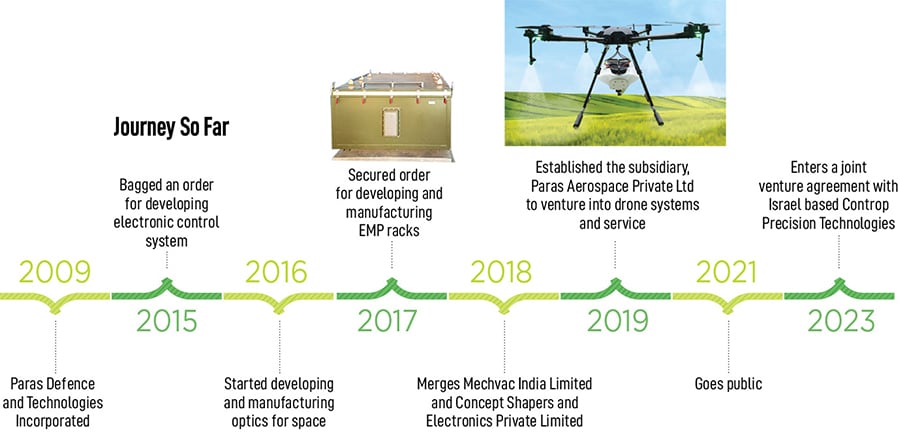

In a gist, that is the story of the father-son duo who have built the ₹2,500 crore Paras Defence and Space Technologies. Paras Defence, named after the Jain God, Parasnath, is a 40-year-old company that specialises in technologies needed for rockets and missiles, space research, naval systems, electronic warfare, drones, and quantum communication, among others.

Paras Defence currently counts the likes of DRDO, Isro, defence shipyards, Hindustan Aeronautics, Larsen & Toubro, and the Tata group among its key customers. The company went public in 2021, its issue oversubscribed was by 304.26 times, receiving bids for 217.26 crore shares against an IPO size of 71.4 lakh shares. It raised ₹170 crore, and on the day of the listing, the shares jumped a staggering 185 percent to its listing price.

“We started in the late 1970s, manufacturing mechanical parts," says Shah, managing director of Paras Defence. “We were a tier 3 company then." Today, the company’s prowess has moved into advanced technology such as providing protection against electromagnetic pulse, manufacturing telescopes for submarines, and manufacturing drones for agricultural use.

“Paras Defence is one of the few companies in India that specialises in the high-end manufacturing of electronics and optronics for defence and space applications," says Harshavardhan Dabbiru, senior defence analyst at consultancy firm GlobalData. “The company has been growing as a sub-system supplier in the Indian defence industry and is involved in some of the key aerospace and defence projects commissioned by the Indian government."

In the last few months, the company has bagged contracts for supplying submarine optronic periscopes for the Indian Navy and supplying the complete glass avionic suite for the Saras MK2 in March 2023. Saras is the first Indian multi-purpose civilian aircraft in the light transport aircraft category and was designed by the National Aerospace Laboratories.

“The core strengths of the company are a strong emphasis on research and development [R&D], as it has over the years obtained capabilities to indigenously design, develop and manufacture turnkey solutions for the defence sector," adds Dabbiru. “It also provides various defence systems and components in areas, including electronic warfare [EW] and surveillance, electromagnetic shielding, armoured vehicles, naval, and space products, which can enable the company to advance up the value chain to foray into markets offering comprehensive products and solutions in the future."

![]()

Modest, slow start

Paras was started by Shah, a businessman. He began by working with public sector companies and ordnance factories among others, supplying parts that they required as India relied heavily on imports. He would do import substitution and indigenisation, and make it locally. “In the ’80s, the PSUs started opening up for indigenisation," he says.

It was also a lucrative business, especially since margins were high, allowing Shah to plough money back into the business, to add further capacity. By the late 1990s, his son Munjal joined the business after his studies in the US.

The father-son duo then began expanding their businesses into motor tubes for rocket and missile programmes, turnkey mechanical units for liquid cooling systems, and titanium structures for naval ships and submarines. Alongside, the company had also established itself in the trading of copper, copper alloys and printed circuit boards. “From making small mechanical parts, we started doing bigger parts," Shah says. “We started partnering with more people and put together a team that could do anything under the sky in mechanical manufacturing."

By 2012, the company also expanded to optics manufacturing for thermal imaging. Around the same time, it acquired a stake in Concept Shapers, a defence electronics company, which gave Paras access to manufacturing control systems, including consoles or high-end computing devices, making it a mechanical and electronics company. “We became India ‘s number one company for optics manufacturing," Shah says. “Today we continue to enjoy the same status." Concept Shapers, of which Amit and Shilpa Mahajan were the promoters, joined Paras Defence in various capacities.

The foray into optics manufacturing along with electronics, meant that the company could now offer a bouquet of services to its customers, emerging as something of a one-stop shop offering mechanical, electronics, optical and software capability. “With this capability and exposure, we got into areas that were the need of the hour," Shah says. For instance, the company became the only one in the country to offer periscopes for submarines and now delivers one periscope every 45 days.

