Mamaearth's parent valuations fair play?

The digital-first BPC brand aims to raise around Rs 1,701 crore via IPO, with a price band of Rs 308-Rs 324 a share. Will the new valuations fetch fresh investors for Mamaearth's parent in primary mar

Even as Honasa Consumer, which owns the flagship brand Mamaearth, has stripped its valuations to raise funds via the initial public offering (IPO) route, not all are convinced. It is pegged roughly at a valuation of $1.2 billion (Rs 10,000 crore) in its current form, which is much less than what the company had earlier projected, at $3 billion (Rs 24,000 crore), in its draft red herring prospectus (DRHP) last December. Its current valuation is similar to its fundraising in January 2022, when the company was valued at $1.2 billion.

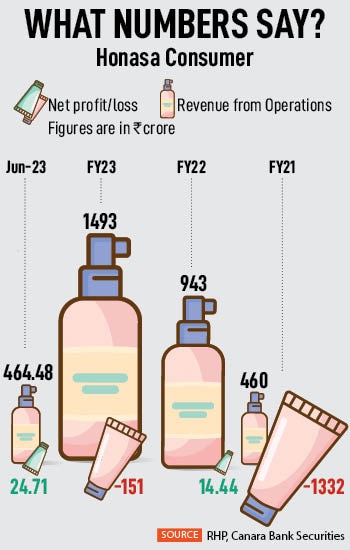

“Based on its annualised FY24 earnings per share, the IPO appears to be aggressively priced at 97 times, discounting all immediate positive factors and seems like the company is leveraging its proven track record to justify a premium valuation," say analysts at brokerage firm BP Equities. They explain that along with its recent profitability, Honasa’s ongoing struggle to fortify its bottom line and ensure sustainable earnings growth demand cautious consideration. Honasa generates the bulk of its business from Mamaearth, with its revenue dependence at 82 percent in FY23, which is concerning and high risk, say analysts.Honasa Consumer posted a net loss of Rs 151 crore in FY23 compared to a net profit of Rs 14.44 crore in FY22. It had closed FY21 with a net loss of Rs 1,332.21 crore. In the latest available financials, for the three months ending June, it reported a net profit of Rs 25 crore. Its revenue has grown at a CAGR of 80 percent over FY21-23, with a volume growth of 102.28 percent. As on FY23, it has an adjusted Ebidta of 3.4 percent, with negative working capital due to its asset light model.

The digital-first beauty and personal care (BPC) brand aims to raise around Rs 1,701 crore, with a price band of Rs 308-Rs 324 a share. The offer consists of a fresh issuance of shares worth Rs 365 crore, and an offer-for-sale (OFS) of 4.13 crore equity shares by promoters and investors. The issue will be open for subscription from October 31 to November 2.

Based on the upper band of the price, Nitin Gupta, analyst at Emkay Global Financial Services, considers three scenarios to assess its valuations. He finds valuations of Honasa Consumer expensive, in a scenario where revenue CAGR would be 10 percent with Ebidta margin at 6 percent. For Gupta, the valuation looks attractive in a scenario where the company looks to double its turnover in the next three years, while it looks fair when the company would register a 20 percent revenue CAGR with Ebidta margin at 10 percent.

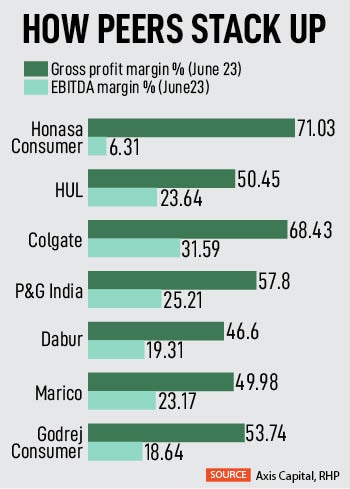

With gross margin at 70-75 percent, Honasa is aiming to build profitability with scale. “Offline expansion is likely to add wings, thus helping sustain healthy growth for its brand offerings. Given expanding retention rates, customer acquisition costs gradually taper. Additional benefits can be expected in marketing spends [for Mamaearth, spends have started moderating] and freight costs [with expected slow growth in online volume]. With Honasa’s production being fully outsourced, Ebidta flow to earnings is likely to be smooth," Gupta adds. He points out Honasa’s high revenue concentration on a single brand (Mamaearth), high ad spends and its inability to turn around acquired businesses as key risks.

