Investor appetite fading for IPOs of new-age tech companies

Even as the listing rush made a late start in 2023, new-age tech companies, considered to be the darling of investors, went missing from fundraising in the capital markets. What went wrong?

Investors warmed up to Indian primary markets fundraising only in the second half of 2023 as equities remained veiled under uncertainties, mostly due to geo-political crisis. Even as the IPO rush made a late start in 2023, ‘new age tech companies’ (NATC), the darling of investors, went missing from fund raising activities in the capital markets. Valuation concerns made bankers and promoters nervous about such companies going public as investors scouted for profitable companies with low cash burns and stable margins.

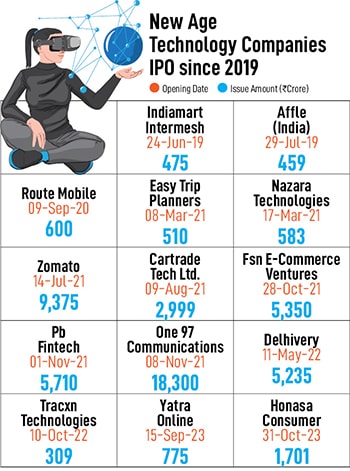

There were only two companies from the NATC space, which cumulatively raised Rs2,476 crore through the initial public offering (IPO) route in 2023. Shares of Yatra Online made a stock market debut in September while Mamaearth’s parent Honasa Consumer was listed in November. The pomp and show of this category of companies was in display in 2021 when most bankers and private equity experts banked on them to lead the IPO rally with promises of juicy returns.

Following Covid, when markets were flushed with abundant liquidity due to low interest rates triggering spectacular equities rise in late 2020 and 2021, these category of companies entered into primary markets with glitz and hype. However, that fizzled out soon as these companies’ path-to-profitability remained invisible while stock markets performances were shaky on heavy dumping down after the initial days of listing.

“The performance of NATC stocks after their IPOs in 2021 have made investors rethink their investment rationale. They now lay greater importance on profitability, or at least a path to profitability in the near term that is clearly visible," says Venkatraghavan S, managing director -investment banking, Equirus.

He draws a parallel of the current situation to the IPOs of infrastructure development companies in the mid to late 2000s, where it was not just about winning projects, but about actually executing them profitably or of real estate company IPOs in the same period, where the focus moved away from owning land banks to actually developing them and monetising them profitably.

Large new-age technology companies like Nykaa (FSN E-Commerce Ventures), Zomato and Paytm (One97 Communications), which went public in 2021, have performed badly in the secondary markets with severe value erosion for shareholders. For instance, investors in the IPO of One97 Communications lost almost 70 percent of their investment by 1.5 years of the issue. That made investors conscious of valuations of IPO-bound companies and raise questions on their business prospects.

Investors are now increasingly growing concerned about steep valuation premium commanded by some of the new age companies with a more realistic expectations of profitability and refocusing on fundamentals. They are becoming more selective and betting on resilient companies with solid growth plans.

“There are several factors at play that have delayed IPO plans by the NATCs. The poor post IPO performance of some of India’s start-up unicorns which went public in 2021 dampened the market sentiment towards such issuers coupled with larger global macro-economic concerns," reasons Abhimanyu Bhattacharya, partner, Khaitan & Co.

The broader macro-economic slowdown had an adverse impact on fund-raising plans by issuers across the board. “A number of NATCs which listed in the ‘Go-Go’ year of 2021 saw their stock price nose-dive post IPO due to global inflationary pressures, geo-political conflicts, and their own financial performance. Whilst several IPO bound NATCs are waiting on the sidelines to go public in 2024, cash flow positive issuers will find the runway smoother for a successful listing," Bhattacharya elaborates.

In 2021, seven companies from the NATC space raised a cumulative sum of Rs42,826 crore following by a dry spell run in following two years. Among the seven, Paytm owned by One97 Communications was the largest issue raising Rs18,300 with an overall subscription of 1.8 times. Next in line was Zomato which raised Rs9,375 crore, Policybazaar owned by PB Fintech (Rs5,710 crore), Nykaa owned by FSN e-Commerce Ventures (Rs5,350 crore), Carwale (Rs2,999 crore), Nazara Technologies (Rs583 crore) and EaseMyTrip (Rs510 crore). Next year saw only two companies in the category going public: Delivery (Rs5,235 crore) and Tracxn Technologies (Rs309 crore).

The IPO landscape for the new age technology companies has been underwhelming due to elevated valuations, escalated uncertainty, and a need for firms to turn towards positive cash flows and good margins. Hence, the lack of these factors has shaken the confidence level a bit, explains Jahnavi Prabhakar, economist, Bank of Baroda.

She adds that the prolonged squeeze in funding for startups has continued and the demand for such start-ups have relatively been lower. The focus is more towards better governed firms, with improving profitability is much needed as the current juncture. “Given the tight financial conditions and ever evolving macroeconomic landscape, the focus has shifted back once again towards the fundamentals: realistic valuations, right pricing and a strong business model," Prabhakar adds.

However, Bhattacharya does not agree that the appetite to chase unicorn IPO is fading away soon in India. “The market retains a keen interest for unicorns which can demonstrate profitability and positive cash flows," he adds.

Primary markets remained dry and slow in the first six months of the year followed by a super hectic period of new stocks going public in the last few months of 2023. There were 46 IPOs in 2023 so far, raising a cumulative Rs 41095.36 crore, according to Forbes India analysis based on data sourced from Prime Database. The number will rise further more by December-end as few issues are still open for subscription and waiting to be listed. This is around 30 percent lower than Rs 59301.7 crore worth of amount raised through 40 IPOs in 2022, which also included a large issue like Life Insurance of India (LIC). LIC’s IPO issue size, in May 2022, was Rs 21,008.48 crore, largest ever in Indian history.

