Tata Technologies IPO gambit: Will it pay off?

A quick scan of analysts' views on the Tata Technologies IPO will make investors enthusiastic at the prospects. The first public issue by a Tata company in almost two decades has made it look more app

The eagerness of investors to grab shares of Tata Technologies in its initial public offering (IPO) round is quite palpable. The valuation of the issue is priced at a discount compared to its peers in the mid-segment of IT services companies with a favourable risk reward for investors. However, the growth of Tata Technologies has remained slower than its peers in the period FY16-23, but has been gradually picking up pace.

What may work in the company’s favour are its brand legacy, as it belongs to the Tata group, extensive automotive expertise and diversified global presence, according to analysts.

With a price band of Rs 475-Rs 500 apiece, Tata Technologies is aiming to raise Rs 3,043 crore. The company is valued at roughly Rs 20,283 crore and is only an offer-for-sale (OFS) by promoter Tata Motors and investors Alpha TC Holdings and Tata Capital Growth Fund 1. The issue will remain open for subscription from November 22-24.

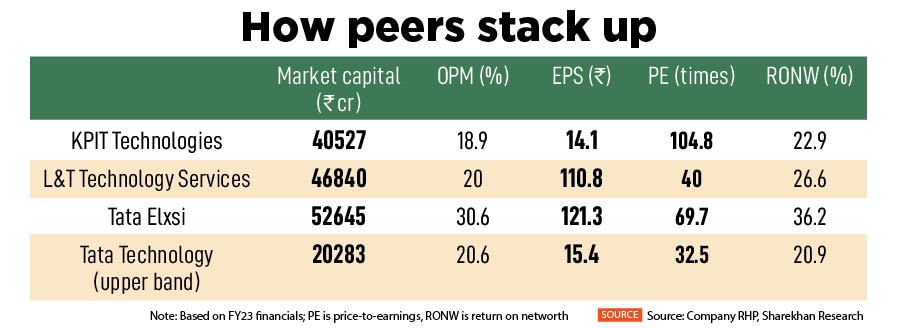

The offer is valued at 32.5 times and 30.9 times its FY23 earnings per share (EPS) at upper and lower price band respectively, say analysts at Sharekhan by BNP Paribas. “The issue price is at a steep discount of 69 percent and 53 percent to its peers KPIT and Tata Elxsi on FY23 financials. At annualised EPS, the IPO is valued at 28.8 times it FY2024E EPS, Tata Technologies’ future outlook is promising given its proven track-record, established capabilities in ER&D services and focus on adjacencies of Aerospace & TCHM (transport and construction heavy machinery)," they add.

Based on FY23 financials, KPIT Technologies shares are available at 104.8 times PE, which is the most expensive in the segment, show calculations by Sharekhan. Tata Elxsi PE is at 69.7 times while L&T Technology Services is at 40 times.

