Economic offences surge in India, while convictions lag

Rise in digital transactions and shift of economic activities to smaller cities mean criminals are exploiting gaps in regulatory frameworks and law enforcement

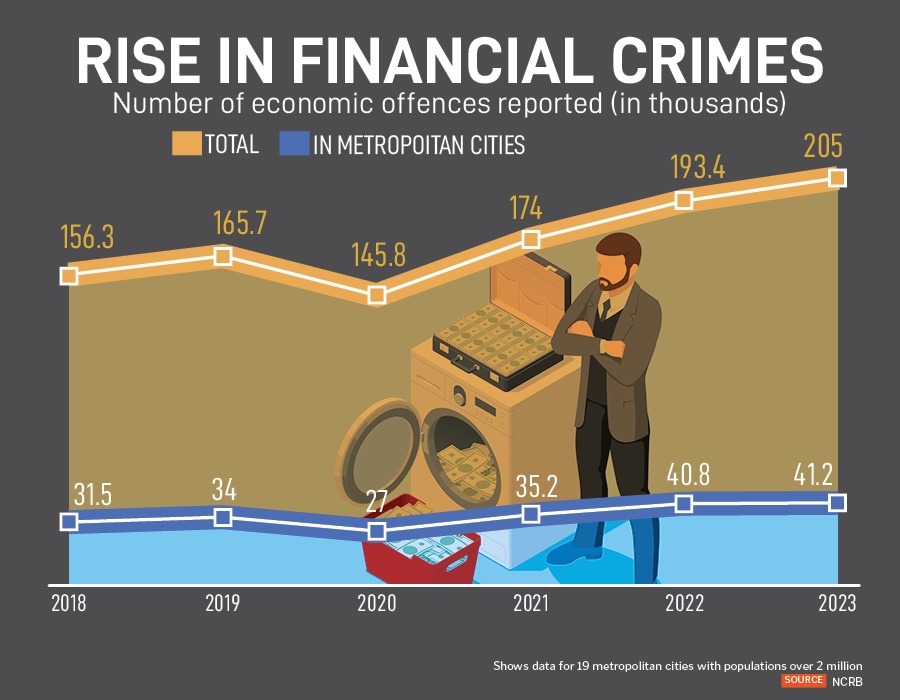

Financial crimes in India surged to a five-year high in 2023. Data from the National Crime Records Bureau (NCRB) reveals that the total number of registered economic offences nationwide crossed the 200,000 mark in 2023, registering a high of 205,000 cases. This marks a significant 18 percent increase since the high of about 174,000 cases recorded during the Covid-19 pandemic in 2021.

While the rise in reported cases reflects both greater awareness and increased digital activity, a deeper analysis of the trend in metros highlights a geographical shift and challenges in judicial action. According to the NCRB report, cases pertaining to forgery, cheating and fraud, counterfeiting, and criminal breach of trust under Sections 406 to 409 of the Indian Penal Code (IPC) constitute economic or financial offences. While forgery and fraud account for about 88 percent of all cases, criminal breach of trust makes up about 11 percent.

The upward trajectory of economic crimes has been particularly acute in India’s major urban centres. Across 19 metropolitan cities, offences rose from 31,501 in 2018 to 41,220 in 2023. Metros consistently account for about a fifth of the national tally of economic offences.

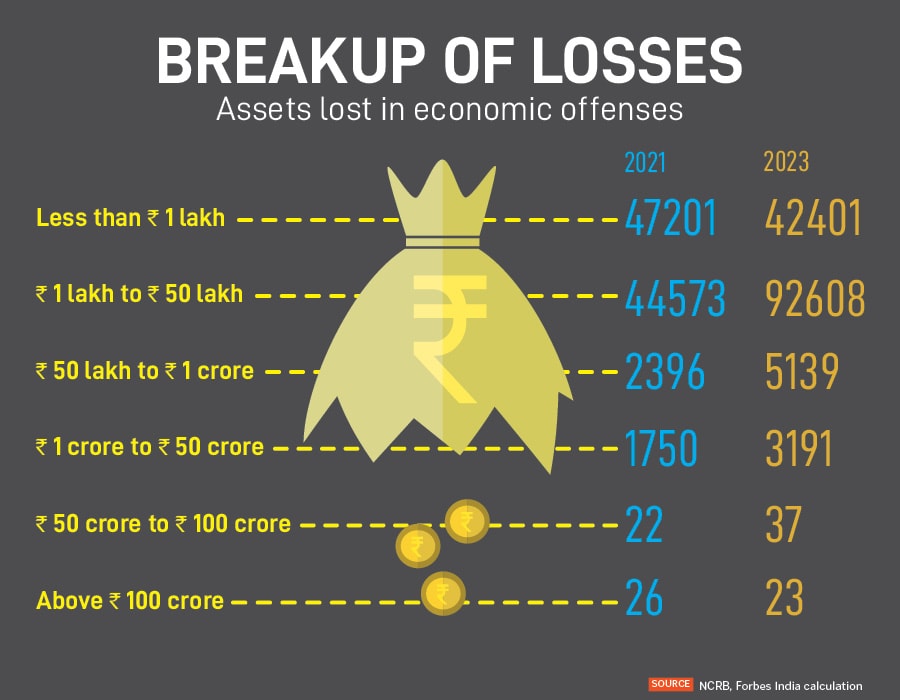

This growth in financial crimes aligns with India’s rapid digital adoption, expanding e-commerce sector, and the mass adoption of digital transactions. The cost of these offences is revealed in the magnitude of assets lost. While most of the cases registered in 2023 involved losses of less than Rs 50 lakh, the scale of organised and high-value fraud remains a significant threat to investor and business confidence. In 2023, there were 3,191 cases where assets lost ranged from Rs 1 crore to Rs 50 crore; 37 cases involved losses between Rs 50 crore and Rs 100 crore, and 23 cases involved losses exceeding Rs 100 crore each.

