What is the future of opinion trading in India?

Will it be banned? Will the courts deliver their verdicts this year? Will the apps that enable opinion trading perish? You can place bets on these questions, but will it ultimately be legal?

A little more than four years ago, Bharat Chandani, 35, became one of the early adopters of opinion trading. He had heard about it from a friend and decided to try his hand at it. “I believed my general knowledge was good and thought I would have an edge," says the coaching centre teacher from Indore, who focussed on questions on the economy and cinema.

Chandani walks us through a typical trade cycle. For instance, the question can be, “Will India’s economy reach $5 trillion before the end of 2025?" Traders must choose either a simple “yes" or “no", and decide how much to trade. The value of trades ranges from ₹0.5 to ₹9.5.

If Chandani believes there is a 60 percent chance that India’s economy will be worth $5 trillion in 2025, he would put his money on ₹6 and, maybe, 1,000 lots. That will mean placing ₹6,000 on the trade. If another user believes there is only a 40 percent chance of it, meaning a 60 percent chance it will not happen, they can place the same trade on the other side, on the “no" answer. Here, the elements of a market are created, and one is playing against other players.

Trades start once the order is matched. Think of it as a buyer and seller at the same price for a stock to trade. In order to make money, Chandani would need a greater number of users disagreeing with him. So, if money were placed on ₹5 on the “no" side, Bharat would walk away with winnings at the end of the trade if the Indian economy did reach $5 trillion.

“I would recommend it only to those who are well-read and can hold their nerve. There are times when they might not get their price, and deciding whether to hold or exit can get challenging," says Chandani. Some apps offer tutorials and information packs. He also points to the illiquidity in some trades. As the probabilities keep shifting, it is possible to exit the trade midway by taking one’s profits or cutting losses.

Where it gets interesting (and addictive), according to people in the industry, is that trades can last minutes (“the price of bitcoin in the next 10 minutes"), days (“will it rain in the first week of June?"), weeks (“will a particular team win the IPL?") or months (“will the first quarter GDP growth exceed 6 percent?"). So, there is always something to do on the platform.

Opinion trading is on the rise the world over. Kalshi, an app synonymous with predictive markets in the US, had a field day during the Donald Trump-Elon Musk fracas. Users placed bets on whether Trump would exit X, the social media platform Musk owns, by the end of the year (17 percent probability) or whether Musk and he would mend fences (63 percent probability).

It boils down to the argument that the “wisdom of the crowds" often gets things right and is at times a more reliable indicator than expert opinion or even data. Case in point being the 2024 US presidential elections. While pundits believed Kamala Harris was a shoo-in, the odds on the trades on Kalshi in late October prompted Wall Street to take the possibility of a second Trump presidency seriously.

“Except for the extremes, when people get emotional, prediction markets have been extraordinarily accurate," says I Rose Nelson, professor of law and the author of www.gamblingandthelaw.com, a widely read blog.

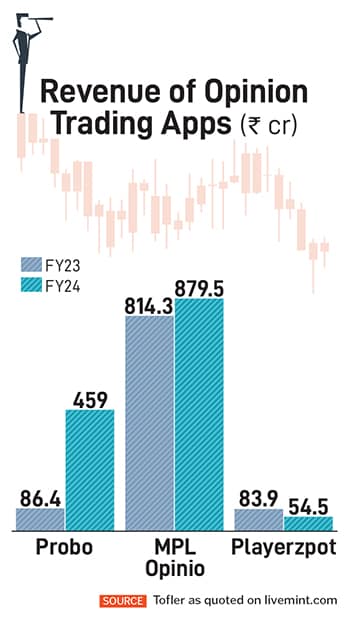

In 2024, Kalshi saw a hockey stick-curve growth in both revenues and trades. Data for 2025 is not out yet. In India, too, activity on opinion trading has surged on platforms such as Probo and also on those, such as MPL Opinio, which are not wholly into opinion trading. MPL declined comment.