The focus on optics solutions brought it under the lens of Isro, which struck a partnership with Paras Defence for optical solutions that include mirrors and optics for large telescopes. The company offers the likes of multifold lenses for space imaging in nanosatellites, solid reflector antennas, and large deployable reflector subsystems.

“Because of this success, Isro wants us to now go for forward integration," Shah says. “They want us to build complete payloads or sensors that will be integrated on the spacecraft or the launch craft, and deployed wherever they want to. The company is also launching a mission that involves hyperspectral imaging technology.

“With optics, we are now into mechanical, optical, optomechanical, electromechanical, electronics, system architecture and software," Shah says.

New frontiers

Over the past few years, the company has undergone a significant transition, first by going public, and through its foray into new frontiers and setting up as many as seven new subsidiaries.

Of that, the company is now taking serious bets on its drones, unmanned aerial vehicles (UAV), and anti-drone systems. India’s drone market is expected to grow to $23 billion by 2030 according to a report by industry body Ficci and consultancy firm EY, making India the drone hub of the world. The Indian defence services are also expected to rely heavily on drones.

![]() In 2021, in an attempt to promote the indigenous drone industry, the government allowed for a production linked incentive (PLI) scheme for drones and drone components with a total incentive of ₹120 crore for the next three years. In February, the US also approved the sale of 31 MQ-9B armed drones to India at an estimated cost of $3.99 billion.

In 2021, in an attempt to promote the indigenous drone industry, the government allowed for a production linked incentive (PLI) scheme for drones and drone components with a total incentive of ₹120 crore for the next three years. In February, the US also approved the sale of 31 MQ-9B armed drones to India at an estimated cost of $3.99 billion.

“According to GlobalData estimates, India is expected to spend $16.8 billion cumulatively between 2023 and 2033 on acquiring various categories of military UAVs," says Dabbiru. “The Indian military UAV market is expected to grow at a CAGR of 7.6 percent during the same period. Similarly, the Indian Armed Forces are also expected to spend $17.7 billion cumulatively between 2023 and 2033 on procuring various EW systems. Hence, the companies competing in these sectors are expected to witness multiple growth prospects in the next decade."

“We are building optical systems for drone-based applications and building systems that are high performance for airborne platforms such as helicopters, for fighter aircraft and we are looking at specialising for drone cameras," says Shah.

In the process, Paras Defence is indigenising the manufacturing of drones, including making different types of cameras for small drones, and larger UAVs, while scaling up its offerings for the civilian sector. Civilian drones are to be used for agriculture and pesticide spraying. “Most companies are integrators, getting parts from outside India and integrating it here," Shah says. “We have started indigenising most of the key items that go into making the entire drone, including the radar."

The company is also building a crash-proof drone, which will return to the base if the user is an amateur, equipping it with drone bags, that will work like an airbag to protect the drone in case of a crash landing.

But even as it scales up its drone offerings, the company has also set up a subsidiary that is readying anti-drone devices such as jammers to protect hostile and spurious drones. “This will not be restricted to the local market, and will also be exported," adds Shah. “There’s a big export market and we will be offering very aggressive pricing."

![]()

It’s not just drones. The company’s new subsidiaries include one for quantum technologies such as quantum communication and quantum sensing. There is also a subsidiary, Mechtech Thermal Private Limited, set up this year to look into designing, developing, and validating thermal products for the aviation, defence, and space sector.

Two other subsidiaries, Ayatti Innovative makes metal products for railway coaches while Opel Technologies provides solutions for efficient sourcing globally.

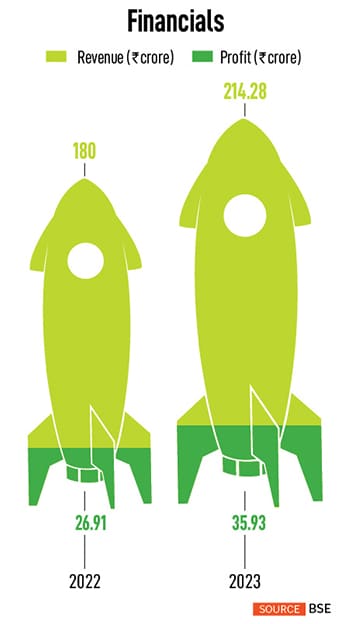

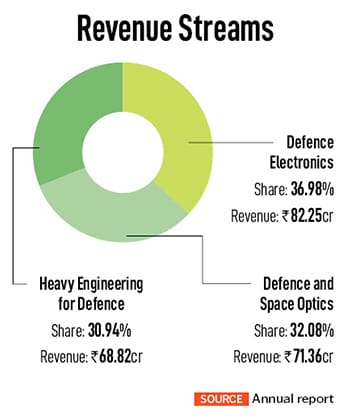

In all, the company offers over 40 products, with defence electronics contributing the most to its annual revenue. Last year, the company’s revenues grew by 20 percent to ₹214.28 crore, while profits surged 37 percent to ₹35.93 crore. Today, Paras is also the only company in India providing turnkey EMP protection solutions. An electromagnetic pulse (EMP) is a burst of electromagnetic radiation that can damage or destroy electronics and is used in modern warfare.

