IPOs heat up again; issues worth Rs39,000 cr to test market's appetite

28 companies are aiming to raise a total of Rs38,690 crore through public listings. Is weakness in the markets prepared to absorb such liquidity now?

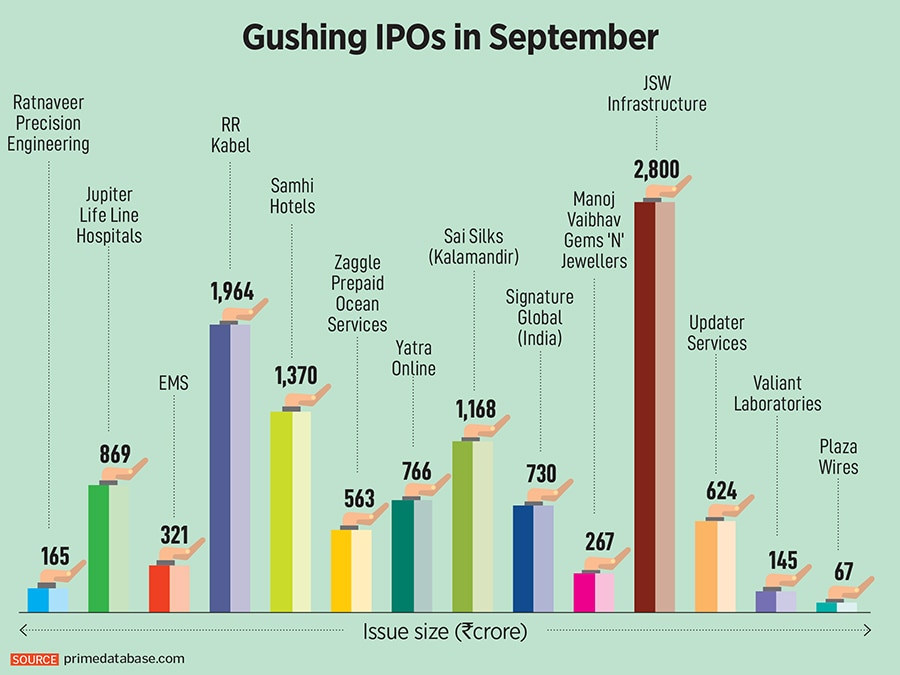

Who says IPO markets have cooled off or have lost their charm? A glance at the primary markets in September will show a picture that is just the contrary. In September, 14 companies launched their initial public offerings (IPOs) to cumulatively raise Rs11,821 crore, in one of the busiest months of the primary markets in 2023. However, the stock markets were weak, with the Sensex declining around 300 points in September.

Typically, strong secondary markets follow a gush of IPOs, when promoters remain confident of their companies’ valuations and their ability to raise funds. Healthy markets in July and August boosted that confidence, but the rally fizzled out soon, puzzling investors and promoters of companies, and may further pose a threat to the slew of IPOs waiting to open for subscriptions and subsequent listings.

A total of 28 companies are aiming to raise a cumulative sum of Rs38,690 crore and have received approval from the Securities and Exchange Board of India (Sebi), according to a Forbes India analysis based on Prime Database. Some of the big companies in the fray are EbixCash (Rs6,000 crore), Tata Technologies (Rs5,000 crore), Indegene (Rs3,200 crore), Tata Play (Rs2,500 crore), IndiaFirst Life Insurance (Rs2,000 crore) and Honasa Consumer, owner of MamaEarth (Rs400 crore).

Another 32 companies have filed offer documents with Sebi and are awaiting its approval. Some marque companies awaiting approval are Oravel Stays, owner of Oyo Hotels (Rs 8,430 crore), NSDL (Rs4,500 crore), Fincare Small Finance Bank (Rs1,000 crore), Muthoot Microfin (Rs1,350 crore), Fedbank Financial Services (Rs1,700 crore) and Jana Small Finance Bank (Rs1,100 crore).

However, unfavourable factors such as crude oil nearing $100 per barrel, which may weigh on inflation toppling the fiscal maths, are already threatening the rise of Indian equities. Foreign institutional investors (FIIs) have also started withdrawing money from equities, with the net outflow at $1.66 billion in September.

“Weakness in the secondary markets is of course concerning for those promoters waiting to launch their companies’ IPO," says Deepak Jasani, retail research head, HDFC Securities. He explains that once issues lose their premiums in subscriptions or on the first day of listing, attractiveness of primary markets among investors takes a hit. “But at times, lower subscription of issues also means higher allotment of shares to those who bid for it, and hence less disappointment. This is the positive side to it," Jasani adds. According to him, as market returns are falling, promoters may hold their fund-raising plans via IPOs and the primary markets may revive only when equities get back on their feet. Jasani doesn’t see the markets going higher in the medium term due to rising interest rates and declining institutional flows.

