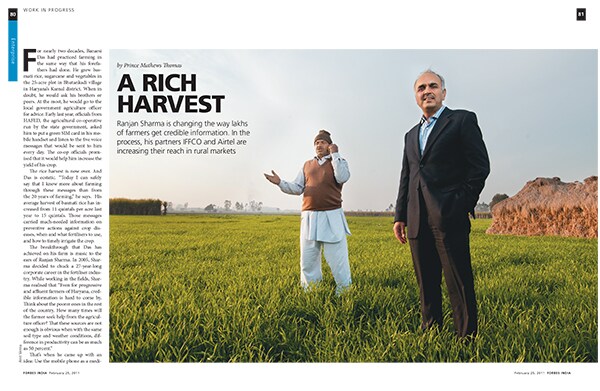

A Rich Harvest

A Rich Harvest

Ranjan Sharma is changing the way lakhs of farmers get credible information—information that can help improve productivity by as much as 50 percent. His idea: Use the mobile phone to send information to farmers on better agricultural practices. Sharma roped in two critical partners: IFFCO, or Indian Farmers Fertilisers Co-operative, which sells almost 40 percent of the fertilisers sold in India, and Bharti Airtel. That partnership resulted in IFFCO Kisan Sanchar, or IKSL. IKSL uses IFFCO’s huge network to sell co-branded SIM cards to farmers, who use them to make calls. They also receive five free voice messages daily on agriculture and related issues. In less than three years, the service is available to over 85 lakh farmers across 18 states. In the process, his partners IFFCO and Airtel, too, are increasing their reach in rural markets.

First published in the February 25, 2011 edition.

Year 3 (2011-2012)

Year 3 (2011-2012)

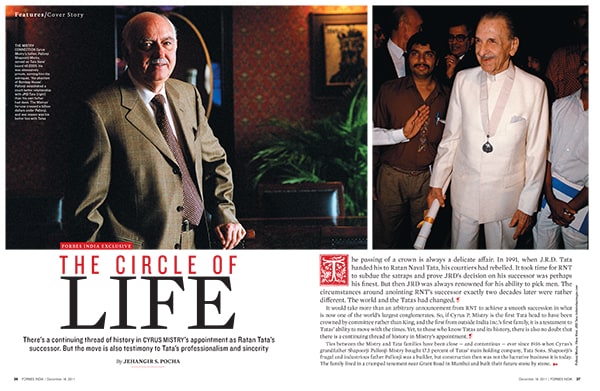

The Circle of Life

That in november 2011 tatas announced Ratan Naval Tata’s successor to be Cyrus Mistry and that the two would work together for a year to enable the transition, is a testimony to RNT’s professionalism and sincerity. So, if Cyrus P Mistry is the first Tata head to have been crowned by committee rather than King, and the first from outside India Inc’s first family, it is a testament to Tatas’ ability to move with the times. Yet, to those who know Tatas’ history, there is a continuing thread of history in Mistry’s appointment. Ties between the Mistry and Tata families have been close—and contentious—ever since 1936 when Cyrus’s grandfather Shapoorji Pallonji Mistry bought 17.5 percent of Tata Sons.

First published in the December 16, 2011 edition. Over the Rainbow

Over the Rainbow

A pervasive culture of silence has long bedevilled efforts to create workplace equality for employees who are Lesbian, Gay, Bisexual and Transgender (LGBT). But at several large multinationals, a quiet churning is taking place to create workplace equality. Many of these companies are discovering that creating LGBT-inclusive work environments makes good business sense. In June 2011, HR representatives of 11 top multinationals came together for a day at the Bangalore campus of IBM to share best practices for fostering a culture of LGBT inclusion. The session, held away from media glare, was the second such meeting since December. The informal collaboration marks a first-of-its-kind endeavour in India’s corporate sector to create LGBT-friendly workplaces.

First published in the July 1, 2011 edition.

