TCS: Layoffs are a low-hanging fruit

In the absence of clear growth drivers, the layoffs announcement at India's largest IT services company failed to enthuse investors

News of layoffs at TCS, India’s largest IT services company, sent a collective chill down the spines of both employees and investors.

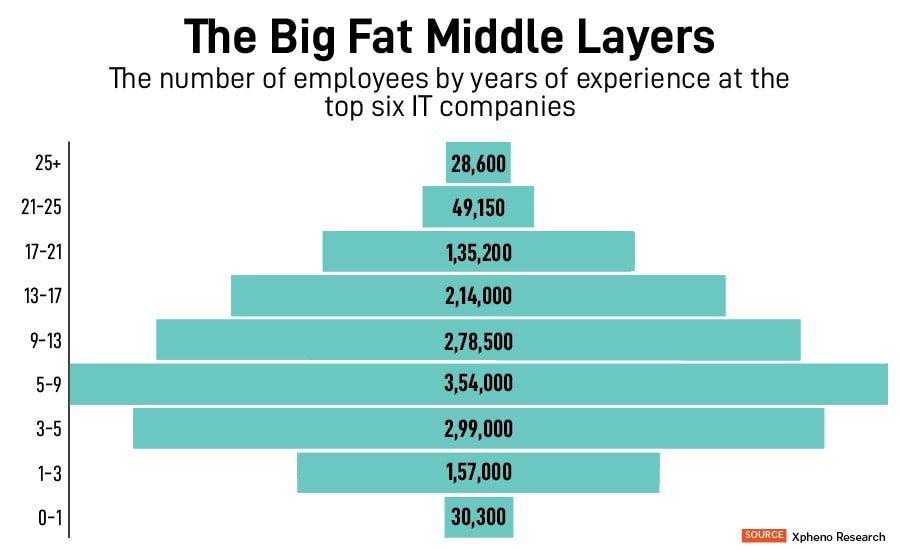

Foremost on their minds was the thought that, after three years of tepid growth, low or non-existent wage hikes and a slow pace of hiring, companies may have to resort to trimming their workforce in order to maintain profitability as well as prepare for an era that demands a vastly different set of skills. The TCS layoffs will target 12,000 mid- and senior-level employees, or 2 percent of its workforce.

Still, if TCS believed that investors would be enthused with this response, the Day 1 reaction showed that markets value growing, agile businesses more than shrinking, floundering companies. According to analysts Bernstein, this was the third action in the last three months that pointed to the company focusing on conserving margins. In April, it deferred wage hikes and, in June, it restricted the number of non-billable days for employees to 35 in a year.

The layoffs point to a deeper malaise in IT companies. Over the past year, the Nifty IT Index is down 13 percent, compared to 0.6 percent for the Nifty. Among IT companies, it is the frontline ones that have borne the brunt, with TCS down 30 percent, Infosys 19 percent, Wipro 5 percent and HCL Tech 10 percent. A key reason for this is uncertainty over future growth prospects and the terminal value of these businesses. Reducing hiring, laying off people and deferring wage hikes are unlikely to give investors a clear picture on growth.

While AI is often pointed to as a threat to entry-level jobs, a significant issue has been the lack of agility these new companies have shown in dealing with clients.

Second, large product companies like Amazon, Meta and Netflix have laid off 1.22 lakh employees in the US over the last year. As a result, the business Indian IT companies would get from them has also dried up. This ties in with the fact that IT spending globally has been weak on account of rising tariffs and the uncertainty they bring.

Third has been the rise of freelance platforms–Fiverr, Upwork, Freelancer, Guru. These have allowed businesses to parcel out work in a manner that bypasses large companies. “Now, people whose core skill is managing people find their roles being questioned," says Karanth, pointing to the fact that mid- to senior-level people need to be either tech, domain or client experts to survive.

India’s top six bellwether IT companies—TCS, Infosys, Wipro, HCL Tech, Tech Mahindra and LTI Mindtree—employ an estimated 5 lakh people at the mid- to senior-levels. It is this layer that may not be needed.

Indian IT companies had a 13.76 percent weightage in the Nifty and a slowing in profitability for this sector would make it harder for Nifty earnings to compound at the 12-14 percent that investors have grown accustomed to over the last three years. IT services exports stood at $387.5 billion in FY25.

Wages from the IT sector have played an outsize role in discretionary consumer spending, with employees flocking to malls at IT hubs over the weekend. They’ve also contributed to sales of entry-level homes and cars as well as demand for air travel, insurance and education. A slowdown in hiring or layoffs would impact a host of sectors and leave India bereft of a strong growth engine.

First Published: Jul 28, 2025, 18:00

Subscribe Now