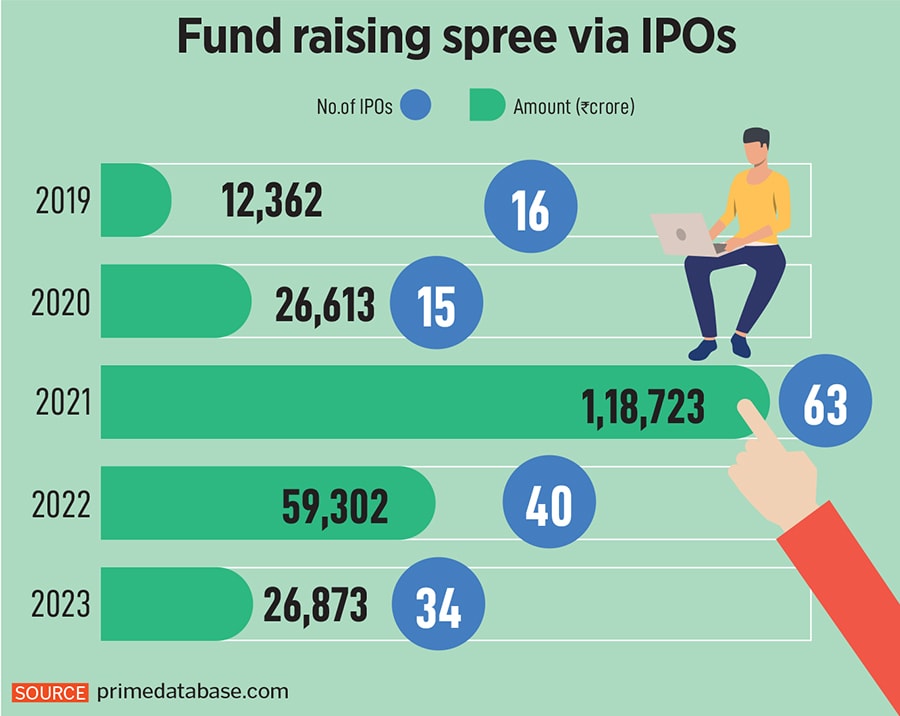

There was a lull in the primary markets in the last few months. So far this year, 34 companies have raised funds via IPOs, with a cumulative issue size of Rs 26,872 crore. This compares to 40 issues in previous years raising Rs59,302 crore. IPOs broke all records in 2021, with 63 companies hitting the markets and raising a combined Rs1,18,723 crore.

However, this is a global phenomenon. In the first nine months of 2023, global IPO volumes fell 5 percent, with proceeds down by 32 percent year-on-year, shows an EY analysis. In the first three quarters of 2023, there were 968 IPOs globally, with $101.2 billion in capital raised, a 5 percent and 32 percent decrease year-over-year (y-o-y), respectively.

“In the past decade, IPO numbers and proceeds from emerging markets have both increased by more than 30 percent, primarily due to faster economic growth compared to developed countries. Until this point of 2023, emerging markets accounted for 77 percent of the global share by number and 75 percent by proceeds," says George Chan, global IPO leader, EY.

According to Chan, investors will continue to care more about the fundamentals, such as strong balance sheets, healthy cash flows, and resilience amid weak economic conditions, rather than how fast the company can grow and how high the valuation could reach.

Faced with tighter liquidity and a higher cost of capital, investors are turning to companies with strong fundamentals and a path to profitability, he adds. In response, IPO prospects need to demonstrate their financial health and potential for value creation. As valuation gaps narrow, investors are reviewing the post-listing performance of the new cohort of IPOs, which, if positive, could renew market confidence.

Also Read: New IPOs lock-in to expire till December: Will stocks face outflows?

As in previous years, IPOs still predominately offer exit routes for existing shareholders rather than raise fresh capital. According to an analysis by Kotak Institutional Equities, offer-for-sale (OFS) amounts have been significantly higher than fresh capital issuance amounts over 2018-23. Private equity (PE) and venture capital (VC) investors have made exits through both the primary (IPOs) and secondary (block deals) market routes.

“The trend of PE exits has accelerated in 2023 as they have used buoyant secondary market conditions to sell their holdings (full or part) to institutional (foreign and domestic) and retail investors," says Sanjeev Prasad, MD and co-head, Kotak Institutional Equities.

As a result of promoter sell-offs, promoter holdings in the BSE-200 Index have declined to 48.8 percent in the June quarter from 50.3 percent in the preceding three months. The combined holding of domestic investors has increased by 90 basis points to 23.5 percent at the end of the June quarter.

First Published: Sep 28, 2023, 18:11

Subscribe Now