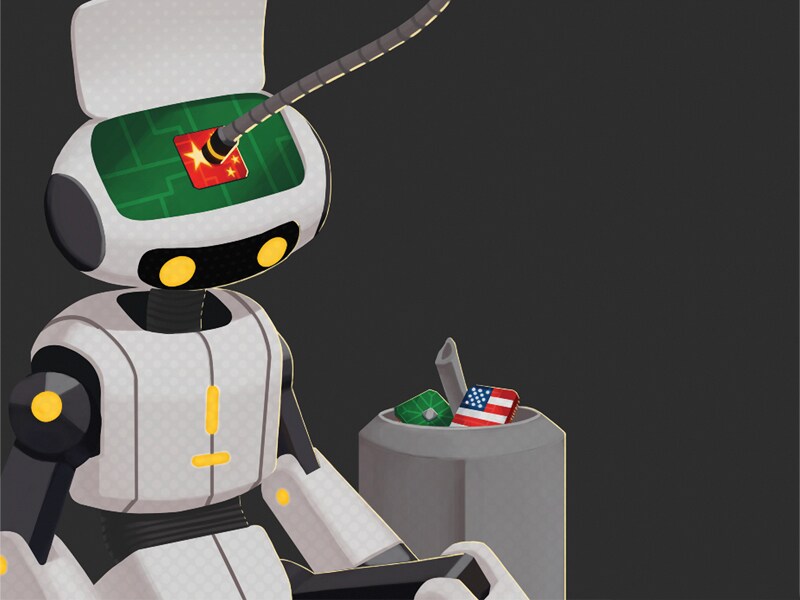

Unplugging America: Is China ready to reduce reliance on foreign technology?

China is determined to reduce its reliance on foreign technology. But is the country ready for the consequences?

Image: Courtesy CKGSB [br]

Image: Courtesy CKGSB [br]

Saturday, October 27 was supposed to be an historic day for China’s growing aerospace industry. Landspace, a Beijing-based startup, was set to become the first private Chinese company to launch a rocket into outer space.

At 4 p.m., Landspace’s ZQ-1 rocket blasted off smoothly from the Jiuquan Satellite Launch Centre in Inner Mongolia. Spectators watched the ZQ-1 shed its first two stages as it cut through the pristine blue skies.

Then, something went wrong. At 6.40 p.m., a fault occurred during the third stage. Soon after, Landspace declared the mission a failure. The company will have to wait until 2020 for its next shot at history.

A few weeks later, Elon Musk’s SpaceX completed its 20th successful launch of 2018. The US company’s Falcon 9 rocket delivered cargo craft Dragon into orbit before landing back on Earth, ready for its next mission.

It is unfair to draw sweeping conclusions based on the performance of just two companies. SpaceX, after all, was founded in 2002, while Landspace was established only in 2015. But the enormous gulf between the firms’ capabilities does serve as a reminder of how far China has to go before it rivals the United States as the world’s leading technological power.

Such a reminder is useful at a time when several US, and a few Chinese, commentators are describing China as a rival to US dominance in innovation. As recently as 2014, arguments that China was somehow incapable of producing groundbreaking research were commonplace in the English-language media. The Harvard Business Review famously ran with an article titled “Why China Can’t Innovate.”

But this viewpoint has been flipped on its head in the past two years. In 2017, USA Today asked “Why China Is Beating the US at Innovation.” A year later, Washington think tank the Council on Foreign Relations declared China’s Made in China 2025 industrial strategy “the real existential threat to US technological leadership.”

The shift in mindset is leading to rapid changes in policy on both sides of the Pacific, as Washington and Beijing gear themselves up for a long-term “tech war.” The US has moved to restrict China’s access to sensitive technologies, leading to a 92% year-on-year drop in Chinese direct investment in US firms as of July, according to Rhodium Group. The Commerce Department is also considering extensive restrictions on exports of “emerging technologies” on national security grounds.

Chinese President Xi Jinping has in turn made indigenous development of core technologies a key priority. “It is becoming increasingly difficult to gain access to leading technologies, and China will ultimately have to rely on itself,” Xi said in September.

The effort to make China self-reliant on core technologies is understandable. But the drive appears to be also creating a misleading impression that China is on the verge of eclipsing the US in science and technology. The reality is that China is still a long way from catching up with America, let alone overtaking it.

Smoke and Mirrors

Spurring innovation has become a central policy focus for Beijing as the drivers that propelled China’s economic miracle—abundant cheap labor and surging investment—continue to weaken.

In a 2015 report, McKinsey found that for China to maintain a fast gross domestic product (GDP) growth rate, it would need to generate at least two percentage points of this growth through innovation, broadly defined.

President Hu Jintao continually called on officials to make boosting “indigenous innovation” a key priority during his time in office. Xi Jinping has placed an even greater emphasis on this area since taking over in 2012. These calls have produced a surge of investment in research and development (R&D), catapulting China up the global innovation league tables.