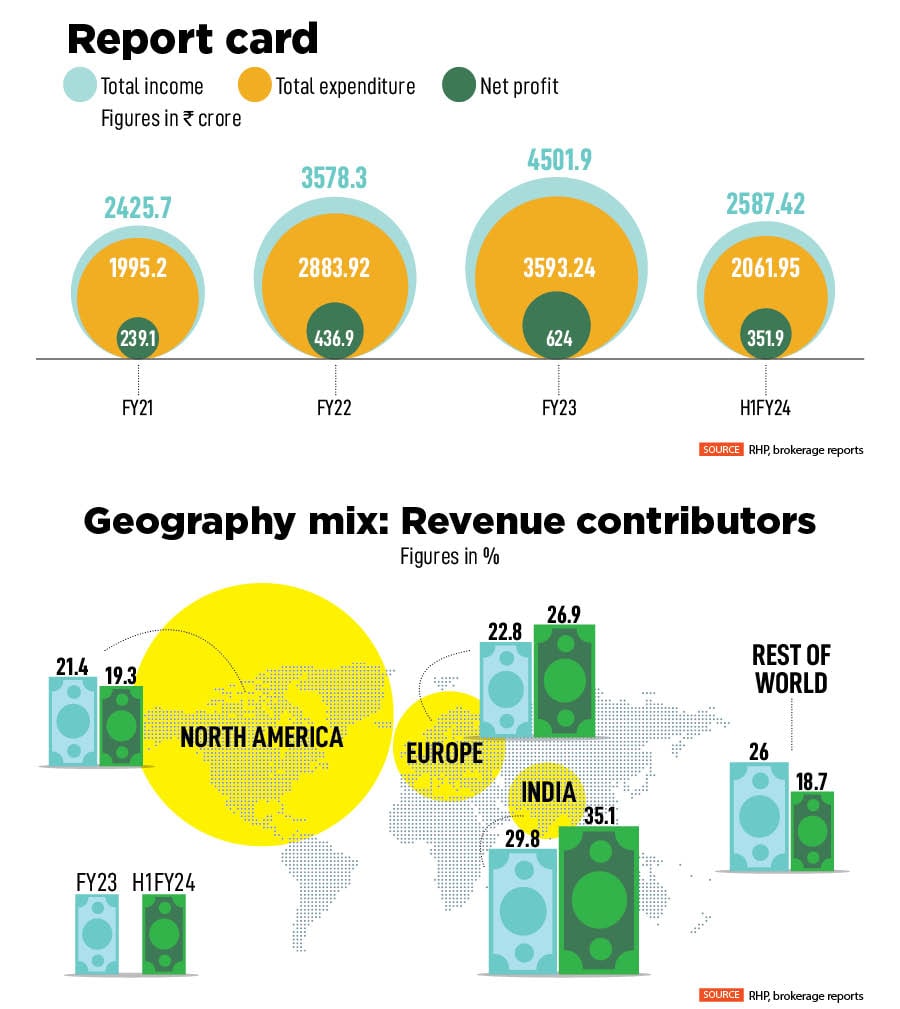

In the year ending March 2023, the total income of Tata Technologies was at Rs 4,501.9 crore rising from Rs 3,578.3 crore in the year-ago period and Rs 2,425.7 crore in FY21. In the same period, even the net profit has grown but so has expenses.

Net profit in FY23 was Rs 624 crore, up from Rs 436.9 crore and Rs 239.1 crore in FY22 and FY21, respectively. In FY23, expenses mounted to Rs 3,593.24 crore from Rs 1,995.2 crore in FY21. In the first six months of current financial year, it hit a net profit of Rs 351.90 crore on a total income of Rs 2,587.42 crore but expenses also stayed high at Rs 2,061.95 crore.

Analysts at SBI Securities believe that Tata Technologies is well placed to encash on the growth opportunities in the ER&D (Engineering Research & Development) space and look at the relatively cheaper valuations. However, the company’s revenues are highly dependent on clients concentrated in the automotive segment, drawing 69 percent of total revenue which makes it risky.

“An economic slowdown or factors affecting this segment may have an adverse effect on the business, financial condition and results of operations," SBI Securities explain. Revenue from the top five clients stands at 57.4 percent of the total revenue and 70.9 percent of the services segment revenue. Jaguar Land Rover, Tata Motors and VinFast are its top clients.

They are also concerned that its group companies like TCS and Tata Elxsi operate in a similar line of business, which may lead to competition with these entities and could potentially result in a loss of business opportunity for the Tata Technologies.

Devang Bhatt, analyst, IDBI Capital, also agrees that if any or all of the top five clients were to suffer a deterioration of their business, cease doing business with the company or substantially reduce their dealings, the company’s revenues could decline, which may have a material adverse effect on the company’s business, results of operations, cash flows and financial condition. However, Bhatt is impressed with the company’s fair valuations and its business strategy plans.

“The company has a comprehensive portfolio of services for the automotive industry that addresses the entire automotive value-chain from concept design to vehicle launch. It also offers turnkey full vehicle development solutions for traditional internal combustion engine powered vehicles, plug-in hybrids and battery electric vehicles, which have been developed over a period of 10 years," Bhatt adds.

Tata Technologies is a pure-play manufacturing ER&D primarily focussed on the automotive industry. ER&D services is defined as the set of services offered to enterprises on activities, which involve designing and developing a device, equipment, assembly, platform, or application such that it may be produced as a product for sale through software development or a manufacturing process. Promoted by Tata Motors, Tata Technologies was incorporated in 1994.

Tata Tech caters to the automotive vertical—the second-largest in terms of global R&D spend with third-party outsourcing mix of 10 percent, which is around $17-18 bullion.

“Although Tata Tech concentrates its outsourced spending in key areas, the emerging sectors of hybrid and electric mobility/powertrain and AD-ADAS align with competitors such as KPIT, Telx, and L&T Technology Services. Growing investment in electric and hybrid vehicles underscores the need for lightweight architecture, a domain in which Tata Tech with its mechanical expertise would play a significant role," says Dipesh Mehta, analyst, Emkay Global Financial Services.

As the existing promoters are making a stake sale, the issue is an OFS. Although the company will not receive any proceeds from this offer, the prime purpose of the issue is to achieve the benefits of listing shares on stock exchanges.

The company has already raised Rs 791 crore via anchor book from a clutch of 67 investors.

Anchor investors include global investors like Goldman Sachs, Government Pension Fund Global, BNP Paribas Funds, Prudential Assurance Company, HSBC Global, Florida Retirement System, Oaktree Emerging Markets Equity Fund, Brinker Capital Destinations Trust, Great Eastern Life-Singapore Life Insurance Fund, RBC Asia Pacific Ex-Japan Equity Fund, and Copthall Mauritius Investment.

First Published: Nov 22, 2023, 14:48

Subscribe Now