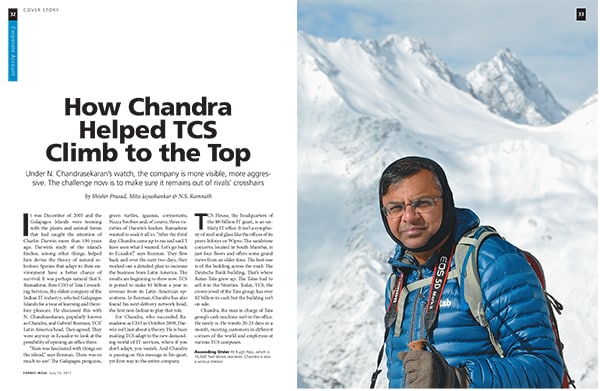

How Chandra Helped TCS Climb to the Top

How Chandra Helped TCS Climb to the Top

N Chandrasekaran is busy making TCS adapt to the new demanding world of IT services, where if you don’t adapt, you vanish. Since the time he has taken over as TCS CEO, revenues have increased from $6 billion to $8.2 billion, and market value has doubled. The biggest shift, though, is in the way the industry, analysts and media now perceive TCS. Till now, Infosys was the cool one, but now it is TCS that is being taken as a yardstick of how the industry is performing. Part of it has to do with Chandra’s charisma and performance. Chandra’s ascent has come at a time when his rivals are a weakened lot. The challenge now is to make sure TCS remains out of rivals’ crosshairs.

First published in the July 15, 2011 edition.

Can Posco Cross the India Barrier?

Can Posco Cross the India Barrier?

The $12 billion POSCO investment in India was supposed to be the biggest FDI project in the country. After six years, that still remains on paper. In Odisha, Posco has been under siege from natives who want it to leave, but the government wants it to stay. Now the South Koreans are finally giving some ground: Taking on local partners giving up on a clause in the 2005 MoU that was one of the main reasons for it to come to India and getting Indians to head its operations. For Gee Woong Sung, managing director, Posco-India, this must be a humbling moment. It shows that Posco is finally beginning to figure out India. This is a country where industrialisation has never had unequivocal acceptance.

First published in the August 12, 2011 edition.

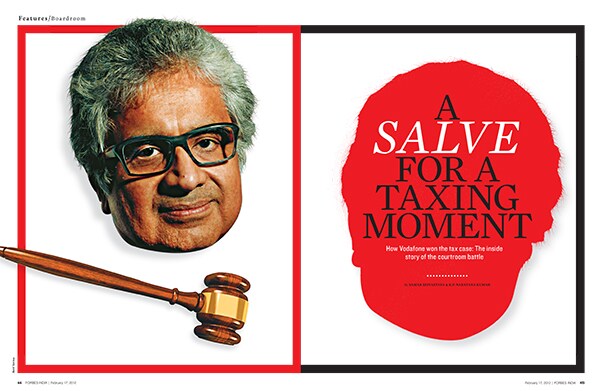

A Salve for a Taxing Moment

Perhaps no case in corporate history has evoked as much interest as the Vodafone tax case. At its core was the contention of the Indian tax authorities that Vodafone had to pay Rs 11,000 crore in tax on the acquisition of Hutchison Essar’s mobile telephony businesses in India even though it was done through subsidiaries registered overseas. The tax authorities and the Bombay High Court asked Vodafone to deposit Rs 2,500 crore. But on January 20, the Supreme Court granted an unequivocal victory to Vodafone. This is the inside story of the courtroom battle—as much senior counsel Harish Salve’s victory as it was Vodafone’s.

First published in the February 17, 2012 edition. Year 4 (2012-2013)

Year 4 (2012-2013)

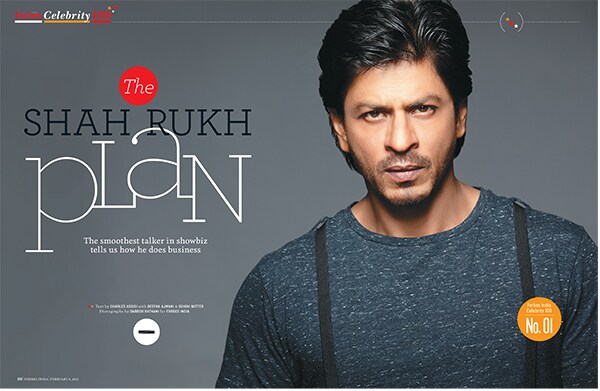

The Shah Rukh Plan

Shah Rukh Khan says he does not understand business. But he is working to a plan. Entertainment is what he knows, understands and gets excited about. So, Red Chillies Entertainment (RCE, the banner he runs his various companies under), is big time into VFX (visual effects), film production, and cricket. RCE, Khan believes, has the potential to generate a few hundred million dollars a year, much like a Hollywood major. And it will outlast him. RCE is making profits now, but the Hollywood-sized scale Khan wants for it is still some time away. Can it get there? What could get in its way?