The IPO edge

Much of the growth in recent times, Shah says, is also due to its decision to go public. In 2021, when Paras Defence went public, its IPO was the second most subscribed issue of the year. The company has very few peers in its category, while the government’s push towards indigenisation for the Indian defence and space sector, also helped Paras attract investors.

“We knew we had to one day get there in order to change your profile," Shah says. “Now people look at your market capitalisation and know you."

![]() The company has a funnel of over ₹1,500 crore, of which it reckons that as much as 90 percent is recognisable. “These days, you get a call saying I want to get married to you," Shah says about new partnerships being formed. “They will say you are very beautiful and lets us let us get married in a week. We will meet at a common place where we discuss engagement and within a month both the lawyers come together and get the deal done." Among its newest partners are Israel-based Controp and US-based US-based Mico-Lam. The company also has partnerships with ISISpace for CubeSat sub-systems, Holland Shielding Systems BV for EMP shielding products, and Invent Gmbh for carbon fiber-reinforced plastic (CFRP) structures.

The company has a funnel of over ₹1,500 crore, of which it reckons that as much as 90 percent is recognisable. “These days, you get a call saying I want to get married to you," Shah says about new partnerships being formed. “They will say you are very beautiful and lets us let us get married in a week. We will meet at a common place where we discuss engagement and within a month both the lawyers come together and get the deal done." Among its newest partners are Israel-based Controp and US-based US-based Mico-Lam. The company also has partnerships with ISISpace for CubeSat sub-systems, Holland Shielding Systems BV for EMP shielding products, and Invent Gmbh for carbon fiber-reinforced plastic (CFRP) structures.

“The launch of the Indian Space Association in October 2021 is promoting the participation of private players in space projects," says Dabbiru. “This is expected to provide growth opportunities for Paras Defence, especially for their space-based products such as the hyperspectral imaging systems, along with their space-based C4ISR systems, avionic suites for rockets and missiles, space optronics, and CFRP structures, among others."

Dabbiru also sees enormous opportunities for Paras when it comes to the government’s push towards more defence platforms, such as submarines, naval vessels, armoured vehicles, and aircraft platforms, indigenously in the coming years, with a high focus on developing local supply chains.

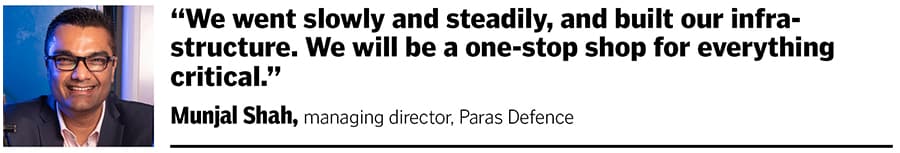

So where does Paras go from here? “We do not come from any inheritance," Shah says. “We went step by step, slowly and steadily, and built up our infrastructure. Revenues are going to grow, and we will be a one-stop for everything critical."

In 2021, in an attempt to promote the indigenous drone industry, the government allowed for a production linked incentive (PLI) scheme for drones and drone components with a total incentive of ₹120 crore for the next three years. In February, the US also approved the sale of 31 MQ-9B armed drones to India at an estimated cost of $3.99 billion.

In 2021, in an attempt to promote the indigenous drone industry, the government allowed for a production linked incentive (PLI) scheme for drones and drone components with a total incentive of ₹120 crore for the next three years. In February, the US also approved the sale of 31 MQ-9B armed drones to India at an estimated cost of $3.99 billion.

The company has a funnel of over ₹1,500 crore, of which it reckons that as much as 90 percent is recognisable. “These days, you get a call saying I want to get married to you," Shah says about new partnerships being formed. “They will say you are very beautiful and lets us let us get married in a week. We will meet at a common place where we discuss engagement and within a month both the lawyers come together and get the deal done." Among its newest partners are Israel-based Controp and US-based US-based Mico-Lam. The company also has partnerships with ISISpace for CubeSat sub-systems, Holland Shielding Systems BV for EMP shielding products, and Invent Gmbh for carbon fiber-reinforced plastic (CFRP) structures.

The company has a funnel of over ₹1,500 crore, of which it reckons that as much as 90 percent is recognisable. “These days, you get a call saying I want to get married to you," Shah says about new partnerships being formed. “They will say you are very beautiful and lets us let us get married in a week. We will meet at a common place where we discuss engagement and within a month both the lawyers come together and get the deal done." Among its newest partners are Israel-based Controp and US-based US-based Mico-Lam. The company also has partnerships with ISISpace for CubeSat sub-systems, Holland Shielding Systems BV for EMP shielding products, and Invent Gmbh for carbon fiber-reinforced plastic (CFRP) structures.