China’s total investment in R&D rose to 2.1% of GDP last year, up from just 1.4% in 2008. The country’s level of investment now rivals those of the US, which has held steady at just under 2.8% of GDP for a decade, and Germany, at 2.9% of GDP. According to a report by PwC published in October, 145 Chinese companies are now among the world’s top 1,000 R&D spenders, up from only 14 a decade ago.

In 2016, China’s State Intellectual Property Office received an extraordinary 1.3 million patent applications, more than double any other country, according to data from the World Bank. China has also overtaken the US as world leader in terms of the total number of scientific papers published, according to statistics released in January by the US National Science Foundation.

The country is now home to more R&D researchers than any other country. China produces 1,177 researchers per million people, three times the level recorded in the 1990s. The US produces 4,321 researchers per million, but this is more than offset by China’s much larger population.

These statistics paint a picture of a China surging toward global dominance. And the progress it has made has indeed been impressive. At the time Harvard Business Review’s article was published, Chinese companies with truly world-class technology were still rare. Now, China is at the cutting edge of a whole host of fields, from smartphones and drones to financial technology.

Alternative Statistics

Yet, the devil is in the details. As Nick Marro, China Lead Analyst at the Economist Intelligence Unit, a London-based think tank, explains, a large number of Chinese firms file patents simply to help them qualify for government subsidies as “high-tech enterprises.”

“We see this phenomenon in other jurisdictions as well, but it is particularly pronounced in China,” says Marro.

A Bloomberg investigation in September found that more than 90% of design patents filed in China are abandoned within five years, suggesting that they have little commercial value.

Despite its vast number of patents, the number of truly groundbreaking innovations coming out of China appears to be relatively modest. Of course, it is difficult to quantify “groundbreaking innovation,” but one way is to look at China’s share of triadic patents—corresponding patents filed at the European, Japanese and US patent offices, which are often called the “gold standard” of patent families.

In 2015, China accounted for 5.2% of global triadic patents, a big increase on its 1.6% share in 2008, but still far below the 26.7% of the US, 31.2% of Japan and nearly 20% of the major European economies. Many of China’s top officials have themselves complained about the poor return Beijing’s vast investment in R&D has produced.

“Major scientific research in China mainly consists of imitation. Original innovations are relatively few and weak, and high-level talent is still scarce,” said Ning Jizhe, Director of the National Bureau of Statistics, in February.

A large chunk of the country’s research investment is still funneled through local governments and state-run research institutes, leading to inefficiencies and waste.

Most of the leading Chinese companies, by contrast, do not spend nearly as much on developing new technologies as their American counterparts. The PwC study of the world’s top 1,000 publicly-traded companies in terms of R&D spending found that US companies accounted for 37.7% of total spending, while Chinese firms made up just 7.8%.

The research budgets of national champions such as Baidu, Alibaba and Tencent are dwarfed by the likes of Alphabet (parent of Google), Amazon and Apple. Alibaba spent $3.6 billion on R&D in 2017, for example, while Amazon invested $22.6 billion.

Digging Deeper

The main reason for this discrepancy, according to Edward Tse, head of Gao Feng Advisory Company, which works with firms both inside and outside China, is that many Chinese have different priorities from their Western peers.

China’s leading companies tend to excel at “applications of existing technology, rather than original research,” Tse told the Wall Street Journal. Many of the most high-profile Chinese success stories of recent years have followed this pattern, with mainland firms taking a Western technology and then using an innovative business model to create a hugely dynamic business.

Tse cites the examples of digital payment services like Alipay and instant messaging apps such as WeChat. Others could include ride-hailing giant Didi Chuxing or online service provider Meituan Dianping.

Kai-Fu Lee, the founder of leading venture capital firm Sinovation Ventures, uses a similar argument to explain China’s success in the field of artificial intelligence.

We are currently living through an “age of implementation” in AI, Lee argues in his book AI Superpowers, as companies focus on finding commercial applications for one core technology: deep learning. Chinese firms have proved particularly adept at creating and rolling out businesses based on deep learning algorithms.

Kaiser Kuo agrees that Chinese companies have a natural advantage in this field. As Editor-at-Large at SupChina and a former Director of International Communications at Baidu, the search company that has been named one of China’s four national AI champions, he is in a position to know.

“Deep learning entails the sifting through oceanic amounts of data to find patterns, and China has this key advantage of owning more data than anyone else,” says Kuo.

“This is due to China turning earlier and more decisively to smartphone-based ordering of food delivery, ride-sharing and so on, which gives us a clear understanding of consumers’ habits.”

The sheer scale of China’s market has had a similar effect on domestic companies in many other industries too. Trying to make new breakthroughs is unnecessary and inefficient. The name of the game for many brands is simply to work out how to get large numbers of products to consumers as quickly as possible.

However, many companies are starting to change their approach as the Chinese market becomes more saturated. Differentiating yourself from your competitors through innovation is increasingly a focus.

According to Shobhit Srivastava, a technology analyst at Counterpoint Research, this trend can be seen in the smartphone industry.