In the record-breaking blockbuster year of 2021, 63 IPOs raised a whopping Rs1,18,723.17 crore, from Rs26,612.61 crore in previous year.

In the record-breaking blockbuster year of 2021, 63 IPOs raised a whopping Rs1,18,723.17 crore, from Rs26,612.61 crore in previous year.

According to EY India, India emerged as the global leader in the number of IPOs year-to-date in 2023. The July-September period of 2023 saw a staggering 21 IPOs in the Indian main market, compared to just four in the same quarter of 2022.

The three largest IPOs in Q3 in terms of proceeds were RR Kable, Concord Biotech, and SAMHI Hotels. Key sectors contributing to this IPO surge included diversified industrial products, consumer products and retail, and technology.

“The IPO landscape is witnessing a surge in activity driven by both an urge to tap the capital markets pre-or-post Indian general elections and strong economic activity, positive domestic and foreign investor sentiment towards India. This momentum is expected to continue well into second half of 2024. To capitalise on this unprecedented growth, businesses must focus on maintaining transparency, robust governance, and innovation in their business models," Adarsh Ranka, partner and financial accounting advisory services leader, member firm, EY Global, says.

In 2023, there were few regulatory developments aimed at enhancing disclosures and market practices, including the introduction of the T+3 (trading plus three days) mechanism for IPOs. This mechanism allows companies to list three days post-closing of the issue, as opposed to six days earlier. This voluntary measure will become mandatory from December 2023.

“Issuers from the traditional sectors were first off the block to list. Whilst these were not “billion-dollar deals" such issuers received tremendous investor interest for reasons mentioned above and it is likely that they have paved the way for a revival of the IPO market in 2024 to host the larger deals," Bhattacharya adds.

As the country is gearing up for general elections in May 2024, promoters and bankers are aiming to rush with their stock markets listing as equities tend to get volatile during the voting period. Adding to that is the uncertainty of economic and business policy continuation if a new political party is voted to power and form a government.

“The pipeline that appears to be building up for IPOs in 2024 appears to be a robust one and is likely to gather steam post general elections in the next year. The market should see a mix of issuers – NATCs as well as from the traditional sectors of the economy. The positive market sentiment towards issuers with good fundamentals as demonstrated by the last round of listings this year is expected to gather momentum and carry on to 2024," says Bhattacharya.

There is a possibility of a lull period in the couple of months leading to the general elections, where the market could be volatile and investors (both FIIs and Domestics) would take a pause and avoid looking at new positions via IPOs, but I believe that would just be a temporary phenomenon.

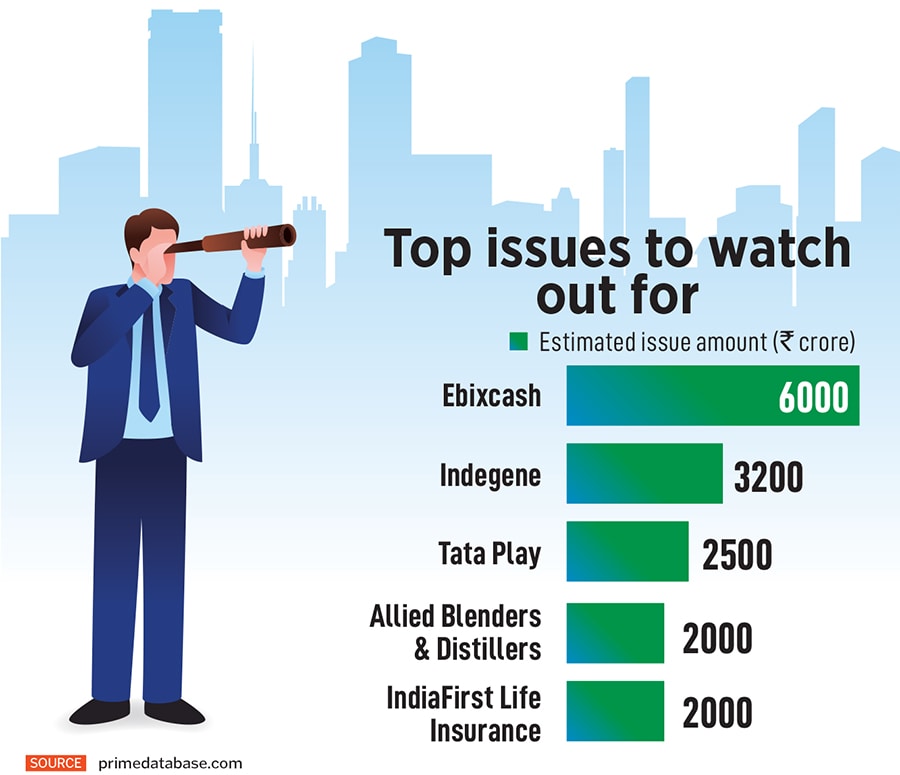

According to Prime Database, there are 28 companies which have received approval for listing to raise Rs31,040 crore in primary markets. In addition to that another 32 companies are waiting for market regulator’s approval, planning to raise Rs35,700 crore through IPO.

As the world sheds uncertainty on account of geo-political challenges, stability in the commodity market, and the beginning of the rate cut cycle by Central Bank these factors are expected to boost the global market, says Prabhakar.

“However, if these conditions do not transpire, the firms have to be prepared to remain agile, with realistic valuations, the adoption of new innovative models, availability of working capital and a healthy balance sheet as they move to maintain their profitability in order to make a mark in the IPO market. In addition, for India, there might be a wait and watch approach ahead of the elections, after which some pick-up might be seen," she explains.

First Published: Dec 18, 2023, 16:33

Subscribe Now