Manish Kumar, 28, a computer programmer from Noida, says his colleagues regularly trade and opinion trading is now the staple of cafeteria conversations.

Concern has risen in parallel. In April, the Securities and Exchange Board of India (Sebi), the stock markets regulator, felt compelled to issue a notification, saying opinion trading was not within the “regulatory purview of Sebi as what is traded is not a security". There have been FIRs filed with police, social media backlash, and—most seriously—court cases. The usual case against opinion trading is that these are mere wagers and, therefore, illegal. As cases wind up before the courts, the next 12 to 18 months ought to determine the fate of opinion trading in India. As things stand, opinion trading apps are one court judgment away from being shut down.

It was 2019. Working for Urban Company, Sachin Gupta and Ashish Garg realised that opinions were dime a dozen. Everyone had one, and expressed it unhesitatingly at the water cooler, in the cafeteria, during breaks at the work desk, anywhere and to anyone who would care to listen.

Will it rain? Will Mumbai Indians win the IPL? Will the pay hike be more than 5 percent? Such questions, and pretty much every other, always found answers—often more than one. Depending on the actual outcome, bragging rights were earned or humble pie devoured. Until then, opinions could also get revised many times.

Garg, 31, wondered what the sanctity of one’s opinion was and whether it was so easy to change it.

And, eventually, what if one could conduct a trade in opinions? Maybe a marketplace could be built.

And, eventually, what if one could conduct a trade in opinions? Maybe a marketplace could be built.

He had several conversations on these with Gupta, who was seven years older. The two were uncertain, as most founders of new ventures are, but went ahead and set up Probo, which has now become India’s largest opinion trading app.

Gupta and Garg had stumbled on a phenomenon that has taken traders and markets by storm over the last year. Opinion trading, or predictive market, or information market—as it is variously known—is a rapidly growing subset of the real money gaming industry which includes poker, rummy and fantasy sports. It allows users to place trades on events that have a defined yes-or-no outcome and taps into people’s love for binary questions.

As more users place trades, the market depth and liquidity increase, and probabilities keep shifting. Probo’s platform itself has facilitated 20 billion trades placed in 2025 (to date). Users can abandon trades, revise them, increase or decrease them. Just like with stock trading, the constant activity keeps them hooked.

When this correspondent tried his hand at opinion trading, he found himself checking the status of his trades regularly. After a while, the pop-up ads were hard to ignore. It was IPL season and trading on cricket was the most advertised.

“Why not try it?" I said to myself.

The set-up was deceptively easy. All I needed after creating a username and password was my bank account information and PAN number. The apps tie up with a background verification agency for age checks, but in my case all it did was confirm that the PAN and bank account names matched. A few minutes later, I was ready to make my first trade.

I entered trades on what the price of bitcoin would be not tomorrow, not a week or month from now, but 10 minutes later. Guiding me were explanations on what determined price movements. I was unconvinced, as all short-term price movements (at least with stocks and currencies) have been proven to be random.

Ten minutes later, I checked and found that I had ended up on the wrong side of the trade. Later that day I entered another trade, and this time I was on the right side, but my order had not been matched with someone taking the opposite side of the trade. So, no payout. Other trades went similarly. I won some and lost some. But these short-term bets felt more like playing a slot machine than requiring any real skill.

Several opinion traders, when asked if it is gambling, disagree and attribute their winnings to skill. The law may not agree.

The rise and rise of opinion trading has brought about a set of legal challenges. Central to this is the ban on gambling in India, both under state and central laws. In India, gambling laws expressly stipulate that “nothing in this Act shall apply to games of skill". In the absence of a ruling on whether these are games of skill, opinion trading operates in a grey zone.

“We looked at this business and though it is very profitable... we decided not to get into it unless there is regulatory clarity. As far as I am concerned, this is illegal," says the founder of a real money gaming website. But he concedes that this was a fantastically profitable business and he is willing to get in quickly if the regulatory green signal came.