“There was a turning point around three years ago, when the Chinese brands began coming up with indigenous innovations to compete as global players,” says Srivastava. “China’s market was becoming increasingly competitive, and innovation was needed to compel consumers to replace their phones in ever shorter intervals.”

Brands such as Huawei, Oppo, Vivo and Xiaomi are now rivaling Apple and Samsung in the design stakes. The Vivo X series recently became the world’s first phone with an in-glass fingerprint sensor, while Oppo’s Find X introduced a slide-out camera to allow for a true full-screen display.

China’s automakers are trying a similar transition as the domestic market matures, but they are starting much further behind their foreign rivals, explains Heiko Rauscher, a partner at consulting firm Oliver Wyman that focuses on the auto industry.

“Ten years ago, most Chinese were buying a car for the first time, and affordability and churning out large volumes were the main criteria for car production,” says Rauscher. “But things are changing now. Consumers increasingly appreciate new tech features.”

At the moment, Rauscher can point to few examples of Chinese brands with “truly innovative” products, even in the electric vehicle market that China is promoting so heavily. “However, it is amazing how fast Chinese automakers are catching up,” he adds.

Remaking Made in China

But as Beijing is well aware, much of this progress has been built on parts and equipment designed abroad. China’s world-leading smartphones cannot function without cutting-edge foreign microchips, and the Android operating system used almost exclusively comes from Google. The country’s rapidly developing auto makers, meanwhile, depend on German and Japanese industrial robots.

This was made brutally clear in early 2018, when the US banned American companies from doing business with telecommunications firm ZTE, due to the Chinese firm having violated sanctions on Iran.

ZTE is one of China’s most feted companies. It supplies telecom equipment to dozens of countries and sold 45 million smartphone handsets in 2017. Yet the firm was crippled by the US sanctions and would have gone out of business had President Donald Trump not reversed the ban.

“The case was the starkest of a long series of wake-up calls for China’s policymakers,” comments Marro of the EIU.

Reducing China’s dependence on core technologies is a central aim of the Made in China 2025 strategy. The policy aims to make China a leading player in virtually all high-tech sectors that drive economic growth in advanced economies. Areas targeted include automobiles, aviation, machinery, maritime, robotics and railway equipment, as well as electric vehicles, information technology and medical devices.

The strategy has generated huge controversy abroad, not least because the policy sets specific goals for raising the market share of domestic companies in many industries. It also makes clear that Made in China 2025 is designed to prepare the ground for Chinese tech companies to enter global markets.

If the policy achieves these ambitious goals, it would certainly impact other advanced economies, though calling the policy an “existential threat” may be stretching it. The reality, however, is that China is still a long way from taking the lead in most of these industries.

Zhang Jun, Dean of the School of Economics at Fudan University, has pointed out that the industries targeted by Made in China 2025 are precisely the ones in which China lags furthest behind the West.

“There is a big difference between applying digital technologies to consumer-oriented business models and becoming a world leader in developing and producing hard technology,” Zhang wrote for Project Syndicate in June.

“China probably remains 15-20 years away from matching the R&D input of, say, Japan or South Korea,” he added. “When it comes to output—the more important factor—it is much further behind.”

A demonstration of the challenges China faces is the aviation sector, where Shanghai-based aircraft maker Comac remains far behind industry leaders Boeing and Airbus. Comac has been developing a long-haul jet, the C919, since 2008, and the plane is due to go into service in 2021, though experts expect it will be delayed until 2024. The jet is built using Western original equipment manufacturers’ systems acquired through joint ventures, and only around 50% of the components are made by domestic suppliers.

“The Western JV partners typically didn’t bring their latest technology into China, meaning that if the C919 goes into service after 2024 it will be well behind its time, with technology from the 2000s,” says Jonas Murby, Principal at aviation consulting firm AeroDynamic Advisory.

Doubling Down

All this means that moving toward technological self-reliance, as President Xi is calling for, will be slow and painful for China. However, the realities of the US’s hardened attitude will force Beijing to do everything it can to fast-track this process.

“The trade war will push China to double down, especially as the ZTE case showed policy makers that the very company at the forefront of Chinese technology innovation was incredibly vulnerable to foreign action,” says Marro.

At the same time, Beijing is doing everything it can to avoid having China’s access to foreign technology further choked off. China recently moved to please Germany by weakening the country’s joint venture rules, allowing BMW to become the first foreign automaker to take a 75% stake in its Chinese production business.

Xi has also become more vocal in pledging to increase protections for foreign firms’ intellectual property. This is a move obviously designed to counter Trump’s accusation that China is stealing America’s trade secrets.

China is taking steps to do this by reorganizing its State Intellectual Property Office to bring it in line with international practice. It will no longer merely act as a patent office but will also be responsible for managing trademarks and geographical indications of origin.

Whether this is enough to appease China’s Western partners remains to be seen. But one thing is certain: on this issue, the balance of leverage is with Washington.

First Published: Aug 23, 2019, 12:16

Subscribe Now