Best under a billion: How Nikhil Sawhney put Triveni Turbine on the global map

The company specialises in turbines of up to 100 megawatts (MW), and are deployed in an array of industries, such as cement, steel and chemicals

Triveni Turbine’s 10-hectare factory complex in the Sompura industrial belt, about 48 kilometers northwest of India’s tech capital, Bengaluru, is a picturesque landscape of pink-and-yellow flowering shrubs and an abundance of mango, coconut and sapodilla trees. But the heart of this verdant campus is another green expanse—a gleaming, 10,000-square-meter shop floor churning out rotors and blades alongside assembly bays and test beds for steam turbines.

Powered by either fossil fuels or renewables such as biomass, these giant machines use steam to spin a rotor to generate electricity. The company specialises in turbines of up to 100 megawatts (MW), producing 300 to 350 machines a year at its two factories (the second is located in another Bengaluru suburb). They are deployed in an array of industries, such as cement, steel and chemicals as well as by independent power producers. (Bigger turbines of more than 100MW make up more than 90 percent of the global steam turbine market.)

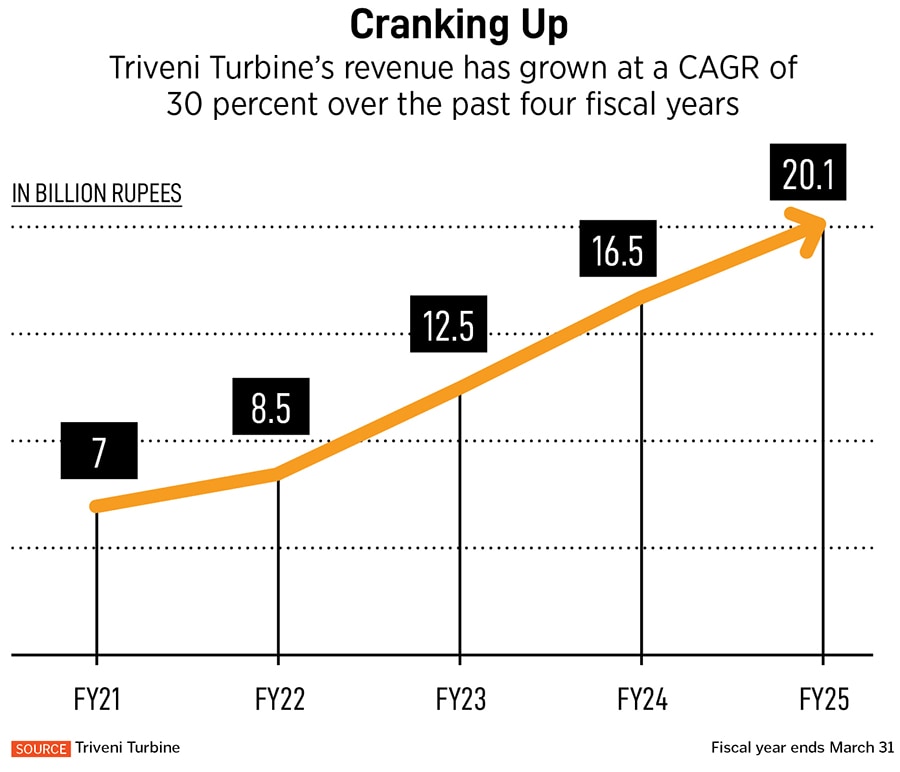

Amid the steady hum of the factory, Nikhil Sawhney, the company’s vice chairman and managing director, reveals his ambitions: “In the next five years, we’ll more than double our revenue,” he says. “I don’t see why we can’t triple it also.” In the year ended March 31, Triveni’s revenue jumped 21 percent from the previous year to a record 20.1 billion rupees ($237 million) and net income rose by a third to 3.6 billion rupees, earning it a spot on the Best Under A Billion list of companies for the second year in a row.