On the flip side, the argument is that in the absence of regulations, there is no telling what penalties may be imposed on opinion trading and so it is best to stay out.

Add to this the stories of users losing amounts that run anywhere between ₹10,000 and ₹10 lakh, which have made their way to the media and these apps have seen police action against them for cheating.

At last count, there were cases piled up in the Chhattisgarh High Court, the Bombay High Court and the Gujarat High Court through public interest litigations (PIL). The petitioners’ contention is that these apps promote gambling and must be banned.

In a ruling in May, the Chhattisgarh High Court banned Probo in the state. In addition, Nagaland, Sikkim, Telangana, Andhra, Tamil Nadu and Haryana have banned opinion trading apps. For now, these cases are winding their way up High Courts and the Supreme Court is still to hear the matter.

“There is as yet no conclusive answer on the legality of such games. Each format offered by the platforms would have to be analysed on a case-by-case basis to determine if they involve a predominance of skill over chance," says Jay Sayta, a technology and gaming lawyer.

Haryana is emerging as a test case in the industry’s battle for survival. In May, a gazette notification banned betting in sports or elections. In addition, an FIR filed by Abhisek Jain, who lost ₹20,000, has resulted in Probo’s bank accounts being frozen by the courts.

The matter is posted for a July hearing once the courts open from vacation and there is also a likelihood that the Punjab and Haryana High Court may adjudicate on whether opinion trading is a game of skill. This would be the first ruling on this matter.

Indian regulators are clear that any activity that constitutes betting is illegal. As a result, sports betting has been outlawed and these activities have either shifted outside the country or take place outside the purview of regulation.

A section of the industry believes that opinion trading amounts to betting, as the trades involve binary outcomes. “For it to be a game of skill, I must be able to control the outcome," says the owner of a fantasy gaming website who declined to be named.

The All India Gaming Federation points out that opinion trading has not been approved by the Skill Games Council, an industry body. The Confederation of All India Traders has asked for a ban on account of misleading advertising and the “digital satta" that these platforms facilitate. It also points to the use of influencers to promote opinion trading as a source of income while omitting the risk involved.

The All India Gaming Federation points out that opinion trading has not been approved by the Skill Games Council, an industry body. The Confederation of All India Traders has asked for a ban on account of misleading advertising and the “digital satta" that these platforms facilitate. It also points to the use of influencers to promote opinion trading as a source of income while omitting the risk involved.

“When influencers talk about winnings, they are pointing to a very small set of users. The vast majority of cases is of people from humble backgrounds losing money," says a former employee of a real money gaming company.

Through a series of court judgments starting in 1967, Indian jurisprudence is clear that skill-based games are permitted and chance-based wagers are not. In the decade starting 2005, online rummy, poker, fantasy sports also found themselves in a similar position.

Meantime, opinion trading companies are trying to lay the groundwork in the hope of one day being declared legal. Top legal talent is being hired. Mukul Rohatgi has appeared for Probo. Studies are being supported in all the various ways to show them in a good light.

Bimal Roy, former director of the Indian Statistical Institute, has come out with such a study using data provided by opinion trading platforms. As an example, he says trades on the outcome of cricket matches could be classified as skill. But, pushed on whether trades on the weather or the price of bitcoin could be classified as skill, he says: “I would have to look at the data."

Globally, predictive markets are classified as betting and regulated. Some countries like Singapore, Taiwan, and the Netherlands have outright bans. The US is different and has permitted them to operate but as Nelson, the blogger and professor, argues, “Futures markets are not legal because they are games of skill. They are legal because Congress has declared them to be legal, if certain criteria are met."

In the US, the regulatory issue snowballed as Kalshi started taking bets during the presidential election. When the trades on the platform proved surprisingly accurate, it was clear that the mood of the crowds was as good a predictor as opinion polls.

Since then, Polymarket, another predictive markets platform, has become X’s official prediction partner, where X posts, combined with artificial intelligence, will allow users to make market predictions.

First Published: Jul 17, 2025, 11:57

Subscribe Now