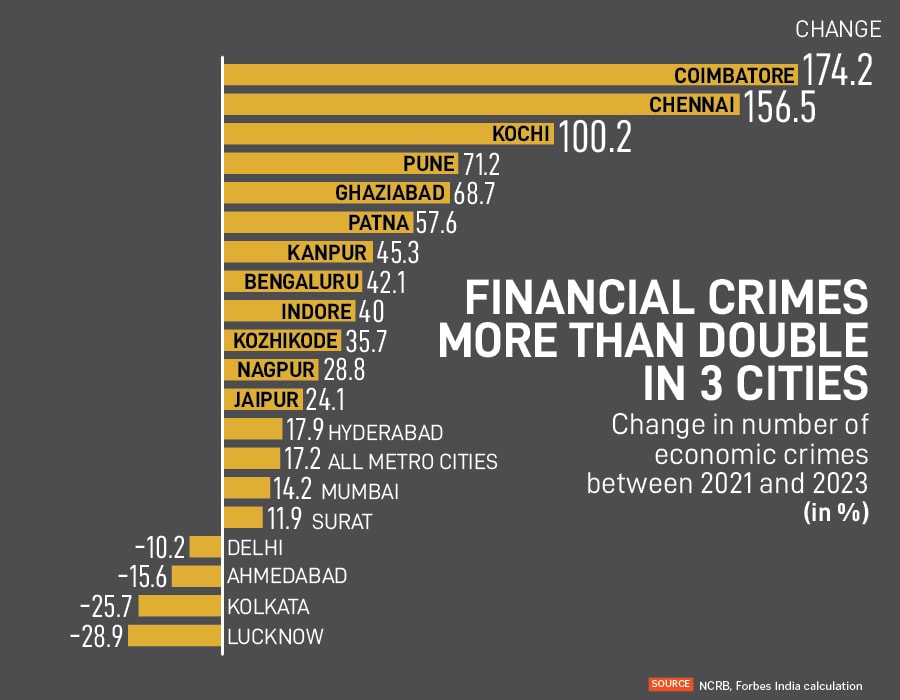

Further analysis of city-specific data indicates that financial crime is now proliferating well beyond hubs like Mumbai, Delhi, Hyderabad and Jaipur, which together account for about half of all the financial crimes across metros. Between 2021 and 2023, the growth in economic crimes in several tier 2 cities dramatically outpaced the metro average of 17.2 percent. The southern cities of Coimbatore, Chennai, and Kochi have emerged as hotspots, witnessing doubling in economic crime numbers. As financial activities and investments move to emerging economic centres driven by IT, manufacturing, and education, criminal elements are following suit by exploiting gaps in regulatory frameworks and law enforcement.

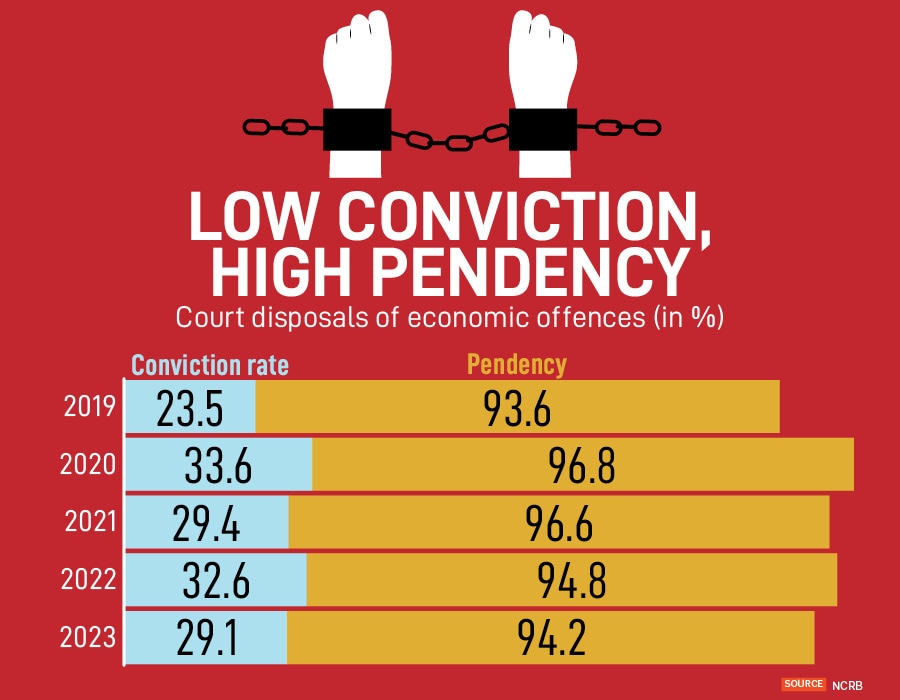

Despite the increase in economic crimes, court disposals of these offences have been slow, with massive pendency and low conviction rates. In 2023, the conviction rate stood at just 29.1 percent, which means less than three in 10 cases tried resulted in a conviction. Pendency has remained consistently above 93 percent since 2019. The conviction rate for economic offences remains lower than overall conviction rates for all IPC crimes nationwide, while the case pendency for these offences remains higher.

First Published: Oct 01, 2025, 16:50

Subscribe Now