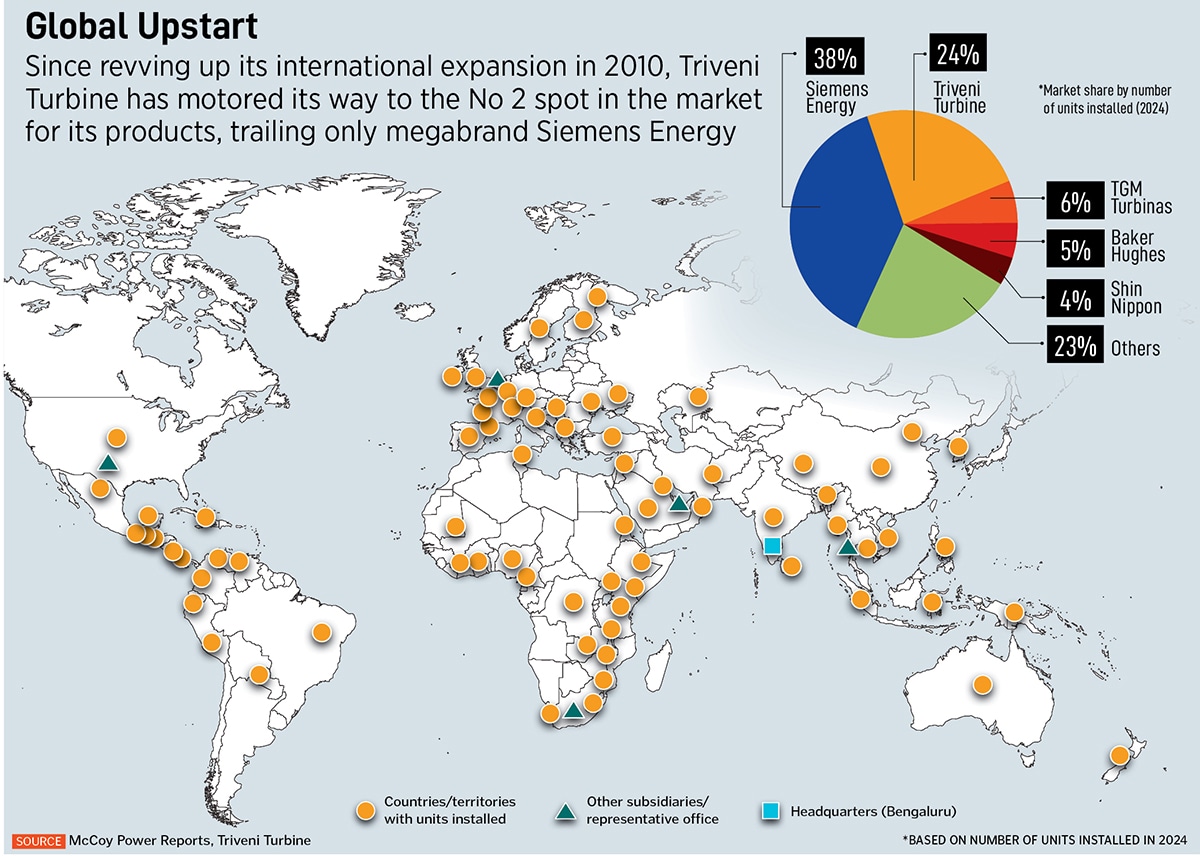

Since getting involved with operations 14 years ago, this fourth-generation scion of a Delhi clan with roots in the sugar business has helped transform Triveni from a largely domestic outfit into a notable global player. Over that period, market cap has surged to $2.4 billion from $262 million and it now has 6,000 installed units in 80 countries, up from 2,500 in 30 markets in 2011. It is the No. 2 player in the global market in the up-to-100MW segment, after Siemens Energy, a spin-off of German giant Siemens, according to US-based energy intelligence firm McCoy Power Reports. “It’s been a journey based on a lot of focus and discipline,” the 48-year-old says.

But Sawhney still has speed bumps to navigate. The steam-turbine business is undergoing rapid change amid the transition to cleaner energy; competition is intense not just from Siemens but other multinational players, such as Brazil’s TGM Turbinas and the UK’s Baker Hughes; and the threat of tariffs is rattling his US expansion plans, making him acutely aware that he must keep innovating. “We need to develop new products and new technologies and create newer market segments all the time,” Sawhney says. “We are very paranoid as a company.”

Since going public in 2011, shares of Triveni have rocketed about 1,600 percent, propelling Sawhney’s father, Dhruv Sawhney, under whom the $1.8 billion fortune is listed, into the billionaire ranks, starting in 2022. The fast-growing turbine business accounts for two-thirds of his net worth of $2 billion, with the rest mostly from a stake in the legacy company Triveni Engineering & Industries, which Sawhney’s older brother, Tarun, 51, runs as vice chairman and managing director. (Their father is chairman and managing director of both companies.)

Triveni Turbine “has a dominant position in the domestic market, an expanding share in the international market, and strong technological prowess”, according to Teena Virmani, a research analyst at Mumbai-based financial services firm Motilal Oswal. “It’s also very efficient financially,” she adds. It leads in India with a 55 percent market share in revenue terms, followed by Siemens Energy India with 40 percent, according to the firm.

While the domestic market for steam turbines contracted 10 percent in revenue terms in fiscal 2025, partly due to national elections and macroeconomic jitters, Virmani expects demand to revive in fiscal 2027. She cites a 120 percent jump in the company’s domestic enquiries—considered a precursor to orders—in fiscal 2025; international enquiries rose 30 percent. Motilal Oswal estimates compound annual growth of 19 percent for both revenue and after-tax profit over the next two years.

The global market for steam turbines up to 100MW, excluding China and Japan, declined about 28 percent in gigawatt terms from 2014 to 2024, according to McCoy. But “we do not think this is reflective of the long-term market”, says Sawhney. Triveni has sustained its momentum, and exports—mainly to Europe, the Middle East and Southeast Asia—accounted for nearly half of total revenue in the year to end-March, up from 11 percent in 2011.

Sawhney says more than 70 percent of its turbines use renewables, such as biomass. This is in line with data from McCoy that machines powered by renewables accounted for nearly three-quarters of the global market for up-to-100MW steam turbines in 2024, up from 42 percent in 2014, while those using fossil fuels fell to 22 percent from 36 percent. In another nod to sustainability, Triveni has devices that turn municipal waste into energy. Many of its machines also go into combined heat-and-power systems, which capture waste heat from generating electricity and use it for other industrial purposes, improving energy efficiencies.

Triveni’s key turning point was in 2010, when the family, which was at the time mostly making only small turbines of under 30MW, revved up its international ambitions by forming a joint venture with General Electric to make bigger machines for overseas markets. The machines were produced in India with GE marketing them abroad. The joint venture helped drive global expansion until 2019 when the partners went their separate ways, with Triveni eventually buying out GE’s stake.

Despite the breakup, exports have jumped threefold since Triveni went solo. “Our competitiveness in that market [for 30MW-100MW turbines] is significant,” Sawhney says. Global sales got a boost in 2016, when he moved into making turbines for the oil-and-gas industry that adhere to safety, efficiency and other standards set by the American Petroleum Institute (API), a US-based trade group. Triveni now supplies API-compliant machines to the Middle East, Southeast Asia, Central and South America, and Europe. Virmani describes the market as competitive but lucrative and says the company’s “technological expertise and faster turnaround capabilities” make it well-positioned to capture a larger share.

Sawhney’s investments in building technological prowess turned out to be another lucrative bet. The company now holds around 400 patents, industrial designs, trademarks and copyrights and rolls out four to five new products a year. It has long-standing research partnerships with universities in India and abroad, including the Indian Institute of Science in Bangalore and the University of Cambridge in the UK, Sawhney’s alma mater. “No one licenses world-beating technology,” he says. “We have to create it ourselves.” Capex for fiscal 2026 is set at `1.7 billion and, besides, R&D will be used for beefing up testing and assembly infrastructure. “We can use cash for growth [via M&A], but we don’t want to grow like that,” Sawhney explains.