First published in the February 8, 2013 edition.

The House of Cards

The House of Cards

The Reddy brothers, founders of the Deccan Chronicle group, seemed virtually unstoppable. Till their luck began to run out. While many say Deccan Chronicle had it coming for years, fact is, till as recently as 2010, it was considered a textbook example of how to run a modern newspaper business. Within a decade, it went from being primarily a one-city newspaper in 2000 with a circulation of roughly 1,50,000 copies and annual revenues of Rs 55 crore to nearly 10 times the circulation and roughly Rs 1,000 crore in revenue by 2010. For much of that period, it threw out spectacular numbers—Ebitda profit margins upwards of 50 percent and substantial net cash flows. It also bought or created numerous other businesses, the two largest ones being retail bookstore chain Odyssey and Deccan Chargers. Yet, behind the headlines, its core business was losing its edge.

First published in the September 14, 2012 edition.

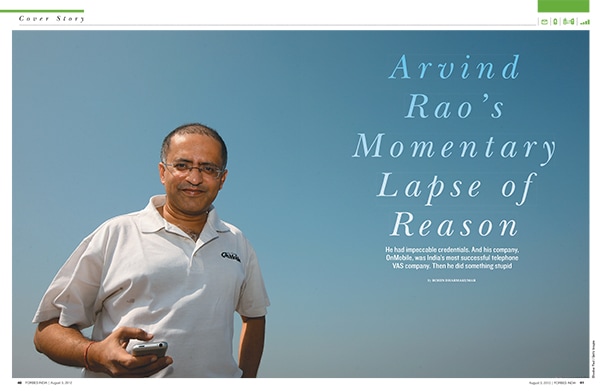

Arvind Rao’s Momentary Lapse of Reason

Arvind Rao’s Momentary Lapse of Reason

He had impeccable credentials. his company, OnMobile, was India’s most successful telephone VAS company. Then he did something stupid. On November 23, 2011, Rao, the co-founder and CEO of OnMobile, bought about 6 lakh shares of his company from the open market. He had to pony up nearly Rs 16.5 crore for them he borrowed the money. However, OnMobile’s shares continued to fall, while Rao’s interest payments ballooned. In an attempt to provide a floor to the share price, Rao pushed through a controversial share buyback plan. He also requested the board for a significant salary increase, which was denied, as was a request for a personal loan. Finally, Rao took the ‘shortcut’. Just that once.

First published in the August 3, 2012 edition. A Tough Poser for Moser

A Tough Poser for Moser

At Moser Baer projects, an energy company that Ratul Puri founded, he has reached every milestone before time. But Moser Baer, the magnetic storage and solar panel manufacturing company, is down for the count. So which one is the real Ratul Puri? Is he a phenomenal entrepreneur or a bad businessman who has destroyed capital? If you are in a bad business, you are often portrayed as a bad entrepreneur. This is what happened to Puri. He is stuck with a business whose best days are behind it. He is the first Indian entrepreneur of size to be tested and bested both by changes in technology as also the Chinese manufacturing juggernaut.

First published in the August 3, 2012 edition.

The Final Tutorial

IIM Ahmedabad (iim-a) and its professors know that winds of change are blowing all round it. Global business schools want to eat its lunch. Newly opened IIMs and other B-Schools want to snag its prized faculty. The world of business itself is changing rapidly. India Inc needs new answers to survive and grow in a globalised world. And India needs IIM-A to showcase its thought leadership in public debate, in doing ground-breaking work on its inchoate but very promising economy. IIM-A needs to do more than what it does so well—teach students or be on policymaking bodies. It needs to change.

First published in the September 14, 2012 edition.

Year 5 (2013-2014)

In a Tailspin

Naresh Goyal’s Jet Airways has been struggling. Its alliance with Etihad has done little good. And the promoter seems to no longer hold sway over its navigation. Financial year 2014 was the lowest point for what was once India’s most powerful service brand. Loss for the year is expected to be around Rs 2,000 crore. Add the woes of subsidiary company Jet Lite, and the problem gets compounded. Jet Lite has negative net worth, and continues to make losses despite loans from its stressed parent. These numbers are chilling, but it isn’t yet time to pen an epitaph. However, there is certainly a cautionary tale to be told, deconstructing the tailspin that the 21-year-old airline finds itself in.