In Q1FY24, Mamaearth’s brand sales in the D2C channel have seen a decline (revenue contribution in online sales reduced to 36 percent in Q1FY24 compared to 47 percent in Q1 FY22), due to the company defocusing on the D2C platform for growth. The D2C platform saw revenue from existing customers rising to 63 percent, while any slowdown in new-customer recruitment will have a negative effect on its growth aspirations.

A beautician uses a day cream of Indian skincare startup Mamaearth as she tends to a customer inside her parlour in Ahmedabad, India. Image: Reuters/Amit Dave

A beautician uses a day cream of Indian skincare startup Mamaearth as she tends to a customer inside her parlour in Ahmedabad, India. Image: Reuters/Amit Dave

The company has built its portfolio of inorganic brands, where successful scale-up would be key. “In the recent past, the company had to scale down Momspresso’s platform, given no visibility on profitability. To this end, the company has recorded impairment loss of Rs 136 crore on goodwill. Additional businesses that the company acquired are BBlunt, a products and salon network, and Dr Seth’s," Gupta adds.

According to Akshay R Pradhan, analyst at Canara Bank Securities, weakness in financial performance is one of the key risks of Honasa. The company has experienced negative cash flows from operating, investing and financing activities in the past. “It has recorded losses in the past. Any losses in the future may adversely impact their business and the value of the equity shares. Subsidiaries including Just4Kids, BBlunt, B:Blunt Spratt and Fusion have incurred losses for certain historical periods. There is no assurance that these entities will be profitable in the future," Pradhan adds.

However, he feels the issue is fairly valued. “The company continuously strives for expansion of distribution by creating brand awareness. In terms of valuation, it is available at enterprise value-to-sales [EV/S] of 6.76 times, which seems fairly valued," he explains.

There are no listed companies in India and globally that are of comparable size from the same industry as that of Honasa. Accordingly, Honasa has not provided an industry comparison in relation to itself. However, there are listed companies in India that are of larger size, with longer operating histories and varied business models and offerings, that operate in the FMCG space, including the BPC segment. Honasa considers few listed companies as their competitors with respect to their BPC products. These companies include Hindustan Unilever, Colgate Palmolive India, Procter & Gamble Health & Hygiene, Dabur India, Marico, Godrej Consumer Products, Emami, Bajaj Consumer Care, and Gillette India.

The primary raise will be directed toward bolstering marketing efforts to enhance brand visibility, establishing new exclusive brand outlets and expanding the network of BBlunt salons. Bulk of the fund-raise can be attributed to OFS, where the promoters and existing investors are looking to monetise investments. Selling shareholders in the OFS category include the promoter duo (Varun Alagh and Ghazal Alagh), followed by Sofina Ventures SA, Evolvence India, Fireside Ventures, Stellaris, Kunal Bahl and Rohit Kumar Bansal (of Snapdeal), Rishabh Mariwala (of Sharrp Ventures), and actor Shilpa Shetty Kundra.

Redseer’s analysis of the financials of listed entities globally suggests that the valuation of pure-play BPC companies is at a premium to FMCG-led BPC companies. This premium is attributed to faster growth and better gross margin profile. High gross margin enables pure-play companies to invest in the brand and drive scale.

Retail investors may gingerly approach Honasa, as recent IPOs like Paytm, Nykaa, Zomato, CarTrade and PB Fintech, which sought high valuations, have seen mighty corrections after stock market debuts. Also, in the last few weeks, overall stock market sentiment has been bearish due to factors like spike in US bond yields, rising crude prices and geo-political crises.

First Published: Oct 31, 2023, 12:58

Subscribe Now