The R&D efforts have translated into more business. In January, in collaboration with an Italian company, it scored a `2.9-billion electrical energy storage project from state-run power-generating company NTPC. The system compresses industrial-grade CO₂ into a liquid state that can be kept under pressure and released as needed. The advantage of the technique is that energy can be stored without the use of rare earths such as lithium, which is used by battery storage makers, Sawhney explains. While he is confident about this technology, he says scaling up might be a challenge. “It’s easy to innovate and prototype in India because of the low cost, but…it is hard to scale up because people are risk-averse,” he explains.

Sawhney realised early on that one way to differentiate Triveni from its competition would be to focus on aftermarket services. The company has partnerships with local workshops and service centres to repair and refurbish not just its own models but also those of other manufacturers. “Since we suffer from a brand discount when compared to global companies, our entire offering needs to be better, we have to up the service game, we have to up the response time,” he avers. Aftermarket services have risen to 32 percent of revenue in fiscal 2025 from 16 percent in 2011.

Another key advantage for Triveni is that it can offer budget-friendly customised products. When Gurgaon-based JK Cement was shopping for a steam turbine for a cement plant in 2022, Triveni was able to integrate a new 18MW device into the company’s existing turbine deck, gearbox, generator and other parts. “They really went the extra mile,” says JK Cement’s CEO Madhav Singhania. “No one else could have come up with the sort of solution that they offered.”

JK Cement says the refit cost less than half the amount they would have had to pay to an off-the-shelf vendor, who would have replaced the whole system. Singhania tapped Triveni again in 2024, seeking a 23MW steam turbine for another factory. Sawhney says that 90 percent of their customers come back with repeat orders.

The company spent $10 million expanding in the US, including opening a 9,300-square-meter assembly plant in Houston last year, closer to its oil-and-gas clients. But Sawhney says the company is “resizing” its US ambitions in the face of potential US trade tariffs. “The increased uncertainty has not led to order conversions,” he explains, adding that the company might switch to using a local supply chain in the US to make turbines stateside if tariffs are onerous. The US unit contributed less than 1 percent to revenue in fiscal 2025.

The ability to pivot may be part of Sawhney’s DNA. His great-grandfather founded a sugar-making business in 1932, then branched into sugar machinery in 1961 and steam turbines in 1968, which at first were powered by bagasse, the residue from crushing cane stalks. In 1973, Sawhney’s father joined the sugar-equipment making and engineering business run by his uncle before merging it with his own father’s sugar mills in 2000 to form Triveni Engineering & Industries. The patriarch is largely credited with modernising the operations.

Sawhney and his brother, Tarun, grew up in Delhi, where the main sugar business was headquartered. Like their father, they both went to the elite, all-boys Doon boarding school in Uttarakhand. Sawhney and his brother also both followed in their father’s footsteps by attending Cambridge, where Sawhney earned a master’s degree in economics. In 2002, he headed to the University of Pennsylvania’s Wharton School for an MBA.

“There was never any pressure to work in the family business…my dad pushed me and my brother to gain outside exposure,” Sawhney says. He interned at Nomura and Barings during his summers at Cambridge, but, after business school, he joined the sugar-trading desk at Triveni Engineering before moving in 2007 to its turbines division, which was eventually spun off to form Triveni Turbine. While the buck still stops with his father, Sawhney says he has operational freedom. “We are very aligned in terms of the larger goals,” he says.

So will the next generation be involved in the business too? “Why not? If I get the grades,” quips Sawhney’s only child, 16-year-old Zahan, who’s headed to the U. for A-level studies. He had accompanied his dad to the Sompura factory in July. “It would be my hope that he works with the business because he finds it exciting and relevant,” says Sawhney. “He can take a business that has a legacy and an industrial customer base and make it more relevant to a wider world.”

First Published: Sep 19, 2025, 14:29

Subscribe Now