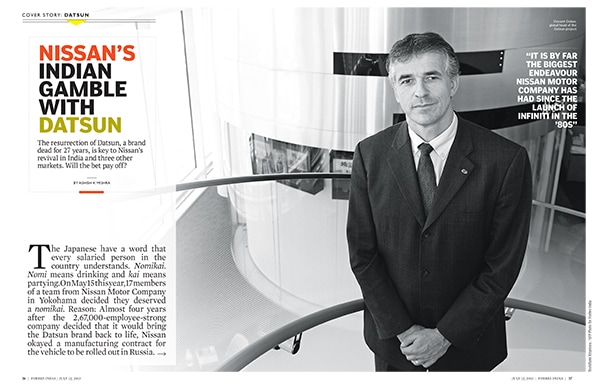

First published in the May 2, 2014 edition. Nissan’s Indian gamble with Datsun

Nissan’s Indian gamble with Datsun

To make it big in fast-growing markets such as India, Russia, Indonesia and South Africa, Nissan decided that it has to gamble big. It decided to revive the Datsun brand, which it had killed deliberately in the mid-1980s, and create a car specifically for these markets, since the main Nissan repertoire hasn’t scored. Not since it created the Infiniti as a luxury car brand in the 1980s has Nissan done anything as big. To bring the Datsun brand back to life, Nissan has okayed a manufacturing contract for the vehicle to be rolled out in Russia. This contract is a risk that runs above $400 million. Not a small bet even for a $100 billion corporation.

First published in the July 12, 2013 edition. Gobble, Gobble, Google

Gobble, Gobble, Google

Whether it’s a web search, watching a video, using a browser, or email, Google is everywhere—and free. But someone is obviously paying for it all. And among them, an increasing number think of Google as an adversary. Google is now often competing with its former customers. Search for a travel route and Google will offer you results from its own ‘Flight Search’ service first. Search for a smartphone and Google will show you multiple sellers listing the same in its ‘Product Search’ service instead of a price comparison site. Websites that were once close partners with Google may wake up one day to realise they’ve been “disrupted”, as their search traffic is diverted to one of Google’s own services.

First published in the July 26, 2013 edition. How the Apollo, Cooper Deal Was Botched

How the Apollo, Cooper Deal Was Botched

Neeraj Kanwar, the md of apollo Tyres, was convinced that the Apollo-Cooper merger would result in the perfect global tyre company. Apollo was already big in India, Europe and Africa. Cooper was established in North America and China. Compared to their individual market position (Cooper at No. 11 and Apollo at No. 17), after the merger, the combined entity would become the seventh largest tyre company in the world. But the $2.5 billion Apollo-Cooper marriage was called off before they could say ‘I do’. Both parties are aggrieved, and everyone, it seems, is to blame. But, as this reconstruction of events indicates, they let the roadblocks puncture their ambition.

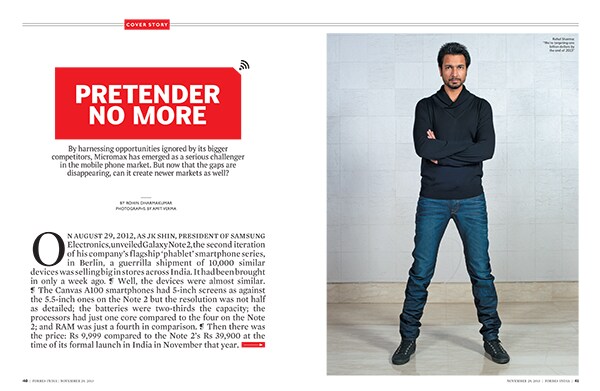

First published in the February 7, 2014 edition. Can Micromax Become India’s Leading Smartphone Maker?

Can Micromax Become India’s Leading Smartphone Maker?

Micromax has come a distance since 2008. According to IDC and CyberMedia Research, the company is the third largest seller of mobile phones in India behind Samsung and Nokia. With its coffers filling up with revenues from the sale of over 2.5 million handsets each month, Micromax is setting its sights even higher. It believes it can vault itself up the global pecking order of smartphones where the downslide of Nokia and RIM has left a vacuum. Micromax claws at their market share by offering ‘good enough’ options for a fraction of the price. How long can this continue?

First published in the November 29, 2013 edition.

First Published: May 24, 2014, 07:21